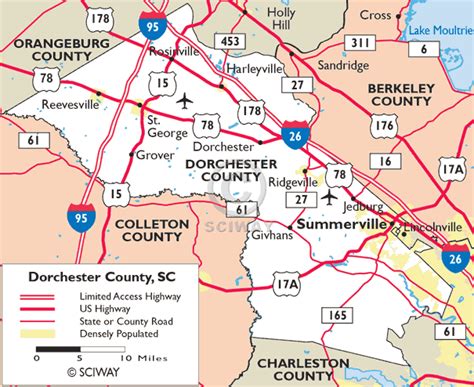

Dorchester County Sc Taxes

In Dorchester County, South Carolina, property taxes play a crucial role in funding various public services and initiatives that contribute to the well-being of its residents and the overall development of the community. This article aims to provide an in-depth exploration of Dorchester County's property tax landscape, shedding light on its workings, implications, and the key factors influencing the tax structure.

Understanding Dorchester County’s Property Tax System

Dorchester County’s property tax system is designed to generate revenue for the county government, enabling it to provide essential services and maintain the infrastructure necessary for a thriving community. The tax is levied on both real and personal property within the county, with rates varying based on several factors.

The property tax assessment process in Dorchester County is a meticulous undertaking, involving the evaluation of each property's fair market value. This value is then used to calculate the tax liability, with the county's millage rate serving as the multiplier. The millage rate, expressed in mills (where one mill equals $1 for every $1,000 of assessed value), is determined annually by the county council, taking into account the revenue needs of various county departments and services.

The revenue generated through property taxes is allocated across a range of public services, including but not limited to education, law enforcement, fire protection, road maintenance, and social services. This allocation is a complex process, influenced by the budgetary requirements of each department and the county's overall financial goals.

Property Tax Rates and Assessment in Dorchester County

Dorchester County employs a two-tiered property tax system, distinguishing between residential and non-residential properties. This differentiation is a common practice aimed at providing equitable taxation, considering the varying uses and values of different types of properties.

| Property Type | Assessment Ratio | Effective Tax Rate (as of 2023) |

|---|---|---|

| Residential | 4% | 8.55 mills |

| Non-Residential | 6% | 10.65 mills |

The assessment ratio, a critical component of the property tax system, determines the percentage of a property's fair market value that is subject to taxation. Dorchester County's assessment ratios for residential and non-residential properties are set at 4% and 6%, respectively. These ratios are applied to the assessed value of the property to calculate the taxable value.

The effective tax rate, as shown in the table, is the rate at which property owners are taxed. This rate is calculated by multiplying the millage rate by the assessment ratio. For instance, a residential property owner in Dorchester County would pay a tax rate of 8.55 mills (1000 x 0.0855%), while a non-residential property owner would be taxed at a rate of 10.65 mills (1000 x 0.1065%).

The Impact of Property Taxes on Dorchester County Residents

Property taxes are a significant financial obligation for homeowners and property owners in Dorchester County. The tax liability can vary significantly based on the property’s assessed value, with higher-valued properties facing higher tax bills. This can be a burden, especially for those on fixed incomes or with limited financial means.

However, the revenue generated from property taxes is a vital source of funding for the county's public services and infrastructure development. It ensures that residents have access to quality education, efficient law enforcement, well-maintained roads, and essential social services. The tax system thus plays a crucial role in maintaining the county's standard of living and promoting its economic growth.

Dorchester County's commitment to responsible financial management and transparency in tax allocation ensures that property tax revenue is utilized effectively and efficiently. Regular budget hearings and public meetings provide residents with opportunities to voice their concerns and contribute to the budgeting process, fostering a sense of community engagement and ownership.

Comparative Analysis: Dorchester County vs. Surrounding Areas

Comparing Dorchester County’s property tax rates with those of neighboring counties provides an insightful perspective on the county’s tax landscape. While tax rates can vary significantly across regions, Dorchester County’s rates are generally competitive and in line with the broader South Carolina property tax environment.

| County | Effective Tax Rate (Residential) | Effective Tax Rate (Non-Residential) |

|---|---|---|

| Dorchester County | 8.55 mills | 10.65 mills |

| Berkeley County | 9.18 mills | 11.48 mills |

| Charleston County | 8.65 mills | 10.81 mills |

As seen in the table, Dorchester County's effective tax rates are relatively lower compared to Berkeley County and slightly higher than Charleston County. This comparative analysis underscores the county's commitment to maintaining a competitive tax environment, which can be an attractive factor for businesses and residents considering relocation or investment.

Furthermore, Dorchester County's tax structure is designed to encourage economic growth and development. The county offers various incentives and tax abatements to attract new businesses and industries, contributing to job creation and a vibrant local economy. This proactive approach to economic development sets Dorchester County apart and positions it as a desirable location for businesses and investors.

Future Implications and Potential Reforms

The property tax landscape in Dorchester County is dynamic, influenced by changing economic conditions, population growth, and shifts in public service needs. As such, the county regularly reviews and adjusts its tax policies to ensure they remain equitable, sustainable, and aligned with the community’s evolving requirements.

Looking ahead, Dorchester County is likely to continue exploring strategies to enhance its tax system's efficiency and fairness. This may involve further refining assessment methodologies to ensure properties are valued accurately and consistently. Additionally, the county may consider introducing new exemptions or deductions to provide targeted relief to specific groups or industries, promoting economic growth and community development.

Dorchester County's commitment to fiscal responsibility and transparency in tax allocation is a cornerstone of its property tax system. As the county moves forward, it will continue to prioritize open dialogue with residents and stakeholders, ensuring that tax policies reflect the community's values and aspirations. This collaborative approach fosters a sense of trust and ownership, reinforcing Dorchester County's position as a desirable place to live, work, and invest.

Conclusion

Dorchester County’s property tax system is a vital component of its financial framework, supporting the provision of essential public services and contributing to the county’s overall development. While property taxes can be a significant financial obligation for residents, the revenue generated plays a pivotal role in maintaining a high quality of life and promoting economic growth.

As Dorchester County navigates the dynamic landscape of property taxation, its commitment to transparency, equity, and fiscal responsibility will continue to guide its tax policies. By staying responsive to the community's needs and embracing innovative strategies, Dorchester County is well-positioned to sustain its position as a thriving and desirable community in the years to come.

How often are property taxes assessed in Dorchester County?

+

Property taxes in Dorchester County are assessed annually, with the assessed value based on the property’s fair market value as of January 1st of the tax year.

Are there any exemptions or deductions available for property owners in Dorchester County?

+

Yes, Dorchester County offers various exemptions and deductions, including homestead exemptions, senior citizen exemptions, and military exemptions. These exemptions can reduce the taxable value of a property, resulting in lower tax bills.

How can I calculate my property tax liability in Dorchester County?

+

To calculate your property tax liability, you’ll need to know your property’s assessed value and the applicable tax rate. Multiply the assessed value by the assessment ratio (4% for residential, 6% for non-residential) and then multiply the result by the effective tax rate (in mills) to determine your tax liability.