New Child Tax Credit News

The Child Tax Credit (CTC) has been a significant policy initiative in the United States, offering financial support to families with children and playing a crucial role in reducing child poverty. In 2021, a historic expansion of the CTC was introduced, providing enhanced benefits to millions of families. As we navigate through 2023, the CTC continues to evolve, with ongoing discussions and potential changes shaping its future.

Understanding the Child Tax Credit

The Child Tax Credit is a federal tax benefit designed to provide financial relief to families with dependent children. It aims to ease the financial burden of raising children and promote economic stability for households across the country. The CTC has undergone various modifications over the years, with the most recent significant overhaul occurring in 2021.

In 2021, the American Rescue Plan Act (ARPA) expanded the CTC, making it more generous and accessible to a broader range of families. This expansion included an increase in the credit amount, making it fully refundable, and introducing advance monthly payments. These changes had a substantial impact on the financial well-being of many American families.

Key Features of the 2021 CTC Expansion

The 2021 expansion brought about several critical changes to the CTC:

- Increased Credit Amount: The credit amount was raised to 3,600 for children under six and 3,000 for children aged six to seventeen. This represented a significant increase from the previous credit amount of $2,000.

- Fully Refundable: The CTC became fully refundable, meaning families could receive the full credit amount even if they had no federal income tax liability.

- Advance Monthly Payments: Families had the option to receive half of their CTC as monthly payments throughout the year, providing them with regular financial support.

- Income Thresholds: The income thresholds for eligibility were adjusted, making the credit available to more low- and moderate-income families.

| CTC Amount | Age of Child |

|---|---|

| $3,600 | Under 6 years |

| $3,000 | 6 to 17 years |

2023 CTC Updates and News

As we enter 2023, there are several important developments and considerations regarding the Child Tax Credit:

Expiration of the Enhanced CTC

The enhanced CTC provisions introduced in 2021 were initially temporary and set to expire at the end of 2021. However, the Consolidated Appropriations Act, 2023, extended these provisions for one additional year, ensuring that families could continue to benefit from the expanded credit in 2022 and 2023.

Advocacy for Long-Term Extension

Advocates and policymakers are pushing for a long-term extension of the enhanced CTC. Research and data have highlighted the positive impact of the expanded credit on families’ financial stability and overall well-being. There is a growing consensus that extending the CTC beyond 2023 could have lasting benefits for children and families.

Proposed Changes for 2024

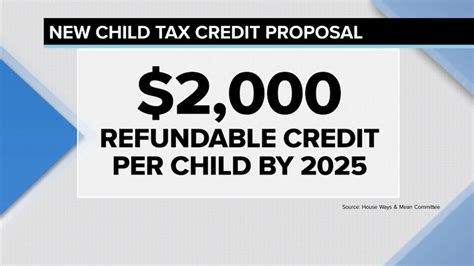

Various proposals are being discussed to modify the CTC for 2024 and beyond. These proposals aim to address specific concerns and improve the credit’s effectiveness. Some key suggestions include:

- Income Limits: Adjusting the income thresholds to ensure that middle-income families continue to receive a substantial credit amount.

- Phase-Out Rates: Modifying the phase-out rates to make the credit more accessible to a broader range of families.

- Age Eligibility: Expanding the age eligibility to include children up to 18 years old, aligning with other child-related benefits.

- Inflation Adjustments: Implementing mechanisms to adjust the credit amount for inflation to maintain its purchasing power over time.

Impact on Families

The Child Tax Credit has had a profound impact on the financial security of families across the United States. According to the Internal Revenue Service (IRS), over 36 million households received advance CTC payments in 2022, with an average monthly payment of $483. These payments have provided much-needed support for families’ daily expenses, education costs, and overall well-being.

Looking Ahead: The Future of the CTC

The future of the Child Tax Credit remains a topic of discussion and debate. While the 2023 extension provides a sense of continuity, the long-term fate of the enhanced CTC is uncertain. However, the positive outcomes and reduced child poverty rates associated with the expanded credit have sparked a renewed interest in making these provisions permanent.

Advocates and policymakers are actively engaging in discussions and negotiations to find a sustainable solution. The goal is to strike a balance between providing financial support to families and ensuring the program's fiscal responsibility. The upcoming years will be crucial in determining the CTC's long-term trajectory and its role in supporting American families.

Conclusion

The Child Tax Credit is a critical component of the social safety net, offering a helping hand to families raising children. The 2021 expansion and its subsequent extension have demonstrated the credit’s potential to make a significant impact on families’ lives. As we navigate the complexities of policy and economics, the future of the CTC will be shaped by ongoing advocacy, research, and a commitment to supporting the well-being of American families.

When did the Child Tax Credit expansion take effect?

+The CTC expansion provisions were introduced in 2021 as part of the American Rescue Plan Act (ARPA) and became effective for tax year 2021.

Who is eligible for the Child Tax Credit?

+Eligibility for the CTC is based on various factors, including income, marital status, and the number of qualifying children. The specific requirements can be found on the IRS website.

How can I claim the Child Tax Credit on my taxes?

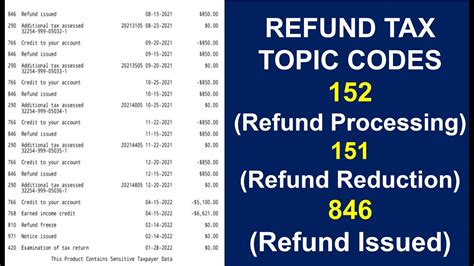

+To claim the CTC, you will need to file a federal income tax return and complete the appropriate tax forms. The IRS provides detailed instructions and resources to guide taxpayers through the process.