Broward County Property Tax

Welcome to a comprehensive guide on understanding and managing Broward County's property tax system. As one of the most populous counties in Florida, Broward County has a unique and intricate property tax landscape that affects its residents and businesses significantly. This article aims to demystify the process, providing an in-depth analysis of the tax structure, its implications, and strategies to navigate it effectively.

Unraveling the Broward County Property Tax System

Broward County’s property tax system is a complex mechanism that plays a pivotal role in the county’s financial infrastructure. It is an essential revenue source for the county, funding various public services and infrastructure projects. Understanding this system is crucial for property owners to ensure compliance and optimize their tax strategies.

Tax Assessment Process: A Deep Dive

The property tax assessment process in Broward County is a meticulous journey, beginning with the determination of the property’s just value. This is the price the property would most likely sell for in a competitive and open market. The county’s property appraiser, Todd D. Mathes, plays a critical role in this process, ensuring accuracy and fairness in valuation.

Once the just value is established, it undergoes a series of adjustments, including the homestead exemption for eligible homeowners, and other applicable exemptions and discounts. These factors influence the final assessed value, which is the basis for calculating the property tax.

| Assessment Category | Description |

|---|---|

| Just Value | The estimated fair market value of the property. |

| Assessed Value | The value used to calculate property taxes, often a percentage of the just value. |

| Homestead Exemption | A discount for primary residences, reducing the assessed value. |

Tax Rates and Calculations: Unlocking the Formula

The property tax rate in Broward County is determined by the millage rate, which is the tax rate per thousand dollars of assessed property value. This rate is set by various taxing authorities, including the county, cities, and special districts. The millage rate is then multiplied by the property’s assessed value to calculate the annual property tax liability.

For instance, if a property has an assessed value of $200,000 and the millage rate is 10 mills (0.01), the annual property tax would be calculated as: $200,000 x 0.01 = $2,000. This calculation provides a clear understanding of the tax burden for property owners.

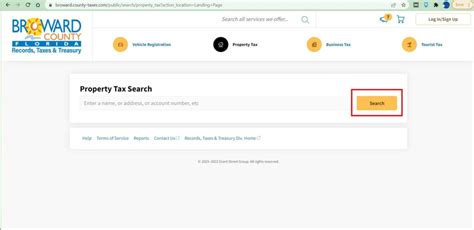

Tax Payment Options and Deadlines: A Comprehensive Overview

Broward County offers several payment options for property taxes, catering to different preferences and needs. Property owners can choose to pay their taxes in full by the deadline or opt for an installment plan, allowing for bi-annual or quarterly payments. This flexibility ensures that taxpayers can manage their financial obligations effectively.

The tax deadline in Broward County is typically in March or April, with specific dates announced annually. Late payments incur penalties and interest, which can significantly impact a property owner's financial planning. It is therefore crucial to stay informed about the payment deadlines and explore the available payment options.

Strategies for Property Tax Optimization: Expert Insights

Navigating the Broward County property tax system effectively requires a strategic approach. Here are some expert tips to optimize your property tax situation:

- Understand Your Exemptions: Familiarize yourself with the various exemptions and discounts available. The homestead exemption, for instance, can significantly reduce your tax burden. Ensure you meet the eligibility criteria and apply for the exemption if you qualify.

- Stay Informed: Keep abreast of changes in the tax landscape, including updates to millage rates and assessment practices. This proactive approach ensures you're prepared for any shifts in tax obligations.

- Consider a Tax Appeal: If you believe your property's assessed value is inaccurate, you have the right to appeal. This process can lead to a reduction in your tax liability if successful.

- Explore Payment Plans: If you anticipate challenges in meeting the full tax payment by the deadline, consider the installment plans offered by the county. This ensures you stay compliant while managing your financial commitments effectively.

Future Implications and Key Takeaways

As Broward County continues to grow and evolve, the property tax system will play a pivotal role in its development. The county’s commitment to transparency and fairness in tax assessments ensures a stable and predictable environment for property owners. However, staying informed and proactive is essential to navigate this complex landscape effectively.

In conclusion, understanding and managing Broward County's property tax system is a critical aspect of financial planning for residents and businesses. By unraveling the assessment process, tax calculations, and payment options, property owners can make informed decisions and optimize their tax strategies. Remember, a well-informed approach is key to navigating the intricacies of the Broward County property tax system.

What is the role of the property appraiser in Broward County’s tax assessment process?

+The property appraiser, Todd D. Mathes, is responsible for determining the just value of properties in Broward County. This value forms the basis for subsequent tax calculations and assessments.

How can I apply for a homestead exemption in Broward County?

+To apply for a homestead exemption, you need to complete and submit the Homestead Exemption Application to the Broward County Property Appraiser’s office. This application is typically available online or at the property appraiser’s office.

What happens if I miss the property tax payment deadline in Broward County?

+Missing the property tax payment deadline in Broward County can result in penalties and interest. It’s crucial to stay informed about the deadlines and explore payment options to avoid additional financial burdens.

Are there any tax relief programs available for senior citizens in Broward County?

+Yes, Broward County offers the Senior Citizen Tax Relief Program which provides eligible senior citizens with a credit on their property taxes. To qualify, you must meet certain age and income requirements and own the property as your primary residence.