Search For My Federal Tax Id Number

In the complex world of tax and financial administration, understanding how to access and utilize your Federal Tax ID number is a crucial skill. This unique identifier plays a vital role in various financial and legal processes, from tax filings to business operations. In this comprehensive guide, we will explore the significance of the Federal Tax ID number, the methods to obtain it, and the various ways it can be used. We will also delve into some common challenges and provide expert tips to ensure a smooth and efficient process.

Understanding the Federal Tax ID Number

The Federal Tax ID number, also known as the Employer Identification Number (EIN) in the United States, is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to businesses, partnerships, trusts, estates, and other entities. It serves as a critical identifier for tax purposes, allowing the IRS to track and manage tax filings and payments effectively.

An EIN is essential for businesses as it distinguishes them from other entities, similar to how a Social Security Number (SSN) identifies individuals. It is used in a variety of financial and legal transactions, including tax filings, payroll management, opening bank accounts, and applying for loans or grants.

Obtaining an EIN is a straightforward process, but it's important to understand the eligibility criteria and the various methods available to apply for one. Let's explore these in detail.

Eligibility and Application Process

The eligibility criteria for obtaining an EIN vary depending on the type of entity. Generally, the following entities are eligible to apply for an EIN:

- Businesses: Sole proprietorships, corporations, partnerships, limited liability companies (LLCs), and other business entities.

- Non-Profit Organizations: Churches, charitable organizations, and other tax-exempt entities.

- Government Entities: Federal, state, and local government agencies.

- Trusts and Estates: Fiduciaries managing trusts and estates for tax purposes.

- Foreign Entities: Non-resident aliens and foreign corporations doing business in the U.S.

To apply for an EIN, there are several methods available, each with its own advantages and requirements:

- Online Application: The most common and efficient method is to apply online through the IRS website. This method offers an instant response and is available 24/7. Applicants must provide their personal information, such as name, address, and taxpayer identification number (SSN or ITIN), along with details about the entity being registered.

- Fax or Mail Application: For those who prefer traditional methods, the IRS also accepts applications via fax or mail. This process takes longer, typically 4 weeks, and requires the completion of Form SS-4. The form must be filled out accurately and mailed or faxed to the appropriate IRS office.

- Third-Party Designee: Entities can also apply for an EIN through a third-party designee, such as an accountant or attorney. This method is useful when the entity's representatives cannot access the online application system or prefer professional assistance. The designee must have the necessary information and authorization to apply on behalf of the entity.

Utilizing Your Federal Tax ID Number

Once you have obtained your EIN, it becomes a crucial tool in various financial and administrative processes. Here are some key ways in which your Federal Tax ID number can be utilized:

Tax Filings

The primary use of an EIN is for tax filings. It is required on various tax forms, including income tax returns, employment tax returns, and information returns. By using your EIN, you can ensure accurate and efficient tax reporting, especially when dealing with complex business structures or multiple entities.

Payroll Management

For businesses with employees, an EIN is essential for payroll management. It is used to identify the business when reporting and paying employment taxes, such as federal income tax withholding, Social Security and Medicare taxes, and federal unemployment tax. Proper use of the EIN ensures compliance with tax laws and helps prevent penalties.

Opening Business Accounts

When opening a business bank account, a Federal Tax ID number is often required. It helps financial institutions identify and verify the business entity, reducing the risk of fraud and ensuring proper record-keeping. Additionally, some financial institutions may offer better terms and services to businesses with EINs.

Business Licenses and Permits

In many cases, an EIN is a prerequisite for obtaining business licenses and permits. Government agencies often require this unique identifier to track and manage business activities, especially when it comes to regulating and monitoring industries such as healthcare, construction, or food services.

Applying for Loans and Grants

When seeking financing, whether through traditional loans or government grants, an EIN is often a requirement. Lenders and grant-making organizations use the EIN to verify the business’s identity and financial history, which is crucial for assessing creditworthiness and eligibility.

Challenges and Expert Tips

While the process of obtaining and using a Federal Tax ID number is straightforward, there can be challenges and pitfalls along the way. Here are some common issues and expert tips to navigate them effectively:

EIN Mismanagement

One of the most common challenges is the mismanagement of EINs, especially in businesses with multiple entities or frequent organizational changes. To avoid this, it’s crucial to maintain accurate records and update the IRS when there are changes to the business structure or ownership.

Lost or Forgotten EIN

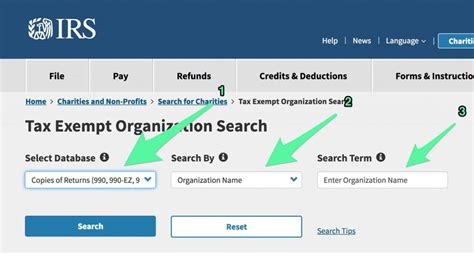

In some cases, businesses may lose or forget their EIN, especially if they haven’t used it in a while. In such situations, the IRS provides a lookup tool on their website, allowing businesses to retrieve their EIN by providing certain details. It’s important to keep this information readily available to avoid delays in financial transactions.

EIN Expiration and Renewal

EINs generally do not expire, but there are certain circumstances where they may need to be renewed. For example, if an EIN is associated with a deceased individual or a revoked business license, it may need to be updated. The IRS provides guidance on when and how to renew an EIN, ensuring businesses can continue their operations without interruption.

Expert Tip: Streamlining the Process

To streamline the process of obtaining and using an EIN, consider the following best practices:

- Maintain a centralized record-keeping system for all financial and tax-related documents, including your EIN and other important identifiers.

- Regularly review and update your business structure and ownership information with the IRS to avoid complications.

- Seek professional advice from accountants or tax advisors, especially when dealing with complex business entities or tax filings.

- Utilize digital tools and software to manage your tax obligations and financial transactions, ensuring accuracy and efficiency.

By following these tips and staying informed about the latest tax regulations, you can ensure a smooth and efficient process when dealing with your Federal Tax ID number.

Conclusion

The Federal Tax ID number is a vital tool for businesses and other entities, playing a critical role in tax filings, financial transactions, and legal compliance. By understanding its significance and utilizing it effectively, you can streamline your financial operations and ensure compliance with tax laws. Remember, staying organized, informed, and proactive is key to successful tax management.

How long does it take to obtain an EIN online?

+Obtaining an EIN online is typically an instant process. Once you submit your application, you will receive an instant response with your EIN. This makes the online method the fastest and most efficient way to obtain an EIN.

Can I use my Social Security Number instead of an EIN for business purposes?

+No, it is not recommended to use your Social Security Number (SSN) for business purposes. An EIN is specifically designed for business entities and provides a unique identifier for tax and financial transactions. Using an SSN for business can lead to complications and potential security risks.

What happens if I provide incorrect information during the EIN application process?

+Providing incorrect information during the EIN application can lead to delays or even rejection of your application. It is crucial to ensure that all the details, such as personal information, entity details, and taxpayer identification numbers, are accurate and up-to-date. If there are errors, you may need to reapply, which can cause unnecessary delays.

Can I use my EIN from one business for another business I start later?

+No, each business entity should have its own unique EIN. Using an EIN from one business for another can lead to complications and confusion, especially when it comes to tax filings and financial transactions. It is important to obtain a new EIN for each new business you establish.

Are there any fees associated with obtaining an EIN?

+No, there are no fees associated with obtaining an EIN from the IRS. The application process is free, whether you apply online, by fax, or by mail. However, if you use a third-party service to obtain your EIN, there may be fees involved.