Nys Sales Tax Online

Welcome to our comprehensive guide on New York State (NYS) Sales Tax for Online Businesses. In today's digital age, many entrepreneurs are venturing into the world of e-commerce, and understanding the intricacies of sales tax compliance is crucial for success. This article aims to provide an in-depth analysis of NYS sales tax regulations, offering valuable insights and strategies for online businesses to navigate this complex landscape effectively.

Understanding NYS Sales Tax for Online Businesses

New York State imposes a sales tax on the sale of tangible personal property and certain services. For online businesses, this means that you may be responsible for collecting and remitting sales tax to the NYS Department of Taxation and Finance. The sales tax rate varies across the state, with a statewide base rate of 4%, and additional local and municipal taxes can apply, resulting in a combined rate that can exceed 8% in some areas.

The obligation to collect sales tax arises when your business has nexus with New York. Nexus is a constitutional requirement that establishes a connection between a business and a state, which triggers the obligation to register, collect, and remit sales tax. For online sellers, nexus can be established through various factors, such as having a physical presence in the state, employing staff in NYS, or exceeding economic thresholds (such as a certain number of transactions or sales volume) in a given period.

Economic Nexus in NYS

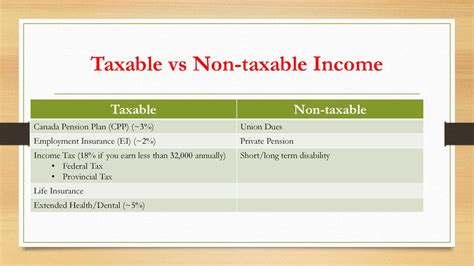

NYS introduced economic nexus laws in response to the Wayfair Supreme Court decision, which allowed states to require out-of-state sellers to collect sales tax based on economic activity rather than physical presence alone. As of our last update, the economic threshold for online sellers in NYS is $500,000 in annual sales or 200 separate transactions in the current or previous calendar year.

| Economic Nexus Threshold | Value |

|---|---|

| Sales Revenue | $500,000 |

| Transactions | 200 |

If your online business meets either of these criteria, you are considered to have economic nexus and are required to register for a Sales Tax Vendor Number, collect sales tax from NYS buyers, and remit the collected tax to the NYS Department of Taxation and Finance.

Sales Tax Registration and Collection

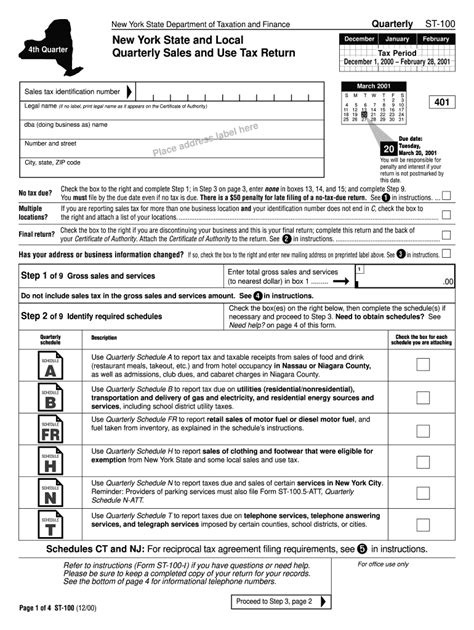

Once you’ve determined that you have nexus with NYS, the next step is to register for a Sales Tax Vendor Number. This can be done online through the New York State Tax Registration portal. During the registration process, you’ll need to provide basic business information and choose a filing frequency (typically quarterly or annually) for submitting your sales tax returns.

When collecting sales tax, it's crucial to accurately calculate the applicable rate for each transaction. This involves considering the buyer's location (as different areas within NYS may have varying local tax rates) and the nature of the product or service being sold. Many e-commerce platforms offer built-in tax calculation tools, but it's always a good idea to double-check the rates and ensure they are up-to-date with the latest NYS regulations.

Sales Tax Compliance and Reporting

Maintaining compliance with NYS sales tax regulations is an ongoing process. Here are some key aspects to consider:

Filing Sales Tax Returns

You must file sales tax returns on the frequency you selected during registration. These returns should accurately report the sales tax collected from buyers and any applicable exemptions or deductions. Late filing can result in penalties and interest, so it’s essential to stay organized and meet your filing deadlines.

Remitting Sales Tax Payments

Along with filing your sales tax returns, you must remit the collected sales tax to NYS. Payments can be made online through the Taxpayer Services Online portal or by other methods, such as electronic funds transfer or check. It’s important to ensure that your remittance matches the amounts reported on your sales tax returns to avoid discrepancies.

Record Keeping and Audits

NYS may conduct audits to ensure businesses are correctly calculating and remitting sales tax. During an audit, you may be required to provide detailed records of your sales, transactions, and tax calculations. Maintaining accurate and organized records is crucial to facilitate a smooth audit process and demonstrate your compliance with sales tax regulations.

Sales Tax Exemptions and Deductions

NYS offers certain sales tax exemptions and deductions that can help reduce your tax liability. Understanding these exemptions is crucial for optimizing your sales tax strategy.

Exempt Products and Services

Some products and services are exempt from sales tax in NYS. These can include certain food items, prescription drugs, and specific types of clothing. It’s essential to stay updated on the latest exemptions, as they can change over time. Consulting the NYS Department of Taxation and Finance website or seeking professional advice can help you identify and apply these exemptions accurately.

Resale and Purchase for Resale

If you’re a reseller, you may be eligible for a Resale Exemption Certificate. This certificate allows you to purchase goods for resale without paying sales tax. However, it’s important to note that you must still collect sales tax from your customers when you sell the goods. Properly understanding and utilizing the resale exemption can help streamline your sales tax obligations and reduce your tax burden.

Strategies for Effective Sales Tax Management

Navigating the complexities of NYS sales tax compliance can be challenging, but there are strategies you can employ to simplify the process and ensure accuracy.

Utilize Sales Tax Automation Tools

Sales tax automation software can be a valuable asset for online businesses. These tools integrate with your e-commerce platform and accounting software to automatically calculate sales tax rates, collect tax from buyers, and generate sales tax returns. By automating these processes, you can save time, reduce errors, and focus on growing your business.

Stay Informed and Proactive

Sales tax regulations can change frequently, so it’s crucial to stay informed about updates and amendments. Subscribe to newsletters or alerts from the NYS Department of Taxation and Finance, and consider joining industry associations or forums where sales tax topics are discussed. Being proactive in your approach to sales tax compliance can help you stay ahead of any changes and ensure you’re always operating within the law.

Seek Professional Guidance

For complex sales tax situations or when in doubt, seeking guidance from a tax professional or accountant with experience in sales tax compliance can be invaluable. They can provide tailored advice, assist with registration and reporting, and help you navigate any challenges or unique circumstances your business may face.

Conclusion

Understanding and complying with NYS sales tax regulations is a critical aspect of running an online business in the state. By familiarizing yourself with the economic nexus thresholds, accurately collecting and remitting sales tax, and staying informed about exemptions and deductions, you can ensure your business operates within the law and maintains a positive relationship with the NYS Department of Taxation and Finance.

Remember, sales tax compliance is an ongoing process, and staying proactive and organized is key to success. With the right strategies and tools, you can efficiently manage your sales tax obligations and focus on growing your online business in New York State.

What is the current NYS sales tax rate?

+The current statewide base sales tax rate in NYS is 4%, but local and municipal taxes can apply, resulting in a combined rate that varies across the state.

How do I determine if my online business has nexus with NYS?

+Nexus is established through physical presence, employment of staff in NYS, or exceeding economic thresholds. Economic nexus in NYS is triggered when your business reaches $500,000 in annual sales or 200 separate transactions in the current or previous calendar year.

What happens if I don’t register for a Sales Tax Vendor Number after meeting the economic nexus threshold?

+Failing to register and collect sales tax after meeting the economic nexus threshold can result in penalties, interest, and potential legal consequences. It’s important to stay compliant with NYS sales tax regulations to avoid these issues.

Are there any sales tax holidays in NYS?

+Yes, NYS sometimes offers sales tax holidays for specific products or occasions. During these periods, qualifying items may be exempt from sales tax. It’s important to stay updated on any sales tax holidays to take advantage of these opportunities and inform your customers accordingly.