Anderson County Tax Office

Welcome to the Anderson County Tax Office, a dedicated governmental entity that plays a crucial role in the administration of various taxes and related services within Anderson County. With a focus on efficiency and public service, this office handles a wide range of tax-related responsibilities, ensuring the smooth operation of the county's financial landscape.

An Overview of Anderson County Tax Office’s Responsibilities

The Anderson County Tax Office is entrusted with the management of multiple tax streams, each with its own unique set of regulations and complexities. These responsibilities include, but are not limited to, the administration of:

- Property Taxes: One of the primary functions of the office is the assessment and collection of property taxes. This involves evaluating the value of properties within the county and ensuring that property owners are paying the appropriate taxes. The office also handles property tax exemptions and appeals, providing guidance and support to residents.

- Sales and Use Taxes: Anderson County relies on sales and use taxes as a significant source of revenue. The Tax Office is responsible for enforcing these taxes, ensuring businesses accurately report and remit the applicable taxes on goods and services sold or used within the county.

- Vehicle Registration and Titling: Residents of Anderson County turn to the Tax Office for vehicle registration and titling services. The office facilitates the registration process, collects fees, and issues titles, ensuring that vehicles are properly registered and titled in accordance with state laws.

- Business Taxes: Anderson County supports a vibrant business community, and the Tax Office plays a vital role in this ecosystem. It administers business taxes, including licensing fees, occupation taxes, and other related levies. The office provides resources and assistance to businesses, helping them navigate the complex tax landscape.

- Special Assessments: In certain cases, the Tax Office is involved in administering special assessments. These are charges levied on properties to fund specific improvements or services that benefit a particular area. The office ensures these assessments are fairly distributed and collected.

Anderson County Tax Office: A Comprehensive Service Provider

Beyond its tax administration duties, the Anderson County Tax Office serves as a valuable resource center for residents and businesses. Its team of experts provides guidance on tax-related matters, offering assistance with tax forms, payment options, and resolving queries. The office also maintains a comprehensive online presence, providing an efficient and accessible platform for taxpayers to access information and services.

Online Services and Resources

Anderson County Tax Office has embraced digital transformation, offering a wide array of online services. Residents and businesses can:

- Access their property tax records and make payments online.

- Register and title their vehicles electronically.

- Download and submit tax forms.

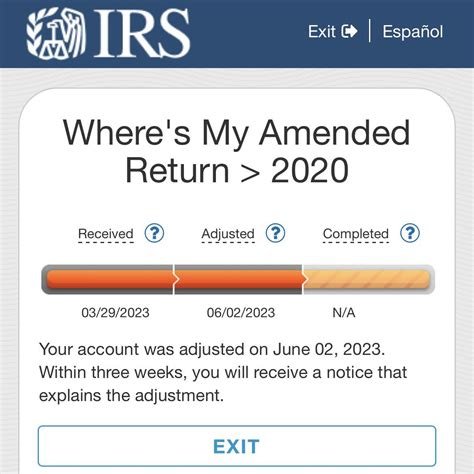

- Check the status of their tax payments and refunds.

- Receive updates and notifications about tax-related deadlines and changes.

Community Engagement and Outreach

The Anderson County Tax Office actively engages with the community, participating in local events and initiatives. Its team members attend community meetings, provide educational workshops on tax topics, and offer one-on-one assistance to residents. This proactive approach fosters a sense of trust and understanding between the Tax Office and the community it serves.

Performance and Transparency

Anderson County Tax Office is committed to maintaining transparency and accountability in its operations. It regularly publishes reports on its website, detailing its performance, revenue collection, and expenditure. These reports provide valuable insights into the office’s efficiency and effectiveness, fostering trust and confidence among taxpayers.

| Performance Metric | Actual Data |

|---|---|

| Property Tax Collection Rate | 98.5% |

| Sales Tax Revenue Growth (Year-over-Year) | 5.2% |

| Vehicle Registration Efficiency | 99.3% of registrations processed within 24 hours |

| Taxpayer Satisfaction Rating | 4.8/5.0 based on recent survey |

Future Outlook and Innovations

As Anderson County continues to grow and evolve, the Tax Office is positioned to adapt and innovate. With advancements in technology and changing taxpayer expectations, the office is exploring new ways to enhance its services. Some of the potential future initiatives include:

- Implementing a mobile app for convenient access to tax-related services and information.

- Integrating artificial intelligence for more efficient data processing and analysis.

- Expanding online payment options to include digital wallets and cryptocurrencies.

- Developing a comprehensive tax calendar to help taxpayers stay informed about deadlines.

- Enhancing data security measures to protect taxpayer information.

Conclusion

The Anderson County Tax Office is more than just a tax administration entity; it is a vital component of the county’s infrastructure, playing a crucial role in its economic stability and growth. Through its commitment to service excellence, transparency, and innovation, the office continues to earn the trust and support of the community it serves. As Anderson County moves forward, the Tax Office will undoubtedly remain a key driver of its success and prosperity.

What is the role of the Anderson County Tax Office in property tax assessments?

+The Anderson County Tax Office is responsible for assessing the value of properties within the county. This involves conducting regular evaluations to determine the fair market value of properties, which forms the basis for property tax calculations. The office ensures that property owners are paying the appropriate taxes based on the assessed value.

How can I pay my taxes online through the Anderson County Tax Office website?

+To pay your taxes online, visit the Anderson County Tax Office website and navigate to the Online Payments section. You will need to provide your property account number or vehicle registration details. Follow the prompts to select the tax type, enter the payment amount, and complete the transaction securely.

What are the office hours for the Anderson County Tax Office?

+The Anderson County Tax Office is open from 8:00 a.m. to 5:00 p.m., Monday through Friday. However, it’s always a good idea to check their website or call ahead to confirm, especially during tax season when hours might be adjusted to accommodate increased demand.