Ca Property Tax Rate

California, often referred to as the Golden State, is renowned for its diverse landscapes, vibrant cities, and dynamic economy. However, alongside its allure, the state is also known for its relatively high property tax rates, which can significantly impact homeowners and property investors. Understanding the nuances of the California property tax rate is crucial for anyone considering purchasing property in the state, as it can affect long-term financial planning and investment strategies.

The Basics of California Property Tax

California’s property tax system is primarily governed by Proposition 13, a constitutional amendment passed in 1978. This proposition introduced two significant changes to the state’s property tax landscape:

- Tax Rate: Proposition 13 set a uniform statewide property tax rate at 1% of the property's assessed value.

- Assessment Limits: It also imposed restrictions on annual increases in property assessments, limiting them to a maximum of 2% per year unless the property changes ownership.

These provisions aim to provide stability and predictability for homeowners and ensure that property taxes do not escalate rapidly, particularly in areas with high property value appreciation.

Understanding the 1% Property Tax Rate

The 1% property tax rate, as mandated by Proposition 13, applies to the assessed value of the property. This assessed value is typically determined by the county assessor’s office and is based on various factors, including the property’s characteristics, location, and recent sales data.

It's important to note that the 1% rate is a statewide standard, but individual counties and municipalities may impose additional taxes or assessments. These supplementary charges can vary widely across the state and may include:

- Local Taxes: Counties, cities, and special districts (e.g., school districts) can levy their own property taxes to fund local services and infrastructure.

- Special Assessments: These are charges imposed on properties within a specific area to finance public improvements like street repairs or infrastructure upgrades.

- Mello-Roos Taxes: Named after the legislation that authorized them, Mello-Roos taxes are special taxes levied in designated community facilities districts to fund public services and infrastructure in newly developed areas.

How Property Taxes Are Calculated in California

The process of calculating property taxes in California involves several steps. First, the county assessor determines the property’s assessed value, which serves as the base for tax calculations.

Next, the assessed value is multiplied by the applicable tax rate, which consists of the 1% statewide rate plus any additional local taxes and assessments. This calculation provides the total tax amount for the property.

It's worth mentioning that California also offers certain exemptions and deductions that can reduce the taxable value of a property. Common exemptions include:

- Homeowner's Exemption: Property owners can apply for a homeowner's exemption, which reduces the taxable value of their primary residence by $7,000.

- Senior Citizen's Exemption: Eligible seniors can receive a $7,000 reduction in their property's taxable value, and this exemption can be transferred to a new property if they move.

- Disabled Veteran's Exemption: Disabled veterans may be entitled to a property tax exemption based on their disability rating.

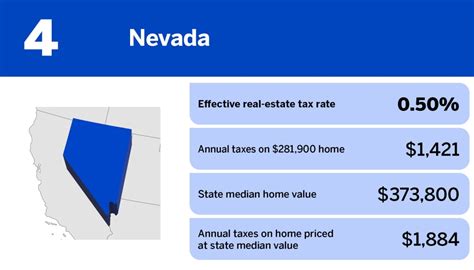

Variations in Property Tax Rates Across California

While the 1% statewide property tax rate provides a uniform baseline, the actual tax burden can vary significantly across California due to the additional local taxes and assessments mentioned earlier. This variation is particularly noticeable in areas with higher costs of living and those that rely heavily on property taxes to fund local services.

For instance, in some of California's most affluent communities, property tax rates can exceed 2% when considering both the statewide rate and local assessments. On the other hand, in more rural or less affluent areas, the total property tax rate may be closer to the 1% standard.

Here's a simplified table illustrating the variation in effective property tax rates across select California counties:

| County | Effective Property Tax Rate |

|---|---|

| Los Angeles | 1.25% |

| Orange | 1.35% |

| San Francisco | 1.15% |

| San Diego | 1.20% |

| Riverside | 1.10% |

The Impact of Property Tax Rates on Homeownership

California’s property tax rates can have a significant influence on homeownership, particularly for first-time buyers and those on a budget. The added costs associated with local taxes and assessments can make homeownership less affordable, especially in regions with high property values.

Additionally, the annual 2% assessment increase limit, as stipulated by Proposition 13, can result in a gradual but steady rise in property taxes over time. While this provision provides stability, it can also make it challenging for homeowners to budget for increasing property tax expenses, especially if their income remains stagnant.

Strategies for Managing Property Taxes in California

Given the potential impact of property taxes on long-term financial planning, here are some strategies that homeowners and investors can consider to manage their property tax obligations effectively:

- Research Local Tax Rates: Before purchasing a property, thoroughly research the local tax rates and assessments in the area. This information is typically available on county assessor websites or through real estate agents.

- Apply for Exemptions: Take advantage of any applicable exemptions, such as the homeowner's exemption or senior citizen's exemption, to reduce your property's taxable value.

- Consider Mello-Roos Districts: If you're purchasing a property in a Mello-Roos district, understand the associated taxes and how they will impact your overall tax burden. These taxes can be significant and should be factored into your financial planning.

- Explore Refinancing Options: Refinancing your mortgage can sometimes result in a lower property tax bill, as the assessed value of your property may be adjusted during the refinancing process.

- Stay Informed: Keep abreast of any changes in local tax policies or assessment practices that could affect your property tax obligations.

Conclusion

California’s property tax landscape, shaped by Proposition 13, offers both benefits and challenges for homeowners and investors. While the 1% statewide property tax rate provides stability and predictability, the addition of local taxes and assessments can significantly impact the overall tax burden. Understanding these nuances is essential for making informed decisions about property ownership in the Golden State.

By staying informed about local tax rates, applying for available exemptions, and implementing effective financial strategies, individuals can navigate California's property tax system with confidence and ensure that their homeownership or investment goals remain within reach.

What is Proposition 13 and how does it affect property taxes in California?

+

Proposition 13, passed in 1978, set a uniform statewide property tax rate at 1% and limited annual property value increases to a maximum of 2% unless the property changes ownership. It provides stability but can result in higher taxes in areas with rapid property value appreciation.

How are property taxes calculated in California?

+

Property taxes are calculated by multiplying the property’s assessed value by the applicable tax rate, which includes the 1% statewide rate and any additional local taxes and assessments.

What are some common exemptions and deductions available in California for property taxes?

+

Common exemptions include the homeowner’s exemption (7,000 reduction in taxable value), senior citizen's exemption (7,000 reduction), and disabled veteran’s exemption (based on disability rating). These exemptions can reduce the taxable value of a property.

How do local taxes and assessments impact property tax rates in California?

+

Local taxes and assessments, imposed by counties, cities, and special districts, can significantly increase the overall property tax burden. These additional charges vary widely across the state and can push the effective property tax rate above the 1% statewide standard.

What strategies can homeowners and investors use to manage property taxes in California?

+

Strategies include researching local tax rates before purchasing, applying for applicable exemptions, understanding Mello-Roos taxes if buying in a designated district, exploring refinancing options, and staying informed about local tax policy changes.