Brevard County Property Tax

Brevard County, nestled along the picturesque eastern coast of Florida, is a region renowned for its vibrant communities, diverse ecosystems, and, like many other counties, its annual property tax assessments. Property taxes are an essential revenue source for local governments, contributing to the maintenance and development of essential services and infrastructure. This article delves into the intricacies of Brevard County's property tax system, shedding light on its unique characteristics, the factors influencing tax assessments, and the steps residents can take to ensure a fair and accurate evaluation of their properties.

Understanding Brevard County’s Property Tax Landscape

Brevard County, with its diverse array of residential, commercial, and agricultural properties, employs a property tax system that adheres to the guidelines set forth by the state of Florida. The property tax, a significant component of the county’s revenue stream, is utilized to fund crucial services such as education, public safety, transportation, and general governmental operations. The county’s unique geographical features, ranging from coastal communities to inland agricultural lands, present a diverse property landscape, making the assessment process intricate and nuanced.

The property tax assessment process in Brevard County is a biennial affair, with the county property appraiser's office undertaking the responsibility of evaluating all taxable properties within the county. This comprehensive evaluation includes assessing the market value of each property, taking into account factors such as location, size, improvements, and the general economic climate. The assessed value serves as the basis for calculating the property tax, which is then distributed among the various taxing authorities within the county, including the county government, school districts, and special districts.

Key Factors Influencing Property Tax Assessments

The determination of property taxes in Brevard County is influenced by a myriad of factors, each playing a critical role in the overall assessment. One of the primary factors is the property’s market value, which is closely tied to the local real estate market conditions. The property appraiser’s office employs various methodologies, including sales comparison, cost approach, and income approach, to ascertain the fair market value of each property. This value is then subject to an assessment ratio, typically set at 10% in Florida, to arrive at the assessed value.

Another significant factor is the millage rate, which is determined annually by the county's Board of County Commissioners and other taxing authorities. The millage rate, expressed in mills (where one mill equals $1 of tax for every $1,000 of assessed value), is the tax rate applied to the assessed value of the property. This rate can vary based on the type of property (homestead, non-homestead, commercial, etc.) and the taxing authority.

Additionally, exemptions and special assessments play a crucial role in the property tax equation. Brevard County, like other Florida counties, offers various exemptions such as homestead exemption, widow(er)'s exemption, and disability exemption, which can reduce the assessed value of a property, thereby lowering the property tax. Special assessments, on the other hand, are charges levied by local governments or special districts for specific improvements or services, such as road maintenance or water management, and are typically added to the property tax bill.

| Factor | Influence on Property Tax |

|---|---|

| Market Value | Determines the assessed value, which is subject to the assessment ratio. |

| Millage Rate | Sets the tax rate applied to the assessed value, varying by property type and taxing authority. |

| Exemptions | Reduces the assessed value, lowering the property tax burden. |

| Special Assessments | Additional charges for specific improvements or services, added to the property tax bill. |

Navigating the Property Tax Process: A Step-by-Step Guide

The property tax process in Brevard County involves a series of steps, each crucial to ensuring an accurate assessment and a fair tax burden. Understanding and following this process can be instrumental in avoiding surprises and potential disputes.

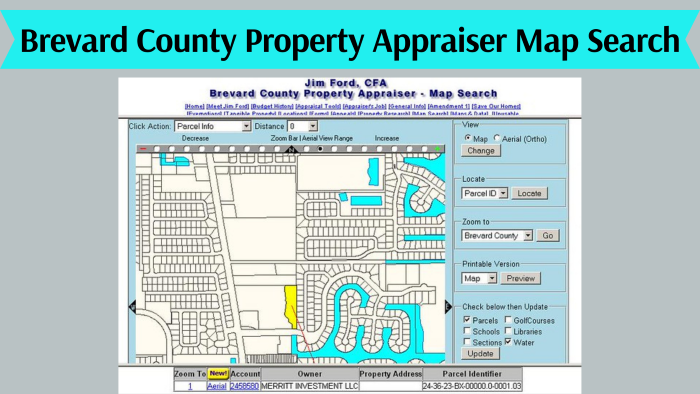

Step 1: Property Appraisal and Assessment

The first step in the property tax process is the appraisal of all taxable properties within Brevard County. This comprehensive appraisal is undertaken by the county property appraiser’s office, which employs a team of trained professionals to conduct physical inspections, review sales data, and utilize advanced valuation models to determine the fair market value of each property. Once the market value is ascertained, it is subject to the assessment ratio to arrive at the assessed value, which forms the basis for calculating the property tax.

Step 2: Notice of Proposed Property Taxes

Following the appraisal and assessment phase, property owners in Brevard County receive a Notice of Proposed Property Taxes (TRIM Notice) from the property appraiser’s office. This notice provides a detailed breakdown of the proposed property taxes, including the assessed value, applicable millage rates, and any exemptions or special assessments. It also serves as a critical communication tool, allowing property owners to review the proposed taxes and identify any potential discrepancies or errors.

Upon receiving the TRIM Notice, property owners are encouraged to review the information carefully. If there are any concerns or questions, the property appraiser's office provides resources and assistance to guide property owners through the review process. This includes access to online tools for verifying property details and the ability to schedule appointments for further clarification or to discuss specific concerns.

Step 3: Challenging Property Assessments

In instances where property owners believe their assessed value is inaccurate or unfair, Brevard County offers a formal process for challenging assessments. This process, known as petitioning for review, allows property owners to present their case to the Value Adjustment Board (VAB), an independent administrative body tasked with resolving property tax disputes. The VAB reviews the evidence presented by both the property owner and the property appraiser’s office to make a fair and impartial decision.

To initiate the petition process, property owners must complete and submit a Petition to the Value Adjustment Board within a specified timeframe, typically 25 days from the date of the TRIM Notice. The petition should clearly outline the reasons for the challenge, supported by relevant evidence such as recent sales data, appraisals, or other comparable property information. It is crucial to ensure that the petition is filed within the designated timeframe to avoid potential penalties or delays in the review process.

Step 4: Final Property Tax Determination

After the petition process, the Value Adjustment Board issues a final determination on the property’s assessed value. If the VAB rules in favor of the property owner, the assessed value is adjusted, which can result in a reduction in the property tax liability. Conversely, if the VAB upholds the initial assessment, the property owner may choose to accept the decision or explore further options, including appealing to the circuit court.

Once the final determination is made, property owners receive a Notice of Final Property Taxes, which outlines the finalized tax amount, including any adjustments resulting from the VAB decision. This notice serves as the official tax bill, and property owners are required to remit the specified amount by the due date to avoid late fees and potential penalties.

Property Tax Relief and Exemptions: A Comprehensive Overview

Brevard County, in line with the state of Florida, offers a range of property tax relief programs and exemptions to eligible property owners. These programs and exemptions are designed to alleviate the tax burden for specific groups of individuals and properties, ensuring a fair and equitable tax system.

Homestead Exemption

The homestead exemption is one of the most widely utilized property tax relief programs in Brevard County. This exemption is available to Florida residents who own and occupy their primary residence as their homestead. To qualify for the homestead exemption, property owners must meet certain criteria, including residency and ownership requirements. The homestead exemption reduces the assessed value of the property, which in turn lowers the property tax liability.

The homestead exemption is particularly beneficial for long-term residents of Brevard County, as it provides a stable and predictable tax environment. By reducing the assessed value, property owners can better plan their financial strategies and ensure their property tax burden remains manageable over the long term.

Additional Exemptions and Relief Programs

In addition to the homestead exemption, Brevard County offers a variety of other exemptions and relief programs to eligible property owners. These include:

- Widow(er)'s Exemption: This exemption provides tax relief to surviving spouses of Florida residents who were eligible for the homestead exemption at the time of their death.

- Disability Exemption: Property owners with permanent disabilities may be eligible for this exemption, which reduces the assessed value of their property, thereby lowering their property tax burden.

- Veteran's Exemption: Active-duty military personnel, veterans, and their surviving spouses may qualify for this exemption, which offers varying levels of tax relief based on the veteran's disability status and service-related injuries.

- Agricultural Exemption: Properties used for agricultural purposes may be eligible for this exemption, which reduces the assessed value based on the property's agricultural use.

- Senior Citizen Exemption: Senior citizens, aged 65 or older, may be eligible for this exemption, which provides a reduction in the assessed value of their property.

It's important for Brevard County residents to explore and understand the various exemptions and relief programs available to them. By taking advantage of these programs, eligible property owners can significantly reduce their property tax liability, making homeownership more affordable and sustainable.

Future Outlook and Potential Changes

As with any tax system, Brevard County’s property tax landscape is subject to potential changes and developments. These changes can be driven by a variety of factors, including shifts in the local real estate market, legislative actions at the state and local levels, and evolving economic conditions.

Real Estate Market Fluctuations

The real estate market in Brevard County, like any other market, is susceptible to fluctuations. Changes in market conditions, such as shifts in supply and demand, can influence property values, which in turn impact property tax assessments. For instance, a booming real estate market with rising property values may result in higher assessments and increased tax burdens for property owners. Conversely, a cooling market with declining property values could lead to reduced assessments and tax relief.

Legislative and Policy Changes

Brevard County’s property tax system is governed by a combination of state and local laws and policies. Changes in legislation, such as amendments to the Florida Constitution or local ordinances, can have significant implications for property taxes. For example, modifications to assessment ratios, millage rates, or the eligibility criteria for exemptions could impact the tax burden for property owners. It’s essential for residents to stay informed about any proposed or enacted legislative changes that may affect their property taxes.

Economic Considerations

The overall economic climate in Brevard County, and the state of Florida, can also influence property tax assessments. Economic downturns or recessions may lead to decreased property values and, consequently, lower assessments. Conversely, periods of economic growth and prosperity can drive up property values, resulting in higher assessments and increased tax liabilities. Property owners should be mindful of these economic fluctuations and their potential impact on their property tax obligations.

Looking ahead, Brevard County's property tax system is likely to continue evolving in response to these various factors. While it's challenging to predict specific changes, staying informed and engaged with local government and community organizations can help residents anticipate and prepare for potential shifts in the property tax landscape.

Conclusion: Empowering Brevard County Residents

Brevard County’s property tax system, while complex, is designed to ensure a fair and equitable distribution of tax obligations among property owners. By understanding the key factors influencing assessments, navigating the tax process effectively, and taking advantage of available exemptions and relief programs, residents can actively participate in and benefit from this system.

As we've explored, the property tax landscape in Brevard County is influenced by a myriad of factors, including market values, millage rates, and exemptions. By staying informed and engaged, residents can ensure their properties are accurately assessed and their tax obligations are fair and manageable. Additionally, by exploring and utilizing the various exemptions and relief programs, eligible property owners can significantly reduce their tax burden, making homeownership more affordable and sustainable.

Looking to the future, Brevard County's property tax system is likely to continue evolving in response to changing market conditions, legislative actions, and economic considerations. By remaining vigilant and proactive, residents can adapt to these changes and ensure their financial well-being. Ultimately, by understanding and actively participating in the property tax process, Brevard County residents can contribute to the vibrant and thriving community that makes this county such a desirable place to live and work.

Frequently Asked Questions

How often are property taxes assessed in Brevard County?

+

Property taxes in Brevard County are assessed biennially, meaning the county property appraiser’s office evaluates all taxable properties every two years. This assessment cycle ensures that property values are accurately reflected in the tax system.

What is the role of the millage rate in property tax calculations?

+

The millage rate is a critical component in property tax calculations. It represents the tax rate applied to the assessed value of a property. The millage rate is determined annually by the county’s Board of County Commissioners and other taxing authorities, and it can vary based on the type of property and the taxing authority.

How can I challenge my property assessment if I believe it is inaccurate?

+

If you believe your property assessment is inaccurate, you can petition for a review by the Value Adjustment Board (VAB). This process involves completing a petition, providing supporting evidence, and presenting your case to the VAB. It’s important to ensure that you file your petition within the designated timeframe to avoid potential penalties.

Are there any exemptions or relief programs available for property owners in Brevard County?

+

Yes, Brevard County offers a range of exemptions and relief programs to eligible property owners. These include the homestead exemption, widow(er)’s exemption, disability exemption, veteran’s exemption, agricultural exemption, and senior citizen exemption. Understanding and applying for these programs can significantly reduce your property tax liability.

How can I stay informed about potential changes to the property tax system in Brevard County?

+

Staying informed about potential changes to the property tax system is crucial for Brevard County residents. You can monitor local real estate market trends, follow legislative developments at the state and local levels, and stay engaged with community organizations and local government initiatives. By staying informed, you can anticipate and prepare for any changes that may impact your property tax obligations.