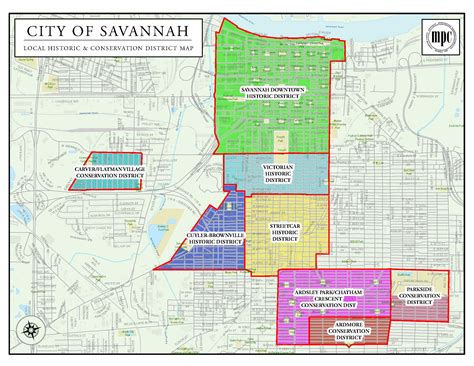

City Of Savannah Taxes

In the charming coastal city of Savannah, nestled in the heart of Georgia, the topic of taxes often arises as a subject of interest and importance for both residents and businesses. Understanding the tax landscape is crucial for individuals and enterprises alike, as it directly impacts financial planning and decision-making. This comprehensive guide aims to delve into the intricacies of City of Savannah taxes, shedding light on the various types, rates, and processes involved.

Understanding the Savannah Tax Structure

The tax system in Savannah, like many other municipalities, is multifaceted and consists of a range of taxes designed to support the city’s operations, infrastructure development, and public services. These taxes are levied on different aspects of economic activity and are a significant source of revenue for the local government.

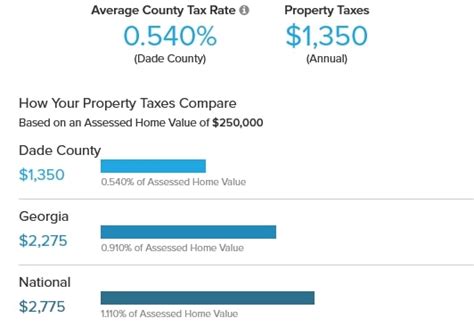

Property Taxes

Property taxes are a fundamental component of the Savannah tax system. These taxes are imposed on both real estate and personal property within the city limits. The Savannah-Chatham County Board of Assessors is responsible for assessing the value of properties, which forms the basis for tax calculations.

The property tax rate in Savannah is 0.93% of the assessed value, which is determined through a complex process that considers factors such as location, property type, and recent sales data. Property owners receive an annual tax bill, which is due by a specific deadline, typically in December.

It’s worth noting that Savannah offers various tax exemptions and incentives to eligible homeowners, such as the Homestead Exemption, which reduces the taxable value of a primary residence. Additionally, the city provides tax breaks for senior citizens and veterans, further easing the tax burden on these demographics.

Sales and Use Taxes

Sales and use taxes are another critical aspect of the Savannah tax structure. These taxes are applied to the sale of goods and services within the city, as well as to the use or consumption of certain products. The City of Savannah Sales Tax is currently set at 1%, which is added to the state sales tax rate of 4% and any applicable county taxes, resulting in a total sales tax rate of 8% for most purchases.

Businesses operating within Savannah are required to collect and remit these sales taxes to the Georgia Department of Revenue. Failure to comply with sales tax regulations can result in penalties and interest charges.

Savannah also imposes a Hotel/Motel Tax of 8% on the rental of hotel and motel rooms, which is collected by accommodation providers and remitted to the city. This tax contributes significantly to the city’s tourism development efforts.

Income Taxes

While Savannah does not have a local income tax, residents still need to navigate the complexities of state and federal income tax systems. The State of Georgia levies an income tax on various sources of income, including wages, salaries, investments, and business profits. The tax rates vary depending on the taxpayer’s income bracket and filing status.

For federal income taxes, residents of Savannah fall under the jurisdiction of the Internal Revenue Service (IRS). The IRS imposes tax rates based on a progressive scale, with higher incomes subject to higher tax rates. Understanding and complying with federal tax laws is essential to avoid penalties and ensure accurate filings.

Business Taxes

Businesses operating within Savannah face a range of tax obligations, including income taxes, payroll taxes, and licensing fees. The city requires businesses to obtain appropriate licenses and permits, and failure to do so can result in penalties and legal consequences.

Savannah offers various tax incentives to attract and support businesses, such as the Job Tax Credit, which provides a credit against state income tax for eligible businesses that create new jobs within the city. These incentives aim to foster economic growth and development in the region.

Tax Payment and Compliance

Understanding tax payment deadlines and compliance requirements is crucial for both individuals and businesses in Savannah. The city provides resources and guidance to ensure taxpayers meet their obligations accurately and on time.

Online Tax Payment Options

Savannah has embraced digital transformation, offering convenient online platforms for taxpayers to manage their tax obligations. The Savannah-Chatham County Tax Commissioner’s Office provides an online portal where residents and businesses can view their tax bills, make payments, and access tax-related documents. This platform simplifies the tax payment process and reduces administrative burdens.

Tax Assistance and Support

For those who require assistance with tax-related matters, the city offers various resources and support services. The Savannah Taxpayer Assistance Center provides guidance on tax payments, exemptions, and other tax-related inquiries. Additionally, the city conducts outreach programs and workshops to educate taxpayers about their rights and responsibilities.

Tax Penalties and Appeals

While the city strives to provide a fair and transparent tax system, instances of non-compliance or disputes may arise. Savannah has established a clear process for taxpayers to appeal tax assessments or penalties. The Savannah-Chatham County Board of Equalization handles such appeals, providing an opportunity for taxpayers to present their case and seek a resolution.

The Impact of Taxes on the Savannah Economy

The tax system in Savannah plays a pivotal role in shaping the local economy. Taxes provide the city with the necessary revenue to fund critical services, infrastructure projects, and community development initiatives. The revenue generated through taxes is invested back into the community, contributing to its overall prosperity and well-being.

Economic Growth and Development

The city’s tax incentives and a supportive business environment have been instrumental in attracting new businesses and fostering economic growth. By offering competitive tax rates and incentives, Savannah has become an attractive destination for entrepreneurs and investors, leading to job creation and a thriving business ecosystem.

Community Development and Services

Tax revenues fund a wide range of public services and community development projects. These include education, healthcare, public safety, infrastructure maintenance, and social welfare programs. The city’s commitment to investing in these areas enhances the quality of life for its residents and contributes to the overall vibrancy of the community.

Future Implications and Tax Reform

As Savannah continues to evolve and adapt to changing economic landscapes, the tax system may undergo reforms to ensure its sustainability and effectiveness. The city’s leaders and policymakers are actively engaged in discussions to strike a balance between generating sufficient revenue and maintaining a competitive business environment.

Potential future reforms may include adjustments to tax rates, the introduction of new tax measures, or the expansion of existing tax incentives. These changes aim to address emerging economic challenges and ensure that Savannah remains a vibrant and prosperous city for generations to come.

What are the current property tax rates in Savannah, GA?

+The current property tax rate in Savannah is 0.93% of the assessed value. This rate is subject to change and is determined annually by the local government.

How often do property taxes change in Savannah?

+Property tax rates are typically reviewed and adjusted annually by the Savannah-Chatham County Board of Assessors. Changes in tax rates are influenced by various factors, including the local budget, economic conditions, and property value fluctuations.

Are there any tax incentives for businesses in Savannah?

+Yes, Savannah offers a range of tax incentives to attract and support businesses. These include the Job Tax Credit, which provides a credit against state income tax for eligible businesses creating new jobs within the city.

How can I stay updated on tax changes in Savannah?

+Staying informed about tax changes is crucial. You can subscribe to official city newsletters, follow local media outlets, and regularly check the websites of the Savannah-Chatham County Tax Commissioner’s Office and the Georgia Department of Revenue for updates and announcements.

Where can I find more information on tax exemptions and discounts in Savannah?

+For detailed information on tax exemptions and discounts, you can visit the Savannah-Chatham County Tax Commissioner’s Office website or contact their office directly. They provide resources and guidance on various tax relief programs available to eligible taxpayers.