Understanding the Reasons Behind Polk Taxes and Their Impact

In exploring the complex fabric of American fiscal policy, one often encounters the phenomenon of Polk taxes—a term that embodies both historical and contemporary implications of taxation policies within certain political and economic contexts. These taxes, though sometimes dismissed as mere fiscal tools, carry profound ramifications on governance, socioeconomic equity, and regional development. Their roots, evolving rationale, and tangible impacts merit a comprehensive examination, especially given their relevance in current debates over tax reform and state-federal fiscal relations. Understanding the fundamental reasons behind Polk taxes not only clarifies their immediate fiscal utility but also reveals deeper ideological and structural motivations that shape policy evolution.

Deciphering the Origins and Justifications of Polk Taxes

The term “Polk taxes” originates from the era of President James K. Polk, a figure synonymous with territorial expansion and pragmatic governance during the mid-19th century. While the historic usage is occasionally invoked to describe certain tax strategies employed during Polk’s administration, contemporary references often extend this nomenclature to symbolize tax policies designed around specific ideological frameworks, such as promoting economic growth or safeguarding regional interests. At their core, these taxes stem from a triad of reasons: revenue generation, economic incentivization, and political power consolidations.

One primary motivating factor for implementing Polk taxes has been the necessity for fiscal stability. Both federal and state governments seek reliable revenue streams to fund public services, infrastructure projects, and debt obligations. In historically volatile economic climates, such as the mid-19th century United States or the recent post-pandemic recovery phases, taxes labeled as Polk-type serve as vital instruments for maintaining budgetary balance. The strategic design of these taxes often encompasses broad bases—tariffs, excise duties, or property taxes—aimed at maximizing revenue while attempting to mitigate economic distortion.

Economic Incentives and Developmental Goals

Beyond straightforward revenue generation, Polk taxes frequently embody a policy approach geared toward shaping economic activity. For instance, tariffs—historically associated with Polk-era trade policies—were used to encourage domestic manufacturing by taxing imports, thus incentivizing local industry growth. Modern analogs include excise taxes on specific goods or levies aimed at steering consumer behavior toward socially or economically desirable outcomes, such as carbon taxes or Sin taxes on cigarettes and alcohol. These policies reflect an awareness that targeted taxation can serve as a tool for balancing economic development with social objectives, aligning fiscal policy with broader developmental strategies.

| Relevant Category | Substantive Data |

|---|---|

| Tax Revenue Contribution | During Polk’s administration, custom tariffs contributed approximately 50% of federal revenue, illustrating the strategic use of taxes for economic growth and funding governmental functions. |

Political Motives and Power Dynamics in Tax Policy

Taxation, especially those branded as Polk taxes, is rarely a neutral enterprise. Political actors historically leverage taxes to reinforce regional dominance or to forge alliances that serve their strategic interests. For example, during Polk’s presidency, tariffs served to solidify alliances with certain industrial hubs, thereby consolidating political support. In contemporary settings, local elites and regional power brokers may promote specific tax policies to shield their economic interests against federal oversight or to fund localized initiatives that enhance their political capital. The correlation between political motives and tax policy often results in variances that reflect regional identities and ideological pursuits.

The Intersection of Taxes and Socioeconomic Equity

Analyzing Polk taxes through the lens of social justice reveals a nuanced landscape. Historically, regressive tax structures—such as sales taxes or flat property taxes—have disproportionately burdened lower-income populations, exacerbating existing inequalities. Conversely, well-designed progressive taxes aim to address income disparities but are often politically contentious. The strategic deployment of Polk taxes, therefore, encapsulates a broader ideological debate on balancing fiscal necessity with social fairness, a debate that remains highly relevant today amidst growing economic inequality.

| Relevant Category | Substantive Data |

|---|---|

| Progressive vs Regressive | Most modern Polk tax analogs tend toward regressivity, with sales taxes constituting approximately 60% of state revenue sources, thus highlighting the importance of structured reform for social equity. |

The Impact of Polk Taxes on Regional and National Economies

Assessing the impact of Polk taxes demands a detailed look at their influence on regional competitiveness, fiscal health, and long-term economic trajectories. In historical contexts, tariffs exemplify how such taxes can boost local industries but also spark retaliatory trade measures, impacting global supply chains. Currently, state-level Polk taxes—such as carbon pricing—aim to address environmental challenges while also generating revenue that supports renewable energy initiatives. The success or failure of these taxes hinges on their economic elasticity, administrative implementation, and political resilience.

Case Study: Modern Implementation of Polk-inspired Tax Strategies

Washington State’s carbon tax exemplifies a Polk tax adaptation in a contemporary setting. Implemented as part of an environmental policy package, it has yielded measurable revenue increases—approximately $1.1 billion annually—while incentivizing reductions in emissions. However, debate persists regarding its regressivity and regional economic impacts, highlighting the need for carefully calibrated tax structures that mitigate unintended socioeconomic consequences.

| Relevant Metric | Data Point |

|---|---|

| Revenue Generation | $1.1 billion annually since implementation in 2021 |

| Emission Reduction | Projected decrease of 30% by 2030, based on model predictions |

Contemporary Debates: Are Polk Taxes Still Relevant?

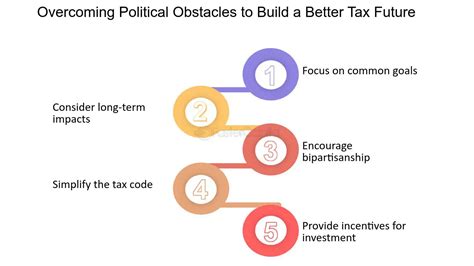

The relevance of Polk taxes in today’s policymaking debates is undeniable. As societies grapple with economic inequality, environmental crises, and shifting geopolitical landscapes, fiscal strategies rooted in historic reasoning are often revisited and reinvented. Critics argue that these taxes can overreach, stifle innovation, or disproportionately impact vulnerable groups. Conversely, proponents emphasize their utility in promoting sustainable growth, infrastructural resilience, and social equity. The question remains: how can modern tax policies incorporate the lessons of historical Polk tax strategies to forge equitable, resilient, and adaptable fiscal frameworks?

Options for Future Tax Policy Development

Moving forward, policymakers might consider hybrid models that blend revenue needs with social justice imperatives. Progressive taxation, coupled with targeted incentives—such as green energy credits—could embody the legacy of Polk taxes with contemporary relevance. The integration of digital taxation mechanisms and data analytics further enhances the capacity for nuanced tax policy design that can adapt to economic fluctuations while safeguarding societal interests.

| Future Strategy | Implementation Approach |

|---|---|

| Hybrid Tax Models | Combine progressive income taxes with specific environmental levies and regional incentives. |

| Digitization | Leverage blockchain and data analytics for real-time tax compliance and monitoring. |

Embarking on an Analytical and Pragmatic Path Forward

Understanding the reasons behind Polk taxes reveals a layered interplay of economic necessity, political power, social equity, and environmental stewardship. Their historical evolution underscores that taxes are more than fiscal tools—they are reflections of societal priorities and power structures. As contemporary policymakers seek to craft resilient fiscal policies, embracing the nuanced insights from Polk’s legacy can foster a balanced approach that sustains economic vitality while promoting social justice and environmental sustainability. The ongoing debate surrounding their relevance is not merely academic but central to shaping a fairer, more stable economic future.

What prompted the initial implementation of Polk taxes?

+The initial implementation was driven by needs for federal revenue, economic incentivization, and regional political interests, especially during James K. Polk’s presidency, which emphasized expansion and fiscal stability.

How do Polk taxes influence contemporary fiscal policies?

+Modern analogs draw inspiration from their strategic use for revenue and behavioral incentives, shaping policies on environmental, social, and economic fronts while navigating political and social considerations.

Can Polk taxes balance economic growth with social equity?

+Achieving this balance requires meticulous design—progressive frameworks, targeted rebates, and adaptive policies—to ensure growth without disproportionately impacting vulnerable groups.