Cuyahoga County Real Estate Taxes

Understanding the intricacies of property taxes is crucial for any homeowner, especially in Cuyahoga County, Ohio, where the real estate tax system plays a significant role in local government funding and community development. In this comprehensive guide, we will delve into the world of Cuyahoga County real estate taxes, exploring the key factors, rates, and processes involved, and offering insights to help property owners navigate this essential aspect of homeownership.

The Basics of Cuyahoga County Real Estate Taxes

Cuyahoga County, nestled in the northeastern part of Ohio, is renowned for its vibrant communities, diverse neighborhoods, and rich history. With a robust property market, it’s essential for residents and prospective homeowners to grasp the fundamentals of real estate taxes to make informed decisions and ensure compliance with local regulations.

Real estate taxes in Cuyahoga County are primarily levied by local governments, including the county itself and the various municipalities within its borders. These taxes serve as a vital source of revenue, funding essential services like education, public safety, infrastructure maintenance, and social programs that benefit the entire community.

How Real Estate Taxes are Calculated

The calculation of real estate taxes in Cuyahoga County involves several key factors, each playing a crucial role in determining the final tax liability for property owners. Here’s a breakdown of these factors:

- Assessed Value of the Property: The first step in tax calculation is determining the assessed value of the property. This value is typically based on a percentage of the property's fair market value, which is the price it would fetch in an open and competitive market. The assessed value serves as the basis for tax computations and is influenced by factors such as the property's location, size, improvements, and market conditions.

- Tax Rate: The tax rate is a critical component in determining the amount of tax owed. In Cuyahoga County, the tax rate is set by the county government and local municipalities. It is expressed as a percentage and applied to the assessed value of the property. Tax rates can vary significantly across different areas within the county, reflecting the unique needs and priorities of each community.

- Exemptions and Deductions: Cuyahoga County offers various exemptions and deductions that can reduce the taxable value of a property. These include homestead exemptions for primary residences, senior citizen exemptions, and deductions for veterans and individuals with disabilities. These provisions aim to provide financial relief to eligible homeowners, making homeownership more accessible and affordable.

| Exemption Category | Description |

|---|---|

| Homestead Exemption | Reduces taxable value for primary residences |

| Senior Citizen Exemption | Offers relief to homeowners aged 65 and above |

| Veteran Exemption | Provides benefits to eligible military veterans |

| Disability Exemption | Assists individuals with qualifying disabilities |

By understanding these key factors and how they interplay, property owners can estimate their tax liability and plan their finances accordingly. It's important to note that tax rates and exemption eligibility may change from year to year, so staying informed about local tax policies is essential for accurate tax planning.

Tax Due Dates and Payment Options

Real estate taxes in Cuyahoga County are typically due in two installments, with specific due dates set by the county treasurer’s office. The payment schedule ensures that property owners have the flexibility to manage their financial obligations throughout the year.

Property owners have several convenient payment options to choose from, including online payments through secure platforms, payment by mail, or in-person payments at designated locations. These options provide flexibility and ease of access, catering to different preferences and technological capabilities.

Exploring Cuyahoga County’s Real Estate Market

Cuyahoga County boasts a diverse and dynamic real estate market, offering a wide range of housing options to cater to various lifestyles and budgets. From charming historic homes in established neighborhoods to modern developments in thriving communities, the county’s real estate landscape is as varied as its residents.

Property Types and Pricing

The county’s real estate market encompasses a spectrum of property types, including single-family homes, condominiums, townhouses, and multi-family dwellings. The pricing of these properties is influenced by factors such as location, size, age, amenities, and the overall market demand.

Cuyahoga County's proximity to major urban centers, such as Cleveland, and its rich cultural heritage make it an attractive destination for homebuyers seeking a balanced lifestyle. The county's diverse neighborhoods offer a mix of urban, suburban, and rural living, providing residents with a unique blend of convenience and tranquility.

Neighborhood Profiles

Cuyahoga County is renowned for its vibrant and diverse neighborhoods, each with its own distinct character and charm. Let’s take a closer look at some of the county’s most popular and sought-after neighborhoods:

- Cleveland Heights: This charming suburb is known for its architectural diversity, with a mix of historic homes and modern developments. Cleveland Heights offers a vibrant cultural scene, excellent schools, and easy access to downtown Cleveland.

- Beachwood: A prestigious and affluent community, Beachwood is renowned for its top-notch schools, luxurious homes, and access to upscale shopping and dining. The neighborhood boasts a strong sense of community and a high quality of life.

- Lakewood: Located on the shores of Lake Erie, Lakewood is a popular choice for those seeking a blend of urban and lakefront living. The neighborhood is known for its walkable streets, vibrant arts scene, and a diverse range of housing options, from historic bungalows to modern apartments.

- Parma: Parma is one of the largest suburbs in Cuyahoga County and is renowned for its strong sense of community and excellent value for homebuyers. The neighborhood offers a range of housing options, including single-family homes, townhouses, and condominiums, making it an attractive choice for families and first-time buyers.

Understanding the Tax Assessment Process

The tax assessment process in Cuyahoga County is a crucial component of the real estate tax system, as it determines the assessed value of properties, which forms the basis for tax calculations. Let’s delve into the intricacies of this process and explore how it impacts property owners.

The Role of the Cuyahoga County Auditor

The Cuyahoga County Auditor’s office plays a central role in the tax assessment process. Their primary responsibility is to ensure fair and accurate assessments for all properties within the county. The auditor’s team conducts regular reviews and appraisals to determine the market value of properties, taking into account factors such as location, size, improvements, and market trends.

The auditor's office employs a team of highly skilled professionals who utilize advanced assessment techniques and data analysis to ensure the integrity of the assessment process. Their expertise and dedication to fairness contribute to the overall efficiency and accuracy of the real estate tax system in Cuyahoga County.

Assessment Appeals and Reconsiderations

Property owners in Cuyahoga County have the right to appeal their property’s assessed value if they believe it is inaccurate or unfair. The appeals process provides a mechanism for homeowners to challenge the auditor’s assessment and seek a more equitable valuation.

To initiate an appeal, property owners must submit a formal request within a specified timeframe, typically after receiving their tax assessment notice. The appeal process involves presenting evidence and supporting documentation to demonstrate why the assessed value should be adjusted. This may include recent sales data, comparable property assessments, or other relevant information.

It's important for property owners to carefully review their assessment and consider whether an appeal is warranted. While the appeals process can be time-consuming, it provides an opportunity for homeowners to ensure that their tax liability is based on a fair and accurate assessment of their property's value.

Tax Relief Programs and Initiatives

Cuyahoga County is committed to supporting its residents and promoting homeownership through a range of tax relief programs and initiatives. These programs aim to provide financial assistance and incentives to eligible homeowners, making property ownership more accessible and sustainable.

Cuyahoga County Homestead Program

The Cuyahoga County Homestead Program is a key initiative designed to assist homeowners with their real estate tax obligations. This program offers a reduction in the taxable value of a property for eligible homeowners, providing much-needed relief and making homeownership more affordable.

To qualify for the Homestead Program, homeowners must meet certain criteria, including owning and occupying the property as their primary residence. The program provides a substantial benefit, reducing the taxable value of the property by a specified amount, which can significantly lower the homeowner's tax liability.

Senior Citizen Tax Abatement

Cuyahoga County recognizes the unique needs and challenges faced by senior citizens, and as such, offers a tax abatement program specifically tailored to this demographic. The Senior Citizen Tax Abatement provides eligible senior homeowners with a reduction in their real estate tax liability, offering financial relief during their retirement years.

To qualify for the Senior Citizen Tax Abatement, homeowners must meet age requirements and have owned and occupied the property for a specified period. The abatement provides a substantial benefit, reducing the tax burden for eligible seniors, and ensuring that they can continue to enjoy their homes without undue financial strain.

Veteran and Disability Exemptions

Cuyahoga County demonstrates its gratitude and support for veterans and individuals with disabilities through a range of tax exemptions. These exemptions provide eligible homeowners with a reduction in their taxable value, recognizing the sacrifices made by veterans and the unique challenges faced by individuals with disabilities.

Veterans who meet certain service criteria and disability requirements are entitled to exemptions that reduce their taxable value, resulting in lower real estate taxes. Similarly, individuals with qualifying disabilities may also be eligible for exemptions, providing much-needed financial relief and ensuring that they can maintain their homes with reduced tax obligations.

The Impact of Real Estate Taxes on the Community

Real estate taxes in Cuyahoga County play a pivotal role in shaping the community’s future and ensuring the well-being of its residents. The revenue generated from these taxes is invested back into the community, funding critical services and initiatives that enhance the quality of life for all.

Funding Essential Services

The revenue collected from real estate taxes is a significant source of funding for essential services in Cuyahoga County. These funds support a wide range of vital programs and infrastructure, including:

- Public education: Real estate taxes contribute to the funding of local schools, ensuring that students receive a high-quality education and have access to the resources they need to succeed.

- Public safety: The revenue supports police, fire, and emergency response services, ensuring the safety and security of residents and visitors alike.

- Infrastructure maintenance: Real estate taxes help maintain and improve roads, bridges, and other critical infrastructure, making the county a safer and more efficient place to live and work.

- Social services: The funds are allocated to support social programs, such as healthcare, housing assistance, and community development initiatives, benefiting vulnerable populations and promoting overall community well-being.

Community Development and Revitalization

Real estate taxes also play a crucial role in community development and revitalization efforts in Cuyahoga County. The revenue generated is invested in projects and initiatives that aim to enhance the county’s infrastructure, improve public spaces, and stimulate economic growth.

These investments contribute to the creation of vibrant neighborhoods, the improvement of public amenities, and the attraction of new businesses and industries. By investing in community development, Cuyahoga County ensures that its residents have access to high-quality public spaces, well-maintained infrastructure, and a thriving local economy.

Tips for Navigating Real Estate Taxes in Cuyahoga County

Understanding the real estate tax landscape in Cuyahoga County is essential for property owners to effectively manage their tax obligations and ensure compliance with local regulations. Here are some valuable tips to help you navigate the process and make informed decisions:

- Stay Informed: Keep yourself updated on local tax policies, rates, and deadlines. The Cuyahoga County Auditor's office and the county treasurer's website are valuable resources for staying informed about tax-related matters.

- Understand Your Assessment: Review your property's assessed value and understand how it was determined. If you have concerns or believe the assessment is inaccurate, consider appealing it through the formal process outlined by the county.

- Explore Tax Relief Programs: Research and apply for tax relief programs for which you may be eligible. The Cuyahoga County Homestead Program, Senior Citizen Tax Abatement, and veteran and disability exemptions can provide significant financial relief and make homeownership more affordable.

- Utilize Payment Options: Take advantage of the various payment options offered by the county treasurer's office. Whether you prefer online payments, mail-in payments, or in-person payments, choose the option that best suits your needs and preferences.

- Seek Professional Advice: If you have complex tax matters or require specialized assistance, consider consulting a tax professional or financial advisor. They can provide expert guidance and ensure you are making the most informed decisions regarding your real estate tax obligations.

Conclusion

Real estate taxes in Cuyahoga County are an essential aspect of homeownership, contributing to the vibrant and thriving communities that make the county a desirable place to live. By understanding the tax assessment process, exploring tax relief programs, and staying informed about local policies, property owners can effectively manage their tax obligations and ensure their financial well-being.

As you navigate the world of real estate taxes, remember that these taxes are a vital investment in the community's future. They fund essential services, support community development, and ensure that Cuyahoga County remains a vibrant and prosperous place to call home. With the right knowledge and resources, you can confidently navigate the tax landscape and contribute to the continued success of this remarkable county.

How often are real estate taxes assessed in Cuyahoga County?

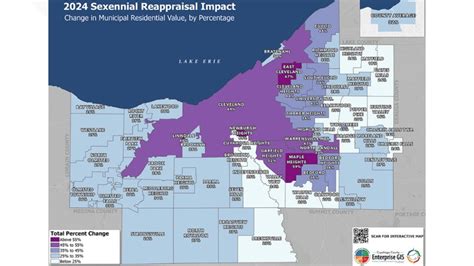

+Real estate taxes in Cuyahoga County are typically assessed every three years. The county auditor’s office conducts regular reviews and appraisals to determine the market value of properties and ensure fair and accurate assessments.

Can I appeal my property’s assessed value in Cuyahoga County?

+Yes, property owners in Cuyahoga County have the right to appeal their property’s assessed value if they believe it is inaccurate or unfair. The appeals process provides a mechanism for homeowners to challenge the auditor’s assessment and seek a more equitable valuation.

What are the payment options for real estate taxes in Cuyahoga County?

+Property owners in Cuyahoga County have several convenient payment options for real estate taxes. These include online payments through secure platforms, payment by mail, and in-person payments at designated locations. The county treasurer’s office offers flexibility to cater to different preferences and payment methods.