Illinois Car Tax

The Illinois car tax, also known as the Vehicle Registration Fee, is a crucial component of the state's revenue stream and has a significant impact on vehicle owners. This tax is an annual assessment levied on registered vehicles in Illinois, contributing to the state's infrastructure development and maintenance.

Understanding the intricacies of the Illinois car tax is essential for vehicle owners, as it directly affects their financial obligations and overall cost of vehicle ownership. This article aims to provide a comprehensive guide to the Illinois car tax, covering its history, calculation methods, payment processes, and its role in the state's economy.

A Historical Perspective

The roots of the Illinois car tax can be traced back to the early 20th century when the state first introduced a vehicle registration fee to fund road construction and maintenance. Over the years, this tax has evolved to keep pace with the changing landscape of transportation and infrastructure needs.

In its initial stages, the car tax was a flat rate, meaning all vehicle owners paid the same amount regardless of their vehicle's value or usage. However, as the state's transportation network expanded and diversified, the tax system underwent several reforms to ensure fair and equitable contributions.

Calculation and Assessment

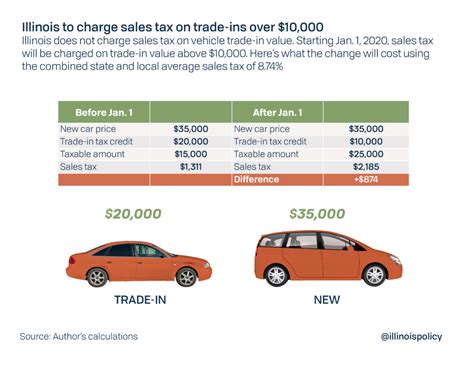

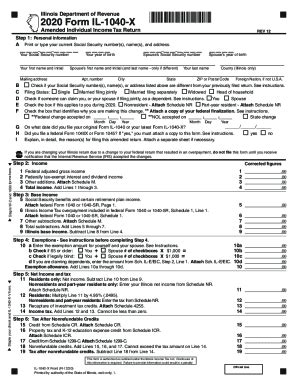

The current Illinois car tax is based on a vehicle’s value and is assessed annually. The Illinois Department of Revenue calculates the tax using a formula that considers the vehicle’s make, model, year, and average trade-in value. This value-based tax system ensures that vehicle owners pay a fair share based on their vehicle’s worth.

The tax rate is expressed as a percentage of the vehicle's value, and it varies depending on the county in which the vehicle is registered. For instance, in Cook County, the tax rate is set at 3%, while in other counties, it can range from 0.5% to 2%. This county-based variation in tax rates is designed to account for differences in local infrastructure needs and costs.

Here's an example to illustrate the calculation process. Let's consider a 2020 Toyota Camry with an average trade-in value of $18,000 registered in Cook County. The car tax for this vehicle would be calculated as follows:

| Vehicle Value | $18,000 |

|---|---|

| Tax Rate (Cook County) | 3% |

| Car Tax | $540 |

Payment Process and Deadlines

Vehicle owners in Illinois are responsible for paying their car tax annually. The payment deadline is typically aligned with the vehicle’s registration renewal date. To ensure timely payment, the Illinois Secretary of State’s office sends out renewal notices and tax statements to vehicle owners ahead of the deadline.

Owners can pay their car tax online, by mail, or in person at a local Secretary of State facility. Online payment is the most convenient option, as it offers real-time confirmation and a faster processing time. Payment by mail requires a check or money order, and the processing time can vary.

In the case of late payments, vehicle owners may incur penalties and additional fees. These late fees can quickly add up, so it's crucial to stay on top of payment deadlines to avoid unnecessary expenses.

The Impact on Vehicle Owners

The Illinois car tax has a significant impact on vehicle owners’ finances and overall cost of ownership. While the tax is designed to fund essential infrastructure projects, it can also represent a substantial financial burden, especially for those with high-value vehicles.

Vehicle owners must consider the car tax as an integral part of their vehicle-related expenses, alongside fuel costs, insurance premiums, and maintenance fees. For instance, the car tax for a luxury vehicle can be several thousand dollars annually, significantly impacting the owner's financial planning.

The Role in Illinois’ Economy

The Illinois car tax plays a vital role in the state’s economy, providing a substantial revenue stream for infrastructure development and maintenance. This tax is a significant contributor to the state’s budget, funding projects that enhance road safety, improve transportation efficiency, and support economic growth.

The revenue generated from the car tax is allocated to various transportation-related initiatives, including road construction, bridge maintenance, public transportation improvements, and traffic safety programs. These investments not only benefit vehicle owners but also contribute to the overall economic vitality of the state.

Moreover, the car tax revenue is essential for maintaining Illinois' transportation infrastructure, which is critical for the movement of goods and people across the state. A well-maintained transportation network attracts businesses and supports economic development, further enhancing the state's economic prospects.

Challenges and Future Outlook

While the Illinois car tax is a vital source of revenue, it also presents challenges and opportunities for improvement. One of the primary concerns is the potential for tax evasion, especially with the rise of online vehicle sales and the complexity of calculating vehicle values.

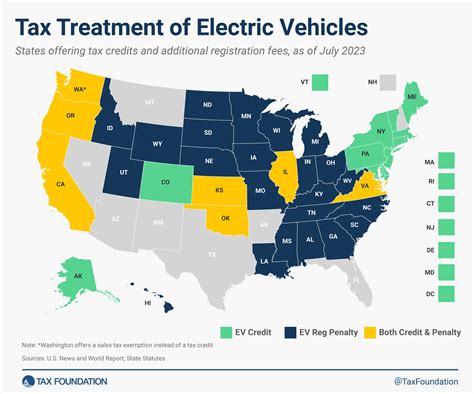

To address these challenges, the state is exploring innovative solutions, such as implementing more advanced valuation methods and enhancing tax enforcement mechanisms. Additionally, there are ongoing discussions about reforming the tax system to make it more equitable and reflective of modern transportation trends, including the growing popularity of electric vehicles and ride-sharing services.

As Illinois continues to evolve, the car tax system will need to adapt to ensure it remains fair, efficient, and effective in funding the state's transportation needs. This may involve further reforms to the tax structure, such as introducing mileage-based fees or incentivizing eco-friendly vehicles.

How often do I need to pay the Illinois car tax?

+The Illinois car tax is an annual tax, meaning you need to pay it once a year. The payment deadline is typically aligned with your vehicle’s registration renewal date.

What happens if I miss the payment deadline?

+If you miss the payment deadline, you may incur late fees and penalties. It’s important to stay on top of payment deadlines to avoid unnecessary expenses.

Can I get a refund if I sell my vehicle before the tax year ends?

+Yes, if you sell your vehicle before the tax year ends, you may be eligible for a refund. You will need to contact the Illinois Department of Revenue to initiate the refund process.