Sales Tax For Seattle

Welcome to a comprehensive exploration of the Sales Tax landscape in Seattle, a city renowned for its vibrant culture, stunning natural surroundings, and a progressive approach to taxation. In this expert-crafted article, we delve into the intricacies of Sales Tax in Seattle, offering a detailed analysis that will empower businesses and consumers alike with a deeper understanding of this essential aspect of the city's economic ecosystem.

Unraveling the Complexities of Seattle’s Sales Tax Structure

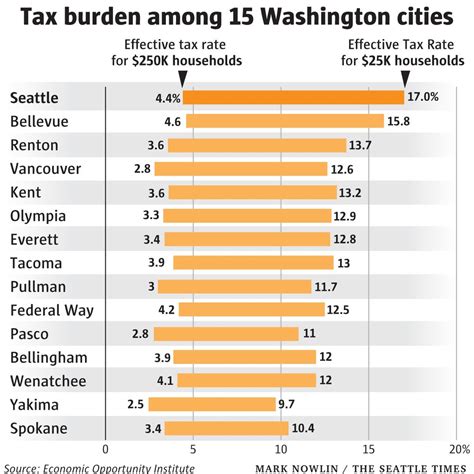

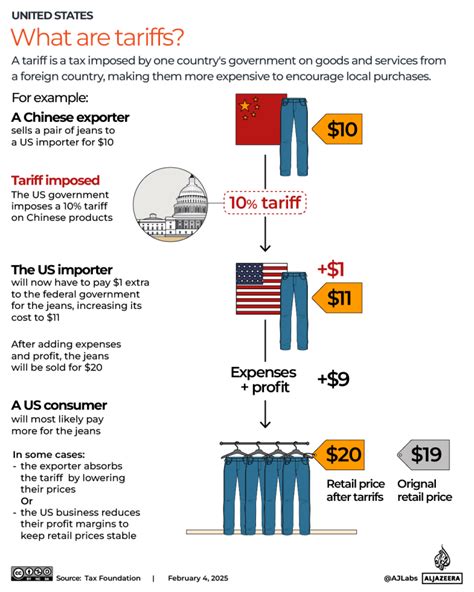

Seattle’s Sales Tax system is a dynamic and intricate framework, designed to support the city’s unique economic needs and goals. Comprising both state and local components, the tax rate is influenced by a range of factors, from the type of goods or services being sold to the specific location of the transaction.

At its core, Seattle's Sales Tax is a consumption tax, levied on the sale of tangible personal property and certain services. The tax is collected by the seller and remitted to the appropriate taxing jurisdiction. The rate varies depending on the location of the sale, with different rates applied for various types of transactions. This variability is a key feature of Seattle's Sales Tax, reflecting the city's commitment to fairness and tailored economic development.

State vs. Local Sales Tax: Understanding the Breakdown

Seattle’s Sales Tax is a collaborative effort between the state and local governments. The state of Washington imposes a base sales tax rate, which is then supplemented by local taxes set by counties, cities, and other local jurisdictions. This two-tiered system ensures that revenue generated from sales tax is distributed fairly across the state, while also allowing local governments to address specific community needs.

For instance, in Seattle, the city imposes an additional sales tax on top of the state rate to fund local initiatives and infrastructure projects. This extra tax rate is a key tool for the city to generate revenue for essential services, from public transportation to healthcare, and even cultural programs.

| Taxing Jurisdiction | Sales Tax Rate |

|---|---|

| State of Washington | 6.5% |

| City of Seattle | 2.25% |

| King County | 0.5% |

| Seattle Transit Benefit District | 0.1% |

| Total Combined Rate (approx.) | 9.35% |

The table above provides a simplified breakdown of the sales tax rates applicable in Seattle. It's important to note that these rates are subject to change, and certain items, like groceries or prescription drugs, may be exempt from the tax or enjoy a reduced rate.

The Impact of Sales Tax on Seattle’s Economy

Sales Tax is a vital component of Seattle’s economic health. It serves as a key revenue stream for the city, enabling the provision of essential public services and infrastructure development. The tax also plays a role in shaping consumer behavior, influencing purchasing decisions and contributing to the overall economic climate of the city.

Moreover, Seattle's progressive approach to Sales Tax, with its tailored rates and exemptions, supports the city's diverse economic landscape. From small businesses to large corporations, each entity contributes to the tax base, fostering a sense of collective responsibility and community benefit.

Navigating the Complexities: Expert Tips for Compliance

For businesses operating in Seattle, understanding and complying with Sales Tax regulations is essential. Here are some expert tips to ensure you’re navigating the system effectively:

- Stay Informed: Keep abreast of any changes in Sales Tax rates or regulations. This includes not only state and city updates but also any local changes that may impact your business.

- Implement Robust Systems: Utilize reliable software and accounting practices to ensure accurate tax calculations and reporting. This minimizes the risk of errors and ensures compliance.

- Understand Exemptions: Familiarize yourself with the items and services that are exempt from Sales Tax in Seattle. This knowledge can help you offer competitive pricing and navigate potential compliance pitfalls.

- Seek Professional Advice: Consult with tax professionals who specialize in Sales Tax to ensure you're optimizing your tax strategies and staying compliant with the latest regulations.

Conclusion: A Forward-Thinking Approach to Taxation

Seattle’s approach to Sales Tax exemplifies the city’s commitment to fairness, community benefit, and economic progress. By understanding and navigating this complex system, businesses and consumers can contribute to the city’s vibrant economy while ensuring compliance with essential tax regulations.

As Seattle continues to thrive and evolve, its Sales Tax system will undoubtedly remain a key driver of its economic success. By staying informed and engaged, we can all play a part in shaping a sustainable and prosperous future for this remarkable city.

Frequently Asked Questions

How often do Sales Tax rates change in Seattle?

+

Sales Tax rates in Seattle can change periodically, typically influenced by local government decisions and budgetary needs. While there is no set schedule for changes, it’s advisable to stay updated through official government sources and tax advisory services.

Are there any special Sales Tax rates for specific industries in Seattle?

+

Yes, Seattle’s Sales Tax system includes special rates for certain industries, such as the hospitality industry, which often has a reduced rate for certain services. These rates are designed to support specific economic sectors and can vary by location within the city.

What happens if I underpay or overpay my Sales Tax in Seattle?

+

Underpayment of Sales Tax in Seattle can lead to penalties and interest charges, while overpayment may result in a refund. It’s crucial to maintain accurate records and seek professional advice to ensure you’re complying with the latest regulations and avoiding potential pitfalls.

How does Seattle’s Sales Tax system benefit the community?

+

Seattle’s Sales Tax system is designed to fund essential public services and infrastructure projects, benefiting the community by supporting healthcare, education, transportation, and cultural initiatives. It also encourages economic development and job creation.

Are there any Sales Tax exemptions or reductions for specific goods in Seattle?

+

Yes, Seattle offers exemptions and reduced Sales Tax rates for certain goods and services, including groceries, prescription drugs, and some medical equipment. These exemptions are designed to support consumer affordability and access to essential goods and services.