Va Sales Tax Rate

The Virginia sales tax rate is an essential aspect of doing business in the state and understanding its intricacies is crucial for businesses and consumers alike. This article aims to provide an in-depth analysis of the Va Sales Tax Rate, its variations, and its impact on the economy. By delving into the specifics, we can offer a comprehensive guide to this critical aspect of Virginia's tax system.

Understanding the Basics of Virginia’s Sales Tax

The sales tax in Virginia, often referred to as the Va Sales Tax, is a consumption tax levied on the sale of goods and certain services within the state. It is a critical source of revenue for the state government, contributing significantly to the overall budget. The tax is applied at various stages of production and distribution, impacting both businesses and consumers.

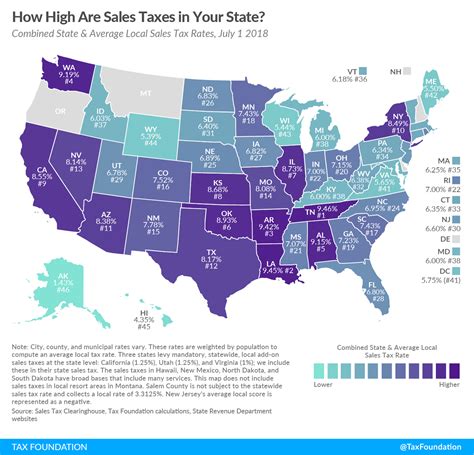

The Va Sales Tax is a combined tax, meaning it includes both the state-level sales tax and any applicable local or regional taxes. This combination results in a unique tax rate for each jurisdiction within the state. The state sales tax rate is set at the state level, while local governments have the authority to impose additional taxes, creating a complex web of tax rates across Virginia.

Key Components of the Va Sales Tax

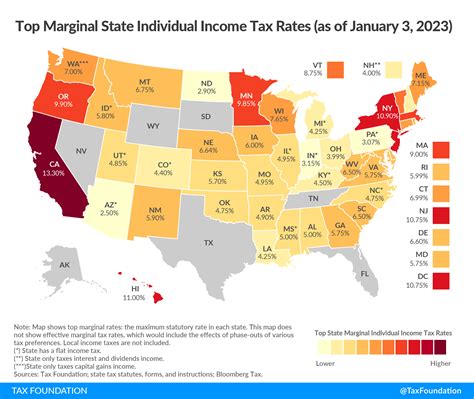

Understanding the Va Sales Tax requires a grasp of its key components. These include the base state sales tax rate, local add-on rates, and any applicable special taxes or exemptions. The base state sales tax rate is a uniform percentage applied across the state, currently set at 4.3%. Local governments, such as counties and cities, have the authority to impose additional taxes, with rates varying widely across the state. These local add-on rates can significantly impact the overall sales tax burden.

| Tax Component | Rate |

|---|---|

| Base State Sales Tax | 4.3% |

| Local Add-On Taxes | Varies by Jurisdiction |

In addition to these core components, there are specific exemptions and special taxes that apply to certain goods and services. For instance, certain food items, prescription drugs, and select services are exempt from the Va Sales Tax. Conversely, there are additional taxes levied on certain products like alcohol and tobacco.

How the Va Sales Tax Rate is Determined

The determination of the Va Sales Tax Rate is a collaborative effort between the state government and local authorities. The base state sales tax rate is set by the Virginia General Assembly and is a crucial component of the state’s revenue stream. Local governments, however, have the autonomy to impose additional taxes, reflecting their unique financial needs and priorities.

The process of setting the Va Sales Tax Rate involves a careful balance between revenue generation and economic considerations. The state and local governments aim to strike a balance that promotes economic growth while also ensuring sufficient revenue for essential services. This balance can be delicate, especially in times of economic fluctuation.

Factors Influencing Sales Tax Rates

Several factors come into play when determining the Va Sales Tax Rate, including economic conditions, budget requirements, and political priorities. During periods of economic growth, there might be a tendency to maintain or reduce tax rates to encourage spending and investment. Conversely, in times of economic downturn, tax rates might be adjusted to generate more revenue for critical services.

The specific needs and priorities of local communities also play a significant role. For instance, a city with a robust tourism industry might opt for a higher sales tax rate to support infrastructure and tourism-related initiatives. On the other hand, a rural community might choose a lower rate to encourage economic development and retain businesses.

The interplay of these factors results in a diverse range of sales tax rates across Virginia, with some jurisdictions having rates as low as 4.3% (the base state rate) and others reaching upwards of 7% or more with local add-ons.

| Jurisdiction | Sales Tax Rate |

|---|---|

| Arlington County | 6.0% |

| City of Alexandria | 5.3% |

| Fairfax County | 4.3% |

| Loudoun County | 6.0% |

| Prince William County | 5.3% |

Impact of Va Sales Tax on the Economy

The Va Sales Tax has a significant impact on the Virginia economy, influencing consumer spending, business operations, and the overall fiscal health of the state. It is a critical tool for managing the state’s finances and directing resources towards essential services and infrastructure development.

Effects on Consumer Behavior

The sales tax directly affects consumer spending habits. Higher tax rates can discourage spending, particularly on non-essential items, as consumers become more conscious of the added cost. On the other hand, lower tax rates can stimulate spending, leading to increased economic activity and potentially attracting more businesses to the state.

The impact of the Va Sales Tax on consumer behavior can vary depending on individual circumstances. For instance, residents of areas with high sales tax rates might opt to shop online or in neighboring jurisdictions with lower rates, impacting local businesses. Conversely, residents of areas with lower rates might have more disposable income, leading to increased local spending.

Implications for Businesses

Businesses operating in Virginia are directly impacted by the Va Sales Tax, both as taxpayers and as entities affected by consumer behavior. The tax adds a layer of complexity to business operations, requiring careful tax compliance and potentially influencing business location decisions.

For businesses, the Va Sales Tax can impact profitability, particularly for those with a physical presence in multiple jurisdictions. Navigating the varying tax rates and compliance requirements can be a challenge, especially for small businesses with limited resources. Additionally, businesses might need to factor in the impact of sales tax on their pricing strategies and overall business model.

State and Local Revenue Generation

The Va Sales Tax is a vital source of revenue for both the state and local governments. The tax contributes significantly to the state’s budget, funding essential services such as education, healthcare, and infrastructure development. Local governments also rely on sales tax revenue to fund their operations and initiatives.

The revenue generated through the Va Sales Tax can vary significantly across the state, reflecting the diverse economic landscapes of different regions. Areas with higher sales tax rates and robust economic activity tend to generate more revenue, providing a financial boost to local governments and their communities.

Future Implications and Potential Changes

As Virginia’s economy continues to evolve, the Va Sales Tax is likely to undergo changes and adaptations to meet the state’s fiscal needs and economic realities. The dynamic nature of the tax system means that businesses and consumers must stay informed and adaptable to navigate these changes effectively.

Potential Reforms and Adjustments

The Virginia government periodically reviews its tax system, including the Va Sales Tax, to ensure it remains fair, efficient, and aligned with the state’s economic goals. Potential reforms could include adjustments to the base state sales tax rate, changes to local add-on rates, or the introduction of new exemptions or special taxes.

These reforms aim to strike a balance between revenue generation and economic incentives. For instance, the state might consider reducing the base sales tax rate to stimulate economic activity, particularly in response to economic downturns. Alternatively, the state might opt to increase the rate to bolster revenue during periods of fiscal constraint.

Adapting to Economic Shifts

The Virginia economy is subject to various external factors, such as national economic trends, technological advancements, and demographic shifts. These factors can influence consumer behavior, business operations, and the overall economic landscape, necessitating adaptations to the Va Sales Tax system.

For instance, the growth of e-commerce has led to a shift in consumer spending patterns, impacting traditional brick-and-mortar businesses and their tax contributions. The state might need to consider adaptations to the tax system to ensure fairness and compliance in the digital age. Similarly, changes in consumer preferences and spending habits could warrant adjustments to tax rates and exemptions.

Long-Term Economic Planning

The Va Sales Tax is a critical component of Virginia’s long-term economic planning. The state government uses the revenue generated from sales tax to fund infrastructure projects, support education initiatives, and promote economic development. As such, the tax system must be adaptable to support these long-term goals.

The state might explore options such as tax incentives for specific industries or regions to encourage economic growth and job creation. Alternatively, the state could consider restructuring the tax system to promote fairness and simplicity, making it easier for businesses and consumers to navigate.

Conclusion

The Va Sales Tax is a complex and dynamic system that plays a crucial role in Virginia’s economy. Its impact extends to consumers, businesses, and the state’s fiscal health, making it a critical aspect of the state’s tax landscape. Understanding the intricacies of the Va Sales Tax Rate is essential for businesses and individuals alike, as it influences their financial decisions and contributions to the state.

As Virginia continues to evolve, the Va Sales Tax will likely undergo changes and reforms to meet the state's evolving needs. Staying informed about these changes is vital for businesses and consumers to adapt their strategies and ensure compliance with the evolving tax landscape.

How often are sales tax rates updated in Virginia?

+Sales tax rates in Virginia are typically updated annually, effective July 1st of each year. However, local jurisdictions may propose changes at other times, subject to approval.

Are there any special sales tax rates for specific industries in Virginia?

+Yes, Virginia has specific sales tax rates for certain industries, such as a lower rate for food and a higher rate for alcoholic beverages. These rates are set by the state and may vary depending on the product or service.

How can businesses stay informed about changes to the Va Sales Tax Rate?

+Businesses can stay informed by regularly checking the Virginia Department of Taxation’s website for updates. They can also sign up for email alerts and stay connected with industry associations and tax professionals for the latest information.