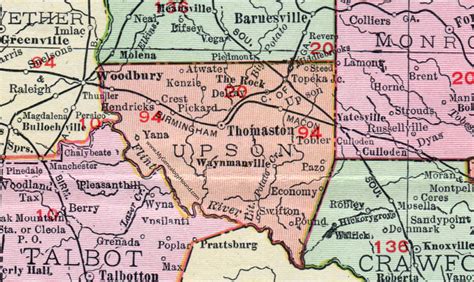

Upson County Tax

Welcome to this in-depth exploration of Upson County Tax, an important topic for residents and businesses within this Georgia county. Upson County, with its rich history and vibrant communities, faces unique tax considerations that shape its economic landscape. This article aims to provide a comprehensive understanding of Upson County's tax structure, offering insights into the tax rates, property assessments, tax incentives, and more. By delving into these aspects, we can gain a clearer picture of the financial obligations and opportunities that come with living and operating in Upson County.

Understanding Upson County Tax Landscape

Upson County, nestled in the heart of Georgia, is renowned for its charming small-town atmosphere and strong sense of community. However, beyond its idyllic exterior lies a complex tax system that plays a pivotal role in the county’s economic development and sustainability. Let’s delve into the intricacies of Upson County’s tax structure, shedding light on the factors that influence the tax landscape and how they impact residents and businesses alike.

Tax Rates: A Key Determinant

At the heart of Upson County’s tax system are the tax rates, which are instrumental in shaping the financial obligations of its residents and businesses. These rates are meticulously calculated and reviewed annually, taking into account a multitude of factors that reflect the county’s economic health and growth aspirations.

One of the key components influencing tax rates is the property tax assessment. Upson County employs a meticulous property assessment process, ensuring that the tax burden is distributed fairly across all property owners. The assessment takes into account various factors, including the property’s location, size, and recent market trends. This approach aims to strike a balance between generating sufficient revenue for the county’s operations and maintaining a competitive tax environment that attracts businesses and residents.

Furthermore, Upson County offers a range of tax incentives aimed at promoting economic growth and supporting local businesses. These incentives, such as tax abatement programs and targeted tax credits, are strategically designed to encourage investment, job creation, and business expansion within the county. By offering these incentives, Upson County aims to foster a business-friendly environment, making it an attractive destination for entrepreneurs and established companies alike.

The tax rates in Upson County are also influenced by the county’s commitment to maintaining essential services and infrastructure. From well-maintained roads and parks to a robust public safety system, the tax revenue plays a vital role in supporting these critical services that enhance the quality of life for residents. Additionally, the county’s tax structure ensures that adequate funds are allocated to education, healthcare, and other vital sectors, contributing to the overall well-being and prosperity of the community.

To provide a clear understanding of the tax rates in Upson County, let’s examine a table showcasing the current tax rates for various property types:

| Property Type | Tax Rate (per $100 of Assessed Value) |

|---|---|

| Residential | $4.30 |

| Commercial | $5.25 |

| Industrial | $3.80 |

| Agricultural | $2.50 |

It's important to note that these tax rates are subject to change based on budgetary requirements and economic conditions. Residents and businesses are encouraged to stay informed about any updates to ensure accurate tax planning and compliance.

Property Assessment: Ensuring Fair Taxation

The process of property assessment is a critical component of Upson County’s tax system, as it directly influences the tax obligations of property owners. The county employs a team of skilled assessors who conduct thorough evaluations of each property, considering its unique characteristics and market value. This meticulous assessment process ensures that property taxes are levied fairly and equitably across the county.

During the assessment process, various factors are taken into account. These include the property’s location, which can impact its value based on proximity to amenities, schools, and other desirable features. The size and condition of the property are also considered, as larger properties or those in need of repairs may have a higher assessed value. Additionally, the assessors analyze recent sales data and market trends to ensure that the assessed values align with the current real estate market conditions.

To provide transparency and enable property owners to understand their assessments, Upson County offers an online assessment database. This user-friendly platform allows residents and businesses to access their property’s assessment details, including the assessed value, tax district, and any applicable exemptions or incentives. By providing this information online, the county promotes transparency and empowers property owners to make informed decisions regarding their tax obligations.

Furthermore, Upson County recognizes the importance of providing support and guidance to property owners during the assessment process. The county’s tax assessor’s office is readily accessible, offering assistance and answering queries related to property assessments. This proactive approach ensures that property owners have the necessary resources and information to navigate the assessment process with confidence and clarity.

To illustrate the assessment process and its impact on tax obligations, let’s consider an example. Imagine a residential property located in a desirable neighborhood of Upson County. The assessors take into account the property’s location, size, and recent sales data of similar properties in the area. Based on their evaluation, the assessed value of the property is determined to be 250,000. With the applicable tax rate of 4.30 per 100 of assessed value, the annual property tax for this residence would amount to 1,075.

By conducting thorough assessments and providing accessible information, Upson County ensures that property taxes are levied fairly and transparently. This approach fosters trust and understanding among property owners, contributing to a stable and prosperous community.

Tax Incentives: Encouraging Economic Growth

Upson County is committed to fostering economic growth and attracting businesses and investments. To achieve this, the county offers a range of tax incentives designed to support and encourage entrepreneurial endeavors and business expansion. These incentives play a crucial role in shaping the county’s economic landscape and enhancing its competitiveness.

One of the key tax incentives offered by Upson County is the Job Tax Credit. This incentive provides a tax credit to businesses that create new jobs within the county. By incentivizing job creation, the county aims to stimulate economic activity, reduce unemployment rates, and enhance the overall prosperity of the community. The Job Tax Credit not only attracts new businesses but also encourages existing businesses to expand their operations and create more employment opportunities.

Additionally, Upson County provides Investment Tax Credits to businesses that make significant capital investments in the county. These credits are intended to encourage businesses to invest in new equipment, facilities, or infrastructure, thereby promoting economic growth and creating a more robust business environment. By offering these incentives, the county demonstrates its commitment to supporting businesses and fostering a culture of innovation and expansion.

Furthermore, Upson County recognizes the importance of preserving its natural resources and promoting sustainable practices. As such, the county offers Green Incentives to businesses that adopt environmentally friendly initiatives. These incentives can include tax credits for implementing energy-efficient measures, adopting renewable energy sources, or engaging in sustainable waste management practices. By encouraging businesses to adopt green initiatives, Upson County aims to create a more sustainable and eco-conscious business community.

To provide a clearer understanding of the tax incentives available in Upson County, let’s examine a table outlining some of the key incentives and their eligibility criteria:

| Incentive Program | Eligibility Criteria |

|---|---|

| Job Tax Credit | Businesses creating new jobs; must meet minimum job creation requirements |

| Investment Tax Credit | Businesses making significant capital investments; minimum investment amount required |

| Green Incentive Program | Businesses implementing environmentally friendly initiatives; must meet sustainability criteria |

It's important to note that these incentives are subject to change and may be modified based on the county's economic development goals and strategies. Businesses interested in taking advantage of these incentives are encouraged to consult with the Upson County Economic Development Office for the most up-to-date information and guidance.

Tax Compliance and Support

Upson County places a strong emphasis on tax compliance and providing comprehensive support to its residents and businesses. The county understands the importance of clear communication and accessible resources to ensure that taxpayers have the necessary information to fulfill their tax obligations accurately and efficiently.

To facilitate tax compliance, Upson County has established a dedicated tax office staffed with knowledgeable professionals who are readily available to assist taxpayers with their inquiries and concerns. The tax office provides a range of services, including tax payment processing, filing assistance, and guidance on tax regulations and deadlines. Whether it’s clarifying tax forms, understanding assessment notices, or seeking advice on tax planning strategies, the tax office serves as a valuable resource for taxpayers in Upson County.

In addition to the tax office, Upson County offers an extensive online portal that serves as a one-stop shop for tax-related information and services. This user-friendly platform allows taxpayers to access a wealth of resources, including tax forms, payment options, and frequently asked questions. The online portal also provides a secure platform for electronic filing, enabling taxpayers to submit their tax returns and payments conveniently from the comfort of their homes or offices.

Furthermore, Upson County recognizes the diverse needs of its taxpayers and strives to accommodate them through various payment options. Taxpayers have the flexibility to choose from a range of payment methods, including online payments, credit card payments, and direct debit arrangements. This ensures that taxpayers can select the payment option that best suits their preferences and financial circumstances.

To further support taxpayers, Upson County organizes regular educational workshops and seminars focused on tax topics. These events provide an opportunity for taxpayers to gain a deeper understanding of tax regulations, learn about tax-saving strategies, and stay updated on any changes or developments in the tax landscape. By investing in taxpayer education, Upson County empowers its residents and businesses to make informed decisions and navigate the tax system with confidence.

In conclusion, Upson County’s commitment to tax compliance and support reflects its dedication to fostering a transparent and accessible tax system. By offering a comprehensive range of services, resources, and educational opportunities, the county ensures that taxpayers have the necessary tools and guidance to meet their tax obligations effectively. This approach not only promotes compliance but also strengthens the relationship between the county and its taxpayers, fostering a sense of trust and cooperation.

The Impact of Upson County Tax on Economic Development

Upson County’s tax system plays a pivotal role in shaping its economic development trajectory. The tax revenue generated by the county’s residents and businesses serves as a crucial funding source for various initiatives aimed at fostering growth, enhancing infrastructure, and improving the overall quality of life for its citizens.

One of the key ways in which Upson County utilizes its tax revenue is by investing in infrastructure development. The county understands that a robust and well-maintained infrastructure is essential for attracting businesses and promoting economic growth. As such, a significant portion of the tax revenue is allocated towards improving roads, bridges, and other critical transportation networks. This investment not only enhances connectivity within the county but also facilitates the movement of goods and services, benefiting both local businesses and residents.

Furthermore, Upson County recognizes the importance of a skilled and educated workforce in driving economic prosperity. A substantial amount of the tax revenue is dedicated to supporting education and training initiatives. This includes funding for schools, scholarships, and vocational programs, ensuring that the county’s residents have access to quality education and the necessary skills to thrive in the job market. By investing in education, Upson County lays the foundation for a talented and capable workforce, attracting businesses and fostering long-term economic sustainability.

In addition to infrastructure and education, Upson County also directs its tax revenue towards community development projects. These projects aim to enhance the overall livability and attractiveness of the county, making it an appealing place to live, work, and invest. From revitalizing downtown areas to developing recreational facilities and green spaces, the tax revenue is utilized to create a vibrant and thriving community. By investing in community development, Upson County not only improves the quality of life for its residents but also creates a positive perception of the county, further attracting businesses and talent.

To illustrate the impact of Upson County’s tax revenue on economic development, let’s consider a real-life example. In recent years, the county has focused on developing a thriving technology sector, recognizing the potential for job creation and economic growth. By allocating a portion of the tax revenue towards establishing a technology hub and providing incentives for tech startups, Upson County has successfully attracted innovative companies and created a thriving ecosystem for tech-related businesses. This strategic investment has not only generated new job opportunities but has also positioned the county as a desirable location for technology-driven enterprises.

In conclusion, Upson County’s tax system serves as a powerful tool for driving economic development and shaping the county’s future. By allocating tax revenue towards infrastructure, education, and community development, the county creates a conducive environment for businesses to thrive and residents to prosper. Through strategic investments and targeted initiatives, Upson County continues to strengthen its economic foundation, ensuring a bright and sustainable future for its citizens.

Conclusion: Navigating the Upson County Tax Landscape

As we conclude our exploration of Upson County Tax, it becomes evident that the county’s tax system is a vital component of its economic ecosystem. From the carefully calibrated tax rates to the comprehensive property assessment process, Upson County ensures a fair and transparent taxation environment for its residents and businesses.

The tax incentives offered by Upson County serve as a testament to its commitment to fostering economic growth and attracting investments. By encouraging job creation, capital investments, and sustainable practices, the county creates a supportive environment for businesses to thrive and expand. These incentives not only stimulate economic activity but also contribute to the overall well-being and prosperity of the community.

Moreover, Upson County’s emphasis on tax compliance and support demonstrates its dedication to building a strong relationship with its taxpayers. The county understands the importance of clear communication and accessible resources, ensuring that residents and businesses have the necessary tools to navigate the tax landscape with ease. From dedicated tax offices to user-friendly online portals, Upson County strives to make tax compliance a seamless and efficient process.

In conclusion, Upson County’s tax system is a well-structured and thoughtfully designed framework that supports the county’s economic development and sustainability. By balancing the interests of its residents, businesses, and the community as a whole, Upson County creates an environment that fosters growth, encourages investment, and enhances the overall quality of life. As we move forward, Upson County’s tax landscape will continue to evolve, adapting to the changing economic landscape and the evolving needs of its citizens.

How often are tax rates reviewed and adjusted in Upson County?

+

Tax rates in Upson County are reviewed annually to ensure they align with the county’s budgetary requirements and economic conditions. Adjustments may be made to reflect changes in the cost of providing services, infrastructure development, and other factors that impact the county’s finances.

Are there any property tax exemptions available in Upson County?

+

Yes, Upson County offers various property tax exemptions to eligible residents. These exemptions include the homestead exemption for primary residences, the disability exemption for qualified individuals, and the senior citizen exemption for residents aged 65 and older. It’s important to consult with the Upson County Tax Assessor’s Office to understand the specific eligibility criteria and application process for these exemptions.

How can businesses in Upson County take advantage of the tax incentives offered by the county?

+

Businesses in Upson County can explore the various tax incentives available by consulting with the Upson County Economic Development Office. This office provides guidance and support to businesses, helping them understand the eligibility criteria and application process for incentives such as tax abatement programs, job creation tax credits, and investment tax credits. By working closely with the Economic Development Office, businesses can maximize the benefits of these incentives and contribute to the county’s economic growth.