Endowment Tax

Welcome to this comprehensive guide on the complex and often misunderstood topic of Endowment Tax, a critical aspect of financial planning and wealth management. Endowment Tax is a subject that impacts a wide range of individuals and organizations, from personal investors to charitable institutions. This article aims to provide an in-depth analysis, exploring the intricacies of Endowment Tax, its implications, and its role in shaping financial strategies.

Unraveling Endowment Tax: An Essential Guide

Endowment Tax is a specialized form of taxation that applies to certain types of endowments and charitable funds. It is a crucial component of the tax landscape, designed to regulate and manage the financial activities of entities that operate within the charitable and not-for-profit sectors. While it may seem niche, Endowment Tax has far-reaching implications for both the entities it affects and the beneficiaries they serve.

This guide will delve into the specifics of Endowment Tax, exploring its historical context, current regulations, and future prospects. By the end, readers should have a comprehensive understanding of this tax mechanism and its role in modern finance.

The History and Evolution of Endowment Tax

The concept of Endowment Tax has its roots in the early 20th century, when governments began to recognize the need for a distinct tax treatment for charitable entities. The initial motivation was to ensure that these organizations, which often held substantial assets, contributed to the public treasury while maintaining their charitable objectives.

Over the decades, Endowment Tax has evolved to become a sophisticated system, with complex rules and regulations governing its application. This evolution has been driven by a delicate balance between the need for fair taxation and the desire to encourage and support charitable activities.

One of the key milestones in the history of Endowment Tax was the introduction of exemptions and incentives for certain types of endowments. These measures aimed to encourage donations and contributions to charitable causes, recognizing the vital role that these entities play in society.

| Endowment Type | Tax Treatment |

|---|---|

| Charitable Endowments | Typically exempt from Endowment Tax, but subject to specific conditions. |

| Educational Endowments | May be eligible for tax benefits, depending on the nature of the institution and its activities. |

| Scientific Research Endowments | Often receive favorable tax treatment to promote innovation and research. |

Understanding the Mechanics of Endowment Tax

Endowment Tax operates on a set of principles that distinguish it from traditional income tax systems. At its core, Endowment Tax is levied on the investment income generated by the endowment, rather than on the endowment's principal amount.

This distinction is crucial, as it allows the endowment to retain and grow its capital, which is essential for long-term sustainability and the fulfillment of its charitable objectives. The tax is typically calculated based on the annual return generated by the endowment's investments, with rates varying depending on the jurisdiction.

The mechanics of Endowment Tax are intricate, involving various calculations and considerations such as:

- Income Thresholds: Endowments may be subject to Endowment Tax only when their investment income exceeds a certain threshold.

- Exemptions: Certain types of income, such as donations or specific types of investment gains, may be exempt from Endowment Tax.

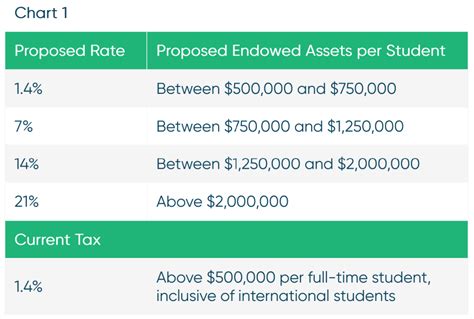

- Rate Structure: Endowment Tax rates can vary, with some jurisdictions employing progressive rates similar to income tax, while others use a flat rate.

- Deductions : Endowments may be entitled to certain deductions, such as expenses related to managing the endowment or charitable activities.

Navigating these complexities requires a deep understanding of the tax system and often involves seeking professional advice to ensure compliance and optimize the endowment's financial position.

Case Study: The Impact of Endowment Tax on Real-World Endowments

To illustrate the practical implications of Endowment Tax, let's consider the example of the Smithsonian Institution, a world-renowned educational and research complex based in Washington, D.C. The Smithsonian's endowment is one of the largest in the world, with a current value of over $1 billion.

The institution's endowment is a critical component of its financial strategy, providing a steady stream of income to support its operations and mission. However, Endowment Tax plays a significant role in managing this income.

In a typical year, the Smithsonian's endowment generates $50 million in investment income. Of this amount, approximately $10 million is subject to Endowment Tax. The institution carefully manages its investments to minimize tax liabilities while maximizing returns, a delicate balance that requires expertise and strategic planning.

The impact of Endowment Tax extends beyond the institution's finances. It also influences the institution's ability to expand its facilities, support new research initiatives, and enhance public access to its vast collections. Proper management of Endowment Tax obligations is therefore essential to the Smithsonian's long-term success and its contribution to society.

The Future of Endowment Tax: Trends and Projections

Looking ahead, the future of Endowment Tax is likely to be shaped by several key trends and developments.

Growing Importance of Endowments

Endowments are becoming increasingly important in funding charitable activities, education, and scientific research. As these institutions grow in size and influence, Endowment Tax will continue to be a critical consideration for their financial management.

Changing Tax Landscapes

Tax regimes around the world are in a constant state of flux. Changes in government policies, economic conditions, and global trends can significantly impact Endowment Tax. Keeping abreast of these changes is essential for endowments to maintain their financial health and strategic advantage.

Technological Innovations in Endowment Management

The rise of financial technology (fintech) is transforming the way endowments are managed. From advanced investment strategies to innovative risk management tools, these technological advancements can help endowments optimize their financial performance and tax efficiency.

Environmental, Social, and Governance (ESG) Considerations

ESG factors are increasingly influencing investment decisions, and this trend is likely to continue. Endowments that integrate ESG considerations into their investment strategies may find themselves in a stronger position, both financially and in terms of public perception.

Conclusion

Endowment Tax is a critical component of the financial landscape, with profound implications for charitable institutions and the communities they serve. This guide has provided an in-depth exploration of Endowment Tax, from its historical evolution to its practical impact on real-world endowments. By understanding the intricacies of this tax mechanism, endowments can navigate the complex financial terrain with confidence and continue to fulfill their vital roles in society.

How is Endowment Tax different from traditional income tax?

+Endowment Tax is distinct from traditional income tax in that it is levied specifically on the investment income of endowments, rather than on the endowment’s principal amount. This approach allows endowments to retain and grow their capital, which is essential for long-term sustainability and the fulfillment of their charitable objectives.

What are the key factors that influence Endowment Tax calculations?

+Endowment Tax calculations are influenced by various factors, including income thresholds, exemptions, rate structures, and deductions. Income thresholds determine when an endowment becomes subject to Endowment Tax, while exemptions can exclude certain types of income from taxation. Rate structures can vary, with some jurisdictions employing progressive rates similar to income tax, while others use a flat rate. Deductions may be available for expenses related to managing the endowment or charitable activities.

How do technological innovations impact Endowment Tax management?

+Technological innovations, particularly in financial technology (fintech), are transforming endowment management. Advanced investment strategies and innovative risk management tools can help endowments optimize their financial performance and tax efficiency. These technologies enable more precise investment decisions, enhance risk assessment, and improve overall financial management, ultimately contributing to better Endowment Tax outcomes.