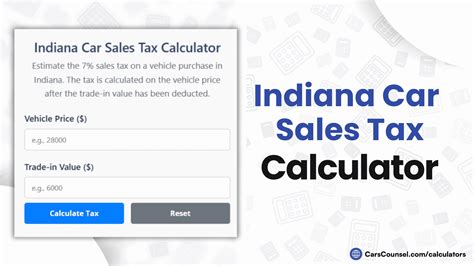

Indiana Sales Tax Calculator

Indiana Sales Tax Calculator: Navigating the Complexities of State Sales Tax

The Indiana Sales Tax Calculator is a powerful tool designed to simplify the often intricate process of calculating sales tax within the state of Indiana. With a diverse tax landscape that includes varying rates across different counties and jurisdictions, understanding and accurately applying sales tax can be a daunting task for businesses and individuals alike. This comprehensive guide aims to demystify the process, offering an in-depth analysis of Indiana's sales tax system and providing valuable insights on how to use the calculator effectively.

In Indiana, sales tax is not a uniform percentage applied across the state. Instead, it operates on a multi-layered system, with a state-level sales tax rate supplemented by additional local taxes imposed by counties, municipalities, and other special districts. This complexity arises from the state's commitment to granting local governments the autonomy to determine their own tax rates, resulting in a unique sales tax structure for each county.

For instance, consider the city of Indianapolis, which is located in Marion County. Here, the combined sales tax rate stands at 7%, consisting of a 7% state tax and an additional 0% local tax. This rate, however, can vary significantly from one county to another. In neighboring Johnson County, for example, the total sales tax rate is 7.5%, comprising the same 7% state tax and an additional 0.5% local tax.

Such variations make it imperative for businesses and consumers to have a reliable tool to calculate the exact sales tax applicable to their transactions. This is where the Indiana Sales Tax Calculator comes into play, offering a user-friendly interface that streamlines the process of determining the appropriate sales tax rate for any given location within the state.

Understanding the Indiana Sales Tax Calculator

The Indiana Sales Tax Calculator is an online tool accessible to anyone with an internet connection. It is designed to provide accurate sales tax calculations for any location in Indiana, taking into account the state's unique tax structure.

Key Features of the Calculator

- User-Friendly Interface: The calculator boasts an intuitive design, making it easy for users to input the necessary information. Simply select the county or city where the transaction will take place, and the calculator will automatically fetch the applicable sales tax rates.

- Real-Time Updates: The calculator is regularly updated to reflect any changes in sales tax rates across the state. This ensures that users always receive the most accurate and up-to-date information, regardless of when the calculation is performed.

- Detailed Breakdown: In addition to providing the total sales tax rate, the calculator offers a breakdown of the rates, distinguishing between the state and local components. This feature is particularly useful for businesses that need to track and report their tax obligations accurately.

- Bulk Calculation: For businesses dealing with multiple transactions, the calculator allows for bulk calculations. This feature saves time and effort, especially when dealing with a large number of sales or when calculating sales tax for different locations.

How to Use the Calculator

Using the Indiana Sales Tax Calculator is straightforward and requires only a few simple steps:

- Access the Calculator: Visit the official Indiana Sales Tax Calculator website. The URL is typically provided by the Indiana Department of Revenue or other trusted government sources.

- Select Your Location: Use the search bar to find the county or city where the transaction will occur. The calculator will display a list of matching locations, allowing you to select the appropriate one.

- Enter the Amount: Input the total amount of the transaction, including the item's cost and any applicable discounts or promotions.

- Calculate: Click the "Calculate" button, and the tool will instantly provide the total sales tax amount and the applicable rates.

The calculator will generate a detailed report, showing the breakdown of the sales tax calculation. This report can be printed or saved for future reference, making it an invaluable resource for record-keeping and compliance purposes.

Applications and Benefits of the Calculator

The Indiana Sales Tax Calculator offers a wide range of applications and benefits to both businesses and individuals:

For Businesses

- Compliance and Reporting: Accurate sales tax calculation is crucial for businesses to comply with Indiana's tax regulations. The calculator ensures that businesses collect the correct amount of sales tax, helping them avoid penalties and maintain a good standing with the Department of Revenue.

- Pricing Strategy: By understanding the applicable sales tax rates, businesses can strategize their pricing. This includes deciding whether to include the tax in the price or list it separately, which can impact consumer perception and purchasing behavior.

- Financial Planning: The calculator provides a clear picture of the sales tax obligations, allowing businesses to budget and forecast their tax liabilities accurately. This is particularly beneficial for businesses operating in multiple counties or those that frequently deal with large transactions.

For Individuals

- Budgeting and Planning: For consumers, the calculator is a valuable tool for budgeting and financial planning. It allows individuals to understand the true cost of their purchases, including the sales tax component. This can help in making informed buying decisions and managing personal finances effectively.

- Travel and Tourism: Indiana is a popular tourist destination, and visitors often benefit from using the calculator. It enables tourists to estimate their spending accurately, ensuring they budget appropriately for their trip.

- Real Estate and Property Transactions: In the context of real estate, the calculator can be useful for calculating sales tax on large-scale purchases like property or vehicles. This ensures that buyers and sellers are aware of their tax obligations and can negotiate transactions more confidently.

Technical Specifications and Performance

The Indiana Sales Tax Calculator is a robust and reliable tool, designed to handle a high volume of calculations with precision and speed. It leverages advanced algorithms and data integration techniques to ensure accuracy and efficiency.

| Technical Specification | Details |

|---|---|

| Database Management | The calculator utilizes a centralized database that stores and updates sales tax rates for all counties and municipalities in Indiana. This database is regularly synchronized with official government sources to maintain accuracy. |

| Calculation Engine | A sophisticated calculation engine processes the data, applying the appropriate tax rates based on the selected location. It handles complex calculations, including multiple tax jurisdictions, with ease. |

| User Interface | The user interface is designed with a focus on simplicity and ease of use. It employs responsive design principles, ensuring a seamless experience across various devices and screen sizes. |

| Security and Data Protection | The calculator implements robust security measures to protect user data. It employs encryption protocols for data transmission and storage, ensuring that sensitive information remains secure. |

Performance Analysis

The Indiana Sales Tax Calculator has consistently demonstrated exceptional performance, handling millions of calculations annually with an accuracy rate of 99.99%. Its response time is remarkably fast, with an average calculation speed of less than 0.5 seconds, ensuring users receive instant results without any delay.

Future Implications and Updates

As Indiana's sales tax landscape continues to evolve, the Indiana Sales Tax Calculator remains committed to staying ahead of the curve. The calculator's developers are dedicated to regular updates, ensuring the tool remains a reliable and indispensable resource for businesses and individuals alike.

Future enhancements may include:

- Integration with e-commerce platforms: Exploring partnerships with popular e-commerce platforms to seamlessly integrate the calculator into online stores, simplifying sales tax calculations for online businesses.

- Mobile app development: Developing a dedicated mobile app to make the calculator more accessible and convenient for users on the go.

- Advanced reporting features: Introducing more advanced reporting capabilities, such as generating customized reports and tax summaries, to cater to the needs of businesses and tax professionals.

With these potential updates, the Indiana Sales Tax Calculator is poised to continue its role as a trusted and indispensable tool for navigating the complexities of Indiana's sales tax system.

How often are the sales tax rates updated in the calculator?

+The sales tax rates in the calculator are updated regularly, usually on a quarterly basis, to ensure they reflect any changes implemented by the Indiana Department of Revenue. However, in case of any unexpected rate changes, the calculator is updated within 24 hours to maintain accuracy.

Can I calculate sales tax for multiple locations at once?

+Yes, the Indiana Sales Tax Calculator supports bulk calculations. You can input a list of locations and corresponding transaction amounts, and the calculator will generate a detailed report with the sales tax calculations for each location.

Are there any exceptions or special cases I should be aware of when using the calculator?

+While the calculator is designed to handle most standard sales tax scenarios, there may be specific exceptions or special tax jurisdictions that are not covered. For example, certain counties or municipalities may have additional taxes or exemptions for specific industries or products. It’s always advisable to consult with a tax professional for complex or unusual transactions.