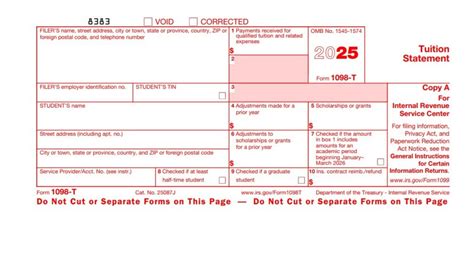

What Is A 1098 Tax Form Used For

The 1098 tax form, officially known as the "Form 1098: Mortgage Interest Statement," is a critical document for US taxpayers who have paid interest on their mortgage during the tax year. This form is primarily used to report the amount of interest paid by a taxpayer to a lender, which can then be claimed as a tax deduction under certain conditions. It's an essential tool for homeowners to maximize their tax savings and is a key component of the US tax system.

Understanding the Purpose of Form 1098

Form 1098 is issued by lenders, banks, or other financial institutions to borrowers who have a mortgage or home loan. The form details the total amount of interest paid by the borrower to the lender during the tax year. This information is vital for taxpayers as it provides an accurate record of their interest payments, which can be used to claim deductions when filing their federal income tax returns.

By claiming the mortgage interest deduction, taxpayers can reduce their taxable income, potentially resulting in a lower tax bill or a larger refund. This deduction is a significant benefit for homeowners, especially those with higher-value mortgages, as it can lead to substantial savings on their tax liabilities.

Eligibility for the Mortgage Interest Deduction

Not all mortgage interest payments are eligible for deduction. To be eligible, the mortgage must secure the taxpayer’s primary residence or a second home. Rental properties or investment properties do not qualify for the mortgage interest deduction. Additionally, there are limits on the amount of mortgage debt that qualifies for the deduction, and the mortgage must be secured by the taxpayer’s principal residence or a second home.

| Type of Property | Eligibility for Deduction |

|---|---|

| Primary Residence | Eligible |

| Second Home | Eligible |

| Rental Property | Not Eligible |

| Investment Property | Not Eligible |

Other Information on Form 1098

In addition to the mortgage interest paid, Form 1098 may also include other important details such as the mortgage insurance premiums paid during the tax year. Mortgage insurance is typically required for loans with a loan-to-value ratio above a certain threshold, and the premiums paid can also be claimed as a tax deduction under specific conditions.

Form 1098 may also provide information on any qualifying debt forgiveness, which can have tax implications. It's important for taxpayers to review their Form 1098 carefully to ensure they are aware of all the deductions they may be eligible for and to understand any potential tax liabilities associated with debt forgiveness.

The Impact of Form 1098 on Tax Strategies

Form 1098 plays a significant role in tax planning and strategy for homeowners. By understanding the information provided on this form, taxpayers can make informed decisions about their deductions and tax liabilities. For example, if a taxpayer has a high mortgage interest payment, they may choose to itemize their deductions rather than take the standard deduction, which can lead to significant tax savings.

Additionally, Form 1098 can be used to track the progress of paying down a mortgage. As the balance of the mortgage decreases over time, so too does the amount of interest paid, which can impact the taxpayer's deductions and overall tax liability. This information can be valuable for long-term financial planning and tax strategy.

Real-Life Example of Form 1098’s Impact

Consider a taxpayer, Jane, who purchased a home with a mortgage of 300,000. In her first year of homeownership, she paid 15,000 in mortgage interest. When she receives her Form 1098, it confirms this interest amount. By claiming this deduction on her tax return, Jane can reduce her taxable income by $15,000, potentially saving her thousands of dollars in taxes.

In subsequent years, as Jane continues to pay down her mortgage, her interest payments will decrease, and so will her potential tax savings. However, by carefully managing her mortgage and understanding the information on her Form 1098, Jane can continue to maximize her tax benefits and effectively plan her finances.

Looking Ahead: Future Implications and Considerations

The mortgage interest deduction provided by Form 1098 has been a long-standing feature of the US tax system, offering significant benefits to homeowners. However, with ongoing discussions about tax reform and potential changes to the tax code, the future of this deduction is not certain.

Taxpayers should stay informed about any potential changes to the tax laws, especially those affecting homeownership and mortgage interest deductions. While the current system provides substantial benefits, it's essential to be prepared for potential adjustments and to understand how these changes may impact personal tax strategies.

Staying Informed and Seeking Professional Advice

Given the complexity of the tax system and the potential impact of various deductions, it’s always recommended to seek professional advice from a tax advisor or accountant. They can provide personalized guidance based on an individual’s specific financial situation and help ensure compliance with the latest tax regulations.

Additionally, staying updated with tax news and changes can help taxpayers anticipate potential adjustments to their tax strategies. Being proactive in understanding tax laws and deductions like those associated with Form 1098 can lead to more effective financial planning and better tax outcomes.

Can I Claim Mortgage Interest Deduction for a Rental Property?

+No, the mortgage interest deduction is generally not available for rental properties or investment properties. It is primarily for homeowners’ primary residences or second homes.

When Should I Expect to Receive My Form 1098?

+Form 1098 is typically mailed to taxpayers by January 31st of the year following the tax year in question. For example, for the tax year 2023, you should receive your Form 1098 by January 31, 2024.

What If I Haven’t Received My Form 1098 by the Expected Date?

+If you haven’t received your Form 1098 by the expected date, it’s recommended to contact your lender or financial institution to request a copy. Alternatively, you can check with the IRS to see if they have any record of the form being filed on your behalf.