2018 Tax Brackets 2018

The 2018 tax year brought significant changes to the tax landscape in the United States with the implementation of the Tax Cuts and Jobs Act. This landmark legislation, signed into law in 2017, ushered in a new era of tax reforms, impacting individuals, families, and businesses across the country. One of the key components of these reforms was the adjustment of tax brackets, which play a crucial role in determining an individual's tax liability.

Understanding the 2018 Tax Brackets

Tax brackets are a fundamental concept in the U.S. tax system. They represent the ranges of taxable income that correspond to different tax rates. In other words, as your income increases, you move up through these brackets, and the applicable tax rate also increases. This progressive tax system aims to ensure that higher-income earners pay a larger share of their income in taxes, promoting fairness and equity.

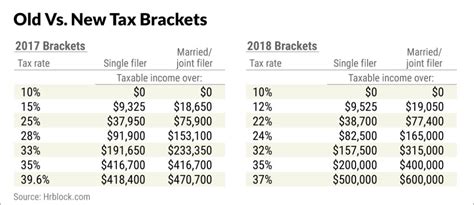

The 2018 tax brackets were notably revised as part of the Tax Cuts and Jobs Act. The legislation reduced the number of tax brackets from seven to seven and adjusted the income thresholds and corresponding tax rates. These changes had a significant impact on tax liabilities for individuals and families, offering tax relief to many while increasing taxes for some higher-income earners.

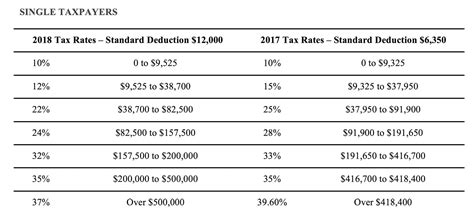

Single Filers: A Closer Look

For single filers, the 2018 tax brackets presented a range of income thresholds and corresponding tax rates. Here’s a breakdown of the brackets for this filing status:

| Tax Rate | Income Thresholds |

|---|---|

| 10% | $0 - $9,525 |

| 12% | $9,526 - $38,700 |

| 22% | $38,701 - $82,500 |

| 24% | $82,501 - $157,500 |

| 32% | $157,501 - $200,000 |

| 35% | $200,001 - $500,000 |

| 37% | $500,001 and above |

These brackets reflect the progressive nature of the U.S. tax system, with tax rates increasing as income rises. For example, an individual with a taxable income of $50,000 in 2018 would fall into the 22% tax bracket, while someone earning $250,000 would be subject to the 35% tax rate.

Married Filing Jointly: Shared Benefits

Married couples filing jointly enjoyed the benefits of a broader tax bracket system in 2018. The tax rates and income thresholds for this filing status were as follows:

| Tax Rate | Income Thresholds |

|---|---|

| 10% | $0 - $19,050 |

| 12% | $19,051 - $77,400 |

| 22% | $77,401 - $165,000 |

| 24% | $165,001 - $315,000 |

| 32% | $315,001 - $400,000 |

| 35% | $400,001 - $600,000 |

| 37% | $600,001 and above |

By filing jointly, married couples could take advantage of the expanded brackets, which offered lower tax rates on a broader range of income levels compared to single filers. This system incentivized marriage and provided financial benefits for couples.

Head of Household: A Unique Filing Status

The “Head of Household” filing status is unique to individuals who are unmarried but maintain households for qualifying persons, such as dependent children. The 2018 tax brackets for this status were as follows:

| Tax Rate | Income Thresholds |

|---|---|

| 10% | $0 - $13,600 |

| 12% | $13,601 - $51,800 |

| 22% | $51,801 - $84,200 |

| 24% | $84,201 - $160,700 |

| 32% | $160,701 - $200,000 |

| 35% | $200,001 - $500,000 |

| 37% | $500,001 and above |

The Head of Household status offers tax benefits to those who provide financial support and a home to qualifying family members. The brackets for this filing status are designed to recognize the financial responsibilities and provide tax relief accordingly.

Qualifications and Deductions: Navigating the System

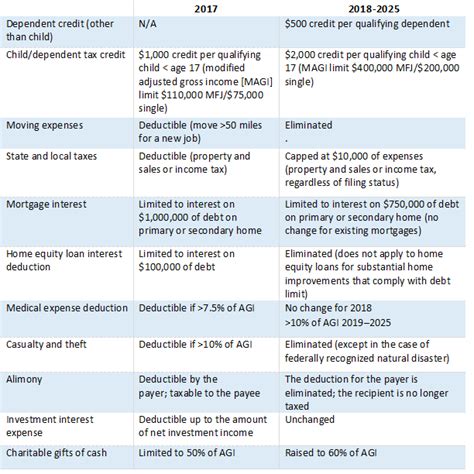

It’s important to note that the tax brackets outlined above represent the standard federal tax rates. However, taxpayers can reduce their taxable income through various deductions and credits, such as the standard deduction, itemized deductions, and tax credits for specific expenses or circumstances. These deductions can significantly impact an individual’s tax liability and may move them into a lower tax bracket.

Additionally, taxpayers can qualify for various tax credits, such as the Child Tax Credit, Earned Income Tax Credit, and Education Credits, which can further reduce their tax liability. These credits are designed to provide financial relief for specific expenses or circumstances, making the tax system more equitable and beneficial for certain taxpayers.

The Impact of Tax Reform: A New Era

The 2018 tax brackets were a direct result of the Tax Cuts and Jobs Act, which represented the most significant tax overhaul in decades. The act brought about several key changes, including lowering tax rates for individuals and corporations, expanding tax brackets, and modifying deductions and credits.

The expansion of tax brackets, as seen in the 2018 tax year, aimed to provide tax relief to a broader range of income levels. The lower tax rates and broader brackets benefited many taxpayers, particularly those in the middle-income range. However, the changes also impacted higher-income earners, as some brackets saw an increase in tax rates.

The tax reform also simplified the tax code by eliminating or limiting certain deductions, such as the state and local tax deduction (SALT), and introducing new ones, like the Family Credit. These modifications aimed to make the tax system more efficient and reduce the complexity often associated with tax filing.

Long-Term Implications and Adjustments

The 2018 tax brackets and the Tax Cuts and Jobs Act ushered in a new era of tax policy in the United States. The reforms aimed to stimulate economic growth, encourage investment, and provide tax relief to individuals and businesses. While the initial impact was notable, the long-term effects are still being evaluated and discussed among economists and policymakers.

As with any major tax reform, there are ongoing debates and adjustments. The Tax Cuts and Jobs Act was designed to be temporary, with many of its provisions set to expire in the future. Congress and the IRS regularly review and adjust tax laws and regulations to address emerging issues and changing economic conditions. Taxpayers and professionals must stay informed about these changes to ensure compliance and take advantage of available tax benefits.

In conclusion, the 2018 tax brackets were a critical component of the Tax Cuts and Jobs Act, shaping the tax landscape for individuals, families, and businesses. The revised brackets and tax rates offered tax relief to many while introducing new challenges for others. Understanding these brackets and their implications is essential for taxpayers to navigate the complex world of taxes and make informed financial decisions.

How did the 2018 tax brackets compare to previous years?

+The 2018 tax brackets represented a significant departure from previous years, primarily due to the Tax Cuts and Jobs Act. The act lowered tax rates and expanded brackets, providing tax relief to many taxpayers. However, some higher-income earners faced increased tax rates.

What was the impact of the Tax Cuts and Jobs Act on the middle class?

+The Tax Cuts and Jobs Act aimed to provide tax relief to the middle class by lowering tax rates and expanding brackets. Many middle-income earners benefited from these changes, resulting in reduced tax liabilities and increased disposable income.

Are there any long-term implications of the 2018 tax reforms?

+The long-term implications of the 2018 tax reforms are still being evaluated. While the reforms aimed to stimulate economic growth and provide tax relief, their impact on the economy and tax policy will continue to be studied and debated by economists and policymakers.