Property Taxes Orange County

Property taxes in Orange County, California, are an important aspect of homeownership and contribute significantly to the local economy. Understanding the ins and outs of property taxation is crucial for residents, as it directly impacts their financial planning and the overall cost of owning a home in this vibrant county. With its diverse range of communities and properties, Orange County's tax landscape offers a unique and dynamic environment.

Understanding Property Taxes in Orange County

Property taxes are a primary source of revenue for local governments and are used to fund essential services such as public schools, law enforcement, fire protection, infrastructure development, and more. In Orange County, these taxes are levied on both residential and commercial properties, with rates varying based on several factors.

The assessment process for property taxes in Orange County is a meticulous one, involving the Orange County Assessor's Office. This office is responsible for determining the assessed value of each property, which forms the basis for tax calculations. The assessed value is not the same as the market value, as it takes into account factors like purchase price, improvements, and other specific guidelines set by the state.

Tax Rates and Assessments

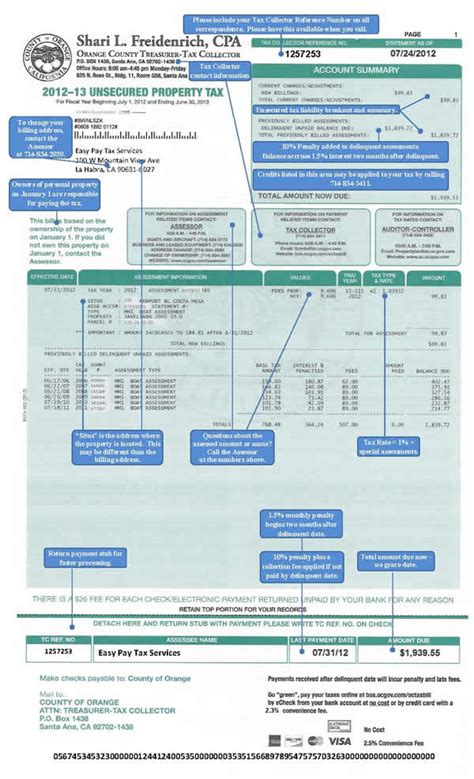

Orange County’s tax rate is comprised of several components, including the base rate set by the county, voter-approved rates for specific purposes like schools or infrastructure, and special assessments for services like flood control or mosquito abatement. These rates are expressed as a percentage of the assessed value and can vary from one area to another within the county.

| Tax Component | Rate |

|---|---|

| Base County Tax Rate | 1.04% |

| Voter-Approved Taxes | Varies (e.g., 0.10% for school bonds) |

| Special Assessments | Varies (e.g., $0.15 per $100 assessed value for mosquito control) |

For instance, a homeowner in Irvine with a property assessed at $700,000 would pay a base county tax of $7,280 (1.04% of $700,000), plus any additional taxes approved by voters or special assessments applicable to their area. These additional rates can significantly impact the overall tax bill.

Proposition 13 and Its Impact

One of the key factors influencing property taxes in California, and by extension, Orange County, is Proposition 13, a constitutional amendment passed in 1978. This proposition limits the tax rate to 1% of a property’s purchase price or assessed value, whichever is lower, and caps the annual increase in assessed value at 2%.

Proposition 13 provides stability for homeowners, as it prevents drastic increases in property taxes. However, it also means that a homeowner's tax bill may not accurately reflect the current market value of their property. This can lead to situations where newer properties with lower assessed values pay less in taxes than older properties with higher assessed values.

The Assessment Process

The Orange County Assessor’s Office plays a critical role in the property tax landscape. This office is responsible for assessing all real property within the county, ensuring that the assessments are fair and accurate, and providing valuable data to taxpayers and the community.

Annual Assessment

Each year, the Assessor’s Office reviews and updates the assessed values of all properties in Orange County. This process involves examining factors such as sales data, building permits, and other relevant information to ensure the assessments remain current.

For homeowners, this means receiving a property tax assessment notice annually, detailing the assessed value of their property and the calculated taxes. If a homeowner disagrees with the assessed value, they have the right to appeal, which is a formal process handled by the Assessment Appeals Board.

Reassessment Triggers

While annual assessments are the norm, certain events can trigger a reassessment of a property’s value. These triggers include:

- Change of Ownership: When a property is sold, the new assessed value is typically set to the purchase price, unless the property is sold to certain relatives (like a parent-child transfer) or as part of a government program.

- New Construction: Any additions or improvements to a property that increase its value may lead to a reassessment.

- Damage or Destruction: If a property is damaged or destroyed, the assessed value may be reduced until repairs are made.

Tax Relief Programs

Orange County recognizes the diversity of its residents and offers several tax relief programs to assist homeowners facing financial challenges or unique circumstances. These programs aim to make property ownership more accessible and equitable.

Senior Citizen Exemption

Qualifying senior citizens (aged 65 and above) may be eligible for an exemption of up to $7,000 on their property’s assessed value. This exemption can significantly reduce the tax burden for older homeowners. The exemption is available to those who meet certain income requirements and have owned and resided in their home for at least three years.

Disabled Veteran Exemption

Veterans with a service-connected disability may qualify for an exemption of up to $150,000 on their property’s assessed value. This exemption is designed to support those who have served our country and may face unique challenges.

Homeowner Assistance Programs

Orange County also offers various assistance programs to help homeowners avoid foreclosure and maintain their properties. These programs provide financial support, counseling, and resources to those facing economic hardship.

Impact on the Community

Property taxes are a significant contributor to the economic health of Orange County. The revenue generated from these taxes funds vital services and infrastructure projects that benefit the entire community. It’s a delicate balance, as higher property taxes can impact the affordability of living in the county, but they also ensure the continued development and maintenance of the region.

Residential Property Tax Contributions

Residential properties make up a substantial portion of the tax base in Orange County. According to recent data, residential properties contribute approximately 70% of the total property tax revenue. This highlights the importance of homeowners’ tax contributions to the local economy.

Community Development and Infrastructure

The funds generated from property taxes are invested back into the community. This includes the development and maintenance of parks, roads, public transportation, and other essential services. For instance, a portion of the taxes goes towards funding the Orange County Transportation Authority (OCTA), which provides vital public transit services throughout the county.

Looking Ahead: Future Implications

The property tax landscape in Orange County, like any other region, is subject to change and evolution. As the county continues to grow and develop, several factors will influence the future of property taxation.

Population Growth and Housing Demand

Orange County’s population is projected to grow steadily in the coming years, which will likely drive an increase in housing demand. This could lead to a rise in property values, potentially impacting tax assessments and revenue.

Infrastructure Needs

As the county’s population grows, so does the demand for infrastructure development and maintenance. This includes everything from road improvements to the expansion of public transportation networks. The funding for these projects often comes from property taxes, so the tax landscape will need to adapt to meet these evolving needs.

Proposition 13 Reforms

While Proposition 13 has provided stability for many homeowners, it has also led to some inequities. As such, there have been ongoing discussions about potential reforms. Any changes to Proposition 13 could significantly impact property tax assessments and the overall tax landscape in Orange County.

FAQs

How often are property taxes assessed in Orange County?

+

Property taxes in Orange County are assessed annually. The Orange County Assessor’s Office reviews and updates the assessed values of all properties each year to ensure fairness and accuracy.

Can I appeal my property tax assessment in Orange County?

+

Yes, if you believe your property’s assessed value is incorrect, you have the right to appeal. The Assessment Appeals Board handles these appeals, and you’ll need to provide evidence to support your case.

What happens if I don’t pay my property taxes in Orange County?

+

Unpaid property taxes can lead to serious consequences, including penalties, interest, and potentially the loss of your property through a tax sale. It’s important to stay current with your tax payments to avoid these issues.

Are there any tax relief programs for low-income homeowners in Orange County?

+

Yes, Orange County offers various tax relief programs, including the Senior Citizen Exemption and Disabled Veteran Exemption. Additionally, there are homeowner assistance programs that provide financial support and resources to those facing economic hardship.

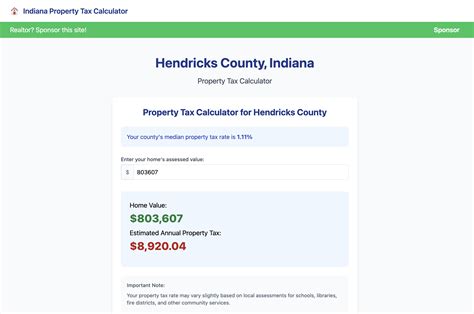

How can I estimate my property taxes in Orange County before buying a home?

+

You can estimate your property taxes by multiplying the assessed value of the property by the applicable tax rate. However, it’s important to note that this estimate may not account for all factors, and you should consult with a tax professional for a more accurate projection.