Pa State Tax Filing

Welcome to this comprehensive guide on Pennsylvania state tax filing. Filing taxes is an essential annual task for individuals and businesses in Pennsylvania, and understanding the process and requirements can help ensure compliance and maximize potential benefits. This article aims to provide an in-depth analysis of the Pennsylvania state tax filing process, covering everything from filing deadlines and forms to tax rates and potential deductions.

Understanding Pennsylvania State Tax Filing

The Commonwealth of Pennsylvania, like many other states, requires its residents and businesses to file state taxes in addition to federal taxes. This is an important source of revenue for the state, which utilizes these funds to support various public services and infrastructure. Pennsylvania’s tax system is designed to be fair and equitable, with a range of tax rates and provisions to accommodate different income levels and business structures.

Pennsylvania Tax Filing Deadlines

One of the most critical aspects of tax filing is understanding the deadlines. For Pennsylvania residents, the standard tax filing deadline aligns with the federal tax deadline, which is typically April 15th. However, it's important to note that this date can change based on weekends and holidays. For instance, if April 15th falls on a Saturday or a holiday, the deadline is usually extended to the following business day.

For individuals who are unable to meet the standard deadline, Pennsylvania offers the option to file for an extension. This extension provides an additional six months to file, pushing the deadline to October 15th. However, it's crucial to understand that an extension to file does not mean an extension to pay. If you anticipate owing taxes, you should make estimated payments to avoid penalties and interest.

| Tax Year | Standard Filing Deadline | Extension Deadline |

|---|---|---|

| 2022 | April 18, 2023 | October 17, 2023 |

| 2023 | April 15, 2024 | October 15, 2024 |

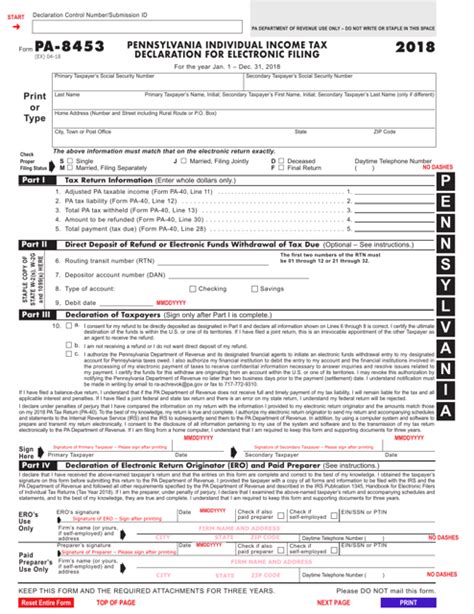

Pennsylvania Tax Forms and Filing Methods

Pennsylvania offers a range of tax forms depending on your specific circumstances. The most common forms include:

- PA-40: This is the standard individual income tax return form for Pennsylvania residents. It's used for reporting wages, salaries, business income, and other sources of taxable income.

- PA-40 ES: If you're a Pennsylvania resident with income that varies throughout the year or if you have significant business income, you may need to make estimated tax payments. The PA-40 ES form is used to calculate and pay these estimates.

- PA-40X: The PA-40X form is for amended returns. If you realize you've made an error on your original tax return, you can use this form to correct it.

- PA-1065: For partnerships and limited liability companies (LLCs) that are taxed as partnerships, the PA-1065 form is used to report business income and losses. This form does not carry any tax liability itself; instead, it passes the income or loss through to the individual partners, who report it on their personal tax returns.

- PA-1065-B: This form is specifically for partnerships or LLCs involved in the business of banking, financial operations, or insurance. It's used to report the allocation of income and losses to partners.

In addition to these forms, Pennsylvania offers various other forms for specific situations, such as the PA-40NRI for nonresident individuals, the PA-1065-S for S corporations, and the PA-100 for corporations.

Pennsylvania offers several methods for filing taxes, including:

- Online Filing: The Pennsylvania Department of Revenue provides an online filing system called e-file, which is secure, fast, and efficient. It's a convenient option for both individual taxpayers and tax professionals.

- Paper Filing: For those who prefer a more traditional approach or have unique circumstances, paper filing is still an option. You can download and print the necessary forms from the Pennsylvania Department of Revenue website and mail them in.

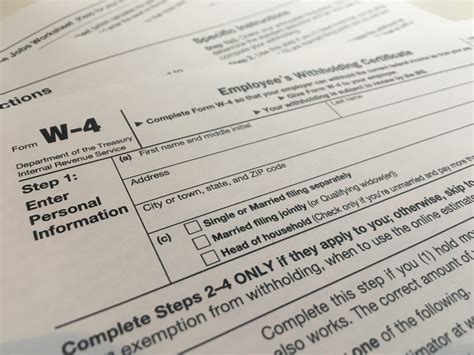

Regardless of the method you choose, it's important to ensure you have all the necessary documentation and information before beginning the filing process. This includes W-2s, 1099s, business records, and any other relevant tax documents.

Pennsylvania Tax Rates and Structures

Pennsylvania employs a progressive tax structure for individual income taxes, which means that higher income levels are taxed at higher rates. This system ensures that those with greater financial means contribute a larger share of their income towards state revenue.

| Income Bracket | Tax Rate |

|---|---|

| First $35,450 | 3.07% |

| $35,450 - $88,625 | 3.45% |

| $88,625 - $132,937 | 3.7% |

| Above $132,937 | 3.87% |

It's important to note that these tax rates are for taxable income only. Your taxable income is calculated after deducting certain allowances, such as personal exemptions and standard deductions. Additionally, Pennsylvania also has a School Tax and Local Tax, which can vary based on your county of residence.

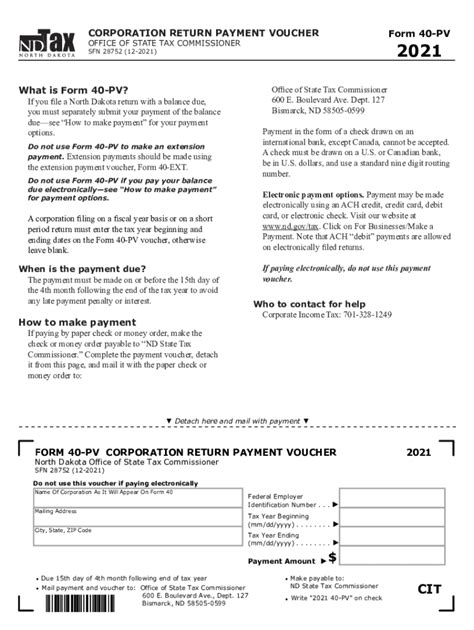

For businesses, Pennsylvania offers a variety of tax structures depending on the type of business entity. For instance, corporations are subject to a Corporate Net Income Tax (CNIT), which is calculated as a percentage of their taxable income. Partnerships and LLCs, on the other hand, are generally not taxed at the entity level but instead pass through their profits and losses to the individual owners, who report them on their personal tax returns.

Tax Credits and Deductions in Pennsylvania

Pennsylvania offers a range of tax credits and deductions to help reduce the tax burden for individuals and businesses. These incentives can significantly impact your overall tax liability, so it's important to be aware of them and understand how to qualify and claim them.

Some of the key tax credits and deductions available in Pennsylvania include:

- Property Tax/Rent Rebate: This program provides a rebate for certain eligible residents based on the property taxes or rent they've paid. It's a great way for seniors and low-income individuals to recoup some of their expenses.

- Low-Income Tax Credit: This credit is available to individuals with low to moderate incomes. It's designed to offset the impact of the state income tax for those with limited financial means.

- Research and Development Tax Credit: Pennsylvania offers a tax credit for businesses that engage in research and development activities within the state. This credit can be a significant incentive for companies to invest in innovation.

- Job Creation Tax Credit: To encourage businesses to create new jobs in Pennsylvania, the state offers a tax credit for each new full-time position. This credit can be claimed for up to five years after the job is created.

- Standard Deduction: Like the federal tax system, Pennsylvania allows individuals to claim a standard deduction, which reduces their taxable income. For the 2023 tax year, the standard deduction is $3,700 for single filers and $7,400 for joint filers.

- Itemized Deductions: If your expenses exceed the standard deduction, you may opt for itemized deductions. This includes deductions for mortgage interest, charitable contributions, medical expenses, and more.

It's important to consult with a tax professional to understand which credits and deductions you may be eligible for and how to claim them effectively.

Pennsylvania Tax Compliance and Enforcement

Pennsylvania takes tax compliance seriously and has various measures in place to ensure that taxpayers meet their obligations. While the state aims to provide support and resources to help taxpayers understand and meet their tax responsibilities, it also has a robust system for enforcement when necessary.

If you fail to file your tax return or pay your taxes on time, you may face penalties and interest. These can quickly accumulate, so it's important to stay on top of your tax obligations. The Pennsylvania Department of Revenue has a dedicated Compliance and Enforcement division that handles audits, investigations, and collections.

Audits can be selected based on a variety of factors, including random selection, data analysis, and tips or complaints. If you're selected for an audit, it's important to cooperate fully and provide all the necessary documentation. The audit process is designed to ensure that taxpayers are accurately reporting their income and claiming appropriate deductions and credits.

In cases of severe non-compliance, the Department of Revenue has the authority to take legal action, which can result in significant fines and even criminal charges. However, it's important to note that the vast majority of taxpayers in Pennsylvania comply with their tax obligations without issue.

Taxpayer Assistance and Resources

Pennsylvania recognizes that tax filing can be complex and offers a range of resources to help taxpayers navigate the process. These resources are designed to provide clarity, answer questions, and offer support.

- Taxpayer Service Centers: The Pennsylvania Department of Revenue operates several Taxpayer Service Centers across the state. These centers provide in-person assistance for taxpayers who need help with their tax returns, have questions about tax laws, or are facing complex tax situations.

- Telephone Assistance: For those who prefer phone support, the Department of Revenue has a dedicated telephone assistance line. Trained representatives are available to answer questions and provide guidance on a range of tax-related topics.

- Online Resources: The Department of Revenue's website is a wealth of information, offering detailed guides, forms, and instructions for various tax situations. It's a great place to start if you have basic questions or need to download forms.

- Taxpayer Education Programs: Pennsylvania offers various educational programs and workshops to help taxpayers better understand their tax obligations. These programs cover a range of topics, from basic tax filing to more complex business tax issues.

Additionally, for those who are comfortable with technology, the Pennsylvania Department of Revenue offers an online chat service and a tax filing app, making it easier than ever to get help and file your taxes.

Pennsylvania Tax Incentives and Economic Development

Beyond the standard tax structure, Pennsylvania offers a range of tax incentives and programs designed to encourage economic development and investment within the state. These initiatives are a key part of the state's strategy to attract businesses, create jobs, and foster growth.

Key Tax Incentive Programs

- Business Tax Incentives: Pennsylvania offers a variety of tax incentives for businesses, including tax credits for job creation, research and development, and investment in certain industries. These incentives can significantly reduce a business's tax burden and provide a competitive advantage for companies operating in the state.

- Film Production Tax Credit: To encourage film and television production in Pennsylvania, the state offers a tax credit for qualified film production expenses. This credit has been instrumental in attracting major productions to the state, creating jobs, and boosting the local economy.

- Historic Preservation Tax Credit: This program provides a tax credit for the rehabilitation of historic structures. It encourages the preservation of Pennsylvania's rich historical heritage while also stimulating economic activity in older, established communities.

- Agriculture Tax Incentives: Pennsylvania's agricultural sector is a vital part of the state's economy. To support farmers and promote agricultural development, the state offers a range of tax incentives, including tax credits for investing in agricultural land and equipment.

These tax incentive programs are carefully designed to align with Pennsylvania's economic development goals and provide a competitive advantage for the state in attracting new businesses and investment.

Impact and Effectiveness of Tax Incentives

Pennsylvania’s tax incentive programs have been instrumental in driving economic growth and development across the state. By providing tax relief and other incentives, the state has successfully attracted new businesses, encouraged innovation, and supported existing industries. The impact of these programs can be seen in various sectors, from film and television production to agriculture and technology.

For instance, the Film Production Tax Credit has brought major productions to Pennsylvania, creating thousands of jobs and generating significant economic activity. Similarly, the Historic Preservation Tax Credit has not only preserved Pennsylvania's rich historical heritage but has also stimulated economic growth in older communities. By incentivizing the rehabilitation of historic structures, the program has encouraged investment and development in these areas, boosting local economies.

Additionally, tax incentives for businesses have been a key factor in attracting new companies to Pennsylvania and supporting the growth of existing ones. By reducing the tax burden on businesses, these incentives make Pennsylvania a more attractive place to invest and operate. This, in turn, leads to job creation, increased tax revenue, and a stronger economy overall.

Conclusion

Understanding and navigating the Pennsylvania state tax filing process is crucial for both individuals and businesses operating within the state. From filing deadlines and forms to tax rates and incentives, this guide has provided a comprehensive overview of the key aspects of Pennsylvania’s tax system. By staying informed and taking advantage of available resources, taxpayers can ensure compliance, maximize potential benefits, and contribute to the state’s economic growth and development.

Frequently Asked Questions

What is the Pennsylvania state tax rate for individuals in 2023?

+

The state tax rate for individuals in Pennsylvania varies based on income brackets. For 2023, the rates are 3.07% on the first 35,450 of taxable income, 3.45% on income between 35,450 and 88,625, 3.7% on income between 88,625 and 132,937, and 3.87% on income above 132,937.

Are there any tax incentives for businesses in Pennsylvania?

+

Yes, Pennsylvania offers a range of tax incentives for businesses, including tax credits for job creation, research and development, and investment in certain industries. These incentives are designed to encourage economic development and make Pennsylvania an attractive place for businesses to operate.

What is the deadline for filing Pennsylvania state taxes in 2023?

+

The standard deadline for filing Pennsylvania state taxes is typically April 15th. However, if this date falls on a weekend or a holiday, the deadline is usually extended to the following business day. For 2023, the deadline is April 18th.

Can I file my Pennsylvania state taxes online?

+

Yes, Pennsylvania offers an online filing system called e-file, which is secure, fast, and efficient. It’s a convenient option for both individual taxpayers and tax professionals.

Are there any tax credits for homeowners in Pennsylvania?

+

Yes, Pennsylvania offers the Property Tax/Rent Rebate program, which provides a rebate for certain eligible residents based on the property taxes or rent they’ve paid. It’s a great way for seniors and low-income individuals to recoup some of their expenses.