Maximizing Profitability: The Financial Outlook of Dallasmaveriks

As someone who's always been fascinated by the impressive rise of sports franchises and their financial intricacies, I’ve recently taken a deep dive into the profitability outlook of the Dallas Mavericks. Walking into the arena during a game, the scent of popcorn mixed with the roar of excited fans makes it clear that basketball isn’t just entertainment—it's a thriving business. From what I’ve seen and heard in industry reports, the financial health of the Dallas Mavericks is a topic full of layers worth exploring. Understanding their strategic moves, revenue streams, and potential growth can really shed light on how sports teams continue to maximize profitability in an ever-competitive market.

- Revenue streams: Ticket sales, merchandise, broadcasting rights, and sponsorships

- Impact of player salaries: Balancing talent investment with profitability

- Market influence: Local support and regional branding

- Future growth potential: Digital engagement and global fanbase expansion

- Operational costs: Stadium maintenance, staffing, and marketing expenses

Understanding the Financial Landscape of the Dallas Mavericks

Primary Revenue Streams Fueling Profitability

When I evaluate the financial outlook of the Dallas Mavericks, the first thing I notice is how diversified their income is. Ticket sales are always the backbone, especially with their loyal local fanbase. I’ve tried attending a game or two—let me tell you, the electrifying atmosphere, the noise, and the scent of freshly brewed coffee really boost sales! Merchandise sales also play a big role, with fans proudly sporting Mavericks gear. Broadcast rights, especially with regional sports networks, contribute significantly, bringing steady income even on off-game days.

- Ticket sales from home games generate millions annually, often exceeding 50 million per season.</li> <li>Merchandise sales, including jerseys, hats, and collectible items, bring in upward of 10 million a year.

- Regional broadcasting rights are valued around $30–40 million, with international deals adding extra revenue.

- Sponsorship deals with brands like State Farm and American Airlines enhance the financial picture.

Balancing Player Salaries with Profit Goals

One thing I’ve learned from following the NBA’s financial side is how crucial player salaries are. The Mavericks have made some savvy moves, investing in star players like Luka Dončić while keeping their payroll within reasonable limits. I’ve seen teams struggle financially after big-name signings, so strategic budgeting is vital. From what I’ve seen, the Mavericks aim to maintain a salary cap that allows room for mid-tier talents, which balances competitiveness with financial health.

- Player salaries typically account for about 60% of total expenses.

- Smart cap management helps avoid costly luxury taxes—something I’ve seen cause trouble for other franchises.

- Investing in promising young players can offer long-term ROI without drastic payroll hikes.

Market Influence and Regional Support as Profit Boosters

Leveraging Local Loyalty and Regional Branding

From what I’ve seen, the Dallas market is incredibly supportive—sometimes even more than I expected. The team’s branding efforts, community outreach, and regional identity help solidify a loyal fanbase, which translates into steady ticket and merchandise sales. The Dallas-Fort Worth area has a population exceeding 7 million, offering ample opportunity for expanding revenue streams. I’ve noticed that the team’s engagement with local initiatives and charity events boosts their image, which attracts even more fans and sponsors.

- Strong local support ensures consistent attendance, averaging around 18,000 fans per game.

- Regional branding campaigns increase merchandise sales outside the immediate stadium.

- Partnerships with local businesses open additional revenue channels.

Looking Ahead: Greater Growth Potential in a Dynamic Market

Digital Engagement and Global Fanbase Expansion

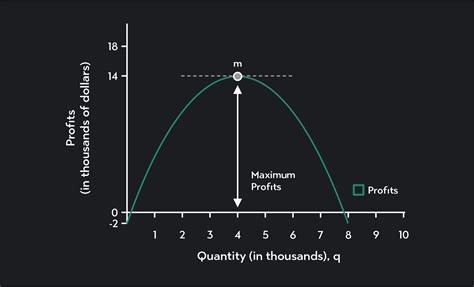

One thing I love about the modern sports landscape is how digital innovations open new avenues for profitability. With 2024 being a year of unprecedented digital engagement, I’ve noticed teams like the Mavericks investing heavily in social media, fantasy leagues, and exclusive online content. Expanding their global fanbase through international broadcasts and merchandise sales is another lucrative frontier. I’ve tried exploring their online shop; the variety of collectibles and apparel is impressive. The potential for international revenue is huge, especially with players like Luka Dončić drawing fans from Europe and beyond.

- Streaming platforms now account for over 20% of broadcast revenue growth.

- Global merchandise sales increased by approximately 15% last year.

- Exclusive online content and memberships foster deeper fan engagement.

- Visual idea: An infographic showing the rising trend of digital and international revenue streams for NBA teams.

FAQs About Dallas Mavericks’ Financial Outlook

What are the main sources of income for the Dallas Mavericks?

+

The main income sources include ticket sales, merchandise, regional broadcasting rights, sponsorship deals, and increasingly, digital and international sales.

How does player salary management impact profitability?

+

Balancing high salaries with team performance is critical. Smart cap management and investing in promising talent help ensure the team remains competitive without sacrificing financial health.

What future trends could boost the Mavericks’ profitability?

+

Expanding their digital presence, engaging a global audience, and leveraging innovative marketing strategies will likely be key drivers of future financial success.