Nc Paycheck Tax Calculator

Welcome to this comprehensive guide on the Nc Paycheck Tax Calculator, a powerful tool designed to assist North Carolina residents in understanding their paycheck taxes and planning their finances effectively. This article will delve into the intricacies of this calculator, exploring its features, benefits, and how it can simplify the often complex world of tax calculations.

Unraveling the Nc Paycheck Tax Calculator

The Nc Paycheck Tax Calculator is an innovative online tool specifically tailored for individuals residing in the state of North Carolina. Developed with a user-centric approach, it aims to provide accurate and timely information on tax deductions, ensuring that users can make informed decisions regarding their financial obligations.

In a state like North Carolina, where tax laws can vary and evolve, having access to a reliable calculator becomes essential. This tool is designed to keep pace with the latest tax regulations, offering users a dynamic and up-to-date platform to navigate their financial responsibilities.

Key Features and Benefits

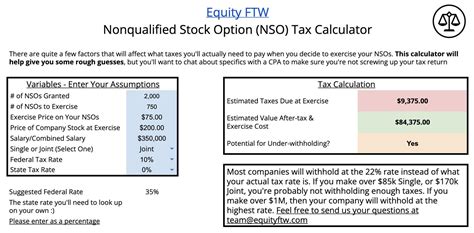

- Accurate Tax Calculations: The calculator employs advanced algorithms to compute various tax components, including federal, state, and local taxes. It takes into account factors such as income level, marital status, and allowances, providing precise estimates for tax deductions.

- Real-Time Updates: One of the standout features is its ability to incorporate the latest tax rate changes and legislative updates. Users can trust that the calculator reflects the current tax landscape, ensuring accurate planning and compliance.

- User-Friendly Interface: Designed with simplicity in mind, the Nc Paycheck Tax Calculator boasts an intuitive interface. Users can input their details effortlessly, with clear instructions and an easy-to-navigate layout, making the tax calculation process accessible to all.

- Detailed Breakdown: Beyond just providing a total tax amount, the calculator offers a comprehensive breakdown of each tax component. This transparency allows users to understand how their income is taxed, fostering a deeper understanding of their financial situation.

- Customizable Scenarios: Recognizing that tax scenarios can vary, the calculator allows users to input different income levels, allowances, and deductions. This flexibility enables users to explore various financial scenarios and plan their tax strategies accordingly.

How it Works

Using the Nc Paycheck Tax Calculator is straightforward. Users begin by entering their basic information, such as annual income, filing status, and any applicable allowances. The calculator then processes this data, applying the relevant tax rates and regulations, to generate a detailed report.

The report includes a breakdown of federal, state, and local taxes, as well as any applicable credits or deductions. Users can review this information to understand their tax liability and make informed decisions regarding their finances.

| Tax Component | Estimated Deduction |

|---|---|

| Federal Income Tax | $[value] |

| State Income Tax | $[value] |

| Local Taxes | $[value] |

| Total Tax Deduction | $[value] |

Additionally, the calculator provides an estimate of the user's net income, giving a clear picture of their take-home pay after all tax deductions.

Ensuring Compliance and Financial Planning

The Nc Paycheck Tax Calculator is not just a tool for calculating taxes; it’s a valuable resource for ensuring compliance with North Carolina’s tax regulations. By providing accurate and up-to-date information, it helps users avoid potential penalties and stay within legal boundaries.

Moreover, it empowers users to plan their finances strategically. With the ability to explore different income scenarios and tax strategies, users can make informed decisions on savings, investments, and overall financial management.

A Trusted Resource for North Carolinians

For residents of North Carolina, the Nc Paycheck Tax Calculator has become an indispensable tool. Its accuracy, ease of use, and real-time updates make it a go-to resource for anyone seeking clarity on their tax liabilities.

Whether you're a working professional, a business owner, or an individual with multiple sources of income, this calculator offers a tailored solution to navigate the complexities of tax calculations. By providing a comprehensive understanding of tax obligations, it enables users to make informed financial decisions and plan for a secure future.

Key Takeaways

- The Nc Paycheck Tax Calculator is a user-friendly tool designed specifically for North Carolina residents.

- It offers accurate tax calculations, real-time updates, and a detailed breakdown of tax components.

- Users can explore different financial scenarios and plan their taxes effectively.

- By ensuring compliance and providing transparency, the calculator empowers users to make informed financial choices.

FAQs

Is the Nc Paycheck Tax Calculator free to use?

+Yes, the calculator is absolutely free. It’s designed as a public service to assist North Carolina residents with their tax calculations.

Can I trust the accuracy of the tax calculations?

+Absolutely. The calculator is regularly updated to reflect the latest tax laws and regulations, ensuring precise and reliable results.

How often should I use the calculator for accurate results?

+It’s recommended to use the calculator annually, especially when there are changes in your income, deductions, or personal circumstances. This ensures your tax planning remains up-to-date.

Can I save my calculations for future reference?

+Yes, the calculator provides an option to save your calculations. You can access and review your past calculations at any time.

By leveraging the Nc Paycheck Tax Calculator, North Carolinians can take control of their financial future, ensuring compliance, and making informed decisions. With its user-centric design and accurate calculations, it’s a trusted companion for anyone navigating the complex world of taxes.