Pay Personal Property Tax Missouri

Navigating the world of taxes can be a complex and often daunting task for many individuals and businesses. When it comes to personal property tax in Missouri, it's crucial to understand the ins and outs to ensure compliance and avoid any unnecessary financial burdens. This comprehensive guide will walk you through the process of paying personal property taxes in the Show-Me State, providing clarity and practical insights along the way.

Understanding Personal Property Tax in Missouri

Personal property tax is a vital source of revenue for local governments in Missouri, funding essential services such as education, infrastructure, and public safety. It is imposed on tangible personal property owned by individuals and businesses, including vehicles, boats, aircraft, and business equipment. The tax is typically calculated based on the assessed value of the property and is due annually.

In Missouri, personal property tax is administered at the county level, meaning the assessment and collection processes can vary slightly from one county to another. This decentralized approach allows for flexibility to meet the unique needs of each community while ensuring a fair and efficient taxation system.

Taxable Personal Property

The state of Missouri considers a wide range of personal property as taxable, including:

- Vehicles: This encompasses cars, trucks, motorcycles, recreational vehicles (RVs), and mobile homes.

- Boats and Watercraft: Any boat or vessel used on Missouri waters, regardless of its primary location, is subject to personal property tax.

- Aircraft: Aircraft registered in Missouri, including planes and helicopters, are taxable.

- Business Equipment: Businesses must pay personal property tax on machinery, furniture, fixtures, and other tangible assets used in their operations.

It's important to note that certain types of personal property are exempt from taxation in Missouri. These exemptions include household goods, clothing, and personal effects. Additionally, agricultural and farming equipment used in production is generally exempt, fostering the state's support for its agricultural industry.

| Property Type | Taxable |

|---|---|

| Vehicles | Yes |

| Boats and Watercraft | Yes |

| Aircraft | Yes |

| Business Equipment | Yes |

| Household Goods | No |

| Clothing | No |

| Agricultural Equipment | No |

Assessments and Valuation

The assessment process for personal property tax in Missouri is conducted annually by county assessors. They determine the assessed value of taxable personal property based on factors such as age, condition, and market value. The assessed value is then used as the basis for calculating the tax liability.

It's crucial for property owners to ensure that their assessments are accurate. Overassessments can lead to higher tax bills, while underassessments may result in penalties. Property owners have the right to appeal their assessments if they believe the value is incorrect. The appeal process typically involves providing supporting documentation and attending a hearing before the county's Board of Equalization.

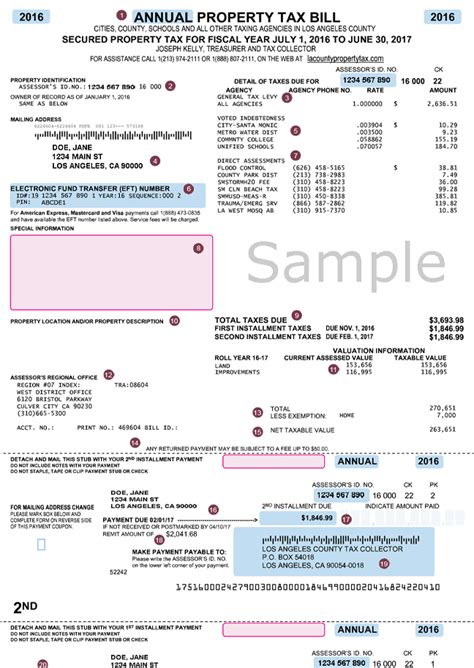

Payment Options and Deadlines

Paying personal property tax in Missouri is a straightforward process, with several payment options available to taxpayers. The due date for personal property tax payments is typically in June, although this can vary slightly depending on the county. It's essential to check with your local county assessor's office for the specific deadline to ensure timely payment and avoid late fees or penalties.

Online Payment

Missouri offers a convenient online payment system for personal property taxes. Taxpayers can access their county's website and navigate to the tax payment portal. Here, they can enter their property information, such as parcel number or account number, and proceed with the payment. Online payments can be made using a credit or debit card, or through electronic funds transfer (EFT) from a bank account.

The online payment system provides a secure and efficient way to pay taxes, allowing taxpayers to complete the process from the comfort of their homes or offices. It also offers the benefit of immediate confirmation of payment, reducing the risk of late payments.

Mail-In Payment

For those who prefer traditional methods, personal property taxes can also be paid by mail. Taxpayers can obtain a payment coupon from their county assessor's office or download it from the county website. The coupon includes important information such as the taxpayer's name, address, and property details.

Taxpayers can then fill out the coupon, include the appropriate payment amount, and mail it to the address specified on the coupon. It's crucial to ensure that the payment is received by the due date to avoid any late fees or penalties. It's recommended to use a trackable mailing service to provide proof of timely payment if needed.

In-Person Payment

In-person payment is another option for Missouri taxpayers. County assessor's offices often have dedicated tax payment counters where taxpayers can pay their personal property taxes. This method allows for immediate confirmation of payment and provides an opportunity to seek assistance or clarification directly from the assessor's staff.

When paying in person, taxpayers should bring their payment coupon or account information to ensure an accurate and efficient transaction. It's advisable to call the assessor's office in advance to confirm their operating hours and any specific requirements for in-person payments.

Tax Calculation and Rates

The calculation of personal property tax in Missouri involves multiplying the assessed value of the property by the applicable tax rate. The tax rate varies depending on the property's location and the services it receives from local governments.

For example, a taxpayer with a vehicle valued at $20,000 in a county with a tax rate of 2.5% would calculate their tax liability as follows:

$20,000 x 0.025 = $500

In this case, the taxpayer would owe $500 in personal property tax for their vehicle.

It's important to note that tax rates can change annually, so it's essential to refer to the most recent tax rate information provided by your county assessor's office.

Tax Relief Programs

Missouri recognizes the financial burden that personal property taxes can place on certain individuals and provides tax relief programs to ease this burden. These programs offer reduced tax rates or exemptions to eligible taxpayers, including:

- Senior Citizen Tax Relief: Qualifying senior citizens aged 65 and above may be eligible for reduced tax rates or exemptions on their personal property taxes.

- Disabled Veteran Exemption: Veterans with a service-connected disability may be exempt from personal property taxes on their primary residence.

- Homestead Exemption: This program provides a reduced tax rate for the primary residence of eligible homeowners, offering financial relief to those with limited incomes.

To determine eligibility and apply for these tax relief programs, taxpayers should contact their county assessor's office or visit the Missouri Department of Revenue's website for detailed information and application forms.

Tips for a Smooth Personal Property Tax Experience

Navigating the personal property tax process in Missouri can be simplified by following these tips:

- Stay Informed: Keep up-to-date with tax due dates, assessment processes, and any changes in tax rates or regulations. This information is readily available on county websites and through local news sources.

- Understand Your Assessment: Review your assessment notice carefully and ensure it accurately reflects your personal property holdings. If discrepancies are found, take prompt action to appeal the assessment.

- Explore Tax Relief Options: If you believe you may be eligible for tax relief programs, don't hesitate to apply. These programs can provide significant financial relief and ease the burden of personal property taxes.

- <Choose Your Payment Method Wisely": Consider the convenience and security of online payment, the traditional nature of mail-in payment, or the immediate confirmation of in-person payment. Select the method that best suits your preferences and circumstances.

By staying informed, understanding your assessment, exploring tax relief options, and choosing a suitable payment method, you can ensure a smooth and stress-free personal property tax experience in Missouri.

FAQs

What happens if I miss the personal property tax deadline in Missouri?

+Missing the personal property tax deadline can result in late fees and penalties. It’s important to pay your taxes on time to avoid additional financial burdens. However, if you find yourself in this situation, contact your county assessor’s office promptly to discuss your options and potential payment plans.

Can I pay my personal property tax in installments in Missouri?

+Some counties in Missouri offer installment payment plans for personal property taxes. These plans allow taxpayers to divide their tax liability into multiple payments throughout the year. Contact your county assessor’s office to inquire about eligibility and the application process for installment plans.

How can I obtain a tax relief application for senior citizens in Missouri?

+Senior citizens seeking tax relief in Missouri can obtain the necessary application forms from their county assessor’s office or by visiting the Missouri Department of Revenue’s website. The application process typically involves providing documentation to prove eligibility, such as proof of age and income.

Are there any online resources to help me calculate my personal property tax in Missouri?

+Yes, many county websites in Missouri provide online calculators or tax estimation tools to assist taxpayers in determining their personal property tax liability. These tools consider factors such as assessed value and tax rates to provide an estimated tax amount. Utilizing these resources can help you budget effectively for your tax obligations.