Maryland State Taxes Payment

Maryland's state tax system is an important aspect of its economy and financial landscape. Understanding the state's tax structure, payment methods, and unique features is crucial for residents, businesses, and anyone interested in the fiscal policies of the Old Line State. This comprehensive guide will delve into the intricacies of Maryland state taxes, covering everything from filing requirements to payment options and strategies.

Understanding Maryland’s State Tax Landscape

Maryland’s tax system is known for its complexity, offering a range of taxes that residents and businesses must navigate. The state’s revenue department, the Comptroller of Maryland, oversees the collection of these taxes, ensuring compliance with state laws and regulations.

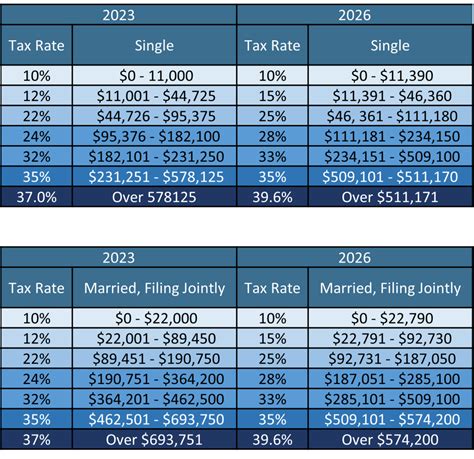

Maryland's tax structure includes income tax, sales and use tax, property tax, corporate income tax, and various other taxes and fees. The state's income tax system is particularly notable for its progressive nature, with rates ranging from 2% to 5.75%, depending on an individual's or entity's taxable income. This progressive system aims to ensure that higher-income earners contribute a larger share of their income towards state revenues.

Key Tax Categories in Maryland

Maryland’s tax system can be broadly categorized into the following key areas:

- Income Tax: This tax is levied on individuals, trusts, and estates based on their taxable income. The state’s income tax rates are progressive, with higher rates applied to higher income brackets.

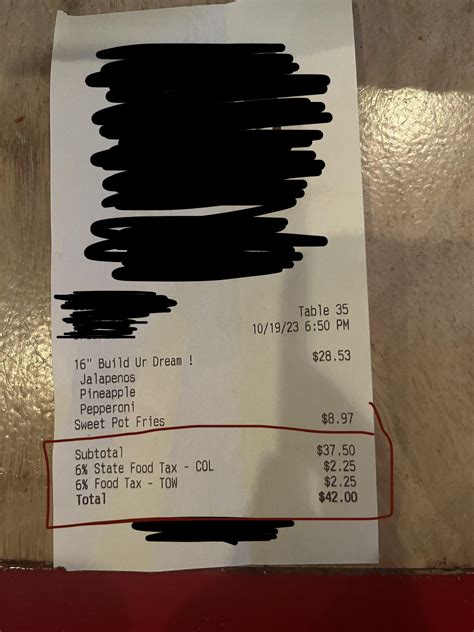

- Sales and Use Tax: Maryland imposes a sales tax on the retail sale, lease, or rental of most goods, as well as certain services. The state’s sales tax rate is 6%, with local jurisdictions allowed to impose additional local sales and use taxes.

- Property Tax: Property taxes are levied by local jurisdictions in Maryland and are based on the assessed value of real property. These taxes fund local services such as schools, roads, and emergency services.

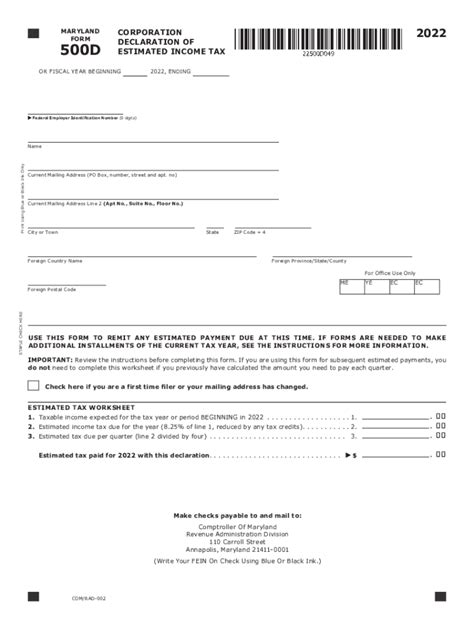

- Corporate Income Tax: Corporations doing business or earning income in Maryland are subject to corporate income tax. The tax rate is 8.25% on taxable income, with various deductions and credits available.

- Other Taxes: Maryland also imposes taxes on various other activities and transactions, including estate tax, inheritance tax, excise taxes, and special taxes on activities like alcohol and tobacco sales.

Navigating the Filing Process: A Step-by-Step Guide

Filing state taxes in Maryland involves a series of steps, from gathering necessary documentation to submitting your tax return. Here’s a simplified breakdown of the process:

- Gather Your Documents: Collect all the necessary documents, including W-2 forms, 1099 forms, business income statements, and any other relevant financial records.

- Determine Your Tax Liability: Calculate your taxable income and the corresponding tax amount. This involves considering your income sources, deductions, and credits.

- Choose Your Filing Method: Maryland offers several filing options, including online filing through the state’s website, paper filing, and electronic filing for businesses.

- Prepare Your Tax Return: Use the appropriate tax forms and guidelines to prepare your tax return. Ensure that you fill out all sections accurately and completely.

- Review and Sign Your Return: Carefully review your completed tax return for any errors or omissions. Once satisfied, sign and date the return.

- Submit Your Return: Choose your preferred submission method. Online filing is generally the fastest and most convenient option, but paper filing is also an option for those without internet access.

- Track Your Refund or Payment: If you’re due a refund, you can track its status online. If you owe taxes, you’ll need to arrange for payment using one of the state’s approved payment methods.

Maryland’s Online Filing System: A Convenient Option

Maryland’s online filing system, known as eFile Maryland, offers a user-friendly platform for residents and businesses to file their state taxes. This system provides a secure and efficient way to complete and submit tax returns, with features like:

- Step-by-step guidance through the filing process

- Real-time error checking to ensure accuracy

- The ability to save your progress and return later

- Secure payment options for any taxes owed

- Quick refund processing for eligible returns

Payment Options: Choosing the Right Method

Maryland offers a variety of payment methods for taxpayers to settle their state tax liabilities. These options are designed to accommodate different preferences and financial situations. Here’s an overview of the available payment methods:

Online Payment Options

- Credit Card: Pay your taxes using a major credit card, such as Visa, MasterCard, American Express, or Discover. A convenience fee applies, but this method offers the convenience of immediate payment.

- Electronic Check (eCheck): Pay using an electronic check drawn on a U.S. bank account. This method is fee-free and can be completed online through the state’s payment portal.

Paper Payment Options

- Check or Money Order: Send a check or money order made payable to the Comptroller of Maryland along with your return. Ensure that you include your tax account number or Social Security number for proper processing.

Other Payment Methods

- Pay by Phone: Taxpayers can call a toll-free number to pay their taxes using a credit card or electronic check. This method is convenient for those without internet access or who prefer a more personal payment option.

- Installment Agreements: For taxpayers who are unable to pay their tax liability in full, Maryland offers installment agreement options. This allows taxpayers to pay their liability over time with interest.

- Tax Refund Offset: Maryland taxpayers who owe past-due child support or certain other debts may have their state tax refund offset to pay off these debts.

Strategies for Effective Tax Management

Managing your state taxes effectively can help you avoid penalties, maximize deductions, and ensure compliance with Maryland’s tax laws. Here are some strategies to consider:

Stay Informed About Tax Changes

Maryland’s tax laws and regulations can change from year to year. Staying informed about these changes can help you adjust your tax planning strategies accordingly. The Comptroller of Maryland’s website is a valuable resource for the latest tax information and updates.

Utilize Deductions and Credits

Maryland offers various deductions and credits that can reduce your taxable income or tax liability. Examples include the Maryland Homesteader’s Tax Credit, the Maryland Personal Property Tax Credit, and deductions for certain medical expenses. Understanding and utilizing these deductions can significantly impact your tax burden.

Consider Tax Planning Throughout the Year

Tax planning isn’t just a year-end activity. By considering tax implications throughout the year, you can make more informed financial decisions. This might include adjusting your withholding allowances, contributing to tax-advantaged retirement accounts, or taking advantage of tax-efficient investment strategies.

Seek Professional Assistance

For complex tax situations or if you’re unsure about the best strategies for your specific circumstances, consider seeking professional advice. Tax professionals, such as CPAs or enrolled agents, can provide personalized guidance and ensure that you’re taking full advantage of the tax benefits available to you.

Performance Analysis: Maryland’s Tax System in Action

Maryland’s tax system has a significant impact on the state’s economy and its residents’ financial well-being. Here’s a closer look at how the system performs in key areas:

Revenue Generation

Maryland’s tax system generates substantial revenue for the state, funding a wide range of public services and initiatives. In the fiscal year 2022, the state collected over $20 billion in taxes, with income tax and sales tax being the primary revenue sources.

| Tax Type | Revenue (in billions) |

|---|---|

| Income Tax | $11.5 |

| Sales and Use Tax | $4.8 |

| Corporate Income Tax | $1.5 |

| Other Taxes | $2.2 |

Economic Impact

Maryland’s tax system plays a crucial role in the state’s economic landscape. The progressive income tax structure, for instance, helps distribute the tax burden more equitably, ensuring that higher-income earners contribute a larger share. This approach can promote economic fairness and support essential public services.

Compliance and Enforcement

The Comptroller of Maryland actively enforces tax laws to ensure compliance. This includes audits, investigations, and enforcement actions to deter tax evasion and ensure that all taxpayers contribute their fair share. The state’s tax enforcement efforts are designed to maintain a level playing field for businesses and individuals alike.

Taxpayer Services and Support

Maryland’s tax authorities provide a range of services and resources to assist taxpayers. This includes online tools for filing and payment, guidance on tax laws and regulations, and assistance for taxpayers facing financial difficulties. The state also offers tax amnesty programs periodically to encourage voluntary compliance and provide relief to taxpayers.

Conclusion: Navigating Maryland’s Tax Landscape

Maryland’s state tax system is a critical component of the state’s fiscal framework, impacting residents, businesses, and the overall economy. Understanding the system’s intricacies, from the types of taxes to the payment options and strategies available, is essential for effective tax management.

By staying informed about tax changes, utilizing deductions and credits, and considering tax implications throughout the year, taxpayers can minimize their tax burden and ensure compliance with state laws. The state's online filing system and diverse payment options also make the tax filing and payment process more accessible and convenient.

As you navigate Maryland's tax landscape, remember that effective tax management is an ongoing process. Stay updated with the latest tax news, seek professional guidance when needed, and leverage the resources provided by the Comptroller of Maryland to ensure a smooth and successful tax experience.

Frequently Asked Questions

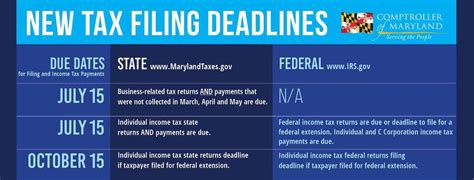

What is the deadline for filing Maryland state taxes?

+The deadline for filing Maryland state taxes typically aligns with the federal tax deadline, which is usually April 15th. However, it’s important to note that this deadline can change depending on the day of the week and other factors. It’s recommended to check the official Comptroller of Maryland website for the most up-to-date information on tax deadlines.

Can I file my Maryland state taxes online?

+Yes, Maryland offers an online filing system called eFile Maryland. This user-friendly platform allows residents and businesses to file their state taxes securely and efficiently. It provides step-by-step guidance, real-time error checking, and the ability to save progress for later completion.

What payment methods are accepted for Maryland state taxes?

+Maryland offers a variety of payment methods to accommodate different preferences and financial situations. These include online payment options like credit card and electronic check, as well as paper payment options such as check or money order. There are also options for phone payments, installment agreements, and tax refund offsets.

Are there any tax credits or deductions available in Maryland?

+Yes, Maryland offers a range of tax credits and deductions to reduce taxable income or tax liability. Some examples include the Maryland Homesteader’s Tax Credit, the Maryland Personal Property Tax Credit, and deductions for certain medical expenses. It’s important to explore these options to take full advantage of the available tax benefits.

How can I stay informed about changes to Maryland’s tax laws and regulations?

+To stay informed about changes to Maryland’s tax laws and regulations, it’s recommended to regularly check the official Comptroller of Maryland website. This website provides the latest updates, news, and guidance on tax-related matters. Additionally, you can subscribe to their email updates or follow their social media channels for timely notifications.