Capital Gains Tax California

Capital gains tax is a critical component of the tax system in the United States, and it plays a significant role in California's fiscal landscape. Understanding how capital gains are taxed in California is essential for investors, business owners, and individuals alike, as it can have a substantial impact on their financial strategies and overall tax liabilities.

This comprehensive guide aims to delve into the intricacies of capital gains tax in California, providing an in-depth analysis of the tax rates, applicable laws, and strategies to optimize your financial outcomes. Whether you're a seasoned investor or new to the world of capital gains, this article will equip you with the knowledge to navigate California's tax system effectively.

Understanding Capital Gains Tax in California

California, like many other states, imposes a tax on the profits derived from the sale of capital assets, which are typically investments or properties held for personal or business purposes. This tax, known as capital gains tax, is distinct from ordinary income tax and is calculated based on the increase in value of the asset from the time it was acquired to the time it was sold.

The significance of capital gains tax in California cannot be overstated, especially given the state's diverse economy and its role as a hub for various industries, from technology and entertainment to real estate and finance. As a result, a substantial portion of California's tax revenue comes from capital gains, making it a critical aspect of the state's fiscal health.

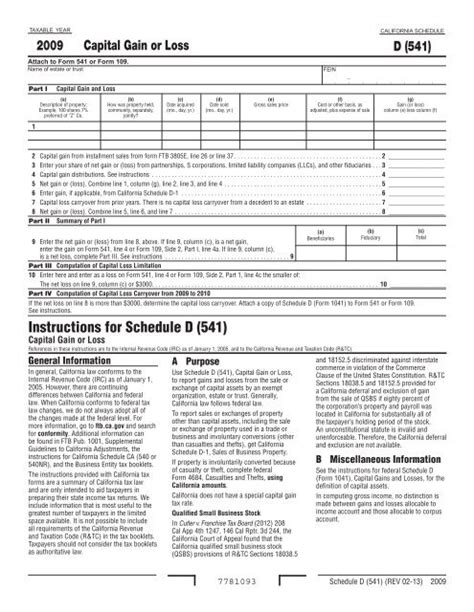

Tax Rates and Brackets

California’s capital gains tax rates are progressive, meaning the tax rate increases as the capital gains amount rises. The state’s tax brackets are aligned with the federal tax brackets, ensuring that taxpayers pay the appropriate rate based on their income level. As of 2023, the tax rates for California capital gains are as follows:

| Income Bracket | Tax Rate |

|---|---|

| $0 - $11,050 | 1% |

| $11,051 - $36,750 | 2% |

| $36,751 - $77,450 | 4% |

| $77,451 - $173,300 | 6% |

| $173,301 - $428,400 | 8% |

| $428,401 - $648,800 | 9.3% |

| $648,801 and above | 10.3% |

It's important to note that these rates are subject to change, and taxpayers should refer to the latest California tax guidelines for the most accurate and up-to-date information.

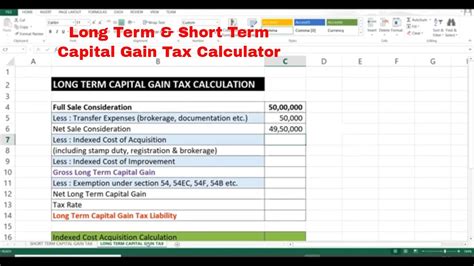

Long-Term vs. Short-Term Capital Gains

Capital gains are classified into two categories: long-term and short-term. The duration for which an asset is held plays a pivotal role in determining the applicable tax rate.

Long-term capital gains are those derived from assets held for more than one year before being sold. These gains are generally taxed at more favorable rates compared to short-term capital gains. In California, long-term capital gains are taxed at the same rates as ordinary income, as outlined in the tax brackets above.

On the other hand, short-term capital gains are those realized from assets held for a year or less before sale. These gains are taxed at the taxpayer's ordinary income tax rate, which can be significantly higher than the rates for long-term capital gains. As a result, understanding the holding period of your assets is crucial for effective tax planning.

Strategies for Optimizing Capital Gains Tax

While California’s capital gains tax system may seem straightforward, there are several strategies that taxpayers can employ to minimize their tax liabilities and optimize their financial outcomes.

Timing Your Sales

One of the most effective strategies for managing capital gains tax is timing your asset sales. By carefully planning the sale of your investments or properties, you can potentially reduce your tax burden. For instance, selling assets that have experienced significant appreciation when your income is lower could result in a lower tax rate.

Additionally, taxpayers should be aware of the potential benefits of holding assets for longer periods. As mentioned earlier, long-term capital gains are taxed at more favorable rates. By waiting to sell assets until they have been held for over a year, taxpayers can often reduce their tax liability.

Utilizing Tax-Efficient Investment Strategies

Another strategy for optimizing capital gains tax is adopting tax-efficient investment strategies. This could involve investing in assets that are less likely to generate short-term capital gains, such as real estate or certain types of bonds. Alternatively, taxpayers could consider investing in tax-advantaged accounts, such as retirement accounts or 529 plans, which offer tax benefits and can shelter capital gains from taxation.

Offsetting Capital Gains with Losses

Taxpayers can also offset their capital gains with capital losses. If you have investments that have declined in value, selling them and realizing the loss can be a strategic move. This loss can then be used to offset capital gains, potentially reducing your overall tax liability.

It's important to note that there are limits to how much of a loss you can claim in a given year, and these rules vary based on your filing status. Consulting with a tax professional can help ensure you're maximizing the benefits of this strategy while adhering to IRS regulations.

The Impact of California’s Tax System on Investors

California’s tax system, particularly its capital gains tax structure, has a significant influence on the behavior and decisions of investors within the state. The progressive tax rates and the distinction between long-term and short-term capital gains can incentivize investors to adopt certain strategies to minimize their tax burden.

For instance, the favorable tax treatment of long-term capital gains may encourage investors to hold onto their assets for extended periods, fostering a more stable investment environment. On the other hand, the higher tax rates for short-term capital gains may deter investors from engaging in frequent trading, which could lead to a more conservative investment approach.

Furthermore, California's tax system can also impact the types of investments that are favored by investors. Assets that generate long-term capital gains, such as real estate or certain stocks, may be more attractive to investors due to their tax advantages. This can influence the overall investment landscape within the state, potentially shaping the growth and development of various industries.

Case Study: The Impact on Real Estate Investments

To illustrate the impact of California’s capital gains tax system, let’s consider the example of real estate investments. Real estate is a significant asset class in California, and the state’s tax treatment of capital gains on real estate can have a profound effect on investment strategies.

Given the favorable tax rates for long-term capital gains, investors may be more inclined to hold onto their real estate assets for extended periods. This could lead to a more stable real estate market, with fewer fluctuations in property values due to frequent buying and selling. Additionally, the tax advantages of long-term capital gains may encourage investors to focus on long-term appreciation rather than short-term gains, fostering a more sustainable investment approach.

However, it's important to note that the tax benefits of long-term capital gains are not without their complexities. For instance, the state's Proposition 13, which limits property tax increases, can interact with capital gains tax in unique ways, especially when considering the sale of properties held for long periods. Consulting with tax professionals and staying informed about the latest tax regulations is crucial for real estate investors in California.

Conclusion: Navigating California’s Capital Gains Tax Landscape

California’s capital gains tax system is a critical component of the state’s fiscal framework, impacting a wide range of taxpayers, from individual investors to large corporations. Understanding the intricacies of this tax system is essential for effective financial planning and strategic decision-making.

By familiarizing yourself with the tax rates, brackets, and strategies outlined in this guide, you can optimize your financial outcomes and minimize your tax liabilities. Whether you're a seasoned investor or a newcomer to the world of capital gains, staying informed and proactive in your tax planning can lead to significant advantages in the long run.

Remember, the tax landscape is constantly evolving, and it's crucial to stay updated with the latest regulations and strategies. By doing so, you can navigate California's capital gains tax system with confidence and make informed decisions that align with your financial goals.

What is the difference between long-term and short-term capital gains in California?

+Long-term capital gains refer to profits from assets held for more than one year, while short-term capital gains are those realized from assets held for a year or less. Long-term capital gains are taxed at more favorable rates compared to short-term gains.

How can I reduce my capital gains tax liability in California?

+There are several strategies, including timing your asset sales to coincide with lower income years, utilizing tax-efficient investment strategies, and offsetting capital gains with losses. Consulting with a tax professional can help tailor these strategies to your specific situation.

Are there any tax advantages for holding assets long-term in California?

+Yes, long-term capital gains are generally taxed at more favorable rates compared to short-term gains. Holding assets for longer periods can result in lower tax liabilities, making it a common strategy for investors.

What is the current capital gains tax rate in California for 2023?

+The tax rates for California capital gains as of 2023 are progressive, ranging from 1% to 10.3%, depending on the income bracket. It’s important to refer to the latest tax guidelines for the most accurate information.

How do California’s capital gains tax rates compare to other states?

+California’s capital gains tax rates are generally higher compared to many other states. However, the tax landscape varies significantly across the country, and it’s essential to compare rates and consider the overall tax environment when making investment decisions.