Maryland State Tax Refund

Maryland's state tax refund system is an important topic for residents and taxpayers alike. Understanding how this system works, the eligibility criteria, and the processes involved can help individuals make informed decisions about their finances and tax obligations. This comprehensive guide aims to delve into the intricacies of Maryland's state tax refund process, providing valuable insights and practical information.

The Basics of Maryland State Tax Refunds

Maryland, like many other states, offers its residents the opportunity to claim refunds on overpaid state taxes. This refund process is governed by the Maryland Tax-General Article, which outlines the rights and responsibilities of taxpayers and the state’s revenue authority. It is essential for individuals to be familiar with this process, as it can result in a welcome financial boost and ensure compliance with state tax laws.

Eligibility and Common Reasons for Refunds

To be eligible for a state tax refund in Maryland, taxpayers must have overpaid their taxes during the tax year. This overpayment can occur for various reasons, such as:

- Withholding too much tax from paychecks.

- Miscalculations in estimated tax payments.

- Eligibility for tax credits or deductions that were not claimed on original returns.

- Changes in income or marital status during the tax year.

It is crucial to note that eligibility does not guarantee a refund, as it depends on the specific circumstances and tax obligations of each individual. Understanding these eligibility criteria is the first step in determining whether one might be entitled to a state tax refund.

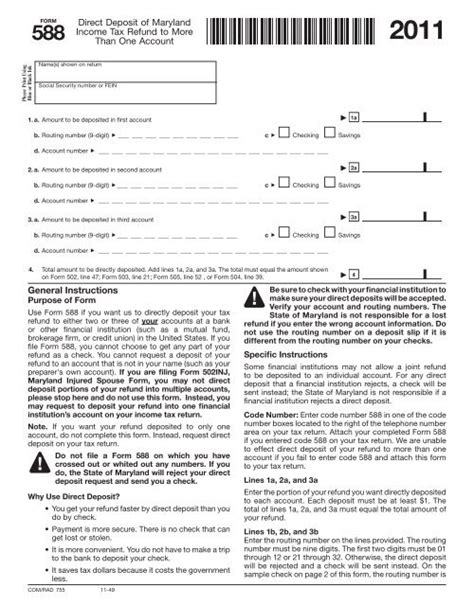

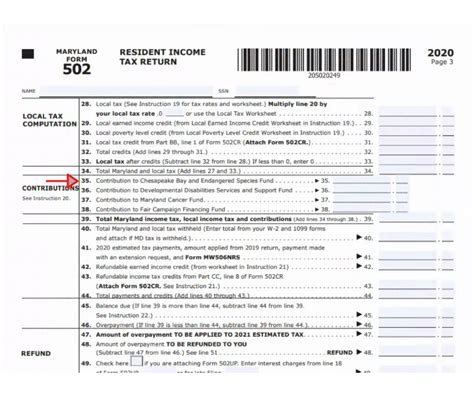

Tax Forms and Filing Requirements

For Maryland residents, the primary tax form used for individual income tax returns is the Maryland Form 502. This form is essential for calculating taxable income, claiming deductions, and determining any tax liability or refund due. The form’s complexity can vary based on an individual’s income, investments, and other factors, so it is advisable to seek professional assistance if needed.

In addition to Form 502, taxpayers may need to file other forms or schedules depending on their specific financial situation. For instance, those with business income may need to file Schedule C, while individuals with rental property income might use Schedule E. The Maryland Comptroller's website provides a comprehensive list of tax forms and instructions, ensuring that taxpayers have the necessary resources to navigate the filing process.

| Form Name | Description |

|---|---|

| Form 502 | Maryland Individual Income Tax Return |

| Schedule C | Profit or Loss from Business |

| Schedule E | Supplemental Income and Loss |

| ... | Other forms as applicable |

Filing Deadlines and Methods

Maryland taxpayers have until April 15th of each year to file their state tax returns. This deadline aligns with the federal tax filing deadline, providing a streamlined process for those who file both federal and state taxes. However, it is important to note that this deadline may be adjusted in certain years due to holidays or other exceptional circumstances.

Maryland offers various methods for filing tax returns, catering to different preferences and needs. Taxpayers can choose from the following options:

- Online Filing: Maryland's online filing system, known as MyMarylandTaxes, provides a secure and efficient way to file tax returns. This method is particularly convenient for those who are comfortable with technology and prefer a paperless process.

- Paper Filing: For those who prefer a traditional approach, Maryland accepts paper tax returns. Taxpayers can download and print forms from the Comptroller's website or obtain them from authorized tax preparers or libraries.

- Professional Tax Preparers: Engaging the services of a professional tax preparer can be beneficial for individuals with complex tax situations. These professionals can ensure accurate filing and maximize any potential refunds.

Calculating and Claiming Your Refund

The process of calculating a state tax refund in Maryland involves a series of steps. Taxpayers must first determine their taxable income, which is the starting point for calculating their tax liability. This involves subtracting any eligible deductions and credits from their total income.

Once the taxable income is established, taxpayers can use the tax tables provided by the Comptroller's office to determine their tax liability. These tables consider factors such as filing status, income level, and any applicable tax credits. By comparing the calculated tax liability to the amount already paid through withholdings or estimated payments, taxpayers can identify any overpayment and claim their refund.

Maximizing Your Refund: Tips and Strategies

Maximizing your state tax refund is not just about claiming what you are owed; it also involves strategic planning and understanding the various tax credits and deductions available. Here are some tips to ensure you receive the maximum refund possible:

Understanding Tax Credits

Tax credits are an important tool for reducing tax liability and increasing refunds. Maryland offers a range of tax credits, each with specific eligibility criteria and usage rules. Some common tax credits include:

- Low-Income Tax Credit (LITC): Aimed at providing relief to low-income earners, this credit can significantly reduce tax liability.

- Child and Dependent Care Credit: Taxpayers who incur expenses for childcare or dependent care can claim this credit, making it easier to manage work-related costs.

- Education Credits: Maryland offers various credits for education-related expenses, such as the Tuition Credit and the Maryland College Investment Plan (MCP), which can help offset the cost of higher education.

- Property Tax Credit: This credit provides relief for homeowners by reducing the tax burden on their property.

Deductions and Exemptions

Deductions and exemptions are another way to reduce taxable income and increase refunds. Maryland allows deductions for various expenses, including medical costs, state and local taxes, and charitable donations. It is crucial to keep accurate records of these expenses to ensure they are correctly claimed on tax returns.

Efficient Withholding and Estimated Tax Payments

Managing your withholding or estimated tax payments efficiently can prevent overpayments and maximize your refund. Taxpayers should review their withholding allowances annually to ensure they are not over-withholding. Similarly, those who pay estimated taxes should carefully calculate these payments to avoid under- or over-estimating their tax liability.

The Impact of Tax Planning

Engaging in proactive tax planning can have a significant impact on your state tax refund. This involves reviewing your financial situation throughout the year and making strategic decisions to optimize your tax position. For instance, taxpayers might consider adjusting their withholding allowances, contributing to tax-advantaged retirement accounts, or timing certain expenses to fall within the tax year.

Handling State Tax Refunds: Best Practices

Once you have filed your tax return and claimed your refund, it is essential to handle the refund process with care. This section provides best practices for managing your state tax refund effectively.

Tracking Your Refund

After filing your tax return, it is natural to want to track the progress of your refund. Maryland offers a Where’s My Refund tool on its Comptroller’s website, which allows taxpayers to check the status of their refund. This tool provides real-time updates, ensuring transparency and peace of mind during the refund process.

Receipt and Verification

When your refund is approved and processed, you will receive a notification from the Comptroller’s office. It is crucial to verify the refund amount and ensure it aligns with your expectations. If there are any discrepancies, taxpayers should contact the Comptroller’s office immediately to address the issue.

Direct Deposit vs. Check

Maryland offers taxpayers the option to receive their refunds via direct deposit or check. Direct deposit is the faster and more convenient method, as it eliminates the wait time associated with mailing a check. Taxpayers can provide their banking details when filing their tax return to facilitate this process.

Investing Your Refund

State tax refunds can provide a significant financial boost, and it is wise to consider how best to utilize this money. Investing your refund can be a smart move, whether it is contributing to a retirement account, funding an emergency fund, or investing in education or business ventures. Financial advisors can provide guidance on the most beneficial investment options based on individual circumstances.

Challenges and Common Issues with State Tax Refunds

While the state tax refund process is designed to be straightforward, there can be challenges and common issues that taxpayers encounter. Being aware of these issues can help individuals navigate the process more effectively.

Processing Delays and Errors

In some cases, tax refunds can be delayed due to processing errors or issues with the tax return. This can be frustrating for taxpayers, especially when they are expecting the refund to cover immediate financial needs. To mitigate this, taxpayers should file their returns accurately and on time, and keep track of the refund status using the available tools.

Audits and Reviews

In rare instances, the Comptroller’s office may select a tax return for audit or review. This is a standard procedure to ensure compliance with tax laws and can be triggered by various factors, such as large deductions or credits claimed. Taxpayers should cooperate fully with the audit process and provide any necessary documentation to resolve the review as efficiently as possible.

Scams and Fraud

Unfortunately, tax refund season also attracts scammers and fraudsters who prey on unsuspecting taxpayers. It is crucial to be vigilant and aware of potential scams, such as phishing emails or phone calls claiming to be from the Comptroller’s office. Maryland taxpayers should remember that the Comptroller’s office will never initiate contact via email or phone to request personal or financial information. Any such communication should be reported immediately.

The Future of Maryland State Tax Refunds

As technology advances and tax laws evolve, the future of Maryland’s state tax refund process is likely to see significant changes. The state is continuously working to improve its online filing system, making it more user-friendly and secure. Additionally, the integration of new technologies, such as blockchain for secure identity verification, could further streamline the refund process.

Furthermore, the state may consider implementing new tax credits or modifying existing ones to better support its residents. This could involve expanding education credits, providing relief for specific industries, or offering incentives for sustainable practices. These changes would not only impact taxpayers' refunds but also contribute to the state's overall economic development.

Legislative Changes and Their Impact

Legislative changes at the state level can have a profound impact on tax refunds. For instance, changes to the tax rates or the introduction of new tax brackets can affect the amount of tax owed or refunded. Similarly, modifications to the eligibility criteria for tax credits or deductions can influence the size of refunds. It is essential for taxpayers to stay informed about any legislative changes that may impact their tax obligations.

The Role of Technology in Tax Refunds

Technology is set to play an increasingly significant role in the state tax refund process. Mobile apps and online platforms will likely become even more prevalent, offering taxpayers convenient and secure ways to file their returns and track their refunds. Additionally, advancements in data analytics could lead to more efficient tax administration, reducing processing times and improving the accuracy of refunds.

Environmental and Social Impact

Maryland, like many states, is also focusing on environmental and social initiatives. This could result in new tax credits or incentives for taxpayers who contribute to these causes. For example, the state might introduce credits for installing renewable energy systems or for businesses that prioritize sustainability. These initiatives not only benefit the environment and society but also provide financial incentives for taxpayers.

Conclusion

Maryland’s state tax refund process is a critical component of the state’s tax system, offering residents the opportunity to reclaim overpaid taxes and make informed financial decisions. This comprehensive guide has outlined the key aspects of this process, from eligibility and tax forms to maximizing refunds and handling potential challenges. By understanding these intricacies, taxpayers can navigate the state tax refund process with confidence and ensure they receive the refunds they are entitled to.

As the state continues to evolve and adapt its tax policies, taxpayers can expect ongoing improvements and innovations in the refund process. Staying informed and engaged with these changes will be essential for making the most of one's state tax refund and contributing to Maryland's economic growth.

What is the deadline for filing state tax returns in Maryland?

+The deadline for filing state tax returns in Maryland is typically April 15th of each year. This aligns with the federal tax filing deadline.

How can I maximize my state tax refund in Maryland?

+Maximizing your state tax refund involves understanding tax credits and deductions. Common tax credits include the Low-Income Tax Credit, Child and Dependent Care Credit, and Education Credits. Additionally, efficient withholding and estimated tax payments can prevent overpayments.

What should I do if my state tax refund is delayed or incorrect?

+If your state tax refund is delayed, use the Comptroller’s Where’s My Refund tool to track its status. If it is incorrect, verify the refund amount and contact the Comptroller’s office immediately to resolve the issue.

Are there any scams or frauds related to state tax refunds in Maryland?

+Yes, taxpayers should be vigilant about potential scams, such as phishing emails or phone calls claiming to be from the Comptroller’s office. Remember, the Comptroller’s office will never request personal or financial information via email or phone.