Pa State Income Tax Refund

The Pennsylvania state income tax refund is a topic of interest for many residents and businesses operating within the state. Understanding the refund process, eligibility criteria, and timelines is crucial for effective financial planning. In this comprehensive guide, we will delve into the specifics of the Pennsylvania state income tax refund, providing you with all the information you need to navigate this process successfully.

Understanding the Pennsylvania State Income Tax Refund

The Pennsylvania Department of Revenue is responsible for administering the state’s income tax system, including the processing of refunds. The state income tax refund is a reimbursement of the excess tax paid by individuals or businesses during the previous tax year. This refund is a crucial aspect of the state’s tax system, as it ensures taxpayers receive their due credit and can plan their finances accordingly.

The refund process in Pennsylvania is designed to be efficient and taxpayer-friendly. The state utilizes modern technology and online platforms to streamline the refund process, making it convenient for taxpayers to track their refunds and receive updates.

Eligibility for Pennsylvania State Income Tax Refund

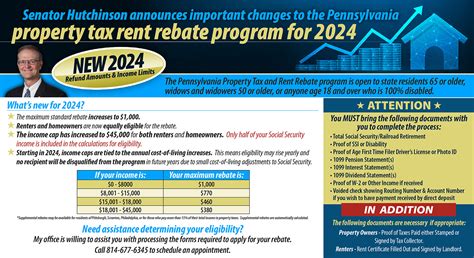

To be eligible for a Pennsylvania state income tax refund, taxpayers must have overpaid their taxes during the previous tax year. This overpayment can occur for various reasons, including changes in income, deductions, or credits claimed. It’s important to note that eligibility is determined by the specific circumstances of each taxpayer’s financial situation.

Here are some key factors that can impact eligibility for a Pennsylvania state income tax refund:

- Filing Status: The taxpayer's filing status, such as single, married filing jointly, or head of household, can influence the refund amount.

- Income Level: The amount of income earned during the tax year is a significant factor in determining the refund. Higher incomes may result in a larger refund, as taxpayers in higher tax brackets may have overpaid their taxes.

- Deductions and Credits: Claiming deductions and credits can reduce the taxable income and, consequently, the amount of tax owed. If a taxpayer qualifies for various deductions or credits, it can lead to a larger refund.

- Withholding or Estimated Tax Payments: Taxpayers who have excess withholding or estimated tax payments throughout the year may be eligible for a refund.

It's important to consult with a tax professional or utilize tax preparation software to accurately determine your eligibility for a Pennsylvania state income tax refund.

Claiming Your Pennsylvania State Income Tax Refund

Claiming your Pennsylvania state income tax refund is a straightforward process, thanks to the state’s user-friendly online platform. Here’s a step-by-step guide to help you navigate the refund claim process:

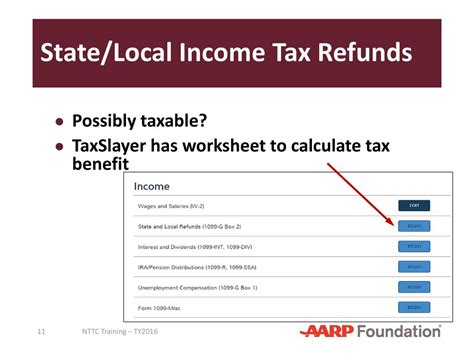

- Gather Your Documents: Before starting the refund claim process, ensure you have all the necessary documents, including your federal tax return, W-2 forms, 1099 forms, and any other relevant financial records.

- Access the Pennsylvania Tax Portal: Visit the official Pennsylvania Department of Revenue website and log in to your account. If you don't have an account, you can create one by providing your personal details and setting up a secure password.

- Select "File a Return": On the dashboard, select the option to file a tax return. You will be guided through the process of completing your Pennsylvania state income tax return.

- Enter Your Income and Deductions: Input your income details, including wages, salaries, and any other taxable income sources. Don't forget to include any deductions or credits you are eligible for.

- Calculate Your Refund: Once you have entered all the necessary information, the online platform will calculate your tax liability and determine if you are eligible for a refund. It will also provide an estimate of the refund amount.

- Review and Submit: Carefully review the calculated refund amount and ensure all the information is accurate. If everything is in order, submit your tax return online. The platform will generate a confirmation number, which you should keep for your records.

By following these steps, you can efficiently claim your Pennsylvania state income tax refund and receive your reimbursement promptly.

Tracking and Receiving Your Pennsylvania State Income Tax Refund

Once you have submitted your tax return and claimed your refund, the next step is to track its progress and receive the reimbursement. Pennsylvania offers a convenient online refund tracking system, which provides real-time updates on the status of your refund.

Refund Tracking Process

To track your Pennsylvania state income tax refund, you can use the Pennsylvania Department of Revenue’s online refund tracking tool. Here’s how it works:

- Visit the Pennsylvania Refund Tracker: Access the official Pennsylvania Department of Revenue website and navigate to the "Refund Tracker" section. You will be prompted to enter your personal information, including your Social Security Number, date of birth, and refund amount.

- Enter Your Information: Provide the required details accurately. The system will use this information to search for your refund status.

- View Your Refund Status: After submitting your information, the system will display the current status of your refund. It will indicate whether your refund has been approved, is in process, or if there are any issues that need to be resolved.

The Pennsylvania refund tracker provides regular updates, allowing taxpayers to stay informed about the progress of their refund. It's a convenient way to monitor the reimbursement process and plan their finances accordingly.

Receiving Your Refund

Once your Pennsylvania state income tax refund has been approved, you have the option to receive it via direct deposit or by check. The method you choose will depend on your personal preference and the availability of your banking information.

If you opt for direct deposit, the refund amount will be electronically transferred to your bank account. This method is fast and secure, ensuring you receive your refund promptly. However, ensure your banking details are accurate to avoid any delays.

If you prefer to receive your refund by check, the Pennsylvania Department of Revenue will mail a physical check to the address provided on your tax return. This method may take a little longer, as it relies on postal services, but it provides a tangible form of reimbursement.

Regardless of the method you choose, you can track the progress of your refund through the Pennsylvania refund tracker until it is received.

Performance Analysis and Comparison

To provide a comprehensive understanding of the Pennsylvania state income tax refund process, let’s analyze its performance and compare it to other states.

Timelines and Efficiency

Pennsylvania has made significant strides in improving the efficiency of its refund process. With the implementation of online platforms and electronic filing, the state has reduced the average processing time for refunds. According to recent data, the average processing time for Pennsylvania state income tax refunds is approximately 4-6 weeks from the date of filing.

This timeline is comparable to many other states, demonstrating Pennsylvania's commitment to delivering timely refunds to its taxpayers.

Refund Amounts and Satisfaction

The amount of the Pennsylvania state income tax refund can vary significantly based on individual circumstances. Factors such as income level, deductions claimed, and tax bracket can influence the refund amount. On average, taxpayers in Pennsylvania receive refunds ranging from a few hundred dollars to several thousand dollars.

Surveys and feedback from taxpayers indicate a high level of satisfaction with the Pennsylvania state income tax refund process. The user-friendly online platform, efficient processing times, and accurate refund calculations contribute to a positive taxpayer experience.

Comparison with Other States

When compared to other states, Pennsylvania fares well in terms of refund processing efficiency and taxpayer satisfaction. While some states may offer slightly faster processing times, Pennsylvania stands out for its comprehensive online services and user-friendly refund tracking system.

Additionally, Pennsylvania has implemented measures to ensure the security and accuracy of the refund process, further enhancing its reputation as a taxpayer-friendly state.

Future Implications and Tax Strategies

As we look to the future, it’s important to consider the potential implications and strategies related to the Pennsylvania state income tax refund.

Technological Advancements

With the rapid advancements in technology, Pennsylvania is likely to continue improving its online platforms and tax filing systems. This will further enhance the efficiency and convenience of the refund process, making it even more accessible to taxpayers.

The integration of artificial intelligence and machine learning algorithms could streamline the refund calculation process, reducing the likelihood of errors and providing faster refunds.

Tax Planning and Strategies

Taxpayers can benefit from proactive tax planning strategies to maximize their Pennsylvania state income tax refund. Here are some tips to consider:

- Optimize Withholdings: Review your withholdings throughout the year to ensure you are not overpaying taxes. Adjust your withholdings accordingly to minimize the amount of excess tax paid and maximize your refund.

- Claim All Eligible Deductions and Credits: Familiarize yourself with the various deductions and credits offered by Pennsylvania. Claiming eligible deductions and credits can significantly reduce your taxable income and increase your refund.

- Utilize Tax Preparation Software: Invest in reputable tax preparation software that can guide you through the process of claiming deductions and credits accurately. These tools can help ensure you receive the maximum refund you are entitled to.

- Stay Informed About Tax Changes: Keep yourself updated on any changes to the Pennsylvania tax laws and regulations. Being aware of these changes can help you adjust your tax planning strategies accordingly.

By implementing these tax planning strategies, taxpayers can optimize their financial situation and make the most of their Pennsylvania state income tax refund.

Frequently Asked Questions

How long does it take to receive a Pennsylvania state income tax refund?

+The average processing time for Pennsylvania state income tax refunds is approximately 4-6 weeks from the date of filing. However, this timeline can vary based on factors such as the complexity of the tax return and the volume of refunds being processed.

Can I track my Pennsylvania state income tax refund online?

+Yes, Pennsylvania offers an online refund tracking tool. You can access this tool on the Pennsylvania Department of Revenue website and track the status of your refund by providing your personal information and refund amount.

What if I haven’t received my Pennsylvania state income tax refund after the expected timeframe?

+If you haven’t received your refund after the expected timeframe, it’s recommended to contact the Pennsylvania Department of Revenue. They can provide further assistance and investigate the status of your refund. You can reach them through their official website or by calling their taxpayer services hotline.

Can I receive my Pennsylvania state income tax refund via direct deposit?

+Yes, you have the option to receive your Pennsylvania state income tax refund via direct deposit. When filing your tax return online, you can provide your banking details to receive the refund directly into your account. This method is fast and secure.

Are there any penalties for claiming a Pennsylvania state income tax refund if I am not eligible?

+Claiming a Pennsylvania state income tax refund when you are not eligible can result in penalties and interest charges. It’s important to accurately determine your eligibility and only claim a refund if you have overpaid your taxes. Consult with a tax professional if you are unsure.