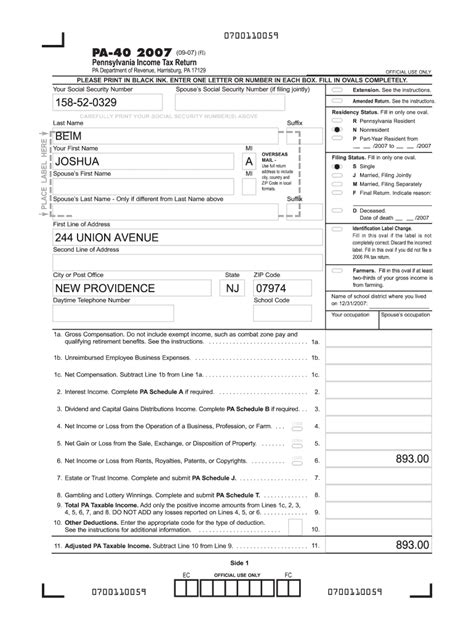

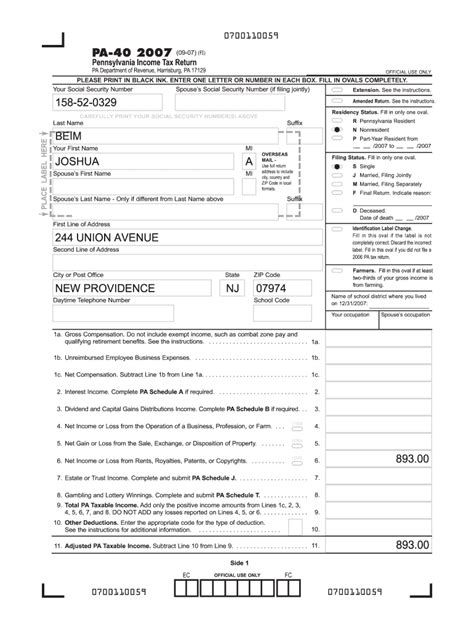

Pennsylvania Tax Return

The Pennsylvania Department of Revenue is responsible for collecting and managing various taxes within the state, including income tax, sales and use tax, corporate net income tax, and more. Filing a tax return in Pennsylvania is a necessary process for individuals and businesses to fulfill their tax obligations and ensure compliance with state laws. This comprehensive guide aims to provide an in-depth analysis of the Pennsylvania tax return process, covering all the essential aspects, from understanding the types of taxes to filing requirements, deadlines, and potential deductions.

Types of Taxes and Who Needs to File

Pennsylvania residents and businesses are subject to a range of taxes, each serving a specific purpose in contributing to the state’s revenue. Here’s an overview of the primary taxes and the entities required to file:

- Personal Income Tax: This is a tax levied on the income earned by individuals, trusts, and estates. Pennsylvania residents and non-residents earning income from sources within the state must file a personal income tax return. The tax rate is currently set at 3.07% for tax year 2023.

- Corporate Net Income Tax: Corporations, including S corporations, are subject to this tax on their net income derived from or reasonably attributable to Pennsylvania sources. The tax rate is 9.99% for most corporations.

- Sales and Use Tax: A tax imposed on the sale, lease, or rental of tangible personal property, as well as certain services. Retailers and vendors must collect this tax from customers and remit it to the state. The base rate is 6%, but local municipalities may add additional sales tax rates.

- Realty Transfer Tax: This tax applies to the transfer of real estate property within Pennsylvania. It is typically paid by the buyer at a rate of 1% of the property’s value.

- Capital Stock/Foreign Franchise Tax: Corporations authorized to do business in Pennsylvania are subject to this tax, which is based on the value of their capital stock or net worth.

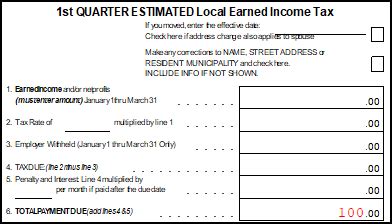

Filing Requirements and Deadlines

Meeting the filing requirements and adhering to the deadlines set by the Pennsylvania Department of Revenue is crucial to avoid penalties and interest charges. Here’s what you need to know:

Personal Income Tax Returns

- Filing Status: All individuals, including part-year residents, non-residents with Pennsylvania-sourced income, and estates or trusts with income, are required to file a personal income tax return.

- Deadline: For tax year 2023, the deadline to file your personal income tax return is April 15, 2024. However, if you are unable to meet this deadline, you can request an extension until October 15, 2024. Keep in mind that an extension only extends the filing deadline, not the payment deadline.

- Filing Options: Pennsylvania offers several ways to file your tax return. You can choose to file electronically using approved software or directly through the Department of Revenue’s website. Alternatively, you can opt for paper filing by mailing your completed tax forms to the appropriate processing center.

Corporate Net Income Tax Returns

- Filing Status: All corporations doing business in Pennsylvania, including S corporations, must file a corporate net income tax return.

- Deadline: The filing deadline for corporate net income tax returns is typically March 15th of the year following the tax year. For example, the deadline for tax year 2023 is March 15, 2024. However, if the 15th falls on a weekend or holiday, the deadline is extended to the next business day.

- Filing Options: Corporations can file their tax returns electronically using approved software or through the Department of Revenue’s website. Paper filing is also an option, but it is recommended to use electronic filing for faster processing.

Deductions and Credits

Pennsylvania offers various deductions and credits to reduce the tax liability for individuals and businesses. Understanding these incentives can help taxpayers optimize their tax returns and potentially save money.

Individual Deductions

- Standard Deduction: Taxpayers can choose to take the standard deduction, which is a set amount that reduces their taxable income. For tax year 2023, the standard deduction is 3,700 for single filers and 7,400 for married filing jointly.

- Itemized Deductions: Instead of taking the standard deduction, taxpayers can itemize their deductions if their total qualifying expenses exceed the standard deduction amount. Common itemized deductions include medical expenses, charitable contributions, state and local taxes, and mortgage interest.

- Education Deduction: Pennsylvania offers a tax deduction for qualified higher education expenses. Taxpayers can deduct up to $4,000 per student for tuition, fees, and other eligible expenses.

Business Deductions and Credits

- Research and Development Tax Credit: Businesses engaged in research and development activities may be eligible for a tax credit. This credit is designed to encourage innovation and can offset a portion of the corporation’s tax liability.

- Film Production Tax Credit: Pennsylvania offers a tax credit to film production companies that film in the state. This credit can help offset the cost of production and promote the state’s film industry.

- Job Creation Tax Credit: Businesses that create new jobs in Pennsylvania may qualify for a tax credit. The credit is based on the number of new full-time employees and can be applied against corporate net income tax.

Filing Tips and Resources

To ensure a smooth and accurate tax filing process, here are some tips and resources to keep in mind:

- Stay informed about tax law changes and updates by visiting the Pennsylvania Department of Revenue’s website regularly.

- Consider seeking professional assistance from a tax preparer or accountant, especially if your tax situation is complex.

- Utilize the Department of Revenue’s online tools and resources, including tax forms, instructions, and frequently asked questions.

- Keep accurate records of your income, expenses, and deductions to simplify the filing process and support your tax return.

- If you have questions or need assistance, reach out to the Department of Revenue’s taxpayer services for guidance.

Performance Analysis and Future Implications

Pennsylvania’s tax system plays a vital role in funding various state services and programs. Analyzing the performance of the tax return process can provide insights into its effectiveness and potential areas for improvement.

Timeliness of Tax Filing

The Department of Revenue aims to process tax returns promptly to ensure timely refunds and minimize taxpayer burden. In recent years, the department has implemented various initiatives to streamline the filing process, including electronic filing options and enhanced data verification systems. These efforts have led to faster processing times, with the majority of returns being processed within 45 days.

Compliance and Enforcement

Ensuring tax compliance is crucial for maintaining the integrity of the tax system. The Department of Revenue employs various strategies to enforce tax laws and collect outstanding tax liabilities. These include audits, tax liens, and collection actions. By effectively targeting non-compliance, the department can recover lost revenue and deter future tax evasion.

Tax Policy Reforms

Pennsylvania’s tax policies are subject to ongoing evaluation and potential reforms. Recent discussions have focused on simplifying the tax code, reducing tax rates, and introducing new incentives to attract businesses and stimulate economic growth. These reforms aim to create a more competitive tax environment and enhance the state’s attractiveness to investors.

Technology Integration

The Department of Revenue is increasingly leveraging technology to enhance its tax administration capabilities. By adopting advanced data analytics and machine learning techniques, the department can identify trends, detect potential fraud, and improve overall tax administration efficiency. This integration of technology is expected to play a crucial role in the future, enabling more accurate and efficient tax collection processes.

What is the difference between a part-year resident and a non-resident for tax purposes in Pennsylvania?

+A part-year resident is an individual who lived in Pennsylvania for only part of the tax year. This status applies if you had a permanent home in Pennsylvania for any part of the tax year but changed your residency status to another state or country during the year. Non-residents, on the other hand, are individuals who do not have a permanent home in Pennsylvania but earned income from sources within the state during the tax year.

Can I file my Pennsylvania tax return electronically if I don’t have access to a computer or the internet?

+Yes, you can still file your tax return electronically even if you don’t have a computer or internet access. The Pennsylvania Department of Revenue provides a toll-free number for taxpayers who prefer to file their returns by phone. You can call the toll-free number and follow the prompts to complete your tax return over the phone.

What happens if I miss the tax filing deadline in Pennsylvania?

+If you miss the tax filing deadline, you may be subject to penalties and interest charges. The penalty for late filing is 5% of the unpaid tax liability for each month (or part of a month) the return is late, up to a maximum of 25%. Additionally, interest is charged on the unpaid tax balance at a rate of 6% per year, compounded daily. However, if you request an extension and pay at least 90% of your tax liability by the original due date, you may avoid late filing penalties.

Are there any tax credits available for low-income individuals in Pennsylvania?

+Yes, Pennsylvania offers several tax credits for low-income individuals and families. The Earned Income Tax Credit (EITC) is a refundable tax credit available to working individuals and families with low to moderate income. Additionally, the Property Tax/Rent Rebate Program provides rebates to eligible Pennsylvania residents who pay property taxes or rent. These credits aim to provide financial relief to those with limited means.