Va Income Tax

Welcome to a comprehensive exploration of the Virginia Income Tax, a vital aspect of the state's financial landscape. Understanding the intricacies of this tax system is crucial for individuals and businesses alike, as it directly impacts their financial obligations and strategies. This guide aims to demystify the Virginia Income Tax, offering an in-depth analysis of its structure, rates, deductions, and other key features, along with practical insights to help you navigate this essential component of the Commonwealth's fiscal framework.

Understanding Virginia’s Income Tax Structure

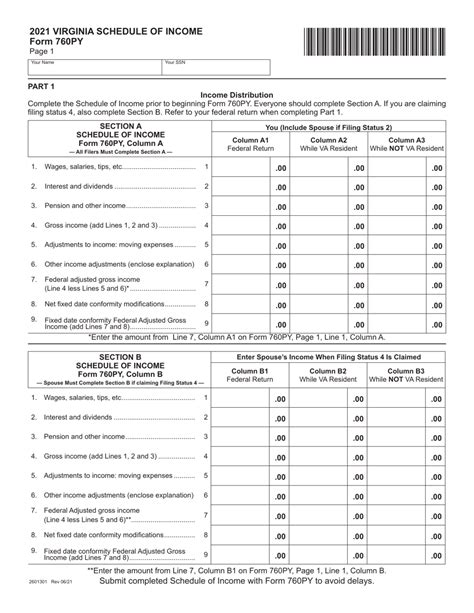

Virginia operates under a progressive income tax system, which means that the tax rate increases as your income rises. This structure aims to ensure that individuals and families with higher incomes contribute a larger share of their earnings towards the state’s revenue, fostering a more equitable tax system. The state’s income tax is distinct from federal income tax, and residents are required to file separate state and federal tax returns.

The Commonwealth of Virginia levies income tax on various sources of income, including wages, salaries, tips, commissions, bonuses, interest, dividends, capital gains, and retirement income. The state's tax system is designed to be comprehensive, capturing a wide range of income streams to contribute to its overall revenue.

| Income Bracket | Tax Rate |

|---|---|

| $0 - $3,000 | 2% |

| $3,001 - $5,000 | 3% |

| $5,001 - $17,000 | 5% |

| $17,001 and above | 5.75% |

The above tax rates are applicable for the 2023 tax year. It's important to note that Virginia's income tax brackets and rates are subject to periodic adjustments to align with economic conditions and revenue needs.

Income Tax Deductions and Credits

Virginia offers several deductions and credits to reduce the tax liability of its residents. These deductions and credits are designed to provide relief to taxpayers, particularly those with lower incomes or specific financial circumstances. Some of the key deductions and credits include:

- Standard Deduction: Virginia allows a standard deduction of $3,000 for individuals and $6,000 for married couples filing jointly. This deduction reduces the taxable income, providing a straightforward benefit for most taxpayers.

- Personal Exemptions: Virginia allows a personal exemption of $2,133 for each dependent, including the taxpayer and spouse. This exemption further reduces the taxable income, providing additional relief for families with dependents.

- Medical Expenses: Taxpayers can deduct unreimbursed medical expenses that exceed 3% of their adjusted gross income. This provision offers some relief for those with significant medical costs.

- Mortgage Interest: Interest paid on home mortgages is deductible, up to a certain limit. This deduction can be especially beneficial for homeowners, as it can significantly reduce their taxable income.

- Property Taxes: Property taxes paid on your primary residence are deductible, providing another avenue for taxpayers to lower their tax liability.

- State and Local Taxes: Virginia allows a deduction for state and local income taxes paid. This provision is particularly beneficial for those who pay high state and local taxes in other jurisdictions.

In addition to these deductions, Virginia also offers various credits, such as the Earned Income Tax Credit, the Senior Citizen's Real Estate Tax Credit, and the Virginia Child and Dependent Care Credit. These credits directly reduce the amount of tax owed, providing significant financial benefits to eligible taxpayers.

Filing Virginia Income Tax Returns

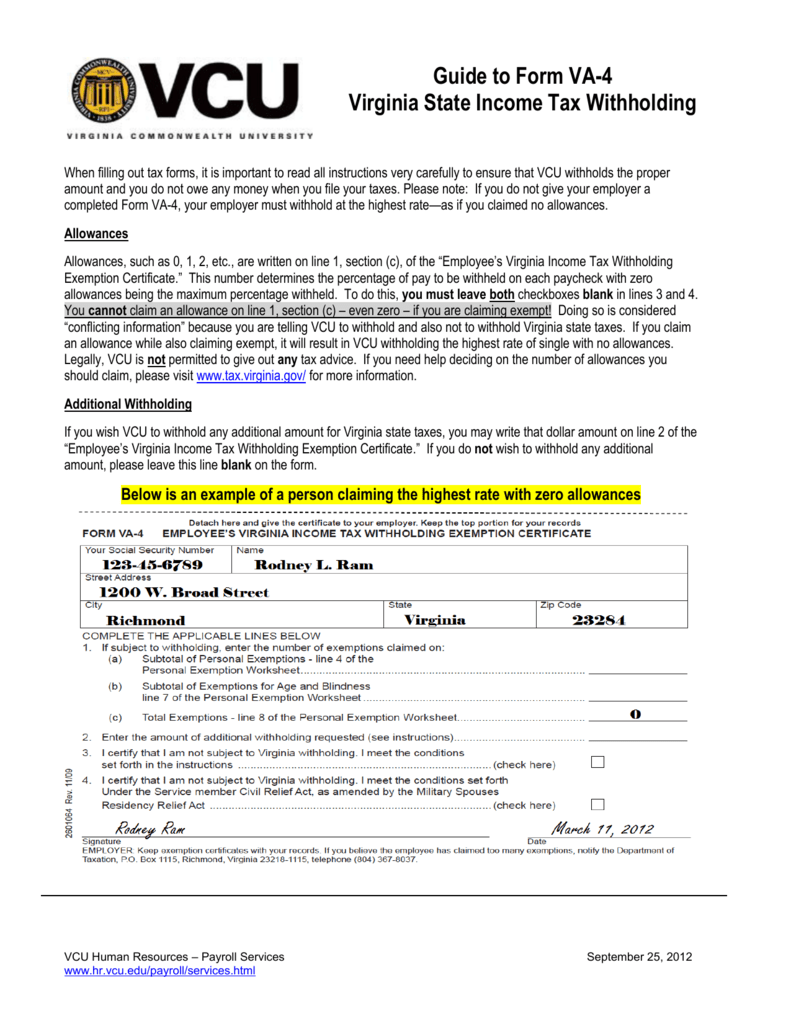

Filing your Virginia income tax return is a crucial step in fulfilling your tax obligations. The process involves gathering relevant financial documents, calculating your taxable income, and determining the applicable tax credits and deductions. Virginia offers both online and paper filing options, providing flexibility to taxpayers.

Online Filing

The Virginia Department of Taxation provides an online filing system called eFile. This platform allows taxpayers to file their returns electronically, offering a convenient and secure method for tax filing. eFile is available for both individual and business taxpayers, and it’s designed to guide users through the filing process step by step.

To file your taxes online using eFile, you'll need your personal information, such as your Social Security Number or Individual Taxpayer Identification Number (ITIN), and financial documents like W-2s, 1099s, and other income statements. You'll also need to have your previous year's tax return information handy, as this can help in the preparation of your current return.

eFile provides real-time error checks and instant confirmation of your submission, ensuring accuracy and peace of mind. The platform also offers the option to pay your taxes electronically, either through direct debit or credit/debit card.

Paper Filing

For those who prefer a more traditional approach or have limited access to digital tools, Virginia also accepts paper tax returns. The state provides official forms, such as Form 760, which can be downloaded from the Department of Taxation’s website. These forms are straightforward and come with clear instructions to guide taxpayers through the process.

When filing a paper return, you'll need to provide the same financial and personal information as you would for an online filing. It's important to ensure that all calculations are accurate and that you've claimed all applicable deductions and credits. Once your return is complete, you'll need to mail it to the address provided on the form.

Regardless of the filing method you choose, it's essential to keep accurate records of your financial transactions and tax-related documents. These records can be crucial in case of an audit or if you need to amend your return in the future.

Tax Deadlines and Penalties

Understanding the tax deadlines is crucial to avoid late filing penalties and interest charges. For Virginia income tax, the deadline for filing your return is typically aligned with the federal tax deadline, which is usually April 15th of the year following the tax year. However, it’s important to note that this deadline can be extended under certain circumstances, such as during a declared state of emergency.

If you're unable to file your return by the deadline, you can request an extension. The extension allows you to postpone the filing of your return, but it's important to note that it doesn't extend the deadline for paying your taxes. You'll still need to estimate your tax liability and make a payment by the original deadline to avoid penalties and interest.

Failure to file your tax return by the deadline or pay your taxes in full can result in penalties and interest charges. The penalties for late filing can be significant, and they increase over time. Additionally, interest is charged on the unpaid tax amount, compounding daily until the balance is paid in full. It's in your best interest to file your return and pay your taxes on time to avoid these additional financial burdens.

Amending Your Tax Return

There may be instances where you need to amend your tax return, such as when you discover a mistake or have additional information that wasn’t available at the time of filing. Virginia allows taxpayers to amend their returns using Form 760X. This form must be filed within three years from the original filing date or two years from the date the tax was paid, whichever is later.

When amending your return, it's crucial to provide all relevant information and documentation to support the changes you're making. This ensures that your amended return is processed accurately and efficiently. It's also important to note that you may receive a refund if you overpaid your taxes, or you may owe additional taxes if you underpaid.

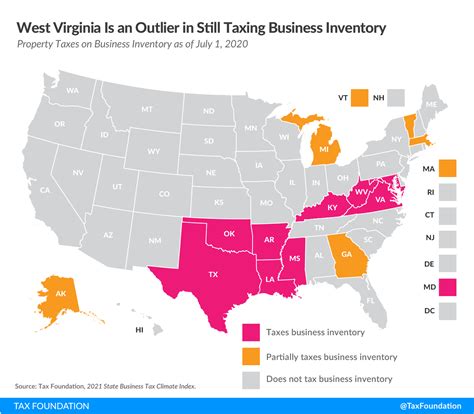

Special Considerations for Businesses

Businesses operating in Virginia are subject to a range of taxes, including income tax, sales and use tax, and various other fees and assessments. The income tax structure for businesses is similar to that for individuals, with progressive rates based on taxable income. However, there are additional considerations and complexities that businesses must navigate.

Business Income Tax Rates

The income tax rates for businesses in Virginia are the same as those for individuals, with a 5.75% tax rate on taxable income above $17,000. However, businesses may have additional income streams and expenses that impact their taxable income, such as business profits, gains from the sale of assets, and various deductions.

Businesses are required to file their income tax returns using Form 500. This form is more complex than the individual tax form, as it takes into account various business-specific factors, such as depreciation, amortization, and business expenses. It's crucial for businesses to maintain accurate financial records and consult with tax professionals to ensure compliance and optimize their tax position.

Sales and Use Tax

In addition to income tax, businesses in Virginia are also subject to sales and use tax. This tax is levied on the sale of goods and certain services, as well as on the use, storage, or consumption of tangible personal property in the state. The sales and use tax rate in Virginia is 4.3%, with additional local taxes in certain jurisdictions.

Businesses are responsible for collecting and remitting sales tax on behalf of the state. This involves registering for a sales tax permit, issuing accurate invoices, and filing periodic sales tax returns. Failure to comply with sales tax obligations can result in penalties and interest charges, so it's crucial for businesses to stay informed and up-to-date with their sales tax responsibilities.

Conclusion: Navigating Virginia’s Income Tax Landscape

Understanding and navigating Virginia’s income tax system is an essential aspect of financial management for individuals and businesses alike. By grasping the progressive tax structure, leveraging available deductions and credits, and adhering to filing deadlines, taxpayers can effectively manage their financial obligations and ensure compliance with state regulations.

For individuals, the progressive nature of Virginia's income tax system means that higher earners contribute a larger share, fostering a sense of equity. The availability of deductions, such as the standard deduction, personal exemptions, and deductions for medical expenses and property taxes, provides avenues for taxpayers to reduce their taxable income and optimize their financial position.

Businesses, on the other hand, face a more complex tax landscape. In addition to income tax, they must navigate sales and use tax regulations, which involve collecting and remitting sales tax on behalf of the state. Accurate record-keeping and timely filing are critical for businesses to avoid penalties and maintain a positive relationship with the Virginia Department of Taxation.

In conclusion, whether you're an individual taxpayer or a business owner, staying informed and proactive about Virginia's income tax requirements is key. By leveraging the information and insights provided in this guide, you can confidently navigate the state's tax landscape, ensuring compliance, optimizing your financial position, and contributing to the Commonwealth's fiscal health.

What is the income tax rate in Virginia for 2023?

+

For the 2023 tax year, Virginia’s income tax rates are progressive: 2% on income between 0 and 3,000, 3% on income between 3,001 and 5,000, 5% on income between 5,001 and 17,000, and 5.75% on income above $17,000.

Are there any income tax deductions available in Virginia?

+

Yes, Virginia offers several deductions, including a standard deduction, personal exemptions, deductions for medical expenses, mortgage interest, property taxes, and state and local taxes.

What is the deadline for filing Virginia income tax returns?

+

The deadline for filing Virginia income tax returns is typically aligned with the federal tax deadline, which is usually April 15th of the year following the tax year. However, this deadline can be extended under certain circumstances.

How can businesses navigate Virginia’s tax landscape effectively?

+

Businesses should stay informed about their tax obligations, including income tax, sales and use tax, and other fees and assessments. Accurate record-keeping, timely filing, and consulting with tax professionals are crucial for compliance and optimizing tax position.

What happens if I miss the tax filing deadline in Virginia?

+

Missing the tax filing deadline can result in late filing penalties and interest charges. It’s important to file your return and pay your taxes on time to avoid these additional financial burdens.