Ms Income Tax Return Status

As we navigate the intricate world of financial obligations, one of the most critical aspects for individuals and businesses alike is understanding the status of their income tax returns. In this comprehensive guide, we will delve into the world of Ms Income Tax Return Status, exploring the various aspects, processes, and implications that come into play. Whether you are a taxpayer seeking clarity on the current status of your tax returns or an individual interested in the intricate workings of the tax system, this article aims to provide an in-depth analysis.

Unraveling the Ms Income Tax Return Status

The process of filing income tax returns is a complex yet necessary procedure that ensures individuals and entities meet their financial responsibilities to the state. Understanding the Ms Income Tax Return Status is pivotal, as it not only helps taxpayers gauge their financial standing but also aids in identifying potential issues or errors in the filing process.

The status of an income tax return is a dynamic entity, often undergoing several stages from the moment it is filed until the final processing is completed. Each stage carries its own significance, offering insights into the progress of the tax return and the potential actions required by the taxpayer.

The Initial Filing Stage

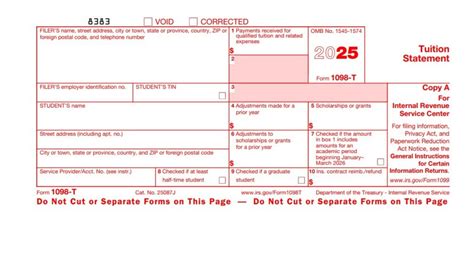

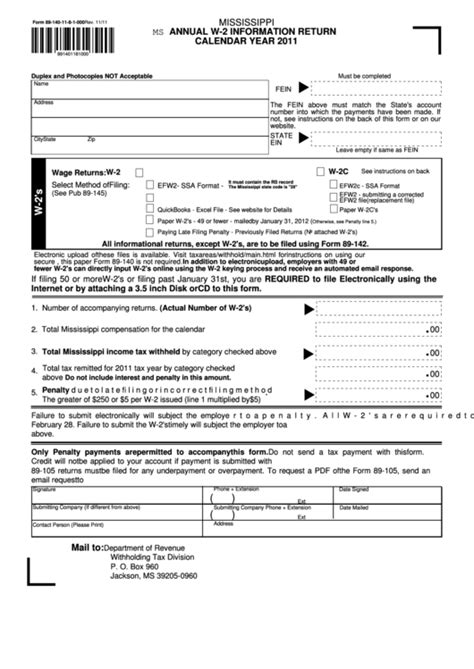

The journey of an income tax return begins with the initial filing. During this stage, taxpayers submit their financial information, detailing their income, deductions, and credits for the relevant tax year. This process can be done manually or through various online platforms, depending on the jurisdiction and the taxpayer's preferences.

Once the return is filed, the taxpayer receives an acknowledgment, which serves as a confirmation that the tax authority has received the return. This acknowledgment usually includes a unique reference number, which is essential for future communications and tracking the status of the return.

| Taxpayer's Actions | Key Considerations |

|---|---|

| Filing Accuracy | Ensure all income sources, deductions, and credits are accurately reported. Any errors or omissions can lead to delays or additional queries from the tax authority. |

| Supporting Documents | Attach all necessary supporting documents, such as pay stubs, investment statements, and receipts, to substantiate the information provided in the tax return. |

Processing and Review Stage

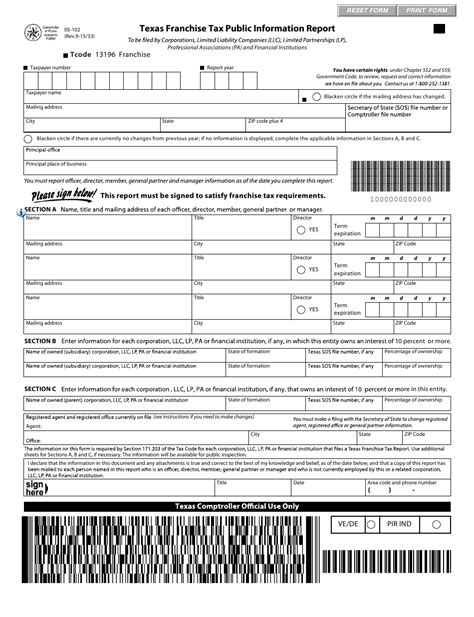

After the initial filing, the tax authority initiates the processing and review stage. During this phase, the tax return undergoes a series of checks and verifications to ensure compliance with tax laws and regulations. This stage is crucial, as it is when potential errors, inconsistencies, or discrepancies are identified.

The tax authority employs various automated systems and manual reviews to scrutinize the returns. This process may involve cross-referencing the information provided with other databases, such as employer records or financial institutions, to verify the accuracy of the data.

If any issues are identified during this stage, the tax authority may issue a notice to the taxpayer, requesting additional information or clarifying certain details. It is imperative for taxpayers to respond promptly to such notices, providing the required information to ensure a smooth processing of their tax returns.

Assessment and Payment Stage

Once the tax authority is satisfied with the accuracy and completeness of the tax return, the assessment stage begins. During this phase, the tax liability is calculated based on the information provided in the return and the applicable tax rates.

If the taxpayer owes tax, they are required to make the payment within the specified timeframe. The payment methods vary depending on the jurisdiction and may include online payment portals, direct bank transfers, or traditional methods such as cheques.

It is essential for taxpayers to ensure timely payment of their tax liabilities to avoid penalties and interest charges. Failure to meet the payment deadline can result in additional fees and may impact the taxpayer's credit rating.

Refund Processing Stage

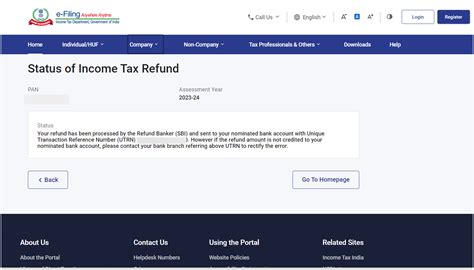

In cases where the taxpayer is entitled to a tax refund, the refund processing stage comes into play. This stage involves the tax authority calculating the amount of refund due to the taxpayer and initiating the refund process.

The time it takes for a refund to be processed and issued can vary depending on several factors, including the complexity of the tax return, the jurisdiction's processing times, and the method of payment. Taxpayers are advised to check the official guidelines and timelines provided by the tax authority to manage their expectations regarding refund processing.

Navigating Common Challenges and Issues

Understanding the Ms Income Tax Return Status is not without its challenges. Taxpayers often encounter various issues and complexities during the filing and processing stages. Being aware of these potential pitfalls can help taxpayers navigate the process more effectively.

Error Identification and Rectification

Errors in tax returns are not uncommon. These errors can range from simple mathematical mistakes to more complex issues, such as incorrect reporting of income or deductions. Identifying and rectifying these errors is crucial to ensure a smooth processing of the tax return.

Taxpayers should thoroughly review their tax returns before submission to minimize the chances of errors. However, if an error is identified post-filing, it is essential to act promptly. Tax authorities usually provide guidance on how to rectify such errors, which may involve amending the return or providing additional documentation.

Dealing with Tax Authorities' Queries

In certain cases, the tax authority may have queries or concerns regarding the information provided in the tax return. These queries can range from simple clarifications to more complex issues requiring additional documentation or explanations.

Responding to tax authority queries is a critical aspect of the Ms Income Tax Return Status. Taxpayers should maintain open lines of communication with the tax authority, providing the necessary information in a timely manner. Failure to respond to such queries can lead to delays in processing or even additional penalties.

Managing Payment and Refund Delays

Payment and refund delays are a common challenge taxpayers face. Delays can occur due to various reasons, such as processing backlogs, administrative issues, or errors in the tax return.

Taxpayers should stay informed about the expected timelines for payment and refund processing. If a delay is anticipated, it is advisable to reach out to the tax authority to understand the reasons and potential solutions. In some cases, taxpayers may be eligible for interest on late refunds, providing some relief during the waiting period.

Future Implications and Long-Term Strategies

Understanding the Ms Income Tax Return Status is not limited to the immediate processing and filing stages. It extends to the long-term implications and strategies taxpayers can employ to optimize their financial planning.

Long-Term Financial Planning

The Ms Income Tax Return Status serves as a cornerstone for long-term financial planning. By understanding their tax obligations and the status of their returns, taxpayers can make informed decisions regarding their financial strategies.

Taxpayers can leverage the insights gained from their tax returns to optimize their investments, savings, and overall financial management. For instance, understanding the impact of deductions and credits on their tax liability can help taxpayers make more strategic decisions regarding their financial portfolios.

Strategic Tax Planning

Strategic tax planning is an essential aspect of financial management. By understanding the Ms Income Tax Return Status, taxpayers can identify areas where they can optimize their tax obligations and potentially reduce their tax liability.

This may involve exploring various tax-saving strategies, such as maximizing deductions, utilizing tax-efficient investment vehicles, or taking advantage of tax incentives and credits offered by the jurisdiction. Working with tax professionals or financial advisors can help taxpayers develop tailored strategies to optimize their tax positions.

Adapting to Changing Tax Laws

Tax laws and regulations are subject to change, often bringing about new challenges and opportunities for taxpayers. Staying informed about these changes is crucial to ensure compliance and optimize tax obligations.

Taxpayers should keep abreast of any updates or amendments to tax laws, regulations, or policies. This may involve subscribing to tax newsletters, following industry publications, or engaging with tax professionals who can provide timely updates and guidance.

Conclusion

Understanding the Ms Income Tax Return Status is a complex yet vital aspect of financial management. It empowers taxpayers with the knowledge and insights needed to navigate the intricate world of tax obligations. From the initial filing stage to the assessment and payment phases, each step carries its own significance, impacting the overall financial well-being of individuals and businesses.

By staying informed, proactive, and engaged with the tax authority, taxpayers can ensure a smooth and efficient processing of their income tax returns. This, in turn, contributes to a healthier financial ecosystem, fostering economic growth and stability.

As we conclude this comprehensive guide, we hope to have provided valuable insights into the world of Ms Income Tax Return Status. Remember, tax obligations are a shared responsibility, and by understanding and fulfilling these obligations, we contribute to the greater good of our communities and nations.

How often should I check the status of my income tax return?

+It is advisable to check the status of your income tax return periodically, especially during the initial processing stages. This helps you stay updated on any potential issues or delays. Most tax authorities provide online portals or apps where you can track the status of your return.

What should I do if I receive a notice from the tax authority regarding my return?

+If you receive a notice from the tax authority, it is crucial to respond promptly. Carefully read the notice and gather the requested information or documentation. Contact the tax authority if you have any queries or need clarification. Responding timely can help resolve issues efficiently.

Are there any tax-saving strategies I can employ to optimize my tax obligations?

+Yes, there are various tax-saving strategies you can explore. These may include maximizing deductions for eligible expenses, utilizing tax-advantaged retirement accounts, or taking advantage of tax credits and incentives. Consulting with a tax professional can help tailor these strategies to your specific circumstances.

What happens if I fail to meet the payment deadline for my tax liability?

+Failing to meet the payment deadline for your tax liability can result in penalties and interest charges. These additional fees can significantly increase your overall tax burden. It is crucial to prioritize timely payment to avoid such penalties and maintain a positive tax standing.