Sales Tax In Torrance Ca

Sales tax is an essential component of the revenue system in the United States, and it plays a significant role in the economic landscape of every state and local government. In California, sales tax is a vital source of funding for public services and infrastructure, and it is administered at both the state and county levels. Torrance, a vibrant city in Los Angeles County, has its own unique sales tax structure that influences local businesses and consumers alike. This article aims to provide an in-depth analysis of the sales tax in Torrance, California, exploring its rates, administration, and impact on the local economy.

Understanding Sales Tax in Torrance, CA

Torrance, a bustling city located in the South Bay region of Los Angeles County, boasts a diverse economy and a thriving business community. Sales tax in Torrance operates under a complex system, with multiple layers of taxation that contribute to the overall rate. Let’s delve into the specifics of sales tax in this vibrant city.

State Sales Tax Rate

Like all cities in California, Torrance is subject to the state sales tax rate, which serves as the foundation for local tax calculations. As of [current year], the state sales tax rate in California is 7.25%. This rate is applied uniformly across the state and forms the baseline for local jurisdictions to build upon.

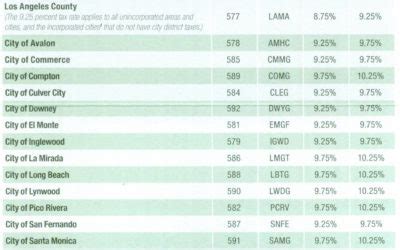

Local Sales Tax Rates

In addition to the state sales tax, Torrance imposes its own local sales tax, known as the Torrance City Sales Tax. This local tax rate is 1.00%, bringing the total sales tax rate in Torrance to 8.25%. The additional local tax is allocated to fund various city projects and services, contributing to the overall development and maintenance of the city’s infrastructure.

District Sales Tax Rates

Torrance is also part of the Los Angeles County Metropolitan Transportation Authority (Metro) district, which levies an additional sales tax to support transportation projects. As of [current year], the Metro district sales tax rate in Torrance is 0.50%, bringing the total sales tax rate in the city to 8.75%. This tax is a crucial source of funding for the development and maintenance of the region’s transportation network.

| Sales Tax Category | Rate |

|---|---|

| State Sales Tax | 7.25% |

| Torrance City Sales Tax | 1.00% |

| Metro District Sales Tax | 0.50% |

| Total Sales Tax in Torrance | 8.75% |

Administration and Collection of Sales Tax

The administration and collection of sales tax in Torrance are a collaborative effort between various government entities. Let’s explore the key players and processes involved.

California Department of Tax and Fee Administration (CDTFA)

The California Department of Tax and Fee Administration is responsible for overseeing and administering the state sales tax. The CDTFA sets the state sales tax rate, establishes tax regulations, and provides guidance to businesses and consumers on sales tax compliance. They also enforce tax laws and ensure that businesses accurately collect and remit sales tax.

Torrance City Government

The Torrance City Government plays a vital role in the administration of the local sales tax. The city’s finance department is responsible for collecting and managing the city sales tax revenue. They work closely with businesses to ensure compliance with local tax laws and regulations. The city government also allocates the funds generated from the local sales tax to various city projects, including infrastructure development, public safety, and community services.

Los Angeles County

Los Angeles County, through its Board of Supervisors, oversees the administration of the Metro district sales tax. The county collects the additional tax and allocates the funds to support transportation projects, such as public transit systems, highways, and road maintenance. The county’s transportation department works in collaboration with the Metro to ensure the efficient use of these funds.

Impact on Local Businesses and Consumers

The sales tax structure in Torrance has a significant impact on both local businesses and consumers. Understanding these effects is crucial for businesses to navigate tax obligations and for consumers to make informed purchasing decisions.

Businesses

For businesses operating in Torrance, the sales tax rate directly affects their revenue and profitability. Here are some key considerations for businesses:

- Compliance and Registration: Businesses must register with the CDTFA and obtain a seller's permit to collect and remit sales tax. Compliance with tax regulations is essential to avoid penalties and legal consequences.

- Tax Collection and Remittance: Businesses are responsible for accurately calculating and collecting sales tax on taxable goods and services. They must remit the collected tax to the appropriate government entities on a regular basis, typically on a quarterly or monthly basis.

- Taxable vs. Exempt Items: Understanding which goods and services are taxable and which are exempt is crucial for businesses. This knowledge ensures accurate tax calculations and prevents overcharging customers.

- Price Strategies: Businesses may need to adjust their pricing strategies to account for the sales tax. Some businesses choose to absorb the tax into their pricing, while others may pass it on to the consumer. The choice depends on various factors, including market competition and customer expectations.

Consumers

Consumers in Torrance are directly impacted by the sales tax rate when making purchases. Here’s what consumers should know:

- Tax Inclusion in Prices: Consumers should be aware that the sales tax is typically included in the displayed prices of goods and services. It's essential to consider the tax when comparing prices and making purchasing decisions.

- Tax Exemptions: Certain items, such as food and prescription drugs, are exempt from sales tax in California. Consumers should be aware of these exemptions to make informed choices and potentially save money on their purchases.

- Online Shopping: When shopping online, consumers should consider the sales tax implications. Many online retailers display prices without tax, and the tax is calculated during the checkout process based on the shipping address. Consumers should be mindful of the total cost, including tax, to avoid surprises at checkout.

Sales Tax and Economic Development

The sales tax revenue generated in Torrance contributes significantly to the city’s economic development and overall prosperity. Here’s how sales tax impacts the local economy:

Infrastructure Development

A substantial portion of the sales tax revenue in Torrance is allocated to infrastructure projects. These funds support the development and maintenance of roads, bridges, public transportation systems, and other vital infrastructure. Well-maintained infrastructure enhances the city’s attractiveness to businesses and residents, fostering economic growth and job creation.

Community Services

Sales tax revenue also funds essential community services, such as public safety, education, and social programs. The city can invest in police and fire departments, ensuring the safety and well-being of its residents. Additionally, sales tax funds can support local schools, libraries, and community centers, providing valuable resources and opportunities for the community.

Business Growth and Investment

The sales tax structure in Torrance can influence business growth and investment decisions. A stable and competitive tax environment can attract new businesses and encourage existing businesses to expand. The availability of funds for infrastructure development and community services creates a positive business climate, fostering economic growth and job opportunities.

Conclusion: Navigating Sales Tax in Torrance

Sales tax in Torrance, California, is a complex yet essential component of the city’s economic landscape. The city’s sales tax structure, with its state, local, and district components, plays a vital role in funding public services, infrastructure, and transportation projects. For businesses, understanding and complying with sales tax regulations is crucial for success and growth. Consumers, on the other hand, should be aware of tax implications when making purchasing decisions to ensure they are well-informed.

As Torrance continues to thrive and develop, its sales tax structure will remain a key factor in shaping the city's economic future. By navigating the sales tax landscape effectively, both businesses and consumers can contribute to the city's prosperity and overall well-being.

How often do businesses need to remit sales tax in Torrance?

+Businesses in Torrance are generally required to remit sales tax on a quarterly basis. However, businesses with higher sales volumes may be required to remit monthly. It’s important for businesses to stay updated with the remittance schedule and ensure timely submissions to avoid penalties.

Are there any sales tax holidays in Torrance?

+Currently, Torrance does not have specific sales tax holidays. However, California occasionally offers sales tax holidays for certain items, such as back-to-school supplies or energy-efficient appliances. These holidays are usually announced in advance and provide an opportunity for consumers to save on specific purchases.

How can businesses stay updated with sales tax regulations in Torrance?

+Businesses can stay informed by regularly checking the websites of the California Department of Tax and Fee Administration (CDTFA) and the Torrance City Government. These websites provide up-to-date information on tax rates, regulations, and any changes or updates. Additionally, businesses can subscribe to email alerts or follow relevant social media accounts for timely notifications.