What Is Sales Tax In Tennessee

Sales tax in Tennessee is a crucial aspect of the state's revenue system, playing a significant role in funding various public services and infrastructure projects. With a unique tax structure and a rich history of tax reforms, understanding the sales tax system in Tennessee is essential for both businesses and consumers.

The Tennessee Sales Tax System

Tennessee’s sales tax is a state-level tax imposed on the sale or lease of tangible personal property, as well as certain services. It is an essential revenue source for the state, contributing to the funding of education, healthcare, transportation, and other vital services.

The state's sales tax rate is currently set at 7%, which is applicable to most retail sales and leases of goods. However, Tennessee's sales tax system is more complex than a simple flat rate, as it involves a combination of state, county, and municipal taxes, leading to varying tax rates across the state.

State Sales Tax

The base state sales tax rate of 7% is applied uniformly across Tennessee. This rate has been in effect since 2020, when the state legislature opted to maintain the rate despite calls for an increase to fund education initiatives.

Local Sales Taxes

In addition to the state sales tax, local governments in Tennessee have the authority to levy additional sales taxes, which are often referred to as local option sales taxes. These taxes are imposed at the county and municipal levels and can significantly impact the overall sales tax rate a consumer pays.

For instance, while the state sales tax rate is a flat 7%, some counties in Tennessee have local sales tax rates ranging from 1.5% to 2.75%. This means that in certain areas, the total sales tax rate can exceed 9%, making it one of the highest combined sales tax rates in the nation.

| County | Local Sales Tax Rate |

|---|---|

| Davidson County | 2.25% |

| Hamilton County | 2.75% |

| Shelby County | 2.5% |

Exemptions and Special Rates

Tennessee’s sales tax system also includes a range of exemptions and special rates for certain goods and services. For example, most groceries are exempt from sales tax, which provides a significant relief for low-income households. Additionally, some services, such as repair and maintenance, are taxed at a lower rate of 4%.

Furthermore, Tennessee offers a sales tax holiday annually, typically in early August. During this period, certain items, such as school supplies and clothing, are exempt from sales tax, providing a much-needed break for families preparing for the new school year.

The Impact of Sales Tax on Tennessee’s Economy

Sales tax is a critical component of Tennessee’s economy, generating billions of dollars in revenue annually. This revenue is essential for funding public services and infrastructure projects, which in turn, contribute to the state’s economic growth and development.

However, the sales tax system in Tennessee is not without its challenges. The varying tax rates across the state can lead to complexity for businesses, especially those with operations in multiple counties. Additionally, the reliance on sales tax as a primary revenue source can be vulnerable to economic downturns, as consumer spending may decrease during recessions.

Sales Tax and Economic Development

Tennessee has been proactive in using its sales tax system to drive economic development. For instance, the state offers sales tax incentives to attract and retain businesses, particularly in the manufacturing and technology sectors. These incentives can include sales tax refunds or exemptions for certain capital investments, which can significantly reduce the tax burden for businesses and encourage economic growth.

Furthermore, Tennessee has also utilized sales tax revenues to invest in infrastructure projects, such as road improvements and public transportation systems, which are crucial for facilitating economic activity and enhancing the state's business environment.

Sales Tax and Social Equity

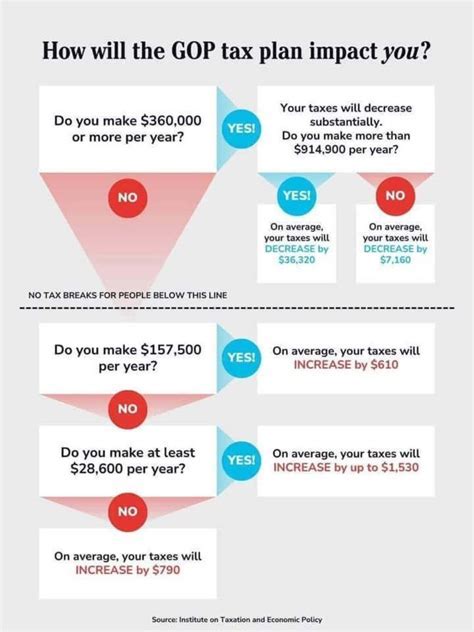

The sales tax system in Tennessee has also been a subject of debate regarding its impact on social equity. While the state’s sales tax structure provides exemptions for essential items like groceries, it does not account for the regressive nature of sales taxes, which can disproportionately impact low-income households.

Advocates for tax reform in Tennessee argue for a shift towards a more progressive tax system, which could include a higher income tax rate for higher-income earners, reducing the burden on lower-income households and promoting social equity.

The Future of Sales Tax in Tennessee

As Tennessee continues to grow and evolve, the state’s sales tax system is likely to undergo further reforms and adjustments. With an ever-changing economic landscape and a growing population, the state will need to adapt its tax policies to meet the needs of its residents and businesses.

One potential area of focus for future tax reforms could be the expansion of sales tax exemptions to include more essential services, such as healthcare and education. This could provide much-needed relief for households and help ensure that these vital services remain accessible to all Tennesseans.

Additionally, as the state continues to attract and support business growth, particularly in emerging industries like technology and renewable energy, it may consider offering targeted sales tax incentives to further stimulate economic development.

Conclusion

Tennessee’s sales tax system is a critical component of the state’s economy, providing essential revenue for public services and infrastructure. While the state’s unique tax structure presents challenges, it also offers opportunities for economic development and social equity improvements.

As Tennessee moves forward, the state's leadership will need to carefully balance the need for revenue with the interests of its residents and businesses, ensuring that the sales tax system remains fair, sustainable, and effective.

What is the current sales tax rate in Tennessee?

+The current state-level sales tax rate in Tennessee is 7% as of 2020. However, local governments can impose additional sales taxes, which can result in varying total sales tax rates across the state.

Are there any sales tax holidays in Tennessee?

+Yes, Tennessee offers an annual sales tax holiday typically in early August. During this period, certain items like school supplies and clothing are exempt from sales tax.

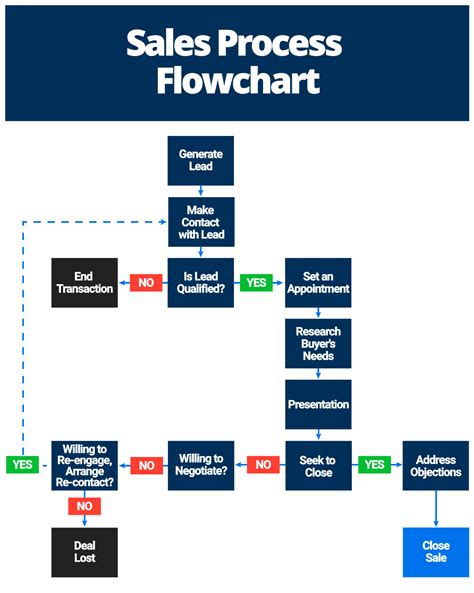

How does Tennessee’s sales tax system impact businesses?

+The varying sales tax rates across Tennessee can present complexities for businesses, especially those operating in multiple counties. However, the state also offers sales tax incentives to attract and retain businesses, particularly in certain sectors.