Home Renovations Tax Deductible

Home renovations and improvements are often significant investments, and it's natural to wonder if there are tax benefits associated with them. In this comprehensive guide, we will explore the world of tax deductions related to home renovations, offering expert insights and practical advice to help you navigate the financial aspects of your home improvement projects.

Understanding the Tax Landscape for Home Renovations

When it comes to tax deductions for home renovations, the landscape can be complex. However, with the right knowledge and strategic planning, you can potentially reduce your tax liability and maximize the financial benefits of your home improvement endeavors.

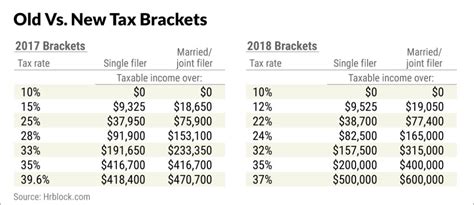

The Internal Revenue Service (IRS) in the United States recognizes certain home renovation expenses as tax-deductible, but the rules and regulations can vary based on the nature of the project, the taxpayer's circumstances, and the tax year. Let's delve into the specifics to help you make informed decisions.

Tax-Deductible Home Renovations: A Detailed Breakdown

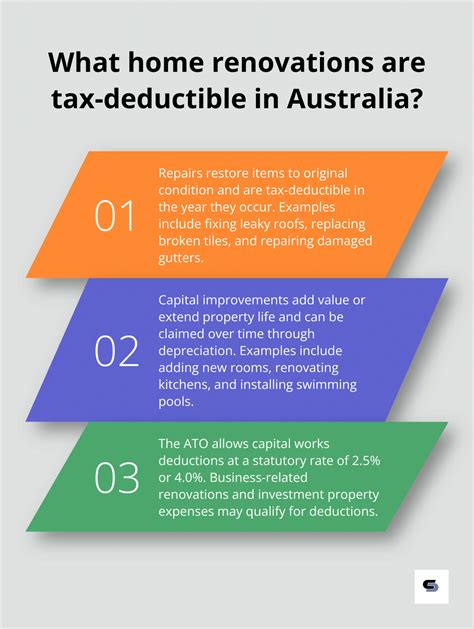

Not all home renovation projects qualify for tax deductions. It’s crucial to understand the types of renovations that are eligible and the specific criteria that apply.

Medical-Related Renovations

One of the primary categories of tax-deductible home renovations is those made for medical purposes. If you or a dependent living with you have a medical condition that requires specific home modifications, you may be eligible for tax deductions. These modifications can include:

- Ramps: Construction or installation of ramps to provide wheelchair access can be tax-deductible.

- Bathroom Modifications: Adaptations to bathrooms, such as installing grab bars, shower seats, or walk-in bathtubs, are often considered medical expenses.

- Widening Doorways: Altering doorways to accommodate wheelchairs or mobility aids is another common medical-related renovation.

- Kitchen Adjustments: Lowering countertops or installing accessible appliances may be deductible if they cater to specific medical needs.

Energy-Efficient Upgrades

Promoting energy efficiency is not only environmentally friendly but can also provide tax benefits. Certain energy-efficient upgrades to your home may qualify for tax credits or deductions. These can include:

- Solar Panels: Installing solar panels to generate renewable energy can lead to substantial tax credits.

- Energy-Efficient Windows: Replacing old windows with energy-efficient models may be eligible for tax deductions.

- Insulation Upgrades: Enhancing your home’s insulation to reduce energy consumption can be a tax-deductible expense.

- Energy-Efficient Appliances: Investing in energy-efficient appliances, such as HVAC systems or water heaters, may provide tax benefits.

Home Office Renovations

If you work from home and have a dedicated home office space, you may be able to deduct certain renovation expenses. However, the IRS has specific guidelines for home office deductions. Here are some key points to consider:

- Space Qualification: The home office space must be used exclusively and regularly for business purposes.

- Deduction Calculation: You can deduct a portion of your home’s expenses, including mortgage interest, property taxes, and utilities, based on the percentage of your home used for business.

- Renovation Deductions: Renovations specifically made to improve your home office, such as adding built-in shelves or installing better lighting, may be deductible.

Disaster-Related Renovations

In the unfortunate event of a natural disaster, such as a hurricane or flood, you may be eligible for tax deductions or credits for necessary home renovations. The IRS offers various tax relief programs for disaster victims, which can include:

- Casualty Loss Deductions: If your home is damaged or destroyed by a disaster, you can deduct the cost of repairs or the decrease in your home’s value.

- Disaster Loan Forgiveness: Some disaster-related loans may be partially or fully forgiven, resulting in tax benefits.

- Tax-Free Disaster Assistance: Certain disaster relief grants or payments are not considered taxable income.

Historic Preservation

If you own a historic home or property, you may be eligible for tax credits through the Historic Preservation Tax Incentives Program. This program encourages the rehabilitation of historic buildings and offers tax credits for qualified expenses. To qualify, the property must be listed on the National Register of Historic Places or located in a registered historic district.

| Renovation Type | Tax Benefit |

|---|---|

| Medical Renovations | Tax deductions for specific modifications |

| Energy Efficiency Upgrades | Tax credits or deductions for energy-saving measures |

| Home Office Renovations | Deductions based on exclusive business use |

| Disaster-Related Renovations | Casualty loss deductions, loan forgiveness, and tax-free assistance |

| Historic Preservation | Tax credits for qualified rehabilitation expenses |

Maximizing Tax Benefits: A Strategic Approach

To make the most of tax deductions for home renovations, consider the following strategies:

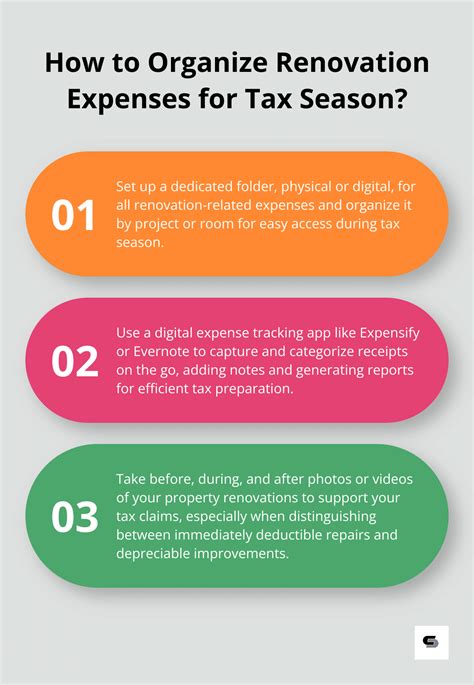

- Record-Keeping: Maintain detailed records of all renovation expenses, including receipts, invoices, and contracts. This documentation is crucial for tax purposes.

- Energy Efficiency Incentives: Stay updated on federal, state, and local tax incentives for energy-efficient upgrades. These incentives can change annually, so it’s beneficial to research the latest programs.

- Home Office Optimization: If you have a home office, ensure it meets the IRS’s exclusive use requirements. Maximize your deductions by allocating expenses appropriately.

- Disaster Relief Resources: In the event of a disaster, familiarize yourself with the available tax relief programs and take advantage of the benefits they offer.

- Historic Preservation Opportunities: If your home qualifies for historic preservation tax credits, work with preservation experts and tax advisors to navigate the process effectively.

Case Studies: Real-Life Tax Benefits

Let’s explore a couple of real-life examples to illustrate the tax benefits of home renovations:

Case Study 1: Energy Efficiency Pays Off

John and Emily, a couple in California, decided to invest in energy-efficient upgrades for their home. They installed solar panels, replaced old windows with energy-efficient models, and upgraded their insulation. As a result, they qualified for federal and state tax credits, reducing their tax liability by several thousand dollars.

Case Study 2: Medical Renovations for Accessibility

Sarah, a single mother with a disabled child, needed to make modifications to her home to accommodate her child’s mobility. She installed a ramp, modified her bathroom with grab bars, and widened doorways. These medical-related renovations qualified for tax deductions, providing her with much-needed financial relief.

The Future of Home Renovation Tax Deductions

The tax landscape for home renovations is subject to change. As the IRS and government agencies continue to prioritize energy efficiency and accessibility, we can expect ongoing updates to tax incentives and deductions. Staying informed about these changes is crucial for homeowners planning significant renovations.

Conclusion

Understanding the tax implications of home renovations is a crucial aspect of financial planning. By strategically approaching your renovation projects and staying informed about tax regulations, you can potentially reduce your tax burden and make your home improvement dreams a reality. Remember, consulting with tax professionals is essential to navigate the complexities of tax deductions and maximize your financial benefits.

What is the threshold for medical renovation deductions?

+The threshold for medical renovation deductions is based on the taxpayer’s adjusted gross income (AGI). Generally, you must exceed 7.5% of your AGI in medical expenses, including renovations, to qualify for a deduction. However, it’s advisable to consult a tax professional for a precise calculation.

Can I deduct the cost of hiring a contractor for home renovations?

+Yes, the cost of hiring a contractor for eligible home renovations can be deducted. This includes the fees for their services, materials, and any other expenses directly related to the project. However, it’s essential to maintain proper documentation and consult a tax expert for guidance.

Are there any tax deductions for routine home maintenance?

+Routine home maintenance expenses, such as repairs, are typically not tax-deductible. However, if the maintenance is directly related to a qualifying renovation or improves the energy efficiency of your home, you may be eligible for deductions or credits. Consult a tax advisor for specific guidance.

How long do I have to keep records of my home renovation expenses for tax purposes?

+It’s generally recommended to retain records of home renovation expenses for at least three years after filing your tax return. However, it’s best to consult a tax professional to determine the specific retention period for your situation.

Can I claim tax deductions for landscaping improvements around my home?

+Landscaping improvements typically do not qualify for tax deductions. However, if the landscaping is directly related to a qualifying medical or energy-efficient renovation, you may be able to claim a portion of the expenses. Consult a tax advisor for clarity.