Sales Tax Sc

In the realm of e-commerce, the Sales Tax Sc, or Sales Tax Scam, has emerged as a complex and evolving issue that has caught the attention of businesses and consumers alike. This deceptive practice, often orchestrated by fraudulent entities, has become a significant concern in the online retail landscape, impacting not only legitimate businesses but also unsuspecting shoppers.

Unraveling the Sales Tax Scam

The Sales Tax Scam is a sophisticated ploy designed to exploit the intricacies of sales tax laws and online transactions. Fraudsters create fake online stores, meticulously mimicking the appearance and functionality of legitimate e-commerce platforms. These counterfeit websites often offer enticing deals and promotions, luring customers with the promise of significant savings.

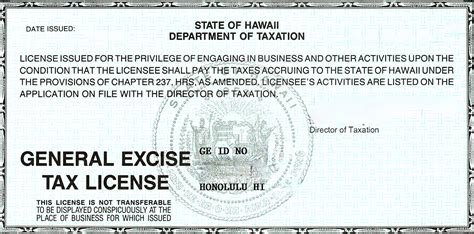

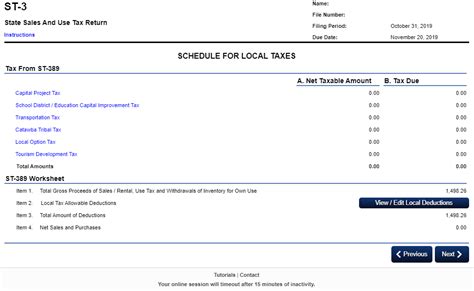

When a customer makes a purchase on one of these fraudulent sites, they are typically charged the advertised price, but the sales tax is either omitted or underreported. The scam operates by diverting the sales tax funds intended for the government to the fraudulent entity's accounts. This not only results in financial loss for the government but also creates a misleading perception of lower prices, attracting more customers and further perpetuating the scam.

One of the key challenges in combating this scam is the difficulty in identifying these fraudulent websites. They often employ tactics such as using domain names similar to established brands, making it hard for consumers to differentiate between the real and fake platforms. Additionally, the scammers continuously create new websites and adapt their strategies to stay one step ahead of law enforcement and consumer protection agencies.

Impact on Businesses and Consumers

The repercussions of the Sales Tax Scam are far-reaching and affect both businesses and consumers. For legitimate e-commerce businesses, this scam creates an uneven playing field. Customers may be drawn to the lower prices offered by fraudulent sites, leading to a loss of sales and potential damage to the brand’s reputation. Moreover, the perception of price disparity can erode consumer trust, making it challenging for honest businesses to maintain their customer base.

Consumers, on the other hand, face significant risks. Aside from the obvious financial loss from paying less sales tax than they should, there are potential consequences for their personal data. Fraudulent websites often collect sensitive information such as names, addresses, and payment details, which can be used for identity theft or sold on the dark web. Furthermore, the products purchased from these sites may be of inferior quality or even counterfeit, leaving consumers with subpar goods and no recourse for refunds or replacements.

Strategies to Combat the Scam

Addressing the Sales Tax Scam requires a multi-faceted approach involving various stakeholders, including government agencies, e-commerce platforms, and consumers.

Enhanced Consumer Education

Educating consumers about the existence and tactics of the Sales Tax Scam is crucial. By raising awareness, consumers can become more vigilant when shopping online, paying closer attention to domain names, pricing discrepancies, and the overall legitimacy of the website. Encouraging consumers to report suspicious activities can also aid in identifying and shutting down these fraudulent platforms.

Improved Verification Processes

E-commerce platforms and payment gateways can implement more rigorous verification processes to identify and flag potential fraudulent activities. This includes employing advanced algorithms to detect suspicious patterns, such as unusual sales tax behaviors or rapid changes in pricing structures. By integrating these measures into their systems, legitimate businesses can better protect themselves and their customers.

Strengthened Legal Framework

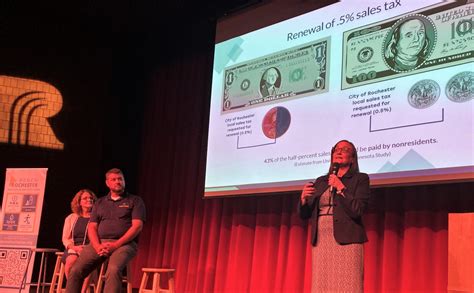

Governments and regulatory bodies play a vital role in combating this scam. By updating and strengthening sales tax laws and regulations, authorities can make it more challenging for fraudulent entities to operate. This includes implementing stricter penalties for sales tax evasion and providing clearer guidelines for online retailers regarding their sales tax obligations.

Collaboration Between Stakeholders

Collaboration between e-commerce platforms, payment processors, and law enforcement agencies is essential. By sharing data and intelligence, these stakeholders can identify patterns, track down fraudulent entities, and shut down their operations. Regular communication and information sharing can significantly enhance the effectiveness of anti-fraud measures.

Real-World Examples and Impact Analysis

The Sales Tax Scam has had a notable impact on various industries, with several high-profile cases highlighting its reach and consequences.

Case Study: Fashion Industry

In the fashion industry, a popular online retailer, known for its trendy and affordable clothing, was found to be involved in a Sales Tax Scam. The retailer was charging customers the advertised price but failing to remit the full sales tax to the government. This resulted in a significant loss of revenue for the state and a potential reputation hit for the brand.

As a result of this incident, the state government implemented stricter regulations, requiring online retailers to provide more detailed sales tax reports. This case also served as a wake-up call for consumers, who became more cautious about online shopping, particularly with new and unfamiliar brands.

Impact on Small Businesses

Small businesses operating online are particularly vulnerable to the Sales Tax Scam. With limited resources and a need to remain competitive, they may find it challenging to implement robust verification measures. As a result, they can become targets for fraudulent activities, leading to financial losses and potential business closures.

To support small businesses, industry associations and government agencies have started offering resources and guidance on sales tax compliance and fraud prevention. This includes providing access to affordable verification tools and educating business owners about the latest scam tactics.

The Future of Sales Tax Compliance

Looking ahead, the landscape of sales tax compliance is expected to evolve significantly, driven by technological advancements and changing consumer behaviors.

Role of AI and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) technologies are expected to play a pivotal role in combating the Sales Tax Scam. These technologies can analyze vast amounts of data, identify patterns, and detect anomalies in sales tax behaviors. By leveraging AI-powered tools, e-commerce platforms and government agencies can enhance their ability to identify and shut down fraudulent activities.

Blockchain Integration

The integration of blockchain technology into sales tax systems offers a promising solution. Blockchain’s immutable ledger and smart contract capabilities can ensure transparent and secure sales tax transactions. By utilizing blockchain, governments can track sales tax payments in real-time, reducing the opportunities for fraud and increasing transparency in the process.

Enhanced Consumer Protection

As the Sales Tax Scam continues to evolve, consumer protection measures will need to keep pace. This includes implementing more robust dispute resolution mechanisms and providing consumers with better access to information about the legitimacy of online retailers. By empowering consumers with knowledge and resources, they can make informed decisions and protect themselves from fraudulent activities.

Conclusion: A Collaborative Effort

The Sales Tax Scam is a complex and evolving challenge that requires a collaborative effort from all stakeholders. By combining consumer education, technological advancements, and strengthened legal frameworks, we can create a more secure and transparent e-commerce environment. Ultimately, the goal is to protect both businesses and consumers, ensuring a fair and trustworthy online marketplace.

How can consumers protect themselves from the Sales Tax Scam?

+Consumers can protect themselves by being vigilant and aware of potential scams. Always check the website’s URL and ensure it matches the legitimate brand. Look for trust seals or security certifications. Compare prices with other reputable retailers, and if a deal seems too good to be true, it probably is. Additionally, regularly review your bank statements and report any suspicious activities to your financial institution.

What steps are being taken by e-commerce platforms to prevent the Sales Tax Scam?

+E-commerce platforms are implementing advanced fraud detection systems, using AI and ML to identify suspicious activities. They are also collaborating with payment processors and law enforcement agencies to share information and track down fraudulent entities. Additionally, some platforms are introducing seller verification processes to ensure the legitimacy of sellers on their platforms.

How can small businesses protect themselves from becoming victims of the Sales Tax Scam?

+Small businesses can educate themselves about sales tax compliance and stay updated on the latest scam tactics. They can utilize affordable verification tools and seek guidance from industry associations or government agencies. Additionally, implementing robust security measures and regularly monitoring their online presence can help identify and mitigate potential risks.

What are the potential legal consequences for individuals involved in the Sales Tax Scam?

+Individuals involved in the Sales Tax Scam can face serious legal consequences, including fines, imprisonment, and civil lawsuits. The exact penalties vary depending on the jurisdiction and the severity of the offense. In some cases, individuals may also be subject to asset forfeiture and permanent bans from operating in the e-commerce industry.