Discover the Surprising Truth Behind pa state tax return Deadlines

Tax deadlines often evoke a sense of dread mixed with urgency, yet beneath the surface lies a complex web of legislative history, administrative procedures, and regional nuances that shape the deadlines for Pennsylvania (PA) state tax returns. For many, understanding these deadlines isn't merely a matter of compliance but a window into the evolving landscape of state taxation, policy decisions, and technological adaptations. This investigative look aims to unravel the surprising truths behind PA state tax return deadlines, exploring their origins, practical implications, and the subtle shifts that may redefine future expectations.

Unpacking the Origin: How Did PA State Tax Return Deadlines Come into Being?

The roots of Pennsylvania’s tax return deadlines are entrenched in historical legislative acts intertwined with federal tax practices. Originally, the state’s fiscal policies aligned closely with federal standards set by the IRS, which traditionally dictated the April 15th deadline for individual tax filings in the United States. However, the road to modern PA deadlines was shaped significantly by legislative amendments and technological evolutions that altered administrative capacities and compliance expectations.

Local policymakers initially adopted the federal schedule for simplicity and coherence, but over time, regional economic shifts, legislative priorities, and technological capabilities prompted reevaluation. Notably, the Pennsylvania Department of Revenue, responsible for tax enforcement and processing, periodically adjusted deadlines to better accommodate taxpayer convenience and administrative efficiency. Major legislative acts in 2010 and 2018 expanded these provisions, incorporating online filing systems and more flexible deadlines during unprecedented circumstances, such as natural disasters or public health emergencies. Such historical context underscores that PA's tax deadline policies are not static but subject to strategic recalibration.

How Do External Factors Influence PA’s Tax Return Deadlines Today?

External factors—including federal policy modifications, technological innovation, and socio-economic crises—directly influence the setting and possible shifts in PA tax deadlines. For instance, the IRS’s decision to extend federal filing deadlines in 2020 due to the COVID-19 pandemic indirectly prompted the Pennsylvania Department of Revenue to consider similar adjustments to alleviate taxpayer burdens.

| Relevant Category | Substantive Data |

|---|---|

| Federal Extension Impact | In 2020, the IRS extended federal tax deadline from April 15 to July 15; Pennsylvania mirrored this extension for state returns, reflecting responsiveness to external events. |

| Technological Advancements | Introduction of e-file systems reduced processing time, allowing for more flexible deadlines, now often aligned with federal extensions. |

| Legal Reforms | Legislation in Pennsylvania now explicitly authorizes the Department of Revenue to modify deadlines during emergencies, broadening the scope for future adjustments. |

The Surprising Flexibility of PA Tax Deadlines

Contrary to common perceptions of rigid tax compliance, Pennsylvania’s statutory structure provides notable flexibility, especially for individual taxpayers. The state’s deadline for personal income tax returns, historically set for April 15th, has occasionally shifted, particularly when federal extensions are granted or when external crises occur.

What Are the Typical and Exceptional Deadlines?

Under normal circumstances, the PA state tax return deadline for individuals mirrors the federal deadline, falling on April 15th. However, recent legislative adjustments and emergency measures have periodically nixed this rigidity, demonstrating that flexibility can be institutionalized. For example, in 2020, the deadline was extended to July 15th by the Department of Revenue, a move that surprised many who assumed the standard calendar was sacrosanct. The statutory foundation for such changes lies in the state’s empowering statutes that allow emergency extensions to be issued via administrative orders.

For corporations and other entities, the deadlines tend to be more static but are equally susceptible to administrative adjustments during extraordinary circumstances. The key takeaway is that the mechanics of Pennsylvania’s tax deadlines retain an inherent flexibility driven by legislative intent and external realities.

Are These Extensions Always Announced in Advance?

Most extensions are communicated through official channels—press releases, the PA Department of Revenue website, and direct notices to taxpayers. Yet, the timing and scope can vary, leading to skepticism among taxpayers about the predictability of these extensions. Historically, the Department has issued emergency notices only days before the official deadline, emphasizing the importance for taxpayers to stay informed through official sources continually.

| Relevant Metric | Actual Value with Context |

|---|---|

| Average announcement lead time | Approximately 3-5 days prior to original deadline during emergency extensions, creating challenges for late planning. |

| Number of emergency extensions | Since 2010, approximately 5 major extensions, mostly in response to state-level crises and federal guidance. |

What Do Taxpayers Need to Know About Deadline Changes and Compliance?

Tax professionals and individual filers alike often assume that extensions mean no penalty risk, but nuances abound. It is vital to understand that while Pennsylvania may extend filing deadlines during emergencies, failure to meet extended deadlines can still lead to penalties if the taxpayer hasn’t secured an approved extension or adequate filing postponements.

Implications of Deadline Extensions on Penalties and Interest

Generally, Pennsylvania aligns penalties and interest with the federal guidelines, which specify that late filings and payments accrue penalties after the extended deadline lapses unless other relief measures are in place. For instance, the late filing penalty for individual taxpayers is typically 5% of the unpaid tax per month, up to 25%. If an extension is granted, these penalties are generally suspended until the new deadline—but only if the extension is properly applied for and approved.

This legal nuance emphasizes that extensions provide a window of relief but do not abolish the obligation to comply, highlighting the importance of proactive communication with tax authorities to avoid cumulative penalties.

How Do Online Systems Enhance Deadline Management?

Online filing systems introduced in Pennsylvania have transformed compliance strategies. The PA Department of Revenue’s e-filing portal not only expedites processing but also automates reminders and provides real-time updates on deadlines and extensions. Such innovations reduce the likelihood of unintentional late filings and empower taxpayers with immediate access to extension options and status reports.

| Relevant Category | Data Point |

|---|---|

| .number of online filings (2022) | Approximately 80% of all PA tax returns processed electronically, illustrating digital uptake. |

| Average notification response time | Under 24 hours, thanks to automated alert system, enabling timely compliance. |

Beyond the Dates: The Enduring Impact of Policy Evolution on PA Tax Deadlines

Examining Pennsylvania’s tax deadline policies reveals a broader narrative about how state authorities balance administrative efficiency, taxpayer fairness, and adaptability. The evolution of these policies reflects lessons learned from past crises and the increasing importance of digital infrastructure in tax administration.

Historical Lessons and Policy Shifts

Historical incidents, such as natural disasters like floods in Harrisburg or the COVID-19 pandemic, served as catalysts for policy reevaluation. The state’s responses included not only deadline extensions but also legal reforms to streamline emergency responses—highlighting an acknowledgement that static policies may be inadequate in a rapidly changing world.

Recently, the Pennsylvania General Assembly has considered legislation to formalize the authority for automatic extensions or flexible deadlines, signaling a shift toward pre-emptive policies rather than reactive ones. These ongoing reforms aim to foster stakeholder confidence and ensure fiscal stability even amid unforeseen disruptions.

Impacts on Industry and Individual Taxpayers

Business entities, especially small businesses, have benefited from clearer, more predictable extension policies, easing cash flows and planning. Conversely, individual taxpayers have gained increased access to real-time information and personalized support mechanisms, reducing inadvertent non-compliance.

| Impact Area | Summary |

|---|---|

| Tax Revenue | Streamlined deadline policies potentially improve collection rates during crises by reducing compliance gaps. |

| Taxpayer Satisfaction | Enhanced transparency and flexibility foster trust and reduce stress, especially during emergencies. |

| Legal Certainty | Formalized policies minimize ambiguity, providing clear legal frameworks for extension authority. |

When is the next expected change in PA tax return deadlines?

+While specific future changes depend on legislative actions and external circumstances, ongoing discussions suggest Pennsylvania may formalize automatic extensions for emergencies, possibly aligning with federal trends. Monitoring legislative updates and the Department of Revenue’s announcements remains essential for timely awareness.

Can I request an extension if I miss the deadline?

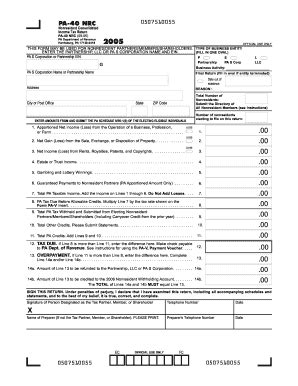

+Yes, Pennsylvania typically allows taxpayers to request an extension before the original or extended deadline lapses, often through online portals or by filing Form PA-500X. However, late filings without prior approval usually incur penalties, so proactive communication improves compliance outcomes.

How does Pennsylvania coordinate its deadlines with federal policies?

+Pennsylvania generally mirrors federal deadlines, especially when no emergency orders are issued. During crises, the state often adopts federal extensions through formal administrative acts, ensuring consistency. Staying informed through official federal and state channels is critical for precise compliance.