Ok Tax Refund Status

Welcome to a comprehensive guide on the status of your tax refund. Filing your taxes can be a tedious process, but the anticipation of a potential refund adds a layer of excitement. In this article, we will delve into the various stages of tax refund processing, provide real-time insights into the current refund status, and offer valuable tips to ensure a smooth and efficient journey from filing to receiving your well-deserved refund.

Understanding the Tax Refund Process

The tax refund process is a carefully orchestrated sequence of events that begins with the submission of your tax return and concludes with the deposit of your refund into your designated account. Let's break down the key stages and shed light on what happens behind the scenes.

1. Tax Return Submission

Filing your tax return is the first crucial step. Whether you choose to do it yourself or engage the services of a tax professional, the process involves gathering all the necessary documentation, such as W-2 forms, 1099s, and receipts for deductions. This step ensures that the IRS has the information it needs to calculate your tax liability accurately.

2. Initial Processing

Once your tax return is submitted, it undergoes initial processing at the IRS. This stage involves a series of checks and verifications to ensure the accuracy and completeness of your return. During this time, the IRS may request additional information or documentation if they identify any discrepancies.

3. Acceptance and Acknowledgment

If your tax return passes the initial checks, the IRS will accept it and provide an acknowledgment. This acknowledgment serves as confirmation that your return has been received and is being processed. At this stage, you can breathe a sigh of relief, knowing that your tax obligations are being addressed.

4. Refund Calculation

With your tax return accepted, the IRS proceeds to calculate your refund. This process involves a detailed examination of your tax liability, deductions, credits, and any applicable tax laws. The IRS employs sophisticated algorithms and systems to ensure the accuracy of the refund calculation.

5. Refund Processing

Once the refund amount is determined, the IRS initiates the refund processing stage. During this phase, the IRS verifies the accuracy of the refund amount and ensures that it aligns with the information provided in your tax return. This step is crucial to prevent errors and fraudulent activities.

6. Refund Issuance

Assuming all checks are cleared, the IRS proceeds to issue your refund. The refund can be delivered in various ways, depending on the method you choose during the filing process. The most common methods include direct deposit into your bank account, check mailed to your address, or a prepaid debit card.

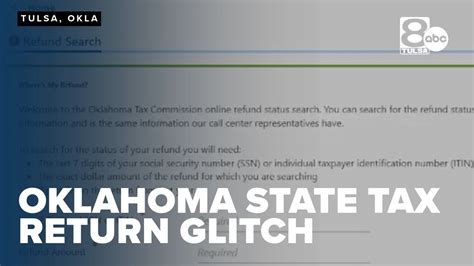

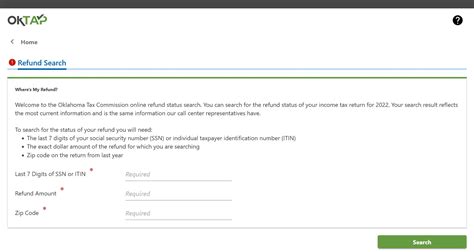

7. Tracking Your Refund

While the IRS works diligently to process your refund, you may find yourself eagerly awaiting its arrival. To satisfy your curiosity and provide transparency, the IRS offers online tools and resources to track the status of your refund. Let's explore these tracking options in detail.

Real-Time Tax Refund Status Tracking

Gone are the days of waiting anxiously by the mailbox for your refund check. The IRS has implemented innovative tools to provide taxpayers with real-time updates on the status of their refunds. Here are the primary methods to track your refund status:

1. IRS2Go Mobile App

The IRS2Go mobile app is a convenient and user-friendly tool that allows taxpayers to check their refund status on the go. Available for both iOS and Android devices, the app provides a simple and secure way to access your refund information. Simply download the app, create an account, and enter your tax return details to track your refund's progress.

2. IRS Online Refund Tracker

For those who prefer a desktop experience, the IRS offers an online refund tracker. This web-based tool provides a comprehensive overview of your refund status, including the date your return was accepted, the estimated refund amount, and the expected deposit date. To access the tracker, visit the IRS website and follow the prompts to input your tax return information.

3. IRS Refund Hotline

If you prefer a more traditional approach, the IRS operates a dedicated refund hotline. By calling the hotline, you can speak to a live agent who can provide real-time updates on your refund status. The hotline is available 24/7, ensuring that you can access your refund information whenever it's convenient for you.

4. IRS Mail Correspondence

In some cases, the IRS may send correspondence regarding your refund via postal mail. This could include notices of any issues or delays in processing your refund. It's essential to keep an eye on your mailbox and promptly respond to any correspondence from the IRS to avoid further delays.

Factors Influencing Refund Timing

While the IRS strives to process refunds as quickly as possible, several factors can impact the timing of your refund. Understanding these factors can help manage your expectations and avoid unnecessary worries.

1. Tax Return Complexity

The complexity of your tax return can significantly influence the processing time. Returns with multiple deductions, credits, or business income may require additional scrutiny, resulting in a longer processing period. Simplifying your tax return and providing clear documentation can help expedite the process.

2. Filing Method

The method you choose to file your tax return can also impact the timing of your refund. Electronic filing, whether through tax preparation software or a professional tax preparer, is generally faster than filing a paper return. Electronic filing allows the IRS to process returns more efficiently, reducing the overall time from submission to refund.

3. Payment Method

The payment method you select for your refund can affect its arrival time. Direct deposit is the fastest and most secure way to receive your refund, with funds typically arriving within 21 days of filing. Opting for a check or prepaid debit card may result in slightly longer wait times, as these methods involve additional processing and mailing steps.

4. IRS Operational Capacity

The IRS's operational capacity can also impact refund timing, particularly during peak tax season. The agency experiences higher volumes of returns during certain periods, which can lead to longer processing times. Planning your tax filing accordingly and avoiding the peak season can help ensure a smoother and faster refund process.

Tips for a Smooth Tax Refund Experience

To make the most of your tax refund journey and ensure a positive experience, consider the following tips:

- File Early: Submitting your tax return early in the filing season can reduce processing times and increase the chances of a faster refund.

- Choose Electronic Filing: Opt for electronic filing to take advantage of the IRS's efficient processing systems and receive your refund more promptly.

- Select Direct Deposit: Direct deposit is the fastest and most secure way to receive your refund. Ensure your banking information is accurate to avoid delays.

- Stay Informed: Keep yourself updated on the latest tax laws and regulations. Being aware of any changes can help you optimize your tax return and avoid potential delays.

- Double-Check Your Return: Before submitting your tax return, thoroughly review it for accuracy. Double-checking your information can prevent errors and reduce the chances of delays during processing.

Frequently Asked Questions

How long does it typically take to receive my tax refund after filing my return?

+The typical processing time for tax refunds is around 21 days. However, this timeline can vary depending on the complexity of your return and the method of filing. Electronic filing and direct deposit generally result in faster refunds.

What if I haven't received my refund after the estimated timeframe?

+If you haven't received your refund within the expected timeframe, it's recommended to check the status of your refund using the IRS2Go app or online refund tracker. If the status indicates a delay, you can contact the IRS refund hotline for further assistance.

Can I track my refund status without an IRS account or app access?

+Yes, you can track your refund status without an IRS account or app access. The IRS provides a dedicated webpage where you can input your tax return information to check the status of your refund. Alternatively, you can call the IRS refund hotline for assistance.

What should I do if I receive a notice of refund delay or discrepancy from the IRS?

+If you receive a notice of refund delay or discrepancy, it's important to respond promptly. Carefully review the notice and follow the instructions provided. You may need to provide additional documentation or information to resolve the issue and receive your refund.

Can I split my tax refund into multiple accounts or receive it in different forms?

+Yes, you have the option to split your tax refund into multiple accounts or receive it in different forms. When filing your tax return, you can specify multiple bank accounts for direct deposit or choose to receive a portion of your refund as a check and the remainder as a direct deposit.

Stay tuned for more insights and updates on the tax refund process. Remember, a little patience and proactive tracking can go a long way in ensuring a smooth and rewarding tax refund experience.