Free Sales Tax Weekend Florida

Welcome to the Sunshine State, where the beaches are sunny, the theme parks are thrilling, and the sales tax weekends offer an exciting opportunity for shoppers to save big! Florida, known for its vibrant culture and year-round attractions, hosts a unique event that draws locals and tourists alike: the Free Sales Tax Weekend. This annual affair is a beloved tradition, offering residents and visitors a chance to enjoy tax-free shopping on a variety of essential items. In this article, we will delve into the details of Florida's Free Sales Tax Weekend, exploring its history, the items eligible for tax exemption, and providing a comprehensive guide to make the most of this fantastic opportunity.

A Brief History of Florida’s Sales Tax Holiday

Florida’s Free Sales Tax Weekend, also known as the Sales Tax Holiday, has become an anticipated event for savvy shoppers. The concept of a sales tax holiday is not unique to Florida; several states across the US have adopted similar initiatives to boost consumer spending and provide relief to families. In Florida, this tradition dates back to 1998 when the state government introduced the Back-to-School Sales Tax Holiday, specifically aimed at easing the financial burden on families preparing for the new academic year.

Initially, the Sales Tax Holiday was limited to school-related items, but over the years, it has expanded to include a broader range of products. This evolution reflects the state's recognition of the event's popularity and its potential to drive economic activity. Today, Florida's Free Sales Tax Weekend is not just a one-time event; it has become an annual celebration, offering residents multiple opportunities to save throughout the year.

Eligible Items and Dates for Florida’s Sales Tax Holiday

Florida’s Sales Tax Holiday is carefully curated to align with specific seasons and consumer needs. The state government announces the eligible items and dates well in advance, allowing shoppers to plan their purchases strategically. Here’s a breakdown of the key dates and items covered by the tax exemption:

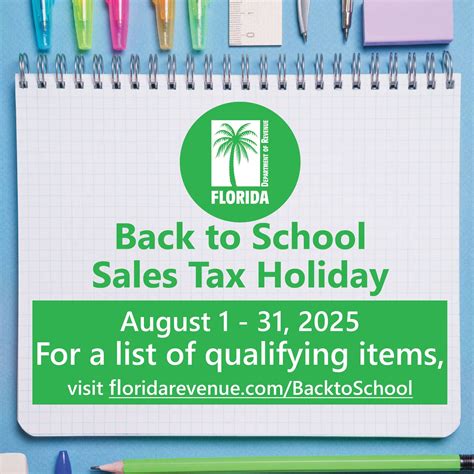

Back-to-School Sales Tax Holiday

This holiday typically occurs in late July or early August, just before the start of the new school year. It’s an excellent opportunity for parents and students to stock up on school supplies, clothing, and technology without the added burden of sales tax. The eligible items include:

- School supplies: Pens, pencils, notebooks, calculators, backpacks, and more.

- Clothing: Uniforms, shirts, pants, shoes, and other apparel.

- Computers and related accessories: Laptops, desktops, printers, and software.

- Books: Textbooks and other educational materials.

- Certain sports equipment: Gym gear, athletic wear, and sports-related items.

During this holiday, items under a specific price threshold are exempt from sales tax, making it an ideal time to purchase essential school items at a discounted price.

Disaster Preparedness Sales Tax Holiday

Given Florida’s susceptibility to hurricanes and severe weather, the state offers a unique Sales Tax Holiday focused on disaster preparedness. Typically held in May or June, this holiday encourages residents to stock up on emergency supplies. The eligible items include:

- Battery-powered radios and flashlights.

- Portable generators.

- First aid kits.

- Water storage containers.

- Tarpaulins and other weather-related equipment.

By offering a tax exemption on these essential items, the state promotes disaster preparedness and helps residents save money on crucial supplies.

Hurricane Preparedness Sales Tax Holiday

In the event of an active hurricane season, Florida may declare an additional Sales Tax Holiday to assist residents in preparing for potential storms. This holiday usually occurs in late August or early September and focuses on hurricane-specific supplies. The eligible items include:

- Hurricane shutters and storm panels.

- Portable generators and fuel containers.

- Ice chests and coolers.

- Chain saws and other power tools.

- Certain building materials for hurricane protection.

This targeted holiday demonstrates Florida's commitment to supporting its residents during challenging weather conditions.

Making the Most of Florida’s Free Sales Tax Weekend

To ensure a successful and rewarding shopping experience during Florida’s Free Sales Tax Weekend, here are some tips and strategies:

Plan Ahead

Familiarize yourself with the eligible items and dates for each Sales Tax Holiday. Create a shopping list and prioritize the items you need most. This proactive approach will help you stay organized and ensure you don’t miss out on any tax-free opportunities.

Compare Prices

While the absence of sales tax is a significant advantage, it’s still essential to compare prices. Different retailers may offer varying discounts and promotions during the holiday. Take the time to research and find the best deals to maximize your savings.

Take Advantage of Online Shopping

Many online retailers participate in Florida’s Sales Tax Holiday. If you prefer shopping from the comfort of your home, be sure to check the websites of your favorite stores to see if they offer tax-free shopping during the designated period.

Consider Bulk Purchases

If you have the storage space and the need, consider buying in bulk during the Sales Tax Holiday. This strategy can lead to significant savings, especially for items with a longer shelf life or those that are used frequently.

Explore Local Businesses

Support local businesses by checking out small shops and boutiques during the Sales Tax Holiday. These stores often offer unique products and personalized shopping experiences.

Conclusion: A Smart Shopping Experience

Florida’s Free Sales Tax Weekend is more than just a shopping event; it’s a strategic initiative that benefits both consumers and the local economy. By offering tax exemptions on essential items, the state encourages residents to save money while also promoting disaster preparedness and supporting local businesses. As a savvy shopper, take advantage of this opportunity to stock up on necessary supplies and enjoy the thrill of tax-free shopping. With careful planning and a little research, you can make the most of Florida’s Sales Tax Holiday and maximize your savings.

When is Florida’s next Sales Tax Holiday?

+The dates for Florida’s Sales Tax Holidays vary each year and are typically announced by the state government in advance. Keep an eye on official state websites and local news sources for updates on the upcoming holiday dates.

Are there any limitations on the price of items during the Sales Tax Holiday?

+Yes, there are specific price thresholds for each category of eligible items. For instance, during the Back-to-School Sales Tax Holiday, items under a certain price (e.g., $150 for clothing) are exempt from sales tax. Check the official guidelines for the latest price limits.

Can I combine sales and discounts with the Sales Tax Holiday savings?

+Absolutely! Many retailers offer additional discounts and promotions during the Sales Tax Holiday, allowing you to combine these savings with the tax exemption. Look for special deals and sales to maximize your savings.