File California State Taxes

Tax season is upon us, and for Californians, it's time to navigate the unique intricacies of filing state taxes. California's tax system, known for its complexity, offers a range of options and considerations that can impact your tax liability and potential refunds. From understanding the state's tax brackets to leveraging deductions and credits, there's a lot to consider when it's time to file. Let's delve into the process, exploring the steps, strategies, and resources available to ensure a smooth and successful tax filing journey.

Unraveling the California Tax Landscape

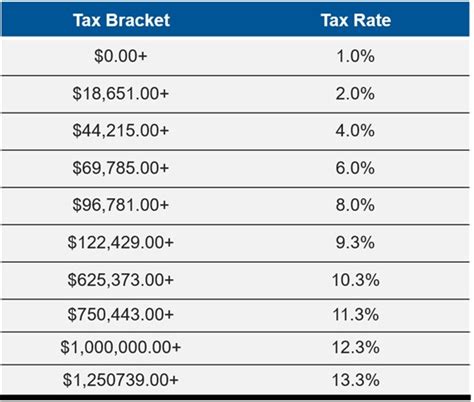

California’s tax system operates under a progressive tax structure, meaning that higher incomes are taxed at progressively higher rates. This system aims to ensure that individuals with greater financial means contribute a larger proportion of their income to state revenues. As of the 2023 tax year, California’s income tax brackets range from 1% to 12.3%, with the specific rate depending on taxable income.

| Tax Rate | Income Range |

|---|---|

| 1% | $0 - $9,750 |

| 2% | $9,751 - $19,500 |

| 4% | $19,501 - $29,250 |

| 6% | $29,251 - $39,000 |

| 8% | $39,001 - $487,500 |

| 9.3% | $487,501 - $585,000 |

| 10.3% | $585,001 - $2,045,000 |

| 11.3% | $2,045,001 - $5,037,620 |

| 12.3% | Above $5,037,620 |

It's important to note that these tax brackets are for single filers; married couples filing jointly may have different thresholds and rates. Additionally, California allows for the use of personal exemptions and standard deductions, which can further reduce taxable income.

Understanding Deductions and Credits

California offers a range of deductions and credits that can help reduce your taxable income and potentially increase your refund. Some of the notable deductions and credits include:

- Standard Deduction: Most Californians can choose to take the standard deduction, which is a set amount that reduces your taxable income. For the 2023 tax year, the standard deduction is $4,500 for single filers and $9,000 for married couples filing jointly.

- Personal Exemptions: California allows for personal exemptions, which reduce your taxable income by a set amount for each exemption claimed. However, personal exemptions were phased out as of the 2020 tax year, so they may not be applicable for many taxpayers.

- State and Local Taxes (SALT) Deduction: California residents can deduct state and local taxes paid, including property taxes and state income taxes, up to a certain limit. This deduction can be especially beneficial for those with high property tax bills or substantial state income tax liabilities.

- Dependent Care Credit: If you paid for childcare or dependent care services to allow you to work or attend school, you may be eligible for a credit. This credit can offset some of the costs associated with childcare, providing a financial benefit to working parents.

- Earned Income Tax Credit (EITC): The EITC is a refundable credit available to low- and moderate-income workers. It provides a financial boost to eligible taxpayers, often resulting in a significant refund.

The Filing Process: A Step-by-Step Guide

Now that we’ve covered some of the key considerations for California state taxes, let’s walk through the filing process step by step:

- Gather Your Documents: Collect all the necessary documents, including your W-2s, 1099s, and any other income statements. If you have deductions or credits to claim, gather supporting documentation as well.

- Choose Your Filing Method: California offers both electronic filing and paper filing options. Electronic filing is generally faster and more secure, with refunds often arriving within 2-4 weeks. Paper filing can take significantly longer, with processing times of 8-12 weeks.

- Calculate Your Taxes: Use a tax calculator or tax preparation software to determine your tax liability. This step is crucial to ensure you're paying the correct amount of taxes and to identify potential deductions or credits.

- Prepare Your Return: Whether you're filing electronically or on paper, carefully complete your tax return. Double-check your calculations and ensure all information is accurate and up-to-date.

- Submit Your Return: If you're filing electronically, use the California Franchise Tax Board's online filing system or authorized e-file providers. For paper returns, mail your completed forms to the address specified by the FTB.

- Track Your Refund (if applicable): If you're expecting a refund, you can track its status online through the FTB's website. Typically, refunds are issued within the processing times mentioned earlier.

Seeking Professional Assistance

Navigating California’s tax system can be complex, especially for those with unique circumstances or high-income levels. In such cases, seeking professional assistance from a tax preparer or accountant can be beneficial. These professionals can provide tailored advice, ensure compliance with state regulations, and help you maximize your deductions and credits.

Additionally, for those who qualify, the Volunteer Income Tax Assistance (VITA) program offers free tax preparation services. This program is designed to assist low- to moderate-income individuals, the elderly, persons with disabilities, and limited English-speaking taxpayers.

Future Implications and Tax Planning

Filing your California state taxes isn’t just about complying with the law; it’s an opportunity to assess your financial situation and plan for the future. By understanding your tax liability and potential refunds, you can make informed decisions about your finances. For instance, if you consistently receive large refunds, you may consider adjusting your tax withholdings to receive more of your income throughout the year.

Furthermore, tax planning can help you optimize your financial strategies. For instance, if you're considering major purchases or investments, understanding your tax liability can help you make more informed decisions. Additionally, if you have a business or are self-employed, proper tax planning can help you manage your cash flow and make the most of available deductions and credits.

Frequently Asked Questions

When is the deadline for filing California state taxes?

+

The deadline for filing California state taxes typically aligns with the federal tax deadline, which is usually April 15th. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day.

Can I file an extension for my California state taxes?

+

Yes, you can file for an extension if you’re unable to meet the filing deadline. To do this, you’ll need to file Form FTB 3519, which grants an automatic six-month extension. However, it’s important to note that an extension only extends the time to file; it does not extend the time to pay any taxes owed.

What is the penalty for late filing of California state taxes?

+

Late filing of California state taxes can result in penalties and interest charges. The penalty for late filing is 5% of the unpaid tax for each month or part of a month the return is late, up to a maximum of 25%. Additionally, interest is charged on the unpaid tax at a rate of 4% per year.

Can I file my California state taxes electronically?

+

Yes, California offers electronic filing as a convenient and secure option. You can use the FTB’s online filing system or authorized e-file providers. Electronic filing often results in faster processing times and quicker refunds.

What deductions and credits are available for California state taxes?

+

California offers a range of deductions and credits, including the standard deduction, personal exemptions (although these were phased out as of 2020), the State and Local Taxes (SALT) deduction, the Dependent Care Credit, and the Earned Income Tax Credit (EITC). It’s important to review your eligibility for these deductions and credits to maximize your tax savings.