Santa Clara Tax Rate

The Santa Clara tax rate is an important aspect to consider for residents, businesses, and anyone interested in the economic landscape of this vibrant city in California. With its thriving technology sector and diverse community, understanding the tax structure is crucial for making informed financial decisions. In this comprehensive guide, we will delve into the specifics of the Santa Clara tax rate, covering everything from property taxes to sales and income taxes, and how they impact the city's economy.

Unraveling the Santa Clara Tax Structure

Santa Clara, known as the “Capital of Silicon Valley,” boasts a robust economy and a unique tax system that contributes to its financial prosperity. The city’s tax structure is designed to support its thriving industries while also funding essential public services and infrastructure development.

Property Taxes: A Key Revenue Source

One of the primary tax categories in Santa Clara is property tax. The city’s property tax rate is influenced by various factors, including the assessed value of the property, the type of property (residential, commercial, or industrial), and the specific tax rate areas within the city.

According to the latest data, the average effective property tax rate in Santa Clara is approximately 1.02% of the assessed value. This rate is slightly higher than the statewide average, reflecting the city's commitment to providing top-notch services and maintaining its reputation as a desirable place to live and work.

| Property Type | Average Tax Rate |

|---|---|

| Residential | 1.05% |

| Commercial | 1.10% |

| Industrial | 1.08% |

The city's property tax system is governed by Proposition 13, a landmark legislation in California that limits property tax increases. This means that the assessed value of a property can only increase by a maximum of 2% annually or by the rate of inflation, whichever is lower. As a result, property owners in Santa Clara can enjoy a degree of stability and predictability when it comes to their tax obligations.

Sales and Use Taxes: Supporting Local Businesses

Sales and use taxes are another vital component of the Santa Clara tax landscape. These taxes are imposed on the sale of goods and services within the city, as well as on the storage, use, or consumption of tangible personal property. The revenue generated from these taxes is crucial for funding essential public services and infrastructure projects.

As of my last update, the combined sales tax rate in Santa Clara is 8.25%, which includes both state and local taxes. This rate is composed of a base state sales tax rate of 6%, a 0.25% local transportation tax, and additional district taxes that vary depending on the specific location within the city.

| Sales Tax Component | Rate |

|---|---|

| State Sales Tax | 6% |

| Local Transportation Tax | 0.25% |

| District Taxes | Varies (up to 1.75%) |

Santa Clara's sales tax revenue is utilized to support a wide range of public services, including education, public safety, transportation, and community development. It also plays a crucial role in funding infrastructure projects that enhance the city's economic competitiveness and quality of life.

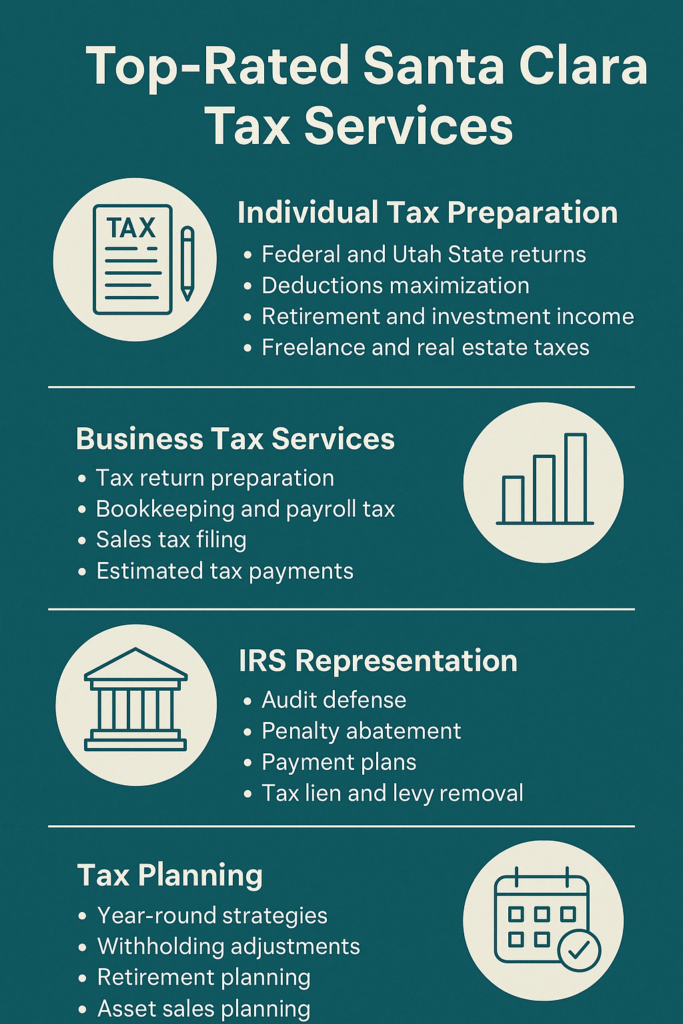

Income Taxes: Contributing to State Revenue

While Santa Clara does not have its own income tax, California’s state income tax system still has a significant impact on the city’s residents and businesses. California imposes a progressive income tax, meaning that higher income earners are subject to higher tax rates.

As of the 2023 tax year, California's income tax rates range from 1% to 13.3%, depending on taxable income. These rates apply to both individuals and businesses, with additional considerations for pass-through entities and specific tax credits and deductions.

| Taxable Income Range | Tax Rate |

|---|---|

| $0 - $9,674 | 1% |

| $9,675 - $41,459 | 2% |

| $41,460 - $56,936 | 4% |

| $56,937 - $79,598 | 6% |

| $79,599 - $144,676 | 8% |

| $144,677 - $289,351 | 9.3% |

| $289,352 - $578,701 | 10.3% |

| $578,702 - $927,999 | 11.3% |

| $928,000 and above | 13.3% |

California's income tax system is designed to promote fairness and ensure that those with higher incomes contribute proportionally more to the state's revenue. The revenue generated from income taxes supports various state-wide initiatives, including education, healthcare, social services, and infrastructure development.

Impact of Santa Clara’s Tax Rates on the Economy

The tax rates in Santa Clara play a pivotal role in shaping the city’s economic landscape and its overall competitiveness. Let’s explore some of the key impacts and considerations.

Attracting Businesses and Investors

Santa Clara’s tax structure, particularly its sales and property tax rates, is designed to create a business-friendly environment. While the city’s property tax rates are slightly higher than the state average, they provide a level of predictability and stability that is attractive to long-term investors and businesses. This stability encourages economic growth and development, making Santa Clara an appealing destination for startups and established companies alike.

Funding Essential Services and Infrastructure

The revenue generated from Santa Clara’s tax rates is a vital source of funding for essential public services and infrastructure projects. The city’s commitment to maintaining a high standard of living and a robust economy is evident in its investment in education, public safety, transportation, and community development initiatives. These investments not only enhance the quality of life for residents but also contribute to the city’s overall competitiveness and appeal.

Promoting Economic Equality

California’s progressive income tax system, which applies to Santa Clara residents, plays a crucial role in promoting economic equality. By imposing higher tax rates on higher income earners, the state ensures that those who benefit most from California’s thriving economy contribute proportionally more to its revenue. This approach helps fund essential services and programs that support low- and middle-income residents, creating a more equitable society.

Impact on Real Estate Market

Santa Clara’s property tax structure, governed by Proposition 13, has a significant impact on the real estate market. The limited annual increases in assessed value provide stability and predictability for property owners, encouraging long-term ownership and investment. This, in turn, contributes to a healthy and vibrant real estate market, benefiting both homeowners and potential buyers.

Future Considerations and Trends

As Santa Clara continues to thrive and evolve, its tax structure will likely remain a topic of discussion and potential reform. Here are some key considerations and potential trends to watch:

- Tax Incentives for Businesses: The city may explore offering tax incentives or credits to attract and retain businesses, particularly in sectors aligned with its economic development goals.

- Infrastructure Funding: With ongoing infrastructure needs, Santa Clara may need to consider additional funding sources or partnerships to support major projects.

- Tax Reform: California's tax system is subject to ongoing debates and potential reforms. Any changes at the state level could have a ripple effect on Santa Clara's tax landscape.

- Economic Diversity: As the city continues to grow, fostering economic diversity and supporting a range of industries will be crucial to maintaining a resilient tax base.

Staying informed about these potential developments and their implications will be essential for residents, businesses, and investors navigating the Santa Clara tax landscape.

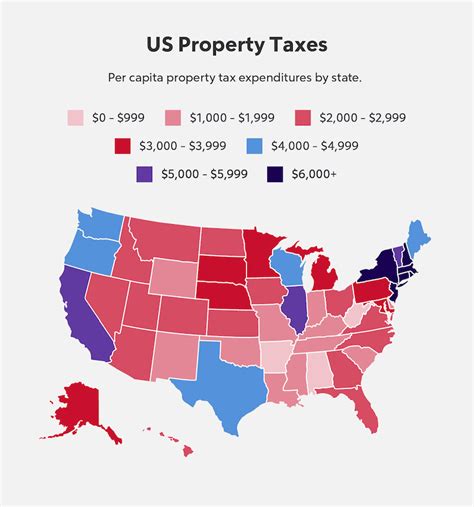

How do property tax rates in Santa Clara compare to other California cities?

+Santa Clara’s property tax rates are slightly higher than the statewide average, reflecting the city’s commitment to providing top-notch services and infrastructure. However, the stability and predictability offered by Proposition 13 make it an attractive option for long-term property ownership.

Are there any tax breaks or incentives for businesses in Santa Clara?

+Santa Clara does offer various tax incentives and programs to attract and support businesses. These incentives may include tax credits, abatements, or reduced tax rates for specific industries or development projects. It’s recommended to consult with local economic development agencies for more detailed information.

How does Santa Clara’s sales tax rate compare to neighboring cities and regions?

+Santa Clara’s sales tax rate is comparable to other cities in the Bay Area and Northern California. The combined rate of 8.25% includes both state and local taxes, with additional district taxes varying based on location. It’s important to note that sales tax rates can differ slightly between cities and counties.

What is the impact of California’s income tax on Santa Clara’s residents and businesses?

+California’s progressive income tax system affects Santa Clara residents and businesses by imposing higher tax rates on higher incomes. While this may impact individuals and businesses with higher earnings, the revenue generated supports essential state services and contributes to economic equality.

How does Santa Clara ensure equitable distribution of tax revenue for public services?

+Santa Clara has various mechanisms in place to ensure equitable distribution of tax revenue. These include budget allocation processes, community input, and targeted initiatives aimed at addressing specific community needs. The city’s commitment to transparency and accountability plays a crucial role in maintaining equity in public service provision.