Ny State Income Tax Status

Welcome to this comprehensive guide on the New York State Income Tax Status, a crucial aspect of financial planning and compliance for residents and businesses alike. Understanding the intricacies of state taxes is essential for managing your finances effectively and ensuring you fulfill your tax obligations. In this article, we delve into the specifics of New York's income tax system, offering a detailed analysis of rates, brackets, deductions, and other vital components.

Understanding New York State Income Tax

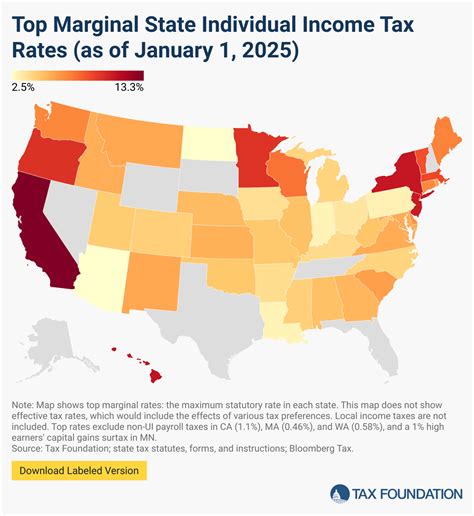

New York State, like many other states in the US, imposes an income tax on its residents and businesses. This tax is a significant source of revenue for the state, funding various public services and infrastructure projects. The state income tax operates separately from federal income tax, meaning residents are subject to both sets of tax regulations.

The New York State income tax system is progressive, meaning tax rates increase as income levels rise. This approach ensures that higher-income earners contribute a larger proportion of their income to the state's revenue, promoting a more equitable distribution of tax burden.

Tax Rates and Brackets

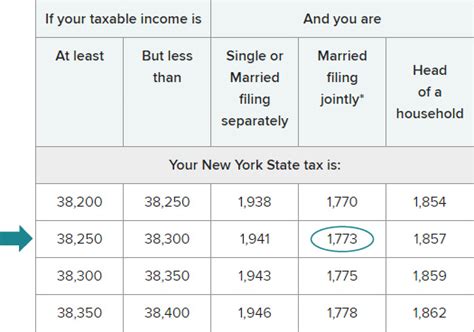

New York State income tax rates are determined by tax brackets, which categorize income levels and apply corresponding tax rates. As of the latest tax year, these brackets and rates are as follows:

| Income Bracket | Tax Rate |

|---|---|

| Up to $8,600 | 4% |

| $8,601 - $11,950 | 4.5% |

| $11,951 - $14,150 | 5.25% |

| $14,151 - $21,900 | 5.9% |

| $21,901 - $161,550 | 6.45% |

| $161,551 and above | 6.85% |

It's important to note that these tax rates are for single filers. Married couples filing jointly may be subject to different brackets and rates.

Deductions and Credits

New York State offers various deductions and credits to reduce the tax burden on its residents. These include:

- Standard Deduction: A set amount that reduces taxable income, varying by filing status. For the current tax year, the standard deduction is $2,300 for single filers and $4,600 for married couples filing jointly.

- Personal Exemptions: An amount that can be deducted for each taxpayer, spouse, and dependent. However, personal exemptions have been phased out for tax years 2020 and beyond.

- Itemized Deductions: These include expenses such as medical costs, state and local taxes, charitable contributions, and mortgage interest. Itemized deductions can reduce taxable income further, but only if they exceed the standard deduction.

- Child and Dependent Care Credit: This credit is available for expenses related to caring for a dependent child or adult while the taxpayer works or looks for work.

- Credit for the Elderly or Disabled: New York State offers a credit for elderly or disabled residents who meet certain income and asset limits.

Filing and Payment Options

New York State offers several options for filing and paying income taxes. The most common methods include:

Online Filing

The New York State Department of Taxation and Finance provides an online filing system, e-file NYS, which is a secure and convenient way to file your tax return. This system allows you to track the status of your return and receive notifications about any issues or refunds.

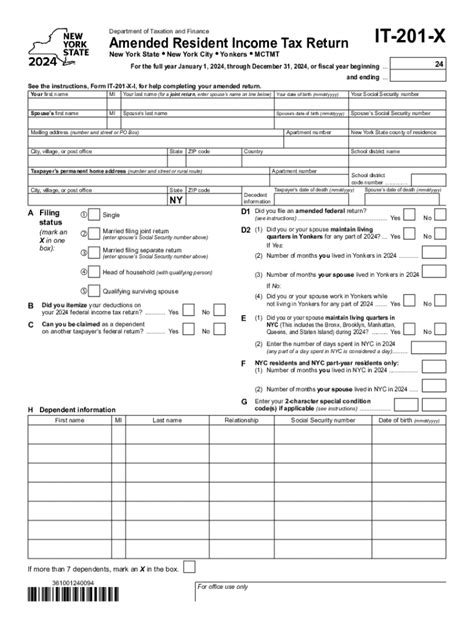

Paper Filing

For those who prefer a more traditional method, paper filing is also an option. The necessary forms can be downloaded from the Department's website or obtained from a local tax office. However, paper filing may result in a longer processing time.

Payment Methods

New York State accepts various payment methods, including:

- Direct Debit: You can authorize the state to withdraw the tax amount directly from your bank account on the due date.

- Credit or Debit Card: Most major credit and debit cards are accepted for tax payments, but be aware that a convenience fee may apply.

- Electronic Funds Transfer (EFT): This method allows you to transfer funds directly from your bank account to the state's account, typically through your online banking system.

- Check or Money Order: You can mail a check or money order to the address provided on the tax form. Ensure you include your payment voucher or write your Social Security Number on the check.

Compliance and Penalties

Non-compliance with New York State income tax regulations can result in significant penalties and interest charges. The state takes tax evasion and non-payment seriously, and it's important to ensure you understand and meet your tax obligations.

If you're unable to pay your taxes in full, it's advisable to contact the Department of Taxation and Finance to discuss potential payment plans or options. Ignoring tax obligations can lead to increased penalties and legal consequences.

Conclusion

Understanding the intricacies of New York State income tax is a critical aspect of financial management for residents and businesses. By familiarizing yourself with the tax rates, brackets, deductions, and filing options, you can ensure you're meeting your tax obligations and taking advantage of any available tax benefits. Remember, staying informed and compliant is key to avoiding penalties and maintaining a positive relationship with the state's tax authorities.

Frequently Asked Questions

What is the deadline for filing New York State income taxes?

+

The deadline for filing New York State income taxes typically aligns with the federal tax deadline, which is usually April 15th. However, this date may be adjusted if it falls on a weekend or a holiday. It’s always advisable to check the official state website for any updates or extensions.

Are there any income tax exemptions for New York State residents?

+

Yes, New York State offers certain exemptions for specific groups of residents. For example, there are exemptions for veterans, the disabled, and senior citizens. These exemptions can reduce taxable income and may apply to both state and local taxes. It’s important to check the eligibility criteria and apply for these exemptions if you qualify.

Can I file my New York State income taxes online for free?

+

Yes, New York State provides a free online filing system called e-file NYS. This system is available to all residents and offers a secure and convenient way to file your tax return. However, keep in mind that some tax preparation software companies may charge a fee for their services, even if they offer a “free” state filing option.

What happens if I miss the tax filing deadline in New York State?

+

Missing the tax filing deadline can result in penalties and interest charges. The amount of the penalty and interest will depend on the amount of tax owed and the length of the delay. It’s always best to file your return as soon as possible, even if you can’t pay the full amount owed. If you’re unable to file by the deadline, consider requesting an extension to avoid late filing penalties.

How can I check the status of my New York State tax refund?

+

You can check the status of your New York State tax refund by visiting the Department of Taxation and Finance’s website and using their Where’s My Refund tool. You’ll need to provide your Social Security Number, filing status, and the exact amount of your expected refund. The tool will provide you with an estimated date for your refund, or you can track the progress of your refund once it has been issued.