7 Benefits of Understanding Stripe Tax for Seamless Business Growth

In an increasingly digital economy, the complexity of sales tax compliance is escalating, forcing many businesses to grapple with a labyrinth of jurisdictional rules and rate variations. Amid this intricate landscape, Stripe Tax emerges as a pioneering solution, offering not just automation but a strategic advantage for companies seeking to scale seamlessly across markets. A nuanced understanding of Stripe Tax’s benefits is no longer optional for forward-thinking entrepreneurs and financial strategists—it’s essential to aligning operational efficiency with growth ambitions. This article elucidates the seven core benefits of mastering Stripe Tax, blending authoritative insights with practical considerations to empower your enterprise's sustainable expansion.

Deciphering the Strategic Role of Stripe Tax in Modern Commerce

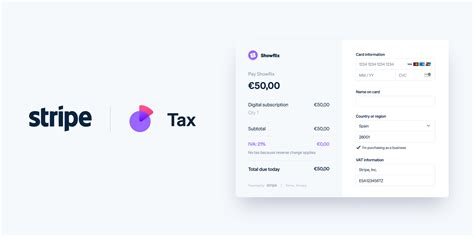

Stripe Tax represents a convergence of cutting-edge technology and regulatory compliance, designed meticulously to address the fragmented nature of sales tax and VAT management. Its evolution reflects an industry-wide acknowledgment: manual tax calculation, reporting, and remittance are no longer scalable solutions in a globalized, digital-first marketplace. By integrating automated tax solutions like Stripe Tax, businesses can mitigate risk, reduce administrative overhead, and unlock new pathways for expansion. This section delves into the foundational importance of Stripe Tax within the broader landscape of ecommerce infrastructure, emphasizing its role in fostering trust, ensuring compliance, and enabling data-driven decision-making.

The Evolution of Sales Tax Management: From Manual Processes to Automation

Historical dependence on manual sales tax calculation—often reliant on excel sheets, third-party spreadsheets, or outdated software—created significant bottlenecks. Errors, delays, and non-compliance penalties presented ongoing risks, especially as businesses sought to operate internationally. The transition towards integrated, automated solutions such as Stripe Tax signifies an industry shift driven by the need for accuracy, efficiency, and scalability. With Stripe's interface offering real-time rate calculation based on geolocation, product categorization, and customer profiles, companies can pivot quickly while maintaining compliance integrity.

| Relevant Category | Substantive Data |

|---|---|

| Global Tax Automation Adoption | According to a 2022 Gartner report, over 60% of enterprises have integrated automated tax solutions to streamline compliance |

| Penalty Reduction | Industry data indicates a 35% decrease in non-compliance penalties when using integrated tax platforms like Stripe Tax |

Seven Benefits of Mastering Stripe Tax for Business Expansion

1. Enhanced Compliance Accuracy and Risk Management

At its core, Stripe Tax leverages sophisticated algorithms and real-time data to ensure every transaction adheres precisely to local tax regulations. Human error in tax calculations can lead to penalties, audits, and damaged reputation—consequences that can derail growth plans. By integrating Stripe Tax, businesses significantly diminish these risks. The platform continuously updates tax rates as fiscal policies evolve, ensuring the enterprise remains compliant without manual intervention.

2. Operational Efficiency and Cost Savings

Manual tax management is resource-intensive—requiring dedicated personnel, ongoing training, and persistent auditing. By automating these processes, Stripe Tax reduces labor costs, accelerates transaction processing, and minimizes errors. Companies deploying these technologies often report a 25-40% reduction in administrative overhead, freeing capital for strategic initiatives such as marketing, R&D, or geographic expansion.

3. Seamless Multi-Jurisdictional Sales

Operationally, expanding into new regions involves understanding a mosaic of tax laws. Stripe Tax simplifies this complexity by dynamically calculating relevant rates based on the customer’s location, allowing instant support for multiple tax environments—whether VAT in Europe, GST in Australia, or sales tax in U.S. states. This agility ensures a frictionless customer experience and reduces cart abandonment due to tax-related surprises at checkout.

4. Improved Decision-Making via Data-Driven Insights

Data generated from Stripe Tax’s analytics offers invaluable insights into transactional patterns, tax liabilities, and compliance statuses. Businesses can leverage this intelligence for strategic planning—identifying high-growth regions, optimizing product pricing, and forecasting tax-related revenue impacts. Such granular visibility is vital for agile decision-making in a competitive landscape.

5. Accelerated Time-to-Market for New Products and Markets

Traditional tax compliance can delay product launches and market entries. Stripe Tax expedites these processes by providing instant, reliable tax calculations without lengthy legal or technical delays. Fast deployment not only captures market opportunities but also enhances brand perception as a responsive, tech-savvy enterprise.

6. Reduction of Audit and Penalty Risks

Tax audits are among the most disruptive compliance challenges. Stripe Tax’s audit trail and comprehensive reporting tools enable companies to produce legible, accurate records, simplifying audits and reducing penalties. The platform’s proactive alerts about potential discrepancies further safeguard against compliance violations, reinforcing fiscal discipline.

7. Future-Proofing in an Evolving Regulatory Environment

Tax policies are subject to constant change—new harmonizations, digital services taxes, and localized adjustments. Adopting Stripe Tax ensures your business remains ahead of regulatory curves through continuous updates and adaptability. This proactive approach provides confidence to scale internationally without the constant concern of regulatory obsolescence.

Integrating Best Practices for Maximized Impact

While the benefits are compelling, optimal results require thoughtful implementation—training teams, integrating with ERP systems, and aligning tax workflows with broader digital strategies. Ensuring a seamless user experience also involves aligning tax automation with payment gateways, invoicing, and compliance documentation. The strategic combination of technology, process optimization, and staff alignment is what transforms an automated platform into a growth catalyst.

Key Points

- Automated compliance accuracy: Minimizes penalties and legal risks through real-time updates.

- Operational efficiency: Reduces overhead, freeing resources for innovation and expansion.

- Multi-jurisdictional flexibility: Supports rapid entry into new markets with localized tax calculation.

- Data insights: Empowers strategic decision-making with transactional analytics.

- Speed and agility: Accelerates product rollouts and market entries.

- Future-readiness: Keeps your business compliant amid evolving global tax regulations.

Conclusion: Mastering Stripe Tax as a Catalyst for Growth

The landscape of commerce continues to shift beneath a backdrop of regulatory complexity and technological innovation. Businesses fortunate enough to leverage solutions like Stripe Tax position themselves at the forefront of this transformation. The seven benefits outlined—ranging from compliance precision to strategic agility—do more than facilitate growth; they redefine the very potential of scalable enterprise operation in a borderless economy. Embracing this technology provides not just a safeguard but a strategic lever that transforms compliance from a bureaucratic obligation into a tangible edge in competitive markets.

How does Stripe Tax simplify international sales compliance?

+Stripe Tax automatically calculates the relevant sales tax or VAT based on customer location, product category, and current regulations, eliminating manual calculations and reducing errors during international transactions.

Can Stripe Tax adapt to changes in local tax laws?

+Yes, Stripe Tax continuously updates its algorithms with the latest tax regulations across jurisdictions, ensuring your business remains compliant without manual adjustments.

What are the main cost savings associated with Stripe Tax?

+Automation reduces labor hours spent on manual tax calculations and reporting, decreasing administrative costs by an estimated 25-40%, and minimizes costly errors and penalties.