Child Tax Credit Increase Proposal

The Child Tax Credit (CTC) is a vital component of the US tax system, designed to provide financial support to families with children. Recently, there has been a significant proposal to increase the CTC, aiming to alleviate the financial burden on families and promote child well-being. This proposal, if implemented, could have a profound impact on millions of American households. Let's delve into the details of this initiative and explore its potential consequences.

Understanding the Child Tax Credit Increase Proposal

The Child Tax Credit Increase Proposal is an ambitious plan put forth by policymakers to enhance the existing CTC program. The primary objective is to increase the credit amount, expand eligibility criteria, and make it more accessible to a broader range of families. By doing so, the proposal aims to address the financial challenges faced by many households, particularly those with low and moderate incomes.

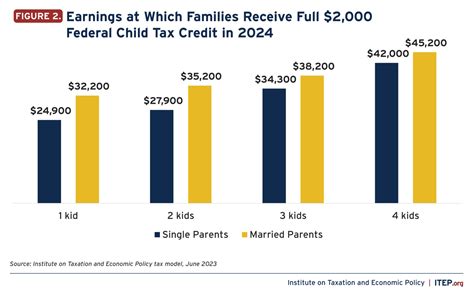

Currently, the CTC allows eligible families to claim a credit of up to $2,000 per qualifying child under the age of 17. However, the proposed changes aim to increase this amount significantly. According to the latest reports, the credit could be raised to $3,000 for children aged 6 to 17 and $3,600 for those under 6 years old. This substantial increase aims to provide a much-needed financial boost to families, helping them meet their basic needs and invest in their children's future.

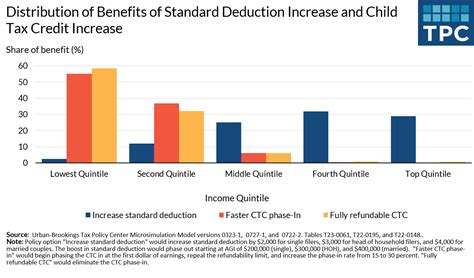

Moreover, the proposal also includes provisions to make the credit fully refundable. This means that even families with little or no tax liability can benefit from the full amount of the credit. By removing income thresholds, the CTC would become a powerful tool to lift millions of children out of poverty and improve their overall well-being.

Key Features of the Proposal

- Increased Credit Amount: As mentioned, the proposal seeks to raise the CTC to 3,000 or 3,600 per child, depending on their age. This increase aims to provide a substantial financial benefit to families.

- Fully Refundable Credit: Making the credit fully refundable ensures that all eligible families, regardless of their income level, can access the full benefits of the CTC. This provision is particularly beneficial for low-income households.

- Monthly Advance Payments: One of the unique aspects of this proposal is the introduction of monthly advance payments. Families would receive half of their CTC as monthly payments throughout the year, providing them with a steady stream of income to cover essential expenses.

- Expanded Eligibility: The proposal aims to broaden the eligibility criteria, allowing more families to qualify for the CTC. This includes considering additional factors such as household size and income levels to ensure a fair and inclusive system.

Potential Impact and Benefits

The Child Tax Credit Increase Proposal, if enacted, could bring about a range of positive outcomes for families and the economy as a whole. Let’s explore some of the key potential benefits:

Reducing Child Poverty

One of the primary goals of the CTC increase is to combat child poverty. Studies have shown that the current CTC structure has already helped reduce poverty rates among children. By increasing the credit amount and making it fully refundable, the proposal aims to further alleviate poverty and improve the living conditions of millions of children.

According to recent estimates, the proposed CTC expansion could lift approximately 4.1 million children out of poverty. This would significantly reduce the number of children living in poverty, providing them with better access to education, healthcare, and overall opportunities for a brighter future.

| Child Poverty Reduction Impact | Potential Reduction |

|---|---|

| Total Children Lifted Out of Poverty | 4.1 million |

| Percentage Decrease in Child Poverty | 26% |

Improving Family Financial Stability

The increased CTC would provide a substantial financial boost to families, especially those struggling to make ends meet. By receiving a larger credit amount, families could better afford basic necessities such as food, housing, and healthcare. This stability would allow parents to focus on their children’s well-being and plan for their future.

Moreover, the monthly advance payments feature would provide families with a consistent and predictable income stream. This would enable better financial planning and reduce the stress associated with unexpected expenses. Families could use these payments to build savings, pay off debts, or invest in their children's education, ultimately improving their long-term financial prospects.

Stimulating the Economy

The Child Tax Credit increase proposal has the potential to stimulate the economy on a macro level. When families receive additional financial support, they are more likely to spend it on goods and services. This increased consumer spending can drive economic growth, create jobs, and boost the overall economy.

Furthermore, the proposal's focus on low and moderate-income families means that the CTC expansion would primarily benefit those who are most likely to spend the additional funds. This targeted approach could lead to a multiplier effect, where the increased spending generates further economic activity and benefits businesses and communities.

Implementation and Challenges

While the Child Tax Credit Increase Proposal offers promising benefits, its implementation is not without challenges. Let’s explore some of the key considerations:

Funding and Budgetary Concerns

Increasing the CTC and making it fully refundable would require significant funding. The proposal estimates that the expanded CTC could cost the government approximately $110 billion annually. Finding the necessary funds and ensuring long-term sustainability is a critical aspect of the implementation process.

Policymakers will need to carefully consider the potential impact on the federal budget and explore innovative ways to finance the program. This may involve reallocating existing funds, identifying new revenue sources, or making adjustments to other programs to ensure the CTC expansion is fiscally responsible.

Administrative Challenges

Implementing a program of this scale and complexity comes with administrative challenges. The Internal Revenue Service (IRS) would need to adapt its systems and processes to accommodate the increased workload and ensure accurate and efficient delivery of the CTC benefits.

Training and hiring additional staff, improving technological infrastructure, and streamlining processes will be essential to handle the increased volume of applications and payments. The IRS will need to work closely with tax professionals, community organizations, and other stakeholders to ensure a smooth implementation process and provide support to eligible families.

Future Implications and Policy Considerations

The Child Tax Credit Increase Proposal has the potential to shape the future of tax policy and family support programs. As we move forward, there are several key considerations and potential implications to keep in mind:

Long-Term Sustainability

Ensuring the long-term sustainability of the expanded CTC program is crucial. Policymakers will need to carefully monitor the program’s impact on the budget and economy and make adjustments as necessary. Regular evaluations and assessments will help identify areas for improvement and address any unforeseen challenges.

Additionally, exploring innovative funding mechanisms, such as public-private partnerships or targeted tax reforms, could provide a more sustainable approach to financing the program. By involving various stakeholders and seeking diverse perspectives, policymakers can develop a robust and resilient funding model.

Expanding Eligibility and Access

While the proposed CTC expansion aims to broaden eligibility, there may still be gaps in reaching all eligible families. Policymakers should continue to refine and improve the eligibility criteria to ensure that no deserving family is left behind. This may involve considering additional factors, such as family structure, caregiver responsibilities, and other unique circumstances.

Furthermore, raising awareness about the CTC and its benefits is essential. Many eligible families may not be aware of the program or face barriers in accessing it. Implementing targeted outreach campaigns, utilizing community organizations, and simplifying the application process can help ensure that all eligible families have equal access to the benefits.

Policy Coordination and Integration

The Child Tax Credit is just one component of a broader network of social safety net programs. Policymakers should consider how the CTC expansion can complement and integrate with other initiatives, such as the Earned Income Tax Credit (EITC), Medicaid, and nutrition assistance programs. A coordinated approach can ensure that families receive the full range of benefits they are entitled to and maximize the impact of these programs.

By aligning eligibility criteria, streamlining application processes, and sharing data across programs, policymakers can create a more efficient and effective social safety net. This integration can help reduce administrative burdens, eliminate duplication of efforts, and ultimately provide better support to families in need.

Potential Policy Adjustments

As the Child Tax Credit program evolves, there may be opportunities for further enhancements and adjustments. Policymakers should remain open to feedback and suggestions from stakeholders, including families, community organizations, and experts in the field. Regular reviews and evaluations can help identify areas where the program can be refined and improved.

For example, policymakers could consider additional incentives for families to save a portion of their CTC payments for long-term goals such as education or homeownership. They could also explore ways to provide targeted support for specific populations, such as single parents or families with special needs children. By continuously refining the program, policymakers can ensure that it remains responsive to the evolving needs of American families.

Conclusion

The Child Tax Credit Increase Proposal presents a promising opportunity to enhance financial support for families and improve the well-being of children across the United States. By increasing the credit amount, making it fully refundable, and introducing monthly advance payments, the proposal aims to alleviate financial burdens, reduce child poverty, and stimulate the economy.

While implementation challenges exist, the potential benefits are significant. Policymakers, government agencies, and community organizations must work together to ensure a successful rollout and address any obstacles that may arise. By carefully considering the long-term sustainability, expanding eligibility, and coordinating with other social safety net programs, the CTC expansion can become a powerful tool to support families and create a brighter future for children.

How does the proposed CTC expansion compare to the current CTC program?

+The proposed CTC expansion aims to significantly increase the credit amount and make it fully refundable, which is a departure from the current program. The current CTC allows a credit of up to 2,000 per child, but it is not fully refundable, meaning that families with little tax liability may not receive the full benefit. The proposed expansion aims to address this issue by providing a larger credit and ensuring that all eligible families can access the full amount.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>What are the potential long-term effects of the CTC increase on the economy?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>The CTC increase has the potential to have a positive long-term impact on the economy. By providing financial support to families, especially those with lower incomes, the program can stimulate consumer spending. Increased spending can lead to economic growth, job creation, and overall prosperity. Additionally, by reducing child poverty, the program can improve educational outcomes and future earning potential, contributing to a more skilled and productive workforce.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>How will the monthly advance payments work, and who will be eligible for them?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>The monthly advance payments are a new feature of the proposed CTC expansion. Eligible families would receive half of their CTC as monthly payments throughout the year. This means that instead of claiming the entire credit at tax time, families would receive a portion of it in advance. The payments would be based on the previous year's tax return, and adjustments would be made at the end of the year to ensure accuracy. All families who qualify for the expanded CTC would be eligible for the monthly advance payments.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>Are there any concerns about the potential impact on the federal budget?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>Yes, the expanded CTC program will require significant funding, estimated at 110 billion annually. Policymakers will need to carefully consider the budget implications and explore innovative funding solutions. While the program aims to reduce child poverty and stimulate the economy, finding sustainable funding sources is crucial to ensure its long-term viability.

How can eligible families stay informed about the CTC expansion and its benefits?

+Eligible families can stay informed by staying updated with the latest news and announcements from government agencies and community organizations. The IRS and other relevant agencies will provide guidance and resources to help families understand the program and their eligibility. Additionally, tax professionals and community outreach programs can offer assistance and support to ensure that families receive the benefits they are entitled to.