Nys Tax Return Status

Welcome to a comprehensive guide on the New York State (NYS) Tax Return Status. Understanding the status of your tax return is crucial for effective financial planning and compliance. This article will delve into the intricacies of the NYS tax system, providing you with valuable insights and practical information. Let's explore the various aspects of tax return status, from the initial filing process to the different stages of processing and potential outcomes.

Understanding the NYS Tax Return Status

The New York State Department of Taxation and Finance plays a pivotal role in managing the state's tax system. When it comes to tax return status, there are several key stages and indicators that taxpayers should be aware of. By grasping these concepts, individuals and businesses can navigate the tax process with confidence and address any potential issues promptly.

The Filing Process: A Step-by-Step Guide

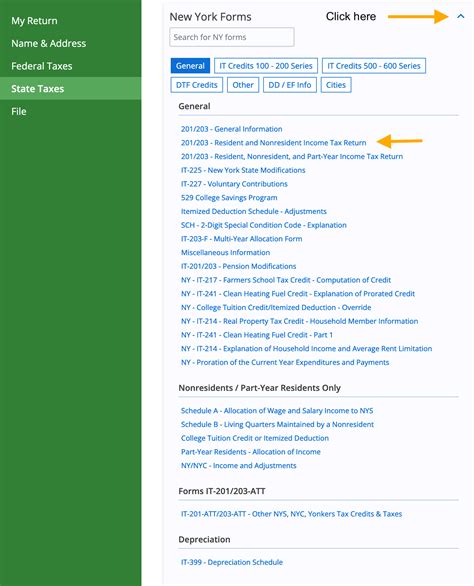

Initiating the tax return process in New York State begins with a thorough understanding of the filing requirements. Taxpayers must gather relevant financial documents, including income statements, deductions, and credits. The NYS tax forms, such as the IT-201 or IT-203, guide taxpayers through the process, ensuring accurate reporting of income, expenses, and deductions.

Once the forms are completed, taxpayers have the option to file electronically or through traditional mail. Electronic filing, often faster and more secure, is encouraged by the NYS Department of Taxation and Finance. This method allows for real-time status updates, making it easier to track the progress of your return.

Processing and Status Updates: What to Expect

After submitting your tax return, the NYS tax authorities begin the processing phase. During this stage, your return undergoes a series of checks and verifications to ensure compliance with state tax laws. The processing time can vary depending on factors such as the complexity of your return and the volume of returns being processed by the department.

To keep taxpayers informed, the NYS tax website provides an online tool for checking the status of your return. This tool displays real-time updates, indicating whether your return has been received, is being processed, or if there are any issues that require your attention. Regularly checking the status can help identify potential delays and allow you to take appropriate action.

| Status Indicator | Description |

|---|---|

| Return Received | Your tax return has been successfully submitted and is awaiting processing. |

| Processing In Progress | The NYS tax department is actively working on your return, calculating taxes, and applying deductions. |

| Review Required | Further review is needed, and you may be contacted for additional information or documentation. |

| Refund Issued | Your refund has been processed and is on its way to your designated bank account or mailing address. |

Potential Outcomes: Refunds, Balances Due, and More

The status of your tax return not only indicates the processing stage but also provides insights into the potential outcomes. Understanding these outcomes is crucial for financial planning and tax compliance.

If your return results in a refund, the status update will indicate the processing of the refund. The NYS tax department will issue the refund to the banking details or mailing address provided on your return. Refunds can take varying amounts of time to process, depending on the method of filing and payment.

In contrast, if your return shows a balance due, the status will prompt you to make the necessary payment. The NYS tax department provides clear instructions on how to make the payment, including options such as electronic transfers, credit card payments, or traditional checks. It's essential to meet the payment deadline to avoid penalties and interest.

In some cases, the status update may indicate a review required status. This could be due to missing information, discrepancies, or errors on your return. The NYS tax department will contact you to resolve these issues, and it's crucial to respond promptly to avoid delays in processing.

FAQs: Common Questions About NYS Tax Return Status

How long does it take to receive my NYS tax refund after filing?

+The processing time for NYS tax refunds can vary. On average, it takes around 4 to 6 weeks from the filing date. However, factors like the complexity of your return and the volume of returns being processed can influence the timeframe. Electronic filing and direct deposit options usually result in faster refunds.

<div class="faq-item">

<div class="faq-question">

<h3>What if I don't receive my refund within the estimated timeframe?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>If your refund hasn't arrived within the estimated timeframe, you can contact the NYS Department of Taxation and Finance. They can provide an update on the status of your refund and offer guidance if there are any issues. Be prepared to provide your tax return details and contact information.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I check the status of my NYS tax return online?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Absolutely! The NYS tax website offers an online tool for checking the status of your tax return. Simply log in to your account or use the provided reference number to access real-time updates on the processing stage and potential outcomes. This tool is a convenient way to stay informed.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What happens if I owe taxes but can't afford to pay the full amount?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>If you owe taxes but face financial difficulties, the NYS Department of Taxation and Finance offers payment plans. These plans allow you to pay your taxes in installments over a specified period. Contact the department to discuss your options and set up a suitable payment plan.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any penalties for filing my NYS tax return late?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, late filing of your NYS tax return can result in penalties and interest charges. The amount of the penalty depends on the extent of the delay. To avoid penalties, it's essential to file your return by the due date, which is typically April 15th. If you can't meet the deadline, consider filing for an extension to buy more time.</p>

</div>

</div>

</div>

Understanding the NYS Tax Return Status empowers taxpayers to navigate the tax system efficiently and make informed financial decisions. By staying informed about the processing stages and potential outcomes, individuals and businesses can ensure compliance and avoid unnecessary delays or penalties. Remember, timely filing, accurate documentation, and regular status checks are key to a smooth tax experience in New York State.