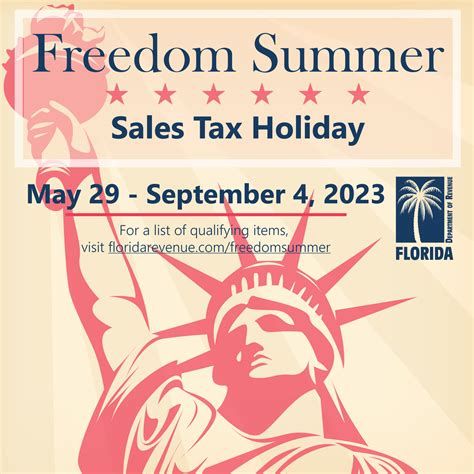

Tax Free Holiday Florida

The Tax-Free Holiday is an annual event eagerly anticipated by residents of Florida, offering a unique opportunity to save on essential back-to-school supplies and certain clothing items. This event, which typically occurs over a designated period in July or August, is a strategic move by the state to ease the financial burden on families and boost local economies. As we delve into the specifics of Florida's Tax-Free Holiday, we'll uncover its history, the items it covers, and its economic impact, providing a comprehensive guide for savvy shoppers and curious minds alike.

Understanding Florida’s Tax-Free Holiday

Florida’s Tax-Free Holiday, often referred to as the Sales Tax Holiday, is a legislative initiative designed to provide temporary relief from sales tax on select items. This holiday is a strategic economic tool, incentivizing consumers to make larger purchases and encouraging local spending. The concept has gained traction in various states across the US, each with its unique rules and eligible items.

In Florida, this event has become a hallmark of the back-to-school season, offering a practical solution to the financial strain that often accompanies the preparation for a new academic year. By waiving sales tax on essential school supplies and clothing, the state effectively reduces the cost of these items, making them more affordable for families. This initiative not only benefits families but also stimulates local economies by driving increased sales during a designated period.

The History and Evolution of Florida’s Tax-Free Holiday

Florida’s journey with the Tax-Free Holiday began in 1998 when the state first introduced a Sales Tax Holiday. Initially, this holiday covered a broader range of items, including electronics, computers, and even hurricane preparedness supplies. Over the years, the focus has shifted, with a greater emphasis on back-to-school essentials.

The evolution of this event is a reflection of the changing needs of Floridians and the state's economy. As education became a more prominent focus, the holiday adjusted to cater specifically to the needs of students and their families. This strategic shift not only benefits families by reducing the financial burden of back-to-school preparations but also aligns with the state's educational goals, ensuring students have the necessary tools for academic success.

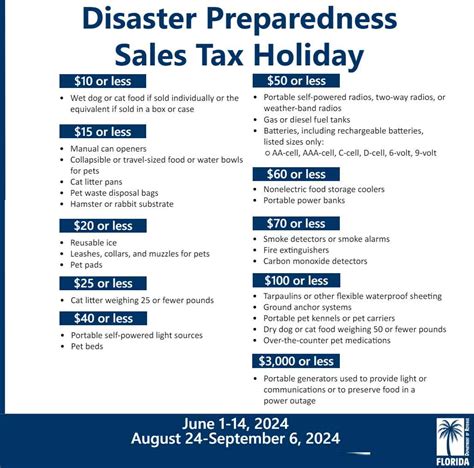

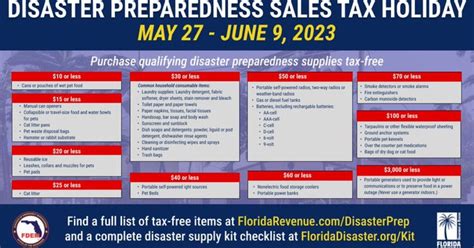

Eligible Items and Categories

During the Tax-Free Holiday, Florida waives sales tax on a range of items that fall into specific categories. These categories typically include:

- School Supplies: This category encompasses a wide range of items essential for students’ academic needs. Pens, pencils, notebooks, binders, backpacks, and even certain types of software are often included. Florida defines these supplies as items used by students for school purposes, typically those that would be required or recommended by schools.

- Clothing: Florida’s Tax-Free Holiday extends to clothing items, providing a welcome break for families shopping for back-to-school attire. This category includes a variety of clothing types, from uniforms to casual wear, ensuring students have appropriate attire for various school activities and events.

It's important to note that there are often specific price limits on eligible clothing items, ensuring that the tax-free status is applied to everyday items rather than luxury purchases. For instance, clothing items priced below a certain threshold, typically around $60 to $100, are eligible for tax exemption during the holiday.

Impact and Benefits of Florida’s Tax-Free Holiday

The Tax-Free Holiday in Florida has a significant impact on both consumers and the state’s economy. For families, it offers a substantial savings opportunity, making essential school supplies and clothing more affordable. This relief can be particularly beneficial for low-income families, helping to reduce the financial strain associated with the back-to-school season.

From an economic perspective, the Tax-Free Holiday stimulates local businesses. During this period, stores experience a surge in sales, with consumers taking advantage of the tax-free status to stock up on necessary items. This boost in sales not only benefits individual businesses but also contributes to the overall growth of the state's economy, fostering a vibrant retail environment.

| Category | Eligible Items |

|---|---|

| School Supplies | Pens, notebooks, backpacks, software, etc. |

| Clothing | Uniforms, casual wear (with price limits) |

Maximizing Savings During Florida’s Tax-Free Holiday

Florida’s Tax-Free Holiday presents a unique opportunity for shoppers to make significant savings on essential items. To make the most of this holiday, it’s essential to be well-prepared and informed. Here are some strategies to maximize your savings during this event:

Plan Your Shopping List in Advance

Before the Tax-Free Holiday begins, take the time to create a comprehensive shopping list. This list should include all the school supplies and clothing items your family needs for the upcoming academic year. By planning ahead, you can ensure you don’t miss out on any essential items during the holiday period.

Consider the specific needs of each family member, whether it's a student heading to college or a child starting a new school year. This approach ensures that you purchase only what you need, avoiding unnecessary spending.

Research and Compare Prices

In the weeks leading up to the Tax-Free Holiday, it’s beneficial to research and compare prices on the items you plan to purchase. This strategy allows you to identify the best deals and ensure you’re getting the most value for your money. Online price comparison tools and in-store research can be particularly useful during this phase.

Additionally, consider checking the prices of items on your list both before and after the holiday. This practice can provide insights into the potential savings you can achieve during the Tax-Free Holiday period.

Utilize Online Shopping

Online shopping can be a valuable tool during Florida’s Tax-Free Holiday. Many retailers offer online-only deals and promotions during this period, providing additional savings opportunities. By shopping online, you can compare prices and products across multiple retailers, ensuring you get the best deal.

Furthermore, online shopping can be a convenient way to avoid crowded stores and long lines, especially during the busy holiday period. This approach allows you to shop from the comfort of your home while still taking advantage of the tax-free status.

Take Advantage of Store Promotions and Coupons

During the Tax-Free Holiday, many retailers offer additional promotions and discounts to attract shoppers. These promotions can include sales, clearance events, and exclusive coupons. By staying informed about these offers, you can further maximize your savings during the holiday period.

Keep an eye on your favorite retailers' websites and social media channels for the latest promotions and deals. Often, these offers are time-sensitive, so acting quickly can ensure you don't miss out on valuable savings opportunities.

| Strategy | Benefits |

|---|---|

| Planning Shopping List | Ensures you don't miss out on essential items, avoids unnecessary spending. |

| Price Comparison | Helps identify the best deals, ensures you get the most value for your money. |

| Online Shopping | Offers convenience, allows for easy comparison of prices and products, often provides exclusive online deals. |

| Store Promotions and Coupons | Provides additional savings opportunities, can include exclusive sales and clearance events. |

Future Implications and Economic Analysis

Florida’s Tax-Free Holiday is a strategic initiative with far-reaching implications for the state’s economy and its residents. As we analyze the future prospects of this event, we uncover its potential impact on consumer behavior, local economies, and the overall fiscal landscape of Florida.

Consumer Behavior and Spending Patterns

The Tax-Free Holiday has a profound effect on consumer behavior, influencing spending patterns during the designated period. During this time, consumers are incentivized to make larger purchases, knowing they will save on sales tax. This change in behavior not only benefits families by reducing their financial burden but also stimulates local economies by driving increased sales.

The holiday's impact on spending patterns is particularly notable in the lead-up to the back-to-school season. Families often plan their purchases strategically, taking advantage of the tax-free status to stock up on essential school supplies and clothing. This strategic shopping not only ensures families are prepared for the new academic year but also contributes to a surge in local spending, benefiting retailers and the wider economy.

Economic Impact and Local Business Growth

The Tax-Free Holiday’s economic impact is significant, especially for local businesses. During the designated period, stores experience a boost in sales, with consumers taking advantage of the tax-free status to make necessary purchases. This surge in sales not only benefits individual businesses but also contributes to the overall growth of the state’s economy.

The holiday's economic impact extends beyond the retail sector. Local service providers, such as those in the hospitality and entertainment industries, also benefit from the increased footfall and spending associated with the holiday. This ripple effect demonstrates the broad reach of the Tax-Free Holiday, stimulating various sectors of the local economy.

Future Prospects and Potential Adjustments

Looking ahead, the future of Florida’s Tax-Free Holiday appears promising. The event has become a well-established tradition, with residents eagerly anticipating its arrival each year. However, as with any legislative initiative, there is room for potential adjustments and improvements.

One potential area of focus could be expanding the range of eligible items. While the current categories cover essential school supplies and clothing, expanding to include other educational resources or even certain electronic devices could further benefit students and families. Such an expansion could align with the evolving needs of modern education, ensuring students have access to the tools necessary for academic success.

Additionally, there may be opportunities to extend the duration of the Tax-Free Holiday. By increasing the number of days or even making it a recurring event throughout the year, Florida could provide even more savings opportunities for its residents. This adjustment could further stimulate local economies and provide a more consistent incentive for consumers.

| Future Prospect | Potential Impact |

|---|---|

| Expansion of Eligible Items | Increased savings opportunities for families, aligned with modern educational needs. |

| Extension of Duration | Enhanced economic stimulation, consistent savings incentives for consumers. |

FAQ

When is Florida’s Tax-Free Holiday typically held each year?

+

Florida’s Tax-Free Holiday is usually held in July or August, aligning with the back-to-school season. The exact dates can vary slightly each year, so it’s advisable to check the official state website or local news sources for the specific dates.

What types of items are typically exempt from sales tax during the Tax-Free Holiday?

+

The Tax-Free Holiday typically covers a range of school supplies and clothing items. This includes items like pens, notebooks, backpacks, and certain types of clothing. It’s important to check the specific guidelines and price limits for each category to ensure eligibility.

Are there any limitations or restrictions on the Tax-Free Holiday savings?

+

Yes, there are certain limitations and restrictions. For instance, the tax exemption often applies to items below a certain price threshold. Additionally, some items, like electronics or luxury goods, may not be eligible. It’s crucial to review the official guidelines to understand these limitations.

How does the Tax-Free Holiday benefit local businesses and the economy?

+

The Tax-Free Holiday stimulates local economies by driving increased sales during the designated period. This surge in sales benefits individual businesses and contributes to the overall growth of the state’s economy, fostering a vibrant retail environment.

Are there any strategies to maximize savings during the Tax-Free Holiday?

+

Absolutely! Planning your shopping list in advance, researching prices, utilizing online shopping, and taking advantage of store promotions are all effective strategies to maximize your savings during the Tax-Free Holiday. These approaches ensure you get the best deals and make the most of this unique opportunity.