Clear Creek Isd Tax Office

Welcome to the in-depth exploration of the Clear Creek Independent School District (CCISD) Tax Office, an essential entity within the Texas education system. As we delve into the operations and services of this office, we aim to uncover its pivotal role in the educational landscape and its impact on the community it serves.

The Significance of the CCISD Tax Office

The Clear Creek ISD Tax Office stands as a vital administrative hub, overseeing the financial aspects of the district’s educational endeavors. With a primary focus on tax collection and management, this office plays a crucial role in ensuring the smooth operation of the school district and its ability to provide quality education to students.

Tax Collection Process

The tax collection process within CCISD is a meticulously organized operation. It involves the assessment of property values, the determination of tax rates, and the subsequent collection of taxes from property owners within the district’s boundaries. This process is guided by state laws and regulations, ensuring fairness and transparency.

The tax office employs a team of dedicated professionals who are well-versed in the intricacies of property tax assessment and collection. They work diligently to ensure that property owners receive accurate assessments and that the tax burden is distributed equitably across the community.

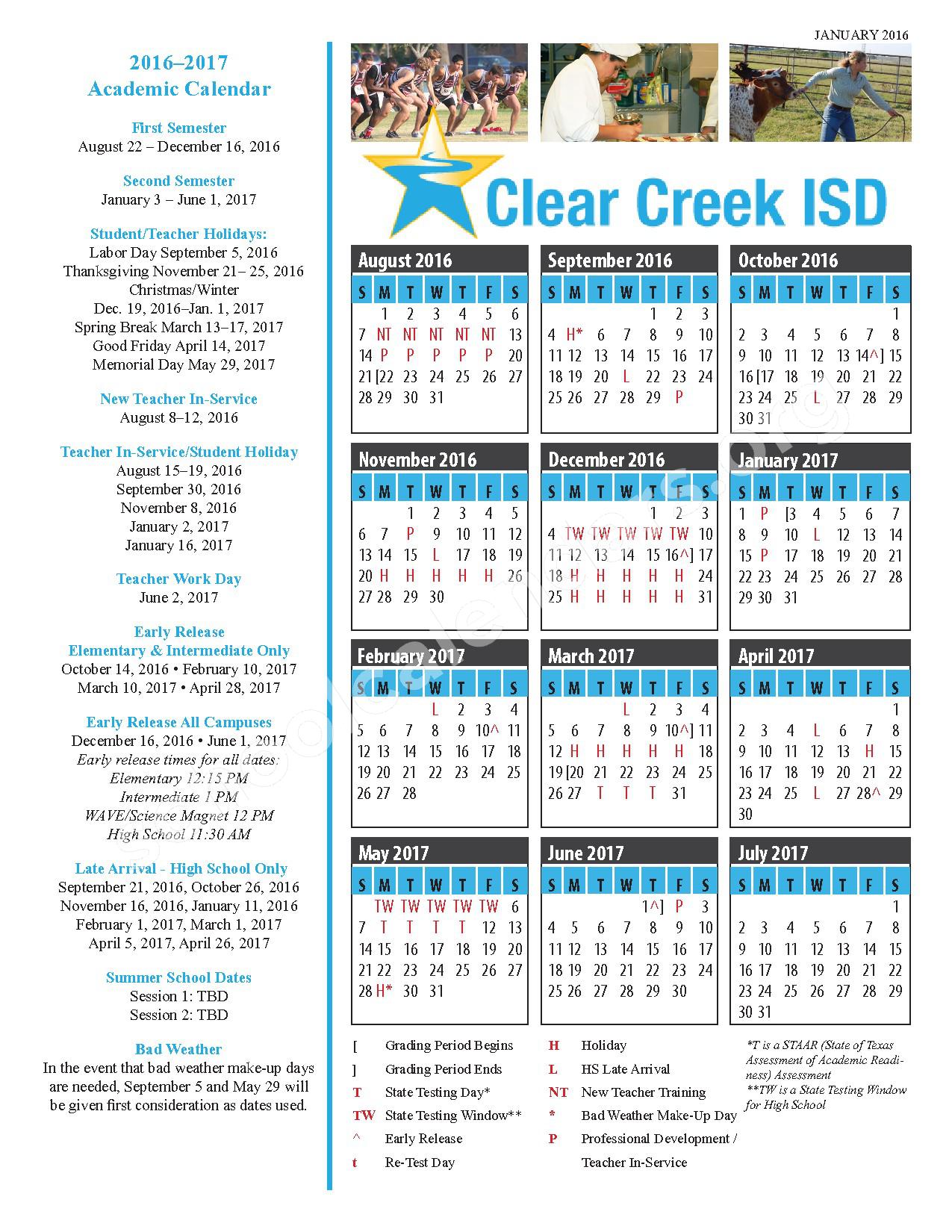

| Assessment Period | Collection Timeline |

|---|---|

| January to April | May to December |

Community Engagement and Outreach

Beyond tax collection, the CCISD Tax Office actively engages with the community. They host informational sessions and workshops to educate taxpayers about the tax process, property assessments, and available exemptions. These initiatives foster a sense of transparency and understanding between the tax office and the community it serves.

Additionally, the office provides personalized assistance to taxpayers, addressing their concerns and queries. Whether it's clarifying tax rates, explaining assessment procedures, or offering guidance on payment options, the CCISD Tax Office strives to ensure that every taxpayer has access to the information and support they need.

Impact on Education and Community Development

The revenue generated through the CCISD Tax Office’s efforts directly contributes to the funding of the school district’s educational programs and initiatives. This funding is crucial for maintaining high academic standards, providing quality resources, and supporting the diverse needs of students.

Educational Initiatives

- The tax revenue supports the implementation of innovative teaching methods and curriculum development, ensuring students receive a well-rounded education.

- It funds extracurricular activities, sports programs, and arts initiatives, fostering a holistic learning environment that nurtures students’ talents and interests.

- Specialized programs, such as STEM initiatives and language immersion courses, are made possible through the financial support provided by the tax office.

Community Development

The CCISD Tax Office’s impact extends beyond the classroom. The tax revenue also contributes to community development projects, enhancing the overall well-being of the district’s residents.

These projects include:

- Upgrading and maintaining school facilities, ensuring a safe and conducive learning environment.

- Supporting local businesses through economic development initiatives, creating job opportunities and stimulating the local economy.

- Funding community events and cultural programs, fostering a sense of unity and pride within the district.

Future Prospects and Innovations

The CCISD Tax Office remains committed to continuous improvement and innovation. With the evolving landscape of education and community needs, the office is exploring new strategies to enhance its operations and better serve the district.

Digital Transformation

Embracing technology, the CCISD Tax Office is undergoing a digital transformation. This includes the implementation of online platforms for tax payments, assessments, and communication, offering taxpayers a more efficient and convenient experience.

The office is also exploring the use of data analytics to optimize tax collection processes, improve accuracy, and enhance overall efficiency.

Community Collaboration

Recognizing the importance of community involvement, the CCISD Tax Office is strengthening its partnerships with local businesses, organizations, and residents. By collaborating with these stakeholders, the office aims to gather valuable insights and feedback, ensuring that its services remain aligned with the community’s needs and expectations.

How can I pay my CCISD taxes online?

+To pay your CCISD taxes online, visit the CCISD Tax Office website and navigate to the "Online Payments" section. Follow the step-by-step instructions provided to complete your payment securely.

What are the tax rates for CCISD properties?

+The tax rates for CCISD properties vary depending on the type of property and its location within the district. You can find detailed information about tax rates on the CCISD website or by contacting the Tax Office directly.

How often are property assessments conducted by CCISD?

+Property assessments are typically conducted annually by CCISD. These assessments ensure that property values are accurately reflected and that tax burdens are fairly distributed.

Does CCISD offer any tax exemptions or discounts?

+Yes, CCISD offers various tax exemptions and discounts to eligible taxpayers. These include homestead exemptions, senior citizen discounts, and exemptions for certain types of properties. It's recommended to consult the CCISD Tax Office or their website for specific details and eligibility criteria.

How can I contact the CCISD Tax Office for assistance?

+You can contact the CCISD Tax Office through their official website, which provides contact information, including phone numbers and email addresses. They are available to address your inquiries and provide personalized assistance.

As the CCISD Tax Office continues its journey of serving the community, it remains dedicated to transparency, efficiency, and community engagement. Through its vital role in tax collection and management, the office ensures the continued growth and success of the Clear Creek Independent School District, benefiting both the educational landscape and the broader community.