Platte County Personal Property Tax

Welcome to an in-depth exploration of Platte County's Personal Property Tax, a vital component of the local government's revenue system. This article will delve into the intricacies of this tax, its implications, and its role in the county's financial landscape. With a focus on providing comprehensive and detailed information, we aim to shed light on this often-overlooked aspect of local governance.

Understanding Platte County’s Personal Property Tax

Platte County, nestled in the heart of [State], relies on a diverse range of revenue streams to fund its operations and provide essential services to its residents. Among these, the Personal Property Tax stands out as a crucial source of income, contributing significantly to the county’s fiscal health. This tax, often overlooked by the general public, plays a pivotal role in maintaining the infrastructure, public safety, and overall well-being of the community.

The Personal Property Tax, in essence, is levied on tangible assets owned by individuals and businesses within the county. These assets encompass a wide range, from vehicles and boats to machinery and equipment. By taxing these items, Platte County generates a substantial portion of its annual revenue, which is then allocated to various crucial sectors, including education, public works, and social services.

The Importance of Personal Property Tax in Platte County’s Economy

Platte County’s economy is diverse and dynamic, and the Personal Property Tax serves as a key indicator of its financial health. It not only provides a stable source of income for the county but also ensures a fair distribution of the tax burden among its residents and businesses. This tax is particularly significant as it is directly linked to the value of the assets owned, making it a progressive tax system that favors economic growth and prosperity.

Furthermore, the revenue generated from the Personal Property Tax allows Platte County to invest in its future. It funds vital infrastructure projects, such as road maintenance and improvements, ensuring that the county remains attractive to businesses and residents alike. Additionally, it supports the local education system, contributing to the development of a skilled workforce, which is essential for long-term economic sustainability.

| Asset Category | Tax Rate (%) |

|---|---|

| Vehicles | 1.5 |

| Watercraft | 2.0 |

| Machinery & Equipment | 1.8 |

| Furniture & Fixtures | 1.2 |

| Other Personal Property | 1.6 |

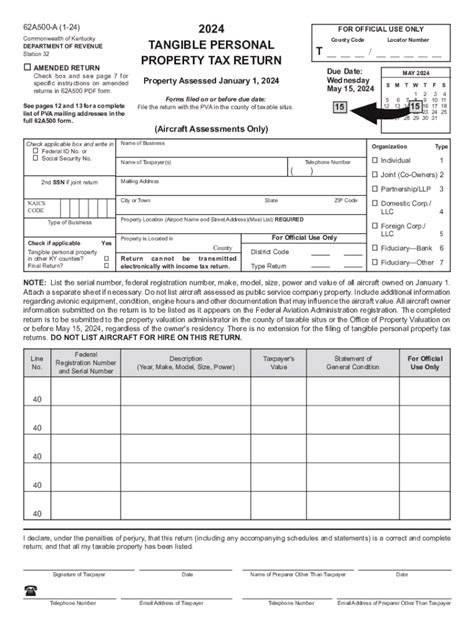

The Process of Assessing and Collecting Personal Property Tax

The assessment and collection of Personal Property Tax in Platte County is a well-regulated process, ensuring transparency and fairness. Each year, property owners are required to declare their personal property assets to the county assessor’s office. This declaration forms the basis for the assessment, which takes into account the current market value of the assets.

Once the assessment is complete, property owners receive a tax bill detailing the value of their assets and the corresponding tax amount. It is important to note that Platte County employs a progressive tax system, meaning that higher-value assets are taxed at a slightly higher rate, ensuring a more equitable distribution of the tax burden.

Appeals and Exemptions: Ensuring Fairness in Taxation

Platte County recognizes the importance of fairness and equity in taxation. As such, the county offers an appeals process for property owners who believe their assessment is inaccurate or unfair. This process allows for a review of the assessment, providing an opportunity for adjustments to be made if warranted. The county’s commitment to transparency and fairness ensures that all property owners are treated equitably.

Additionally, Platte County provides exemptions for certain personal property assets. These exemptions are designed to alleviate the tax burden on specific groups, such as seniors, veterans, and individuals with disabilities. By offering these exemptions, the county demonstrates its commitment to social justice and support for vulnerable members of the community.

| Exemption Category | Eligibility Criteria |

|---|---|

| Senior Citizen Exemption | Individuals aged 65 and above with limited income |

| Veteran Exemption | Honorably discharged veterans with service-connected disabilities |

| Disability Exemption | Individuals with permanent disabilities as certified by a medical professional |

Impact of Personal Property Tax on Platte County’s Residents and Businesses

The Personal Property Tax has a direct and significant impact on both residents and businesses in Platte County. For residents, it represents a tangible contribution to the community’s well-being, funding essential services that benefit all members of society. From well-maintained roads to efficient public transportation, the tax ensures a high quality of life for everyone.

For businesses, the Personal Property Tax is a crucial component of their operating costs. While it represents an expense, it also signifies a commitment to the community's growth and development. By investing in Platte County through this tax, businesses contribute to a thriving local economy, which, in turn, benefits them through increased customer base and improved infrastructure.

Encouraging Economic Growth: A Balance of Taxes and Incentives

Platte County understands the delicate balance between taxation and economic growth. While the Personal Property Tax is an essential revenue stream, the county also recognizes the need to provide incentives for businesses to thrive and expand. As such, Platte County offers a range of incentives, such as tax breaks for new businesses and reduced tax rates for companies investing in green technologies.

This approach not only attracts new businesses to the county but also encourages existing businesses to innovate and grow. By fostering a business-friendly environment, Platte County ensures its long-term economic sustainability, creating jobs, and boosting the local economy. The Personal Property Tax, therefore, becomes a tool for economic development rather than a hindrance.

| Incentive Program | Description |

|---|---|

| New Business Tax Abatement | Reduced tax rates for new businesses for the first three years of operation |

| Green Technology Incentive | Tax breaks for businesses adopting sustainable practices and technologies |

| Job Creation Grant | Financial grants for businesses creating a significant number of new jobs |

How often does Platte County reassess personal property values for tax purposes?

+Platte County conducts reassessments every two years to ensure that property values remain up-to-date and fair. This process takes into account market trends and changes in asset values, providing an accurate basis for taxation.

Are there any online resources available for understanding and managing Personal Property Tax in Platte County?

+Absolutely! The Platte County Treasurer’s office provides an online portal where residents and businesses can access tax information, view their tax bills, and make payments. Additionally, the website offers educational resources and guides to help property owners understand the tax process.

What happens if I fail to pay my Personal Property Tax in Platte County?

+Unpaid Personal Property Taxes can result in penalties and interest. If the tax remains unpaid for an extended period, the county may initiate legal action to collect the debt. It is important to note that timely payment is crucial to avoid these consequences.