Where Do I Find Agi On Tax Return

Tax season is a critical time for individuals and businesses alike, as it involves navigating complex forms and ensuring accurate reporting to comply with the law. One key aspect of tax returns is understanding where to locate the Adjusted Gross Income (AGI), a fundamental metric that serves as a crucial reference point for various tax calculations and deductions.

This article aims to guide taxpayers through the process of identifying and understanding the AGI on their tax returns, offering a comprehensive and expert-level analysis. By providing clear and concise information, we aim to demystify this critical tax concept and empower taxpayers to make informed decisions during the tax filing process.

Unraveling the Concept of Adjusted Gross Income (AGI)

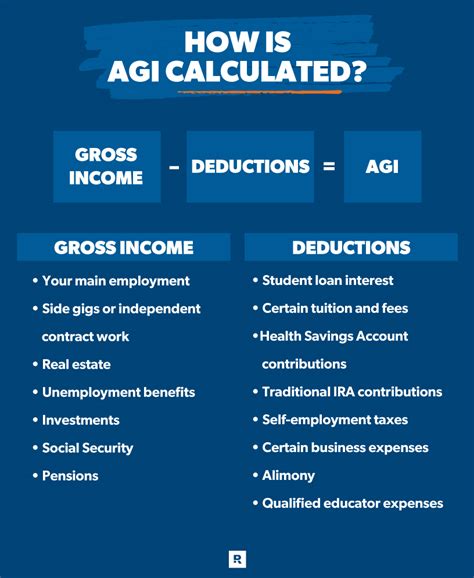

Adjusted Gross Income, or AGI, is a critical metric in the world of taxation. It represents a taxpayer’s total income adjusted for specific deductions and reductions, providing a more accurate reflection of their financial situation than their gross income alone. Understanding AGI is essential for various tax-related decisions, as it serves as a benchmark for determining eligibility for certain deductions, credits, and even tax rates.

The calculation of AGI involves a series of steps, starting with the taxpayer's gross income. This includes all sources of income, such as wages, salaries, interest, dividends, and business income. From there, specific deductions are applied to arrive at the AGI. These deductions can include contributions to retirement accounts, student loan interest, alimony payments, and certain business expenses, among others.

AGI plays a pivotal role in tax planning and strategy. It influences the taxpayer's tax liability, as it often serves as the starting point for calculating taxable income. Additionally, AGI is a key factor in determining eligibility for tax credits and deductions. For instance, the Earned Income Tax Credit (EITC) and the Child Tax Credit are both dependent on AGI, making its accurate calculation and reporting crucial for maximizing tax benefits.

Locating AGI on Various Tax Forms

The process of finding AGI on tax returns can vary depending on the form and the complexity of the taxpayer’s financial situation. Here’s a detailed breakdown of where to locate AGI on common tax forms:

Form 1040: The Primary Tax Return for Individuals

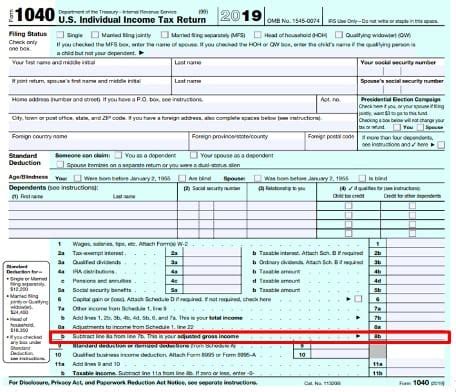

For most taxpayers, Form 1040 is the primary tax form used for filing individual income taxes. The AGI is prominently displayed on this form, making it easy to locate. On the 2022 Form 1040, AGI is found in the following locations:

- Line 11: This line represents the taxpayer’s total income, which is the starting point for calculating AGI.

- Line 38: Here, you’ll find the AGI for the tax year. It’s a crucial number as it carries over to other tax forms and schedules.

It's important to note that the AGI on Form 1040 serves as a key reference point for various other tax forms and schedules, making it a pivotal figure in the tax filing process.

Form 1040-SR: Tax Form for Senior Citizens

Form 1040-SR is a variation of the standard Form 1040 designed specifically for senior citizens aged 65 and older. While the layout may differ slightly, the AGI is still a critical component of this form. On Form 1040-SR, you can find AGI in the following locations:

- Line 11: Similar to Form 1040, this line represents the taxpayer’s total income, which forms the basis for AGI calculation.

- Line 38: The AGI for the tax year is displayed here, just as it is on Form 1040.

Senior citizens should pay close attention to their AGI, as it can impact their eligibility for certain tax benefits and deductions tailored for older taxpayers.

Form 1040-NR: Tax Form for Non-Resident Aliens

Form 1040-NR is designed for non-resident aliens who are required to file U.S. tax returns. While the structure of this form may differ from the standard 1040, AGI is still a vital component. On Form 1040-NR, AGI can be found in the following sections:

- Line 28: This line represents the total income for non-resident aliens, which is used to calculate AGI.

- Line 37: Here, the AGI for the tax year is displayed. It’s an essential figure for non-residents, as it can impact their tax obligations and eligibility for certain deductions.

Non-resident aliens should ensure they understand their AGI, as it can have significant implications for their tax liability and compliance with U.S. tax laws.

Form 1040-X: Amended U.S. Individual Income Tax Return

Form 1040-X is used to amend previously filed tax returns. If a taxpayer needs to correct their AGI, this form is essential. On Form 1040-X, the amended AGI is found in the following locations:

- Line 1: This line represents the corrected total income, which is used to recalculate the AGI.

- Line 3: Here, the amended AGI is displayed. It’s crucial to ensure accuracy when amending this figure, as it can impact the taxpayer’s eligibility for deductions and credits.

Amending tax returns should be done with care, and taxpayers should ensure they understand the implications of changing their AGI.

The Significance of AGI in Tax Strategy

AGI is more than just a number on a tax form; it’s a critical component of tax strategy. Tax professionals and individuals alike use AGI as a tool to optimize their tax position and maximize potential benefits. Here’s a deeper look at the significance of AGI in tax planning:

Determining Eligibility for Tax Credits and Deductions

AGI plays a pivotal role in determining eligibility for various tax credits and deductions. For instance, the Earned Income Tax Credit (EITC) and the Child Tax Credit are both tied to AGI. Taxpayers with a lower AGI may qualify for these credits, which can significantly reduce their tax liability. Understanding how AGI impacts these credits is essential for effective tax planning.

Influencing Taxable Income and Tax Rates

AGI directly affects the calculation of taxable income, which in turn influences the tax rate applied to that income. By strategically adjusting AGI through deductions and credits, taxpayers can potentially lower their taxable income and, consequently, their tax liability. This is a key consideration for high-income earners looking to optimize their tax position.

Impact on Tax Refund or Balance Due

AGI can have a direct impact on whether a taxpayer receives a refund or owes money to the IRS. By accurately calculating and reporting AGI, taxpayers can ensure they receive the maximum refund possible or minimize any balance due. This is particularly important for individuals with complex financial situations or those who rely on tax refunds to manage their finances.

Common Mistakes and How to Avoid Them

When dealing with AGI, it’s crucial to avoid common mistakes that can lead to inaccurate tax returns and potential audits. Here are some of the most frequent errors and strategies to prevent them:

Failing to Report All Income

One of the most common mistakes is neglecting to report all sources of income. This can lead to an inaccurate AGI, which in turn affects the taxpayer’s tax liability and eligibility for credits and deductions. Taxpayers should carefully review their income statements and ensure all income, including interest, dividends, and business income, is reported accurately.

Miscalculating Deductions

Deductions are a critical component of AGI calculation. However, miscalculating or misunderstanding which deductions are applicable can lead to an incorrect AGI. Taxpayers should consult with tax professionals or carefully review IRS guidelines to ensure they’re claiming the correct deductions.

Neglecting to Update AGI on Amended Returns

If a taxpayer needs to amend their tax return, it’s crucial to update their AGI accurately. Failure to do so can lead to inconsistencies and potential issues with the IRS. Taxpayers should carefully review Form 1040-X and ensure that the amended AGI reflects their correct financial situation.

The Future of AGI and Tax Reporting

As technology advances and tax laws evolve, the role of AGI in tax reporting is likely to change. Here’s a glimpse into the future of AGI and its potential impact on taxpayers:

Digital Tax Reporting and AGI

With the increasing popularity of digital tax filing, AGI is likely to become even more accessible and transparent. Taxpayers may benefit from real-time updates and more efficient calculation methods, making the process of determining AGI simpler and more accurate.

Potential Changes in Tax Laws

Tax laws are subject to change, and future legislation could impact the role of AGI in tax reporting. For instance, proposals to simplify tax forms or introduce new tax brackets could affect how AGI is calculated and used. Taxpayers should stay informed about any potential changes to ensure they’re prepared for any adjustments to AGI-related tax strategies.

The Rise of Tax Software and AGI Automation

Tax software and automation are becoming increasingly sophisticated, and this trend is likely to continue. These tools can simplify the process of calculating AGI, making it faster and more accurate. Taxpayers can benefit from these advancements by leveraging tax software to streamline their tax filing process and ensure accurate AGI reporting.

Conclusion

Understanding where to find AGI on tax returns is a crucial step in the tax filing process. By locating and accurately reporting AGI, taxpayers can make informed decisions about their tax strategies, maximize potential benefits, and ensure compliance with tax laws. Whether it’s optimizing deductions, determining eligibility for credits, or influencing taxable income, AGI is a powerful tool for taxpayers to navigate the complex world of taxation.

FAQ

What is the significance of AGI in tax planning?

+AGI, or Adjusted Gross Income, is a critical metric in tax planning as it determines eligibility for various tax credits and deductions. It also influences taxable income and tax rates, making it a key factor in optimizing tax strategies.

How can I ensure I’m calculating my AGI correctly?

+To calculate your AGI correctly, start with your total income and subtract any applicable deductions. It’s crucial to consult tax guidelines or seek professional advice to ensure you’re claiming the right deductions and avoiding common mistakes.

What happens if I report an incorrect AGI on my tax return?

+Reporting an incorrect AGI can lead to issues with your tax return, including inaccurate tax liability, eligibility for credits and deductions, and potential audits. It’s important to review your AGI carefully and amend your return if necessary.

Can AGI impact my tax refund or balance due?

+Yes, AGI can directly impact whether you receive a tax refund or owe money to the IRS. By accurately calculating and reporting your AGI, you can ensure you receive the maximum refund or minimize any balance due.

How can I stay informed about changes to AGI and tax laws?

+To stay informed, regularly check reputable tax websites, subscribe to tax newsletters, and consult with tax professionals. Keeping up with changes in tax laws and AGI-related regulations is crucial for effective tax planning.