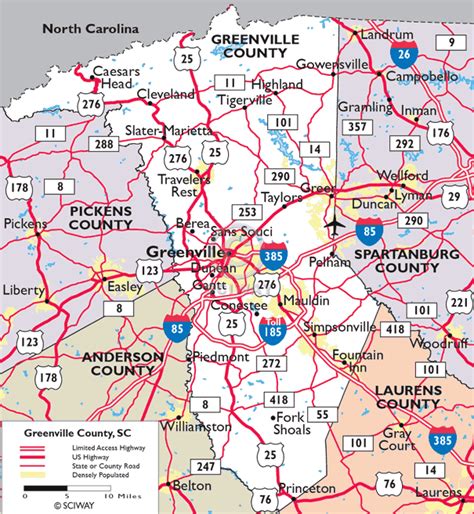

Greenville County Car Taxes

When it comes to car ownership, one aspect that often catches the attention of vehicle owners is the taxation system. In Greenville County, South Carolina, the car tax system is a key component of the local government's revenue stream, impacting both residents and visitors alike. Understanding the intricacies of Greenville County's car taxes is essential for anyone navigating the local automotive landscape.

The Fundamentals of Greenville County Car Taxes

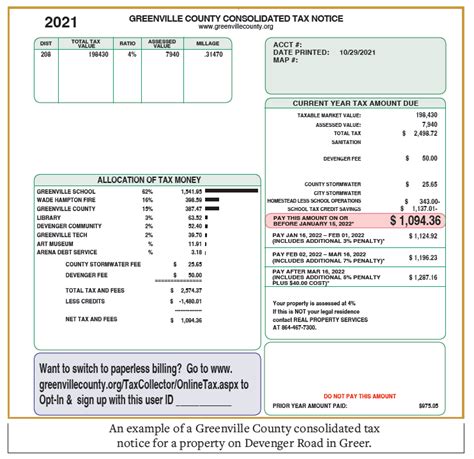

Greenville County imposes a vehicle property tax, also known as an ad valorem tax, on all privately owned vehicles registered within the county. This tax is calculated based on the assessed value of the vehicle and is a significant source of revenue for the county’s operations and infrastructure development.

The tax is levied annually, and the amount due is determined by multiplying the assessed value of the vehicle by the applicable tax rate. The assessed value is typically based on the vehicle's fair market value as determined by the South Carolina Department of Revenue. This value takes into account factors such as the vehicle's make, model, age, and condition.

Assessed Value Calculation

The assessed value of a vehicle is calculated using a specific formula that considers the vehicle’s original purchase price, depreciation rate, and any applicable adjustments. The formula is as follows:

| Assessed Value | = | Original Purchase Price | * | (1 - Depreciation Rate) |

|---|---|---|---|---|

| AV | = | OPP | * | (1 - DR) |

Here, AV represents the assessed value, OPP is the original purchase price, and DR is the depreciation rate. The depreciation rate is determined by the age of the vehicle and can vary annually.

For instance, if a vehicle was purchased for $30,000 and the depreciation rate for its age is 15%, the assessed value would be calculated as follows:

| Assessed Value | = | $30,000 | * | (1 - 0.15) |

|---|---|---|---|---|

| AV | = | $30,000 | * | 0.85 |

| AV | = | $25,500 |

Tax Rate and Due Dates

The tax rate for Greenville County car taxes is set by the county council and can vary annually. As of the latest assessment, the tax rate stands at 10.5 mills, which equates to 0.0105 per dollar of assessed value. Using the previous example, a vehicle with an assessed value of 25,500 would incur a tax of $267.75 (rounded to the nearest dollar) for the year.

The due date for Greenville County car taxes is typically in the early months of the year, with specific deadlines announced by the county government. Failure to pay by the due date may result in penalties and interest charges.

Exemptions and Discounts

Greenville County offers certain exemptions and discounts on car taxes to eligible individuals and vehicles. These provisions aim to alleviate the tax burden for specific groups and promote various initiatives.

Senior Citizen Exemption

Greenville County provides an exemption for senior citizens who meet specific criteria. To qualify, individuals must be at least 65 years old and have a total household income that falls below a certain threshold. The exemption amount is applied to the assessed value of the vehicle, effectively reducing the tax liability.

Disabled Veteran Discount

Veterans with a disability rating of 100% or higher are eligible for a discount on their car taxes in Greenville County. This discount is applied to the assessed value of the vehicle, similar to the senior citizen exemption. The discount amount is determined by the county and is subject to change annually.

Alternative Fuel Vehicle Incentive

To encourage the adoption of environmentally friendly vehicles, Greenville County offers a discount on car taxes for vehicles powered by alternative fuels. This includes electric vehicles (EVs), hybrid vehicles, and those running on natural gas or propane. The discount is typically a flat rate applied to the assessed value of the vehicle and is designed to offset the higher initial cost of these vehicles.

Online Payment and Registration

Greenville County has implemented an online platform for vehicle owners to manage their car tax payments and registration. This platform offers a convenient and efficient way to handle tax-related tasks, including the following:

- Payment Options: Vehicle owners can pay their car taxes online using various methods, such as credit/debit cards, e-checks, or electronic funds transfer (EFT). The platform provides a secure and user-friendly interface for making payments.

- Registration Renewal: The online system allows users to renew their vehicle registration without having to visit a physical location. Owners can update their registration information, pay the required fees, and receive their new registration documents electronically.

- Vehicle Assessment Information: Owners can access their vehicle's assessed value and tax calculation details through the online platform. This transparency helps owners understand the breakdown of their tax liability and make informed decisions.

- Exemption and Discount Applications: Eligible individuals can apply for exemptions or discounts online, streamlining the process and reducing paperwork. The platform guides users through the application process, ensuring they provide the necessary documentation.

Impact on the Community

The revenue generated from Greenville County car taxes plays a vital role in funding essential services and infrastructure projects within the community. A portion of the tax revenue is allocated to road maintenance and improvement, ensuring safe and efficient transportation networks for residents and businesses.

Additionally, the tax revenue contributes to various community development initiatives, such as public safety enhancements, educational programs, and recreational facilities. By investing in these areas, Greenville County aims to improve the overall quality of life for its residents and attract new businesses and visitors.

Economic Development

The car tax revenue also supports economic development efforts within Greenville County. The funds are utilized to attract and retain businesses, create job opportunities, and stimulate economic growth. This, in turn, leads to increased tax revenue, fostering a positive cycle of development and prosperity.

Environmental Initiatives

Greenville County’s car tax system aligns with its environmental sustainability goals. The discounts offered for alternative fuel vehicles encourage the adoption of eco-friendly transportation options, reducing the county’s carbon footprint and promoting a greener future. This approach not only benefits the environment but also contributes to the county’s reputation as a forward-thinking and responsible community.

Frequently Asked Questions

How often do I need to pay Greenville County car taxes?

+Greenville County car taxes are levied annually. The due date for payment is typically in the early months of the year, and failure to pay by the deadline may result in penalties and interest charges.

Are there any exemptions or discounts available for car taxes in Greenville County?

+Yes, Greenville County offers exemptions and discounts to eligible individuals and vehicles. These include a senior citizen exemption, a disabled veteran discount, and an alternative fuel vehicle incentive. It’s important to check the specific criteria and requirements for each exemption or discount.

How can I calculate the assessed value of my vehicle for Greenville County car taxes?

+The assessed value of a vehicle is calculated based on its original purchase price, depreciation rate, and any applicable adjustments. You can use the formula: Assessed Value = Original Purchase Price * (1 - Depreciation Rate). It’s recommended to consult with a tax professional or use online tools provided by Greenville County to ensure accuracy.

What payment methods are accepted for Greenville County car taxes?

+Greenville County accepts various payment methods for car taxes, including credit/debit cards, e-checks, and electronic funds transfer (EFT). These payment options are available through the county’s online platform, offering convenience and security for taxpayers.