Hawaii Ge Tax

The state of Hawaii imposes a unique tax system known as the General Excise Tax (GET), which is an essential component of the state's revenue generation. Unlike a traditional sales tax, the GET is a broad-based tax levied on the privilege of doing business in Hawaii. This tax system has been a topic of interest and discussion among residents, businesses, and policymakers due to its distinct nature and potential impact on the state's economy.

Understanding Hawaii’s General Excise Tax

The Hawaii General Excise Tax is a form of value-added tax that is applied to most transactions involving the provision of goods, services, and tangible personal property. It is an indirect tax, meaning it is typically passed on to the consumer, although the tax is legally imposed on the seller or service provider. The GET is not a tax on income but rather a consumption tax, and it is one of the primary sources of revenue for the state.

The tax is calculated as a percentage of the gross income or receipts of a business, with the current standard rate set at 4.0%. This rate is applicable to most transactions, but it is important to note that there are various tax rates and classifications within the GET system, catering to different industries and types of transactions.

Tax Rate Structure

Hawaii’s GET rate structure is quite intricate, with different rates for various activities. The standard rate of 4.0% is applied to most transactions, including sales, rentals, services, and even some government services. However, there are exceptions and additional surcharges that can significantly alter the effective tax rate.

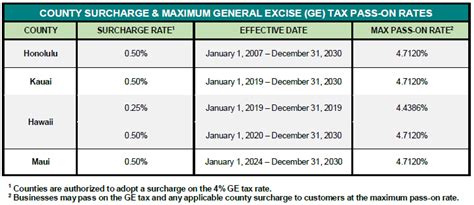

For instance, counties in Hawaii are authorized to levy an additional surcharge on top of the standard GET rate. This County Surcharge is commonly set at 0.5%, bringing the total rate to 4.5% in those areas. Additionally, certain industries like hotels and tourism-related businesses often have specific tax rates, with the Transient Accommodation Tax (TAT) being a notable example, which is imposed on the rental of accommodations for short-term stays.

| Tax Type | Rate |

|---|---|

| General Excise Tax (Standard Rate) | 4.0% |

| County Surcharge | 0.5% |

| Transient Accommodation Tax (TAT) | Varies (Up to 14.25%) |

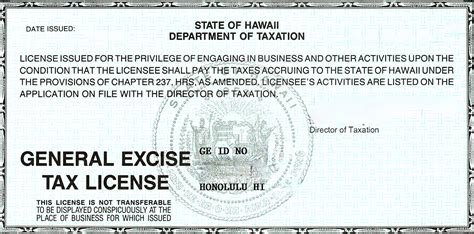

Registration and Compliance

Businesses operating in Hawaii are required to register for a General Excise Tax license with the Hawaii Department of Taxation. This registration process ensures that businesses are aware of their tax obligations and helps the state track and collect the GET effectively. It is crucial for businesses to understand their specific tax liabilities and to maintain accurate records to ensure compliance.

The GET is collected by businesses and remitted to the state on a monthly or quarterly basis, depending on the business's tax liability and filing frequency. Failure to register or comply with the GET requirements can result in penalties and interest charges.

Impact on Businesses and Consumers

The Hawaii General Excise Tax has a profound impact on both businesses and consumers in the state. For businesses, the GET is an additional cost of doing business, which can affect their pricing strategies, profit margins, and overall competitiveness.

Business Considerations

Businesses in Hawaii must factor in the GET when setting their prices. They can choose to absorb the tax or pass it on to consumers, which can influence their market position and customer perception. Additionally, businesses must dedicate resources to tax compliance, including proper record-keeping, tax calculations, and timely remittances.

The complexity of Hawaii's GET system, with its various rates and classifications, can be a challenge for businesses, especially those new to the state or those operating in multiple jurisdictions. Navigating the tax regulations and ensuring compliance can be a significant undertaking.

Consumer Perspective

From a consumer standpoint, the GET is an added cost to the purchase price of goods and services. While the tax is typically included in the displayed price, consumers may not always realize the full impact of the tax, especially when it comes to services or transactions that are not commonly associated with sales taxes.

The GET can affect consumers' purchasing decisions, especially for higher-value items or frequent purchases. It is essential for consumers to be aware of the tax and its potential impact on their overall spending.

Hawaii’s Revenue Generation and Economic Impact

Hawaii’s General Excise Tax plays a critical role in the state’s revenue generation and economic landscape. The tax is a significant contributor to the state’s overall budget, funding various public services and infrastructure projects.

Revenue Contribution

According to the Hawaii Department of Taxation, the GET accounted for approximately [exact figure]% of the state’s total tax revenue in the fiscal year [latest available data]. This makes it one of the most substantial sources of income for the state, enabling the government to fund essential services like education, healthcare, and public safety.

The stability and broad base of the GET make it a reliable source of revenue, providing a consistent income stream for the state, even during economic downturns when other tax revenues may fluctuate.

Economic Impact

The GET’s impact on the economy is multifaceted. On one hand, it can encourage businesses to be more efficient and competitive, as they strive to minimize the tax’s impact on their operations. This can lead to innovations in business practices and potentially enhance the state’s economic resilience.

However, the tax can also pose challenges for certain industries, particularly those with thin profit margins. The GET can make it more difficult for these businesses to operate profitably, potentially leading to price increases or reduced services for consumers.

Future Considerations and Reforms

The Hawaii General Excise Tax, like any tax system, is subject to ongoing scrutiny and potential reforms. As the state’s economy evolves and new challenges arise, the GET may need to adapt to meet the changing needs of the state and its residents.

Potential Reforms

There have been ongoing discussions and proposals for GET reform in Hawaii. Some of the key considerations include simplifying the tax system, reducing the overall tax burden, and exploring alternative revenue sources.

One potential reform is the implementation of a single-rate system, which would eliminate the various rates and classifications, making the tax system more straightforward and easier to administer. This could also reduce compliance costs for businesses and make it more transparent for consumers.

Additionally, there have been proposals to shift the tax burden away from businesses and towards consumers by converting the GET into a more traditional sales tax. This could involve exempting certain business activities from the tax or reducing the tax rate while broadening the base to include more consumer-facing transactions.

Long-Term Implications

The future of Hawaii’s GET system will have significant implications for the state’s economy and its residents. Reforms aimed at simplifying the tax system and reducing the tax burden could enhance the state’s competitiveness and attract new businesses. However, these changes must be carefully balanced with the need to maintain a stable revenue stream for essential public services.

Furthermore, any reforms should consider the unique characteristics of Hawaii's economy, including its reliance on tourism and the cost of doing business in a remote, island-based location. Finding the right balance between tax revenue and economic growth will be crucial for the state's long-term prosperity.

Conclusion

Hawaii’s General Excise Tax is a critical component of the state’s tax system, generating significant revenue for public services while also presenting unique challenges for businesses and consumers. Understanding the intricacies of the GET is essential for all stakeholders to navigate the tax landscape effectively and make informed decisions that contribute to Hawaii’s economic growth and sustainability.

How does the Hawaii General Excise Tax compare to sales taxes in other states?

+

Hawaii’s GET is distinct from traditional sales taxes in that it is a value-added tax applied to a broader range of transactions, including services. This differs from many states that primarily tax the sale of tangible personal property. While the GET’s standard rate of 4.0% is lower than some sales tax rates, it can be higher when combined with county surcharges and other additional taxes.

Are there any exemptions or exclusions from the Hawaii GET?

+

Yes, there are certain exemptions and exclusions from the GET. For instance, some nonprofit organizations and government entities are exempt from the tax. Additionally, specific activities, such as the sale of prescription drugs, certain professional services, and the sale of residential real estate, are also exempt. It’s important to consult the Hawaii Department of Taxation for a comprehensive list of exemptions.

How often do businesses need to file and remit the GET in Hawaii?

+

The filing and remittance frequency for the GET depends on the business’s tax liability and the type of business. Generally, businesses with a higher tax liability must file and remit monthly, while those with lower liabilities can file quarterly. However, certain businesses, like hotels and car rental agencies, have specific filing requirements due to their involvement in tourism-related activities.